The author is an external contributor. Views are personal and do not reflect the opinion and views of PrimeInvestor.

We had suggested in the previous update about the possibility of an upward move in the Nifty 50 index based on early green shoots that were visible. The index managed to seek higher levels but are we on course to hit new all-time-high? This is probably the question at the top of the mind for most!

We shall try to address this question with a look at the short-term outlook. Though the Nifty 50 index managed to creep higher, it is still within the broad range of 23,900-25,600. So we shall take a closer look at the short-term chart of Nifty 50 index along with the breadth indicators, as we always do, to assess what is in store in the near-term. We will also dive deeper into the sectors displaying relative strength and weakness.

Nifty short-term outlook

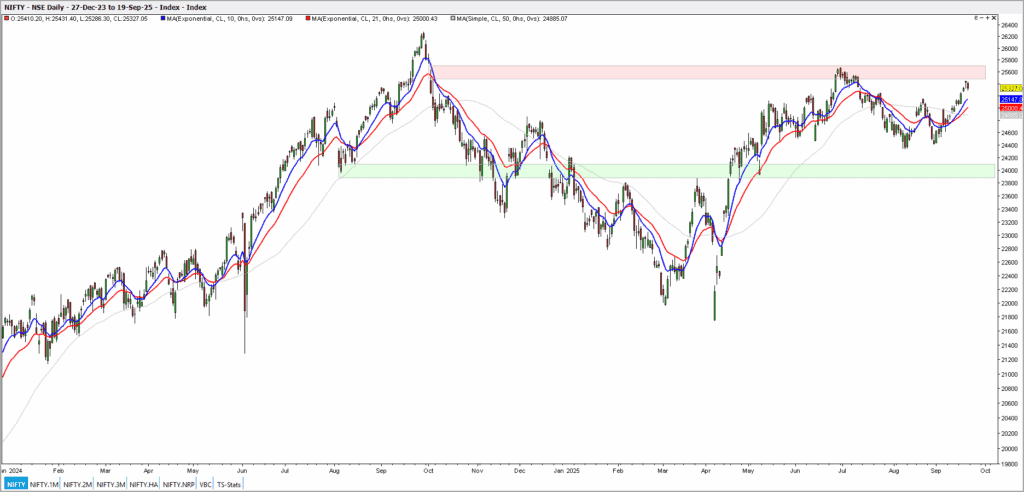

It is apparent from the chart featured below that the Nifty 50 index is still confined to the support and resistance zone highlighted several weeks ago. Only a breakout above the upper end of the range at 25,600 would impart momentum to the upside.

It is positive to note that the index has managed to scale above the short-term moving averages, especially the 50-day simple moving average. While the undertone based on the recent price action is definitely bullish, it would be safer to await a breakout above 25,400 before concluding that the move to new highs is underway. Above 25,600, the index could head to 26,200-26,400 zone.

Let us also look at the breadth indicators to assess the quality of the recent recovery in the Nifty 50 index. As always, we will use the PF-X% breadth indicator which tracks the percentage of stocks that are in a bullish swing in 1% box size in Point & Figure Chart.

The PF-X% breadth indicator for the Nifty 50 universe recovered from 34% on August 31 to a high of 74% now. The recovery in the breadth along with the uptrend in the Nifty 50 index is a healthy sign, suggesting broad based participation by index constituents.

The percentage of stocks trading above their 21-day exponential moving average from the Nifty MidSmall Cap 400 index has also improved from 27.5% on August 28 to 76.75% on September 18, suggesting that the broader markets are attracting buying interest along with the recovery in the Nifty 50 index.

The breadth indicators are supportive of the continuation of the short-term bullish trend. But let us also look at the relative strength charts to assess if the broader markets are indeed outperforming Nifty 50 and also look at sectors to focus if the recent uptrend in Nifty were to persist.

Broader markets: Nifty MidSmall Cap 400 Index

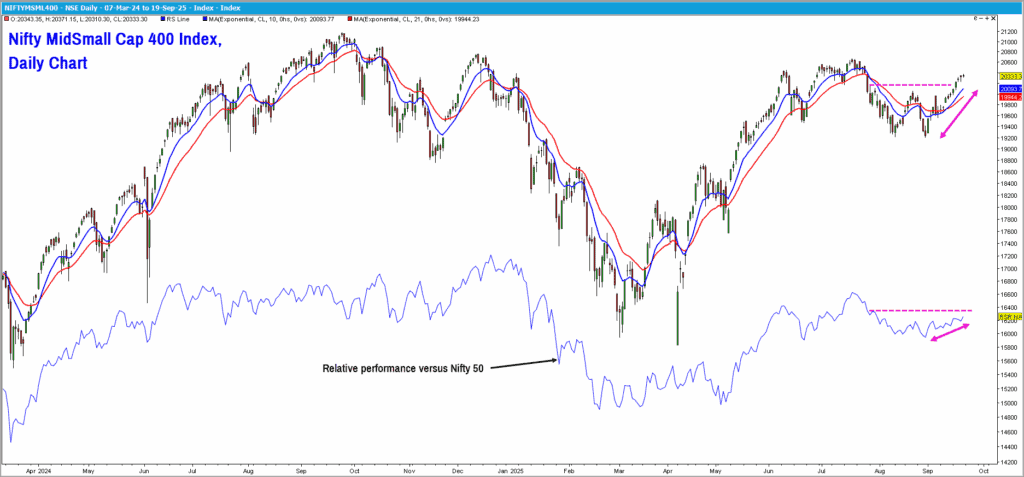

Though this index has coasted higher along with the recent recovery in the Nifty 50 index, there is no signs of relative outperformance yet. Have a look at the daily chart of the MidSmall Cap 400 index featured below. The thin blue line captures the relative performance of this index versus the Nifty 50 index.

