The author is an external contributor. Views are personal and do not reflect the opinion and views of PrimeInvestor.

We had observed in the previous update that the Nifty 50 index is gearing towards hitting a new all-time high but was vulnerable to a short-term cool off. This scenario played out, and the index is now again within striking distance of the all-time high of 26,277 recorded in September 2024.

The key issues that we address in this update are the short-term outlook and targets for the Nifty 50 index, sectors to focus on and the outlook for the mid and small cap stocks. For a change, we shall get started with the weekly chart of the Nifty 50 index along with the usual breadth indicators to assess short-term outlook.

Nifty Short-Term Outlook

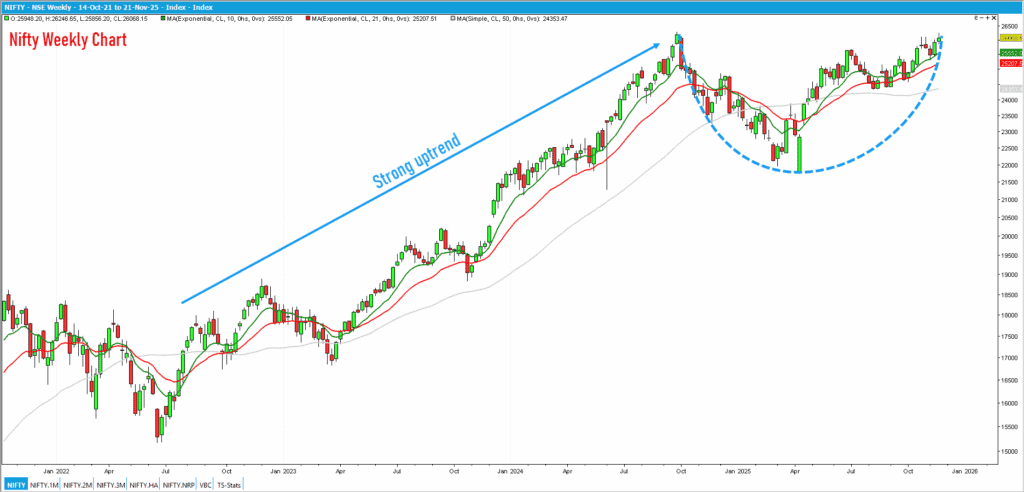

As highlighted in the weekly chart featured below, the Nifty 50 index is tracing out a sequence of higher highs and higher lows, suggesting bullishness. Also, after the sharp and sustained rally during 2022-2024, the index has been in a consolidation and corrective phase since September 2024, which comes across as a classic bullish cup and handle kind of a pattern.

The price could remain in a consolidation for a few weeks before commencing its next leg of the uptrend towards the short-term target of 26,700-27,500 zone. The chances of a rally to this zone would be invalidated only if the index drops below the lower end of the support zone at 24,200.

Let us also look at the breadth indicators to assess the quality of the recent recovery in the Nifty 50 index. As always, we will use the PF-X% breadth indicator which tracks the percentage of stocks that are in a bullish swing in 1% box size in Point & Figure Chart.

The PF-X% breadth indicator for the Nifty 50 universe had recovered from a low of 41.2% on November 7 to current level of 64%, suggesting that there is increased participation along with the recovery in the Nifty 50 index. The cause of concern, however, is the lack of participation and bullishness in the broader markets.

For example, the percentage of stocks trading above their 21-day simple moving average from the Nifty MidSmall Cap 400 index has not displayed any significant improvement during the recent recovery in the Nifty 50 index off the November 7 lows. So let us take a closer look at the Nifty MidSmall Cap 400 index to understand the current technical structure and relative performance of this index versus the Nifty 50 index.

