Prime ETFs

Top ETFs for your portfolio

Researched list of low cost, index options to fortify your long-term portfolio

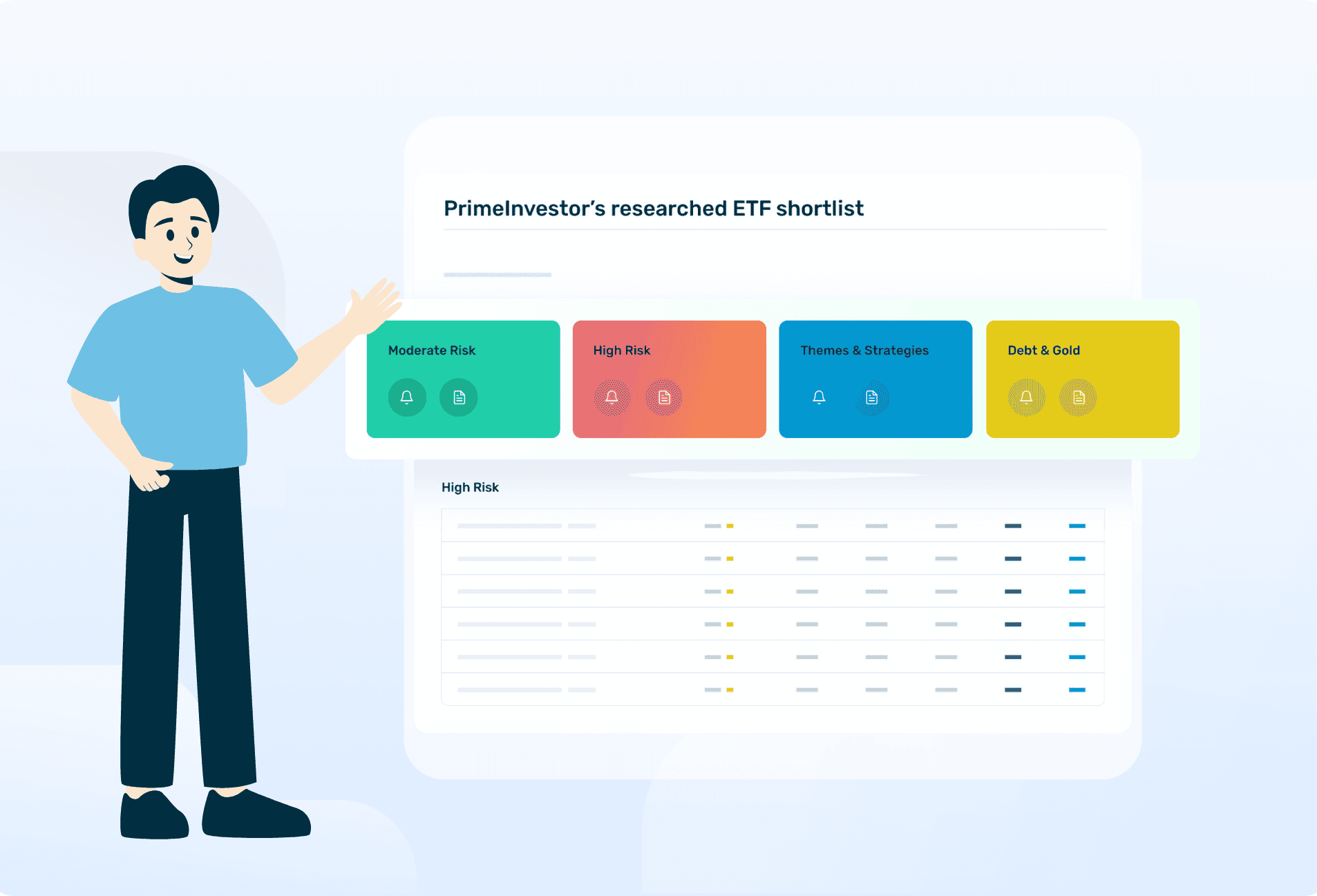

What are Prime ETFs?

Investment-worthy ETFs

Researched list of ETFs filtered on ETF efficiency and investment-worthiness of the underlying index

Diversified basket

A mix of aggressive & moderate risk broad-equity indexes, plus thematic indexes, debt, and gold

Double screening

Step1: ETFs with consistently-performing indices filtered.

Step 2: Efficiency metrics including tracking error, cost, volume & price deviation applied

Periodically reviewed

Quarterly review of ETF performance with additions to identify & capture new ETF opportunities and remove inefficient ETFs to stay with the best

Ready to achieve investment success? Start your free 7-day trial now!

