The author is an external contributor. Views are personal and do not reflect the opinion and views of PrimeInvestor.

We had highlighted in the previous update on the Nifty 50 technical outlook that the index was vulnerable to a pull-back as the short-term trend and breadth indicators had turned overbought. The anticipated pull-back did materialise – but interestingly, the index managed to sustain above the prior swing low at 21,900.

Though there was a gap down below this level on April 7, the price reversed immediately and managed to close well above this swing low, suggesting lot of support and buying interest at these levels.

In this update, let us address the key question: Is there a case for more upside in the short-term? And we will also look at a few sectors that are displaying early signs of outperformance.

Nifty 50 short-term outlook

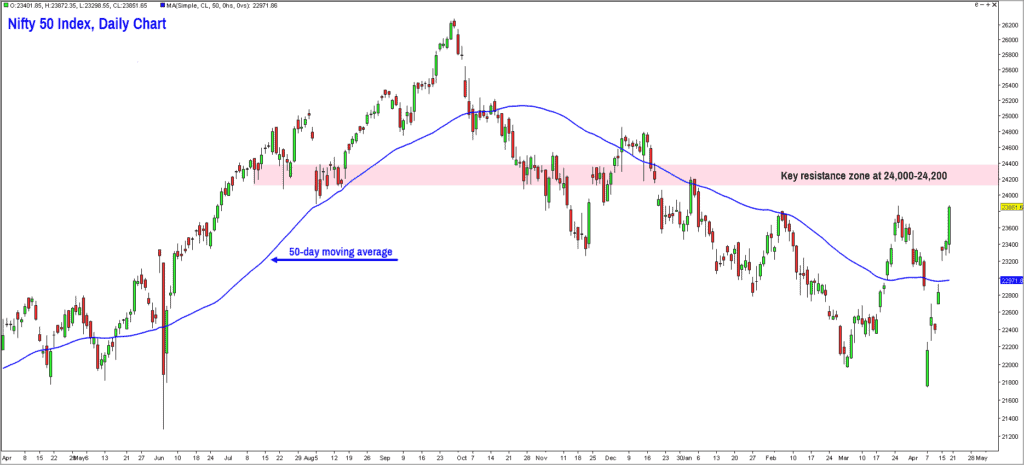

In our prior updates, we mentioned that the Nifty 50 index must move above 24,000 to invalidate the bearish sequence of lower highs and lower lows. There is no change to this basic requirement. A breakout above the resistance zone at 24,000-24,200 would indicate that the recent low at 21,900 is a significant one. Though the recent rally off the April 7 low is impressive, the price is yet to decisively break the bearish sequence of lower highs and lower lows.

On the positive side:

The close above the 50-day moving average is a healthy sign. The short-term breadth indicators too have dramatically improved and have reached an overbought zone. This suggests that the recent bullishness has percolated to the broader market segments too.

The percentage of stocks trading above their 200-day moving average from the Nifty MidSmallCap 400 index has also improved to 28% as compared to 22% recording during the prior leg of the rally that was completed on March 25.

While the long breadth indicator is suggesting a bullish undertone, there is a possibility of a short-term consolidation or pullback. The recent spike in price along with the overbought scenario in the short-term breadth indicators suggests that the Nifty 50 index could get into a consolidation or a minor pull-back.

However, the odds of a breakout of the resistance zone at 24,000-24,200 are getting brighter. The next target for the index is at the 24,800-25,100 zone. As long as the price sustains above 22,800-22,900 zone, there would be a strong case for a push to 24,800-25,100. The improvement in the relative performance of the Nifty 50 index against Nifty Composite G-sec Index as well as the Dollar Index also strengthens the case for a rally to the 24,800-25,100 zone.

However, let us not speculate further on whether the index can hit new highs in the near future. This discussion might be premature at this juncture. For now, we still have to play the waiting game though the odds of the bullish sentiment sustaining in the near term is certainly improving.

So, let us wait for a decisive breakout above 24,200 and monitor the behaviour of the long-term breadth indicator before getting too excited about the upside targets. As always, we will come up with timely updates to keep you abreast with our latest outlook.