Nifty MidSmall Cap 400 Index

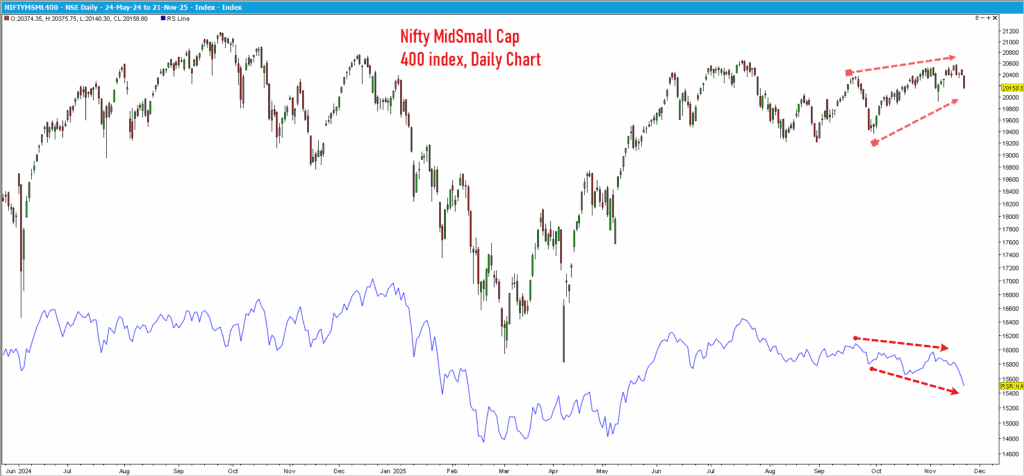

This index has struggled to keep pace with the Nifty 50 index in the past few months. There is a clear underperformance of this index in comparison to the Nifty 50 index suggesting that one should remain cautious about fresh exposures in the mid and small cap universe. Have a look at the chart featured below which captures the relative performance and the price action of the Nifty MidSmall Cap 400 index.

The blue line in the above chart captures the relative performance of the MidSmallCap index versus the Nifty 50. Notice the clear negative divergence between the price action and the relative performance line – while the price has recovered recently, blue relative performance line has breached prior swing lows and trending lower. This is classic negative divergence, warranting caution.

Unless the Nifty MidSmall Cap 400 index breaks out above the resistance at 21,000, there is no point considering exposures in broader markets. Apart from the breakout above 21,000 it is also important to check the relative performance and the improvement in breadth of this index before considering inclusion of mid and small cap stocks in the portfolio.

Sector indices

Now, let’s move to sector indices that are showing interesting trends.

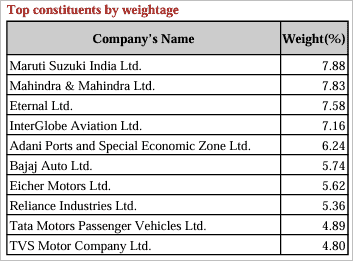

Nifty Mobility Index: We had highlighted the Nifty Auto index as one of the outperformers and bullish sectors in the prior updates. The Nifty Mobility index fits into this genre too. The Mobility index was launched in December 2021; the top 10 index heavyweights are below:

The Mobility index has a more interesting mix of stocks compared to the Auto index and it is also a relative outperformer too versus the Nifty 50 index. Short-term outlook for the mobility index is bullish, and the next target is 24,400-25,000. The bullish outlook would be under threat if this index drops below 21,200.

Nifty Bank Index: After several months of relative underperformance, the bank index has displayed commendable relative strength versus the Nifty 50 index in the past several weeks. The index has managed to reach fresh all-time highs ahead of the Nifty 50 index, suggesting outperformance. The short-term outlook for the bank index is positive and a rally to the next target zone to 62,500-63,000 appears likely. The bullish outlook would be under threat if the index slides below the support level at 56,500.

Summary

The medium to long term outlook for the Nifty 50 index is bullish. There is a possibility of some consolidation/ correction in the near term. But until 24,400 is breached, there would be a strong case for a rally to the target zones mentioned above. Select sectors such as Nifty Auto, Nifty Bank, Nifty Mobility and Nifty Rural are bullish and come across as relatively strong sectors versus the Nifty 50. Broader markets are yet to show clear signs of bullishness and outperformance.

2 thoughts on “Technical outlook: Is the Nifty 50 gearing up for a bullish ride?”

What is the logic of technical view on Nifty Mobility Index. There is no fund underlying this index.

Hello:

Appreciate that query. The logic here is to bring to our reader’s notice that these stocks / sectors are displaying strength. If there is a fund or ETF then it makes the job that much easier. Otherwise, one can look to include the stocks individually, based on personal stock selection criteria and risk appetite. The other option is to look for funds which have most of the top stocks of this index, so that it can act as a proxy.

Hope this helps.

B.Krishnakumar