A Research-First PMS

MFs, stocks, or both — choose your path to superior returns with expert management. From asset mix to sizing, we handle the decisions to build you portfolios that endure across changing markets.

A Research-First PMS

MFs, stocks, or both — choose your path to superior returns with expert management. From asset mix to sizing, we handle the decisions to build you portfolios that endure across changing markets.

Before managing money, we review it.

Most PMS firms start with strategies. We start with your existing portfolio.

Review of Stocks & Mutual Funds

Comprehensive analysis of all your holdings across asset classes.

Overlap, concentration & risk analysis

Identify hidden risks and concentration across your portfolio.

Clear Buy / Hold / Sell calls

Actionable recommendations based on our research framework.

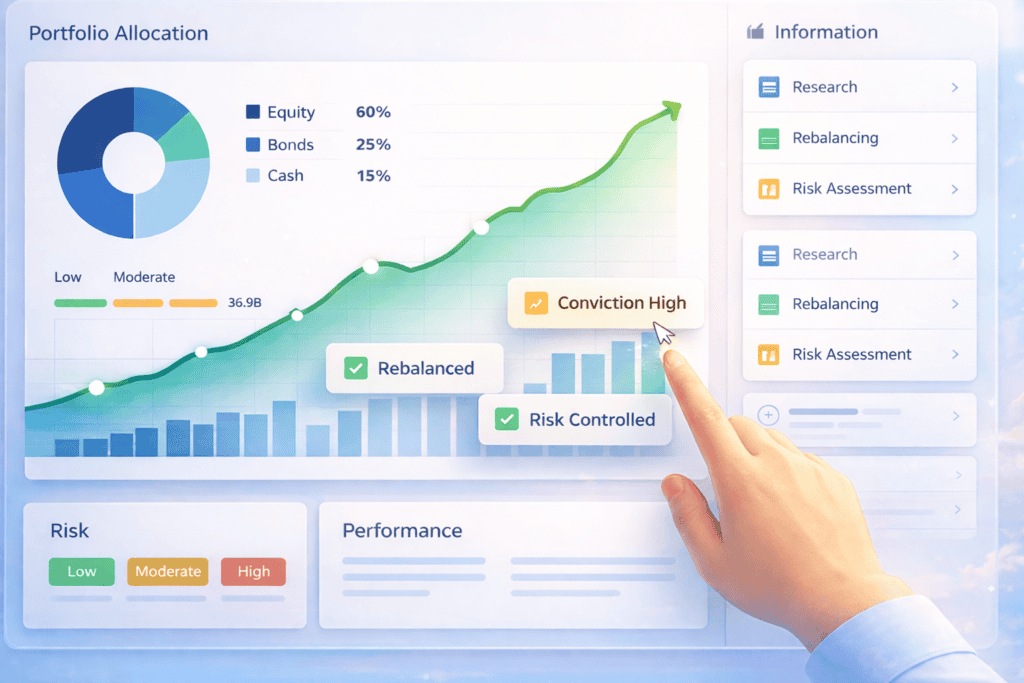

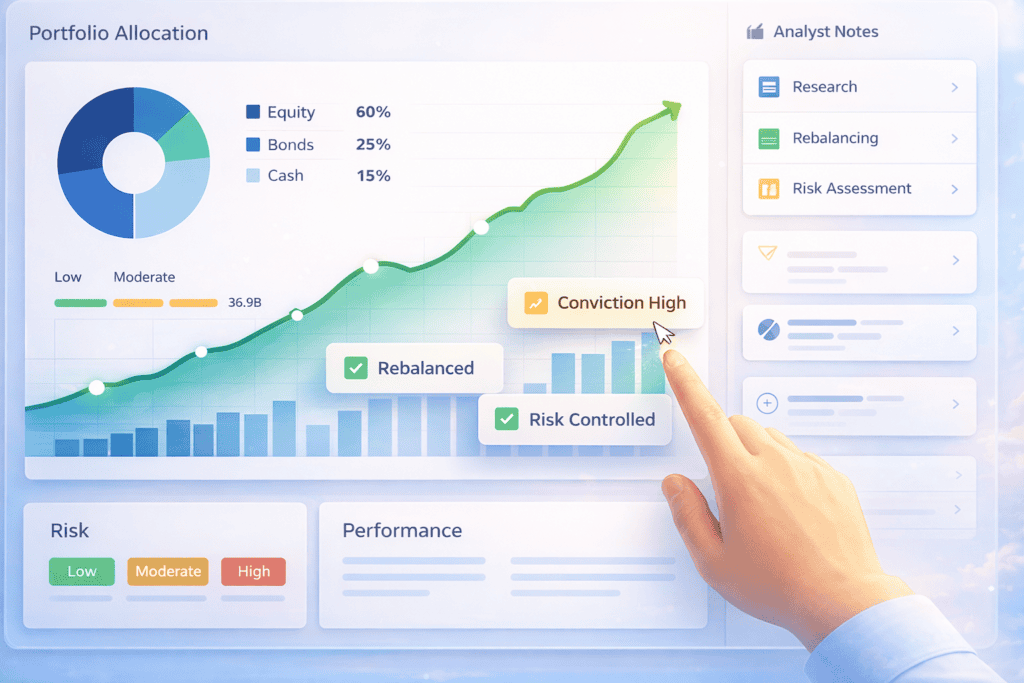

Our PMS Strategies

Each strategy is built on rigorous research and disciplined portfolio construction.

