CAGR Calculator (Compound Annual Growth Rate)

Know what this CAGR calculator can do

The CAGR Calculator will tell you how much compounded annual returns an investment has made, over a number of 1-year time periods.

What is CAGR?

CAGR, short for Compounded Annual Growth Rate, is also known by other names such as compound returns, compounded annual returns and annualised returns.

The CAGR shows you the compounded returns that a one time investment, invested for multiple years, has generated each year.

For example, if you invested Rs. 10,000 in stocks of a company in 2014 and those stocks are worth Rs. 20,000 today, your money has doubled and that sounds great. But how much returns did your investment of Rs. 10,000 generate each year? That’s what our CAGR calculator will arrive at for you and in this case, it is 14.87%. You can use the CAGR to decide how well (or badly) an investment has fared.

CAGR Calculation Formula

The formula for calculating compounded annual growth rate on an investment is to simply take the return fraction and raise it to the power of (1/n) where n is the number of years invested and then subtract 1 to remove the principal component.

CAGR = [(Value at the end / Value at the beginning) ^ (1/n)] – 1

You don’t need to “understand” this formula or even memorise it – just knowing that there is one is enough – you can always look it up!

How to calculate CAGR

CAGR works on the principle of compounding. Here is a simple example of compounding.

Suppose you lend someone Rs 1 lakh in exchange for 10% interest on it for a year. At the end of the year, you get Rs 1.1 lakh (Rs 1 lakh + 10% of Rs 1 lakh = Rs 1,10,000).

Now, if you lend back the Rs 1.1 lakh for 10% interest again, at the end of the second year, you make Rs 1.21 lakh (Rs 1.1 lakh + 10% of Rs 1.1 lakh = Rs 1,21,000).

Money building on itself in this manner is what is called compounding.

However, if you lend the money for 5 years and in return your money is doubled at the end of 5 years, the total returns (absolute return) you would make on your investment over 5 years would be 100%.

But what would the annual returns be? If you were to simply divide the 100% by 5, you would get 20% which would be what we call ‘simple returns’. But if we apply the CAGR formula, the return would be 14.87%. What this means is that the money compounded every year at the rate of 14.87%.

So, this is how CAGR gets calculated from an absolute return.

Benefits of CAGR Calculator Online

CAGR is at the foundation of evaluating nearly any investment. Investments are often made for the long-term, spanning several years. In such a situation, it would be very useful to look at how much the investment returned (or “performed”) on an annual basis rather than on an absolute basis and here are the main reasons why:

- If we want to know whether an investment return is ‘good’ or ‘bad’ we need to know how long it took for the return to materialise.

- Many other financial metrics, especially inflation, are expressed in annual terms, and for us to benchmark our returns with these other metrics, we should use something that is correlated with time as well.

- To be able to compare different investment options, we need to be able to compare these options and the CAGR is the best candidate to compare returns across different investment avenues.

Looking up the formula or even just calculating it (if you remember the formula) can be cumbersome and time consuming, especially if you are not someone who manages their money full-time. Here, a CAGR calculator can be a godsend.

How CAGR should and should not be used

The compounded annual growth rate is a versatile metric. The best use case for annual returns would be to compare two similar investment instruments. For instance, if you are evaluating past performances of two similar mutual funds.

However,

- You should not use annual returns for any period less than one year.

- You should not compare returns over different periods in time.

- Annual returns cannot and should not be used for investments like SIPs.

- CAGR cannot be used to calculate how much your investment returned when your investment involves multiple transactions. (Here you should use XIRR – more on that in the FAQ section).

How to use the PrimeInvestor CAGR Calculator

Using the PrimeInvestor CAGR calculator is as easy as 1-2-3. All you need are the following three inputs.

- Your initial investment amount

- The number of years for which it was invested or will be invested

- The final amount

Feed in these three values and hit the ‘Calculate’ button to find out the compounded annual growth rate or CAGR on your investment!

FAQ

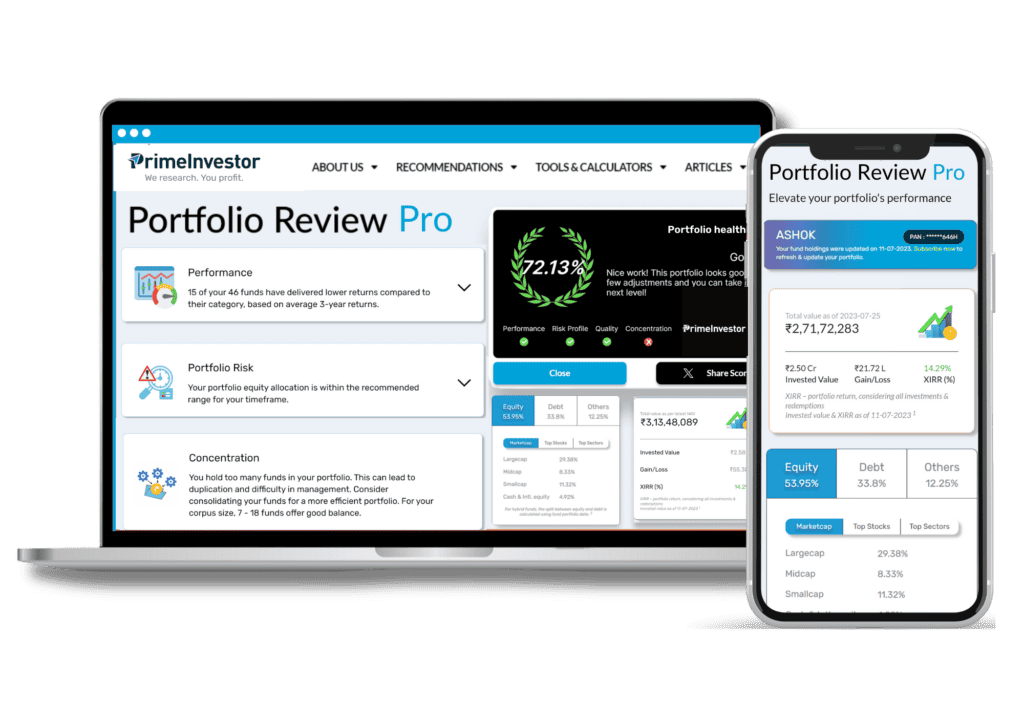

Review your mutual fund portfolio now !