No credit card or payment needed!

How you benefit from

Prime ETFs

Easy to use

Bucketed into simple categories - moderate, high risk, strategic, and debt & gold to help you allocate right.

Only the best indices

Get only those indices that are investment-worthy for your long-term portfolio

Filtered for liquidity risk

Avoid getting stuck with an illiquid ETF. We also alert you to limit exposure if turnover is not high.

Quarterly updates

Quarterly reviews and updates to alert you to new passive opportunities and cut exposure in poor-performing indexes.

Frequently asked Questions

How can I invest in ETFs in India?

ETFs in India are listed and traded on stock exchanges just as stocks are. Therefore, you will need a demat and trading account to invest in ETFs. You will hold ETFs in your demat account the same way as you hold your shares. Every ETF has an NAV, which reflects the movement in the underlying portfolio of stocks.

However, when you invest in ETFs, as you are buying and selling on the stock exchange, you will have to pay the market price for the ETF. Just as with stocks, there are buyers and sellers for an ETF, and this demand and supply determines the price of the ETF. The market price of the ETF can deviate from the underlying NAV depending on the demand-supply. Therefore, you need to choose ETFs in India which have high liquidity on exchanges and low tracking error.

What are the best ETFs in India?

There is no single best ETFs in India. Each ETF aims to track a specific index. This index could be a debt index, equity index, or gold. The investment worthiness of an ETF depends on the underlying index performance. To pick the best ETFs, you need to first choose the category of index you want to invest in. This could be large-cap, broad-market and so on. Next, you need to look at the merit of the index; not all indexes are good investments. The final factor is tracking error.

However, we have made picking the best ETFs for your portfolio easy with Prime ETFs. In Prime ETFs, the initial filtering criteria considers key metrics such as tracking error, deviations between market price and underlying NAV, and trading volumes. From there, we pick the best ETFs based on a qualitative assessment of the index.

For an index to be worthy of investment, it can be any of three types. One, it can represent the broad market segment and is a simple market-weighted index. Or, it could be ones that give active funds stiff competition. Or, it can offer a different strategy or theme. To this end, Prime ETFs covers the top ETFs to invest in, across moderate and high-risk equity, strategies & themes, and debt & gold. You can pick the ETF that best meets what your portfolio requires. The ETF itself should not have erratic trading volumes or significant deviations between market prices and NAVs or high tracking error.

What are the types of ETFs in India?

Equity ETFs, obviously, form the bulk of the available ETFs in the Indian context. Equity ETFs can be split into those that track broad marketcap-weighted indices, thematic/sector, and factor based. The ETFs in the debt space are split into target-maturity ETFs and other ETFs that don’t have a fixed maturity date. Commodity ETFs cover gold and silver.

Prime ETFs - what makes it unique?

Prime ETFs is a list of the top ETFs that you can use in your portfolio, either to build an all-passive portfolio or to diversify your active mutual fund portfolio. Prime ETFs is unique in that it covers a diverse set of opportunities in equity markets, as well as debt and gold. Prime ETFs allows you to know which ETFs are investment-worthy and which are good portfolio diversifiers.

The underlying indexes of Prime ETFs represent key market segments across large-cap, mid-cap and broad market. They also cover thematic or sectoral ETFs as well as strategy indices. Gold ETFs and debt ETFs also form part of Prime ETFs. Our aim in Prime ETFs is to help you pick the top ETFs for your portfolio. We have gone with those that keep deviations between their market price and NAV low, that have enough liquidity and show consistent trading patterns.

Ready to achieve investment success? Start your free 7-day trial now!

No credit card or payment needed!

Other useful links to use

ETF Ratings

The only place to easily choose low-cost ETFs based on comprehensive rating and liquidity data

Nifty PE Ratio History

Powerful historical data of Nifty PE ratio movement to help understand present market valuations

Prime Stocks

Uncover fundamentally sound stocks for long-term wealth creation

Portfolio Review Pro

Your one-stop to monitor & review performance, risk & allocation of your MF portfolio and take corrective action.

Recent Articles

CategoriesPrime Recommendation

Prime Fund Recommendation: A Balanced Advantage Fund that has proven its mettle

-

Bipin Ramachandran

- 3 Comments

CategoriesPremium

Iran-US War: — Market Impact Analysis Across Three War Scenarios

-

PrimeInvestor Research Team

- 2 Comments