Prime Vision

Mutual Funds & ETFs

Asset-allocated, smartly-diversified portfolios for long-term wealth, suiting different risk profiles.

Prime Synergy

Mutual funds + stocks

Blends mutual fund stability with focused stock exposures for alpha generation, with dynamic adjustments.

Prime Velocity

Stock Portfolio

Multicap, sector-agnostic portfolio that cherry-picks stocks with high growth potential.

The Experience Driving our PMS

60+ years of battle-tested investing wisdom. We’ve seen the crashes, survived the bubbles, and learned what actually compounds wealth.

20+ years of expertise in investment research across equity and debt markets. Rich experience in working directly with investors across the spectrum, solving real-world problems.

16+ years of research experience in mutual fund and equity research, and investor advisory. Adept at building transparent methodologies to analyse products in an unbiased manner.

Why We're Different from a Typical PMS

We’re not yet another stock-picking PMS. We’re built to address real wealth goals, not just chase returns.

Traditional PMS

- High Risk

- Focused only on stocks

- Single asset class exposure

-

Best used for high-risk

allocations only

Prime PMS

- Options across risk profiles

- Multi-product using MFs, stocks, ETFs & bonds

- Diversified across equity, debt & gold

- Serves as a core, holistic wealth solution

Simple, Fair Pricing. No Performance Fees.

Transparent fee structure that aligns our interests with yours.

- Fixed management fee

Fixed AUM-based fee keeps costs clear, predictable and fair. No fine print!

- No performance fee

No additional fees on profits earned. Returns are yours to keep!

- Competitive rates

Reasonably priced management fees, compared to most PMS offerings

- Aligned interests

Simple, competitive fee structure ensures advice aligned with your long-term wealth creation.

How our fixed fee model works

Invested amount: ₹ 1 Crore | Annual return: ≈ 12%

The table above is for illustrative purposes only.

Latest Research Reports

Long-Short SIFs – Derivative Strategies

Indian IT Sector – Disrupted or Defeated?

Trusted by Serious Long-Term Investors

Hear from investors who value research depth, clarity, and alignment of interests.

Prasanth Ethiraj

Primeinvestor greatly helps in making my investment decisions in Stocks and Mutual Funds easier. It gives me great relief by simply choosing from their recommendations instead of getting confused by visiting various sites to choose the best quality funds.

Manish Kumar

Bravo ! For a non-compromising and investor-friendly approach, and not getting swayed by hype.There is so much garbage out there – someone has to call a spade a spade.

Sunil B

What a powerhouse team! This team, arguably, truly represents some of India’s most skilled and trustworthy personal finance experts. Following their insights for over 15 years has greatly helped enhance my understanding of finance.

Balaji V

There are many firms which gives advise, I find PrimeInvestor to be more balanced , simple and authentic. They cover a wide range of product for retail investors Stock MF Bonds etc

Frequently Asked Questions

Clear answers to common questions about our PMS service.

What is Portfolio Management Services (PMS)?

Portfolio Management Services (PMS) is a professionally managed investment solution where your portfolio is actively managed by experienced fund managers based on your risk profile, goals, and investment horizon. Unlike mutual funds, PMS offers personalised portfolios and higher flexibility in asset allocation and security selection.

How is PrimeInvestor PMS different from traditional PMS offerings?

Most traditional PMS products focus only on stocks and carry high risk. PrimeInvestor PMS is designed as a core wealth solution, using a multi-asset approach across equities, debt, gold, mutual funds, ETFs, and stocks—depending on the chosen strategy. The focus is on risk-adjusted returns, downside protection, and disciplined asset allocation rather than aggressive stock bets alone.

What is the minimum investment required for PMS?

The minimum investment for PrimeInvestor PMS is ₹50 lakh per PAN, as mandated by SEBI. This amount can be deployed across one or more strategies based on suitability and diversification needs.

How does PrimeInvestor PMS manage risk?

Risk management is central to the PMS framework. This is achieved through:

Strategic asset allocation across asset classes

Controlled position sizing

Active monitoring and rebalancing

Defensive allocations during expensive market conditions

The focus is on containing losses, as avoiding deep drawdowns is critical for long-term wealth creation.

Can NRIs invest in PMS in India?

Yes. NRIs with a valid full KYC and an Indian demat account can invest in PMS through appropriate NRE/NRO accounts, subject to regulatory compliance and documentation.

Try it Now

Ready to move from advice to execution?

Start with a comprehensive portfolio review or schedule a conversation with our team.