Post -IPO listing, we have a HOLD call on this stock.

The secondary market may not be in the most festive mood but the primary market certainly is, with a spate of IPOs from big names with even bigger ticket sizes. The latest is the much-awaited IPO of LG Electronics’ India arm, LG Electronics India Limited (LG India).

After filing the DRHP back in December 2024, the company shelved its IPO plans before announcing it again in September 2025.

LG India will be the second company with a Korean parent to be listed in India that is a household name.

Here is why we think you should ‘hit’ subscribe on this IPO.

About the offer

This IPO is entirely an offer for sale by the parent company LG Electronics Inc; it currently owns 100% and is looking to offload about 10 crore shares which translate into a 15% stake. Priced at between Rs. 1,080 – Rs. 1,140 per share, the parent company is looking to raise Rs. 11,600 crores at the upper end of the price band.

The IPO opens for subscription from October 7 to October 9 with a tentative listing date of October 14, 2025. The parent, LG Electronics Inc, will own 85% of the company post issue. Minimum public holding rules in India may require the parent to dilute a further stake later.

The business

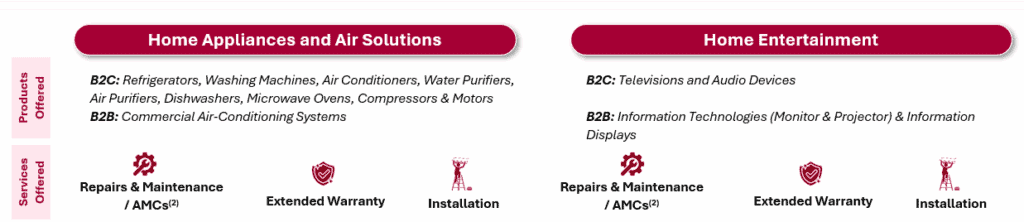

Established in 1997 as a wholly owned subsidiary of LG Electronics, LG India needs little introduction as a market leader in the Indian white goods market. The company primarily operates under two business segments – Home Appliances and Home Entertainment. While the company also had a mobile communication division in the past, this was discontinued in FY23 at both the India and the global level. The home appliances segment accounts for three-fourths of the revenue, with a few products clearly dominating LG India’s revenue mix.

Source: RHP

Two manufacturing units, one in Noida and the other in Pune with a total installed capacity of 1.451 crore units cater to over 80% of the sales in India. A third manufacturing unit that is coming up in Sri City, Andhra Pradesh will further expand production capacity when it goes live in FY27.

Beyond manufacturing and distribution, the company has built out a comprehensive service ecosystem offering installation, repair, and maintenance across its entire product portfolio. While LG India primarily caters to the domestic market, it also exports to the Middle East, Africa, Asia and South-Central America. This accounts for less than 10% of total sales.

Positives

# 1 Market Leadership Through Strategic Execution

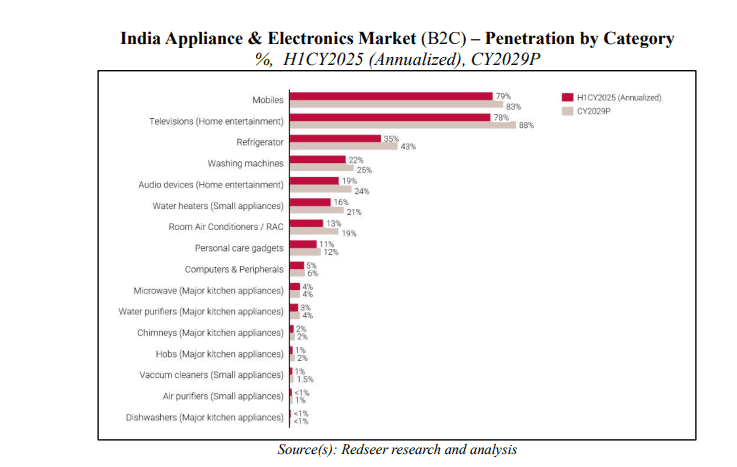

India’s appliances and electronics market has faced several challenges including volatile weather patterns and raw material cost pressures in the last several years. Despite these challenges, the sector has grown at a 7% CAGR from CY2019 to CY2024 as per the Redseer report that has been referred to in the prospectus.