As highlighted in the above chart, the relative performance of the MidSmall Cap 400 index has lagged behind, suggesting underperformance in recent weeks. Technically, a breakout above 20,900 would suggest that the Nifty MidSmall Cap 400 index is headed to the next target of 21,900-22,300. The positive outlook would be under threat if the index drops below swing low at 19,000.

Keep an eye on the relative performance of this index await signs of outperformance before considering fresh exposures in the broader markets.

Sector indices

Now let’s move on to specific sectors to identify those displaying weaknesses or strengths relative to the Nifty 50.

Nifty PSU Bank Index

This index has managed to outperform the Nifty 50 index since March 2025. It may be recalled that this index was a rank underperformer during the corrective phase in the Nifty 50 index that commenced from September 2024 highs. The price action and relative performance is impressive for the PSU Bank index. Technically, a rally to 8,150-8,250 appears likely. The positive outlook would be under threat if the PSU Bank index drops below the support level at 6,850.

Nifty Bank Index

This is one of the key sectors both in terms of economic fundamentals as well as the weightage of banking stocks in the Nifty 50 index. As observed in prior updates, the banking index has struggled to sustain any bullish momentum and has also underperformed the Nifty 50 index on a consistent basis. There is no reason to turn bullish in the Nifty Bank index, which is more or less a proxy for private banks in terms of weightage of the constituents.

From a short-term perspective, the bank index is still tracing out a bearish sequence of lower highs and lower lows, which is not a healthy sign. Only a breakout above 58,000 would reinstate bullishness in this sector. A fall below 53,000 would be a major sign of weakness.

Nifty Transportation & Logistics Index

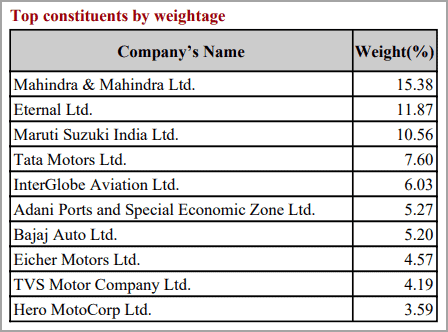

Along with the Nifty Auto Index, this index too is displaying relative strength, and the price action is bullish too. This index was launched in April 2022 and aims to track the performance of portfolio of stocks that broadly represent the Transportation & Logistics theme.

Here are the top constituents in terms of weightage:

This is one of the few indices trading near their all-time highs which is a healthy sign. The short-term outlook is bullish and rally to 27,900-28,500 appears likely. Only a close below 23,000 would invalidate the positive outlook for this index.

Summary

While the recent recovery in the Nifty 50 index appears promising, the price is still confined to the broad trading range. Await a breakout above the upper end of the range at 25,600 before considering exposures in the outperforming sectors. Along with Transportation and Logistics, sectors such as Defence, Capital Markets, Nifty EV indices are setting up well.

6 thoughts on “Technical outlook: Is the Nifty on course for a new high?”

Hi Mr. krishnakumar,

Nifty Small cap 250 index has come down. Is it worth picking some small cap stocks from Nifty Small cap 250 index or pick up good small caps from the current level?

What are the prospects of Mid and small cap stocks in 2026?

Hello Mr.Badri,

The Small Cap Index has been a relative underperformer versus the Nifty 50 index and the Small index Index has also been in a downtrend for several months now. I find little reason to consider fresh exposures in this segment. I would wait for signs of uptrend in the index along with signs of relative out-performance versus Nifty 50. Until then better to wait.

Technically, if 15,500 level is broken, the Small Cap Index could then slide to the major support at 15,200 odd levels. If the index manages to cross 16,700-17,000 then things could improve.

Hope this helps.

B.Krishnakumar

Hi KrishnaKumar Sir, would like to know the updates on recent breakouts in Silver, is it okay to consider fresh positions now or wait for corrections ?

Hello Srikanth:

Both gold and silver appear overheated in the short-term. I would not be keen to take fresh exposures here. Better to wait for some cool off to happen. Either a time consolidation and/or price consolidation might happen is my expectation.

Hope this helps

B.Krishnakumar

Hi KrishnaKumar Sir, thanks for the update.

Would like to check on the update of breakouts on hotels vs nifty as stated in the previous update. Any changes from previous update for now on this?

Hello Srikanth:

There is no change to the bullish outlook shared for the hotels sector in the prior update. Hope this helps.

Regards

B.Krishnakumar