We have always underscored the importance of poring over the fine print when you buy insurance. But sometimes, despite our best efforts or a particularly convincing agent, we end up with a policy that we regret buying as soon as we get our hands on the policy document. Fortunately, if one acts quickly, a bad or unsuitable insurance purchase can be reversed. Here, we tell you about how you can use the free look period in life and health insurance policies to your benefit.

What is free look period?

We’ve all bought that outfit that looked great under the flattering lighting in the store but turns out to be terrible once we get home. If you still have the receipt, the tags on the clothing and are within the stipulated time window, you can go and return it and get your money back.

This is essentially how the free look period works for insurance. The free look period is one of several measures put in place by the IRDAI to safeguard the interests of the policy holder. You have a free look period in both life and health insurance.

Free look period in life insurance

As per Insurance Regulatory and Development Authority of India (Protection of Policyholders’ Interests) Regulations, 2017, “the insurer shall inform clearly by the letter forwarding the policy to the policyholder that he has a free look period of 15 days from the date of receipt of the policy document and period of 30 days in case of electronic policies and policies obtained through distance mode, to review the terms and conditions of the policy and where the policyholder disagrees to any of those terms or conditions, he has the option to return the policy to the insurer for cancellation, stating the reasons for his objection, then he shall be entitled to a refund of the premium paid subject only to a deduction of a proportionate risk premium for the period of cover and the expenses incurred by the insurer on medical examination of the proposer and stamp duty charges.”

Now, that’s the definition of the free-look period. But how should you utilize this period and what should you keep in mind? Here are important pointers:

- Once you have bought a term plan, ensure you receive the policy document within a reasonable time. If not, flag it to the insurer so you can make sure it is not lost in transit.

- Make sure you go through your term policy document with a fine-toothed comb as soon as you receive it. Check to see if there is any mismatch between what was communicated to you about the policy features, costs, exclusions and so on and what the actual policy you have received contains. Also assess once more if the policy suits your requirement.

- Ensure you have some document that proves the date you received the policy document as the onus is on you to establish date of receipt of the policy document. Remember that you have only 15 days from the date of receipt of the policy document and 30 days in case of electronic policies.

- If you find that the policy is not the best for you, promptly communicate this in writing directly to the insurer. To avoid losing precious time, the best way would be to visit an office of the insurer to submit your cancellation request. It’s also best that you have concrete reasons for rejecting the policy, as you will be required to explain the same.

- Some insurers even have forms specifically for this purpose like this one from Canara HSBC Life Insurance. You will also need to communicate the reasons due to which the policy does not suit you.

- Your free look cancellation request will need some documents to be submitted too in order for it to be processed. This includes your policy document in original.

The insurer will almost certainly reach out to you to see if there is anyway the mismatch between your expectations and the policy can be remedied. If the above does not work, then the insurer will have to refund to you the premium amount after deducting the following:

- A proportionate amount for when the cover was in force

- Expenses incurred on pre-policy medicals

- Stamp duty.

It is worth remembering also that you would have paid GST on your premium. However, the guidelines and regulations from IRDAI do not specify what happens to the same in the event of cancellation during the free look period. There is, therefore, some ambiguity regarding refund of GST paid.

If the plan was a ULIP, then in addition to the above, the insurer also has to repurchase the units you own at the price on the date of cancellation (which could be lower or higher than when you purchased them).According to IRDAI (Protection of Policyholder’s Interests) Regulations, 2017, once the insurer receives the free look cancellation request (which should include the documents required to process the same), it should be processed and the refund made within 15 days. Remember that the free look cancellation provision will only apply to a new policy and not to renewals.

Free look period in individual health insurance

IRDAI (Health Insurance) Regulations 2016 states that “All new individual health insurance policies issued by Life Insurers, General Insurers and Health Insurers, except those with tenure of less than a year shall have a free look period.”

But here’s a key point to note. While IRDAI (Health Insurance) Regulations 2016 and IRDAI Consumer Affairs Booklet clearly state that the free look cancellation is available for individual health insurance policies with a tenure of a year or more, IRDAI’s consumer education portal places this at 3 years.

Therefore, our suggestion is to take note of this provision while purchasing a health cover and if the tenure you are opting for is less than 3 years (but not less than 1 year), make sure that you have the benefit of the free look period. Availability (or lack) of free look period should be clearly mentioned in the policy wordings.

- Just like in the case of a life insurance plan, once you have purchased a health insurance plan, ensure you receive the document within a reasonable time frame.

- Once you receive it, do go through it thoroughly without wasting any time. Look for exclusions in treatments, room rent limits, and other conditions that may reduce the benefit of the policy. Run a check to ensure that the policy features meet your requirements, and to catch any deviations between what you were told about the policy and the actual policy.

- You only have 15 days to review the terms and conditions and to cancel it if it doesn’t work for you. However, insurers have leeway to increase the free look period as per Guidelines on Standardization of General Terms and Clauses in Health Insurance Policy Contracts. If it is more than the standard 15 days, you will find it mentioned in your policy document.

- Communicate in writing and with reason directly to the insurer if you find your new policy unsuitable. The insurer will reach out to you to try and remedy the situation but if it is still unworkable for you, the insurer will have to process your request.

- Here again some insurers could have standard forms for free look cancellation and you will need to submit documents such as the policy document in original to process your request.

- As long as you have not made any claim during the free look period, as per IRDAI regulations, you are entitled to a refund of the premium after deducting a pro-rated amount for the period when the cover was in force, expenses on pre-policy medicals if any and stamp duty charges. Here again, the regulations do not specify what happens to the GST that you would have paid on your premium.

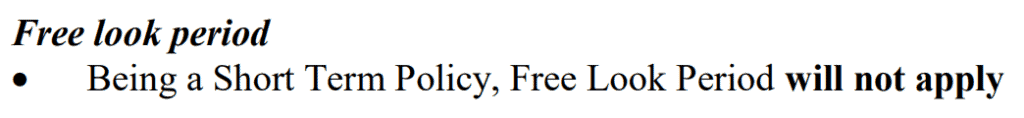

Do note that the free look period is only available on new policies and not when you renew, port or migrate. It is also not available on policies with tenures shorter than a year as mentioned above. Therefore, a product like Corona Kavach does not come with a free look period. The availability of the free look period will be mentioned in the policy document like in the example shown below.

Source: Corona Kavach Policy Brochure – National Insurance Company

If you have exercised your right to cancel during the free look period, ensure that you get alternative health cover so you are not left uninsured.

How PrimeInvestor can help

Buying insurance can sometimes be tricky and the free look provision offers you a way out if you have made a bad purchase. It will cost you time and a little money though. You could however, improve your chance of getting it right the first time and not go through the hassle of free look cancellation by using Prime Health Insurance – our recommended list of health insurance products and Prime Term Insurance – our curated list of term policy covers. We also have a DIY Term Insurance Selection Tool that lets you sort insurers based on some key parameters.

Useful links: IRDAI Consumer Affairs Booklet, IRDAI (Protection of Policyholders’ Interests) Regulations 2017, IRDAI (Health Insurance) Regulations, 2016