SWP Tax Calculator

Know what this SWP with tax calculator can do

An SWP, or Systematic Withdrawal Plan, can turn your investments into a steady income stream. Just set up an amount to withdraw each month and the magic happens. Imagine you have Rs 10 lakh invested in a fund. With an SWP, you could choose to withdraw Rs 10,000 every month. The fund would then automatically sell the necessary units to cover that amount and send the money straight to you.

An SWP typically works with a mutual fund. But there are other ways to build an income stream. You could invest in an interest-bearing deposit or bond and the regular interest payout would become your income.

But whether from mutual funds or other investments, tax needs to be considered. Every time you redeem from a fund or you receive interest income, there is tax that you have to pay. This eats into your income, in turn impacting how long your money will last in SWP. So how to calculate tax in SWP?

With our SWP tax calculator, that’s how! This SWP calculator with tax considers the annual income generated, incorporates the tax paid and then shows you how long your money will last.

Benefits of SWP Tax Calculator

Putting things down in numbers is always a more accurate way to plan your finances than arbitrary assumptions. The SWP Tax calculator helps in such planning. There are different ways in which this SWP calculator with tax can benefit you.

- One, when you want to set up an income stream. You need to know how long your money can last for a given income level. Using the SWP Tax calculator will help you understand if the regular income and income period you set will be adequately met by your corpus.

- Two, to know how much you will need to save up to meet regular income requirements. Adding tax in SWP calculator will give you a more realistic picture of the wealth you need to build.

- Three, to understand the impact of tax on SWP. If your income stream is high enough to warrant you paying tax and you do not calculate tax on SWP, your corpus may be inadequate.

How to calculate tax on SWP

The main step to calculate tax on SWP is to determine the potential tax bracket. With the change in taxation rule for debt funds, the indexation benefit for investments made after April 1 2023 have been removed. Tax is applied on the capital gains at your tax slab rate. But also remember that your income stream can be met by many sources such as SWP from mutual funds, interest income from FDs or government bonds, pension and so on. Interest income is simply added to your total income.

This means you can assume a flat tax rate to calculate tax on SWP. In an SWP calculator with tax, apply the tax rate on SWP to arrive at tax to be paid. This tax to be paid will also have to be met by the SWP amount. Therefore, you will have to withdraw more than your income amount from your corpus to account for the tax outgo. We have made this easy for you, though, with our SWP tax calculator.

What is the formula for the SWP tax calculator

The SWP tax calculator takes into account taxes, returns, your expenses and inflation along with your total investment amount. The SWP calculator with tax applies inflation on the cost of living or your expense to arrive at a more accurate result of how long your corpus will last. The calculator additionally uses the future value formula to estimate growth in your overall corpus, while systematically reducing the withdrawal amount plus tax paid each year.

How does the SWP tax calculator work?

The SWP tax calculator takes the following inputs from you to show you how your corpus will change over the years as you steadily withdraw.

- Corpus amount: This is the total value of your investment from which you plan to set up monthly income flow.

- Annual expense: This is the total expense you will have each year. The SWP tax calculator takes this amount as your withdrawal amount.

- Expected return: This is return that you expect your corpus to generate. Remember that the part of the corpus that you are not withdrawing will continue to earn returns. However, you cannot keep this invested in high-risk investments as safety of your money is important. Therefore, keep a realistic return expectation along the lines of FD or debt mutual fund returns.

- Expected inflation rate: This is the annual increase in your expenses, to account for a general rise in cost of living.

- Taxation rate: This is the probable tax rate that you will pay on this income stream you are generating.

The SWP tax calculator takes these inputs and provides you with the number of years your corpus will last. The calculator additionally gives you a table detailing the remaining value of your investment and the total expense each year.

Note the following points on how the SWP calculator with tax works

- The calculator assumes an annual withdrawal, at the beginning of the year. Returns and taxes are considered at the end of the year.

- The calculator assumes the entire withdrawal (i.e., income needed to meet expenses) is taxed at the chosen rate. Actual taxes may vary based on your investment – SWPs from debt funds, for example, will suffer taxes on the gain component alone while interest income will be fully subject to tax.

The SWP tax calculator should be considered only as a guide or estimate to understand how long your investments can help generate income. The actual number of years for which your corpus will last will be determined by the actual withdrawal, taxes, and returns. The results of the calculator are indicative in nature and not advisory. It cannot be considered to be financial planning or a cash-flow analysis.To get readymade portfolios for income generation, check out Prime Portfolios. If you are looking for fixed deposits that balance interest rate and safety, check out Prime Deposits. For bond recommendations on government, bank or corporate bonds, check out Prime Bonds.

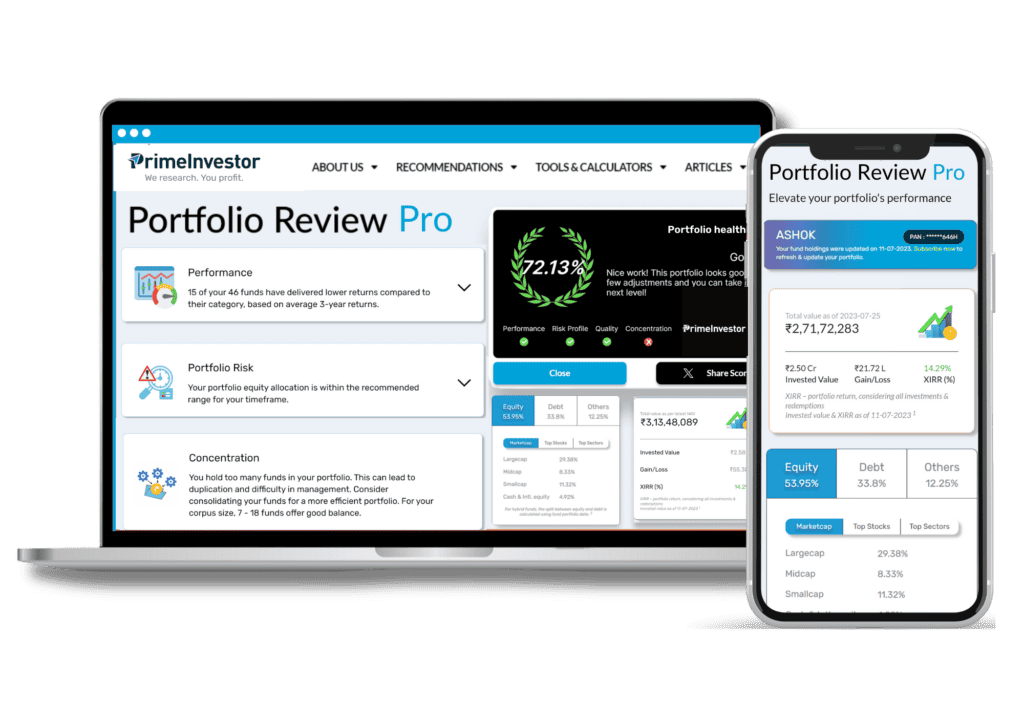

Review your mutual fund portfolio now !