Sector outlooks

Now, let us turn our attention to a few sectors that are displaying relative strength and outperformance in comparison to the Nifty 50 index. These are the sectors that could outshine if the recent bullishness were to persist.

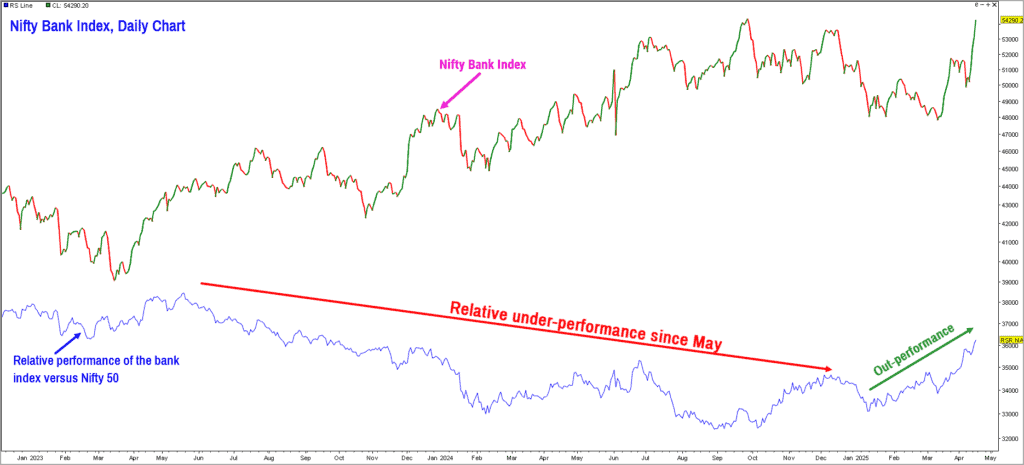

#1 Nifty Bank Index

After a sustained bout of underperformance since May 2023, this index has displayed relative strength in the past few months. This index is among the few that is trading at the 52-week highs even while the Nifty 50 index is still 9% away from its corresponding level.

It is evident from the above chart that the Bank index has displayed bullishness and relative strength versus Nifty in the past few months. The next target for the Nifty Bank index is 59,800-60,500 zone. The positive outlook for the bank index would be invalidated if the price closes below 49,700.

#2 Nifty Financial Services Index

This is another index displaying relative strength in comparison to the Nifty 50 index. Along with Nifty Bank, this index too is trading at its 52-week and all-time highs. This index has been a star performance since October 2024 and there are no signs of this trend reversing.

The short-term outlook for the Financial Services index is bullish and a rally to the next target zone at 28,500-29,000 appears likely. Only a fall below 21,500 would invalidate the positive outlook for this index.

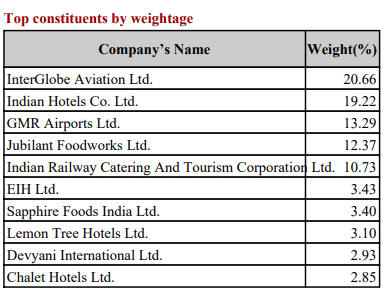

#3 Nifty Tourism Index

This is another index within the striking distance of its all-time highs. A breakout above 9,400 would be a sign of strength and could push the index to the next target at 9,900-10,300 zone. Here are the top index heavyweights of the Tourism index.

Keep an eye on this sector too as it could spring a surprise if the recent bullish trend in the market continues. The positive outlook for the Tourism index would be negated on a close below the 8,000 level.

The other sectors displaying early signs of positivity include the likes of Nifty Oil & Gas, Nifty PSE, Nifty Defence, and Nifty PSU Bank. There is still a lot of work that needs to be done before one can consider exposure in these three sectors. So, these are the ones that hold promise, but it would be too early to rush in now.

Summary

To summarize, there are green shoots suggesting short-term bullishness for equity markets. The fact that the Nifty 50 index did not break below its prior swing low at 21,900 is a major sign of strength. The subsequent rally and the momentum behind the up move are indicative of buying interest in the markets.

Watch out for sustained improvement in the long-term breadth indicator of broader markets before taking exposure in the mid and small cap universe. For now, there is no conclusive signs of outperformance of the broader markets. The message here is to be cautiously and selectively bullish in equity markets as long as 21,900 is not breached.