SWP Calculator

Know what this SWP calculator can do

What is a Systematic withdrawal plan?

For those who aren’t in the know, a quick explanation of what an SWP is first. If you know, skip this section!

The purpose of an SWP is to ensure that you have a regular flow of income to meet expenses by automatically withdrawing an amount from your investment each month (or any other periodicity).

So, if you have, say Rs 10 lakh in a fund, you can set up an SWP to withdraw Rs 10,000 every month. The fund will redeem units equivalent to this Rs 10,000 and pay the amount out to you.

How can a SWP calculator assist you?

You have worked hard to build your retirement corpus. Now you want to plan your regular withdrawals to meet your expenses and other outflows via SWP but you also want to make your savings last.

This SWP Calculator enables you to figure out exactly how long your investment corpus will last when you use systematic withdrawal plan or the SWP route to withdraw money from the corpus.

How to use the SWP calculator?

This SWP Calculator is very user-friendly and requires only the following four simple inputs from you.

- Amount of corpus

- Expected investment returns from the corpus

- Expected rate of inflation during the period of withdrawal

- The monthly withdrawal amount

The expected returns and expected inflation are assumed to be 8% and 6% respectively – but you can change them to any reasonable number.

The output you get when you hit the ‘calculate’ button, will tell you how many years you can sustain the withdrawal before exhausting the corpus.

Why do an SWP?

The benefits of an SWP are as follows:

- One, you could possibly end up paying lower tax on the withdrawn amount in the form of capital gains tax (depending on the type of mutual fund and how long you have held it and the tax bracket that you fall under) than you would if the same amount came to you in the form of fixed deposit interest or if you opted for the IDCW (formerly known as dividend option).

- Two, an SWP is more flexible as it allows you to change the monthly withdrawal to suit your requirements – you can go higher if needed or lower. It is hard to do so in a fixed deposit. It’s also easier to tap into to withdraw a higher amount to meet any sudden large expense.

- Three, it is a far better substitute to the IDCW option (formerly known as dividend pay-out option) of mutual funds. You decide how much you want as income every month and are not leaving it up to the AMC to declare what it wishes to.

How can a SWP calculator benefit you?

An SWP calculator can quickly and easily help you arrive at how long your corpus will last for an expected rate of return and inflation rate so that one, you don’t spend hours computing this and two, you are not in for a nasty surprise one you start using an SWP to withdraw from your corpus for your periodic financial requirements.

SWP Taxation

When you take the SWP route to withdraw from your corpus, your withdrawals are taxed in the same way as exits from a mutual fund, i.e. capital gains. This would depend on the type of fund that your corpus is invested in. Take a look at the table below:

Where should your corpus for SWP be invested?

When you need to make steady withdrawals:

- One, you cannot take the risk that your fund could see big losses or prolonged underperformance. This takes any equity and equity-oriented fund out of the picture. While your corpus can have equity (as we discussed last week), shift it to debt before you need to access the amount for SWP. Also barred are credit risk funds and any other debt fund that holds low-credit papers.

- Two, you cannot afford your fund to have return fluctuations. Volatility in returns means that you may wind up redeeming on losses or that your investment is not going to grow steadily enough for you to comfortably withdraw from.

Low volatile debt categories are usually those that earn returns through accrual. These funds are the most suitable for SWP purposes.

- Liquid funds and ultra short/low duration/ money market funds are the most suited for SWP. The bulk of your SWP portfolio (at least 60-70%) should be in these funds, as the aim is to have steady and safe returns.

- The liquid category is one that offers the steadiest returns, especially in short-term periods of 1 year and lower and are low risk as well.

- Ultra short and similar categories can generate losses in 1/3 month timeframes and therefore better suited for SWP after say, 6 months to 1 year of holding. But as some funds in this category carry credit risk, check to make sure that you’re not inadvertently taking on risk.

- For other accrual categories such as short duration, banking & PSU debt, or corporate bond, keep investments to a third of the portfolio. These funds can pep up your SWP portfolio returns. But start withdrawing only after completing 2-3 years of holding as these funds need this period for optimum returns. Ensure that you’re not taking credit risk here, either.

- Dynamic bond funds are best avoided. They switch between duration and accrual and this pushes the category’s volatility higher. Not only that, a wrong interest rate call can wipe out returns built up.

- Gilt funds are also volatile given that gilt prices fluctuate based on interest rates. However, if you do want to hold gilt funds because of their low credit risk, you will have to allow at least 5-7 years before you can begin withdrawing from them.

What an SWP is not

An SWP does not necessarily mean that your capital will stay intact forever. Based on inflation, your withdrawal and returns you may eventually start drawing down from your capital. Your fund units can go to zero. Maintaining a reasonable withdrawal rate helps push back the time when you draw from the capital and lets your corpus last long enough that you don’t fall short of money. This is unlike an FD, where your principal stays intact.

Make sure you have a diversified income stream with fixed income products such as FD and Senior Citizens Savings Schemes and use SWP as an add-on.

You can read this detailed article about SWP to get more information.More information about safe withdrawal rate

Start managing your finances better with quality research & recommendations from us

FAQ

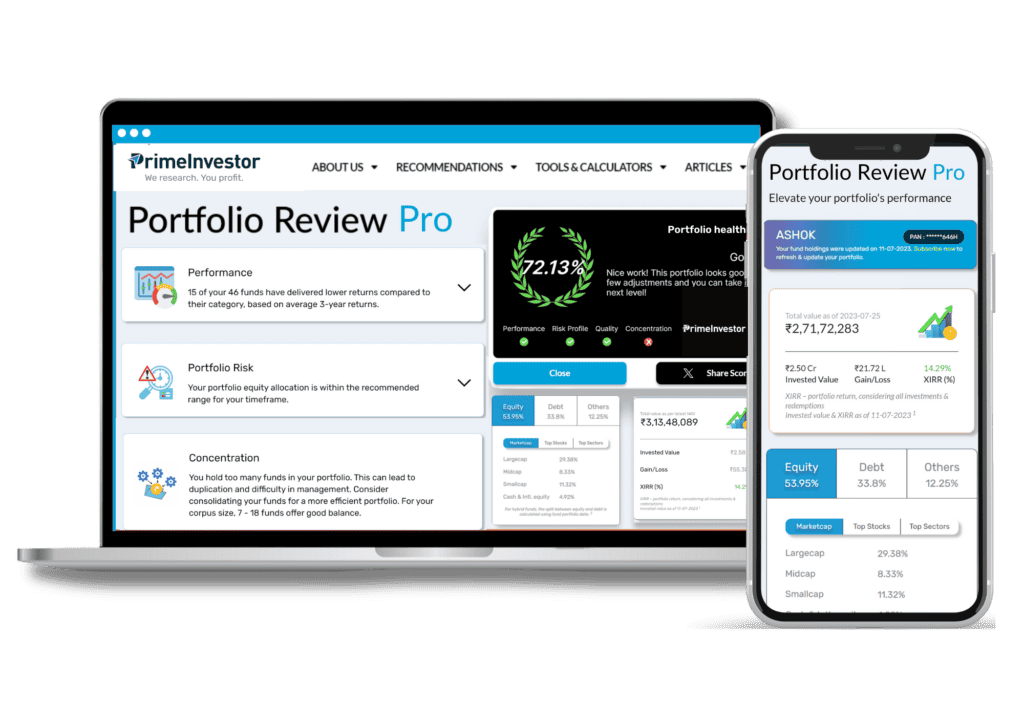

Review your mutual fund portfolio now !