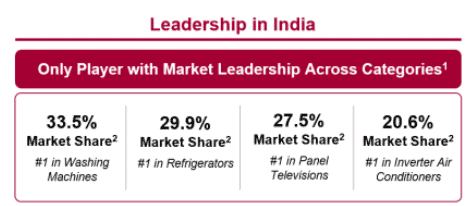

LG India has managed a stronger growth trajectory recently. While the 10-year revenue CAGR stands at 6.5%, sales have grown 13.1% over the last three years and 9.2% over the last five years. This has cemented LG India’s position as the market leader in appliances and electronics (offline channel per the Redseer report) – a position it has held from CY22 through June 2025.

The company has remained the dominant brand across major appliances, despite losing some market share between CY22 and CY24. The market share losses were on account of LG’s own strategic choices on exiting entry-level segments, rationalizing product portfolios and competition from retail chain brands and online-first players.

Source: RHP

The factors that drive LG’s market dominance are:

Consumer-Focused Innovation: LG India has gathered consumer insights via its distribution and service networks, using this feedback to develop products specifically for Indian consumers. This has resulted in products such as convertible refrigerators tailored for vegetarian diets and washing machines with a dedicated cycle for traditional clothing like sarees and India’s first 4K OLED TV in 2015.

Localized Manufacturing and Robust Supply Chain: Many consumer-facing MNCs in India rely on supplies from foreign group entities for their inputs and this escalates manufacturing costs. But for LG, over 80% of domestic sales are sourced from its two advanced manufacturing facilities in Noida and Pune. These units produce finished products and critical components including compressors and motors, giving LG India control over product development, quality, costs, and delivery timelines.

The company maintains long-standing supplier relationships domestically to feed these plants. Local procurement increased from 50.48% in FY23 to 54.12% in Q1 FY26. This enables rapid procurement adjustments and agile demand response while controlling inventory costs. The result: 90% of deliveries reach trade partners within 6-7 days. On-ground inventory at the retailers’ end is a critical driver of white goods sales, as customers prefer brands and models that they can physically see and try out.

Multi-Channel Distribution: LG India operates across both segments: B2C (over 90% of market) and B2B (commercial enterprises, hospitality). As of June 30, 2025, the company operates India’s largest distribution network for home appliances and consumer electronics, spanning 35,640 B2C touchpoints including LG BrandShops, modern trade outlets (Reliance Retail, Croma, Vijay Sales), online platforms, and traditional stores, distributors, and sub-dealers.

While post-pandemic, there has been a consumer shift to online channels, this has been more marked in small appliances. In the large appliances market, physical stores which enable demos and insights from sales staff, still offer comfort to customers. The expectation is that going forward the online channels will grow at a faster clip than the offline channels. Here, the LG brand should stand the company in good stead. LG’s flagship products are large appliances involving a big financial commitment and are often purchased using the Buy Now Pay Later (BNPL) route.

Serves a Diverse Consumer Base: LG India targets both the premium and value ends of the market effectively:

- Premium Positioning: The company has a strong presence in mid-to-premium categories, particularly smart TVs, refrigerators, and air conditioners. Products integrate AI, IoT, and energy-efficient technologies appealing to tech-savvy, affluent consumers. LG BrandShops offer personalized service and showcase high-end models, reinforcing the premium brand image.

- Value Segment: Through its extensive distribution network—traditional stores, sub-dealers, and rural sales offices—LG India reaches price-sensitive consumers. Regional product adaptations reflect a localized, value-driven approach. The company also outsources manufacture of some products at the low end of the price point.

Omni-Channel Strategy: LG India integrates offline presence with digital engagement through its website, e-commerce marketplaces, and partner platforms. Products are tailored to regional needs (such as hot/cold ACs for North India winters), and trained sales promoters enhance customer experience and cross-selling opportunities.

The company’s long-standing trade partnerships are reinforced by a robust after-sales network—one of the industry’s largest—comprising 1,006 authorized service centers, 13,368 engineers, and 4 call centers. A multi-platform presence (e-commerce, modern trade, exclusive brand outlets) ensures accessibility across all buyer segments.

Thus, as a market leader, LG India is well-positioned to capitalize on accelerating market growth in the durables market, projected at ~11% CAGR from CY2024 to CY2029 according to the Redseer report quoted in the prospectus.

While this seems like a steep jump from the 7% in the previous five calendar years, it is worth noting that CY19 to CY24 included the pandemic years and also coincided with new energy-related regulations that interrupted sales of white goods. This Crisil report notes that the industry grew at 13% in FY25 and estimates a 11% to 12% growth in FY26 and FY27 as well thanks to rising adoption of consumer durables financing, which also supports premiumisation.

Recent GST rationalization provides additional momentum, incentivizing consumers to premiumize and upgrade during upcoming replacement cycles. This will be a major growth tailwind in India especially in products that already have a high penetration level.

In addition to growth drivers such as rising disposable income, urbanization and increasing female workforce participation, consumers are increasingly investing in household upgrades and looking for smart, energy-efficient appliances to support changing lifestyles (such as shopping weekly rather than daily which translates into a need for a larger refrigerator / freezer, greater adoption of dishwashers etc.).

The opportunity is particularly compelling given low penetration rates in LG India’s core categories such as refrigerators, washing machines, air conditioners. Major kitchen appliances, currently a small sales contributor with penetration in the low single digits, offer significant potential.

Source: RHP

Robust growth forecasts for these segments through FY29 (exceeding the 11% industry expectation in categories such as air-conditioners and other major appliances) position LG India’s for better-than-industry growth.

Source: EY Report

#2 Robust financials with industry leading metrics

LG India operates with financial discipline, delivering industry-leading profitability and return ratios.

EBITDA margins have expanded consistently from 9.98% in FY22 to over 12% in FY25, driven by strategic pricing, favorable raw material trends, and efficiency improvements. The company continues to improve operational efficiency through targeted initiatives such as improving line capacity by reducing production losses, upgrading machines, redesigning product structures for manufacturing ease etc.

Regular cost optimization measures have yielded tangible results: raw material costs as a percentage of revenue declined from 70% in FY23 to 67.31% in FY25. LG India’s RoCE consistently outpaces other consumer electronics players, reflecting superior asset utilization.

Capital structure discipline is evident from LG’s history. LG India has not had to raise capital to fund its growth and consequently share capital remained stable over the years (until a bonus issue in FY25) while reserves and surplus grew substantially.

While LG’s return ratios have historically been healthy, they have received a further leg-up ahead of the IPO by LG India paying out exceptional interim dividends to its parent. The company paid out Interim dividends of Rs. 2,092 crore in FY24 and Rs. 2,488 crore in FY23 at rates of over 1,800-2,200%. In our view, LG however retains sufficient cash for its capex needs. Cash and cash equivalents stood at Rs. 4,574.93 crore as of June 2025, with sufficient headroom to fund the Sri City expansion.

#3 Capacity expansion to make India a manufacturing hub

While the Noida and Pune plants currently serve domestic demand, LG India is rapidly expanding production capacity through a new state-of-the-art facility in Sri City, Andhra Pradesh. The technologically advanced manufacturing facility represents a USD 600 million (Rs. 5,200 crore) investment. The facility is expected to become operational by March 31, 2027, with a phased production rollout. Phase 1 will focus on air conditioners and air conditioner compressors and subsequent phases on washing machines and refrigerators.

At full capacity, the plant will be capable of annually producing 2 million air conditioner compressors, 1.5 million air conditioners, 850,000 washing machines and 800,000 refrigerators. The facility will concentrate on high-end product lines such as french door refrigerators and front-loading washing machines.

The additional capacity serves a dual purpose:

- Meeting rising domestic market demand

- Serving neighboring export markets including the Middle East, Bangladesh, and Sri Lanka. LG India currently exports to 47 countries and export orders are via the parent. With the ability to manufacture more premium products, more export opportunities could open up too.

The Sri City facility is a key driver of future growth for LG India.

Key risks

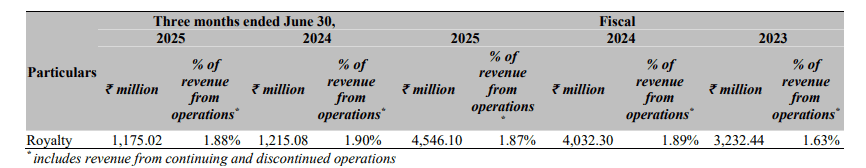

#1 Royalty

Like most MNCs, LG India operates under a license agreement with parent LG Electronics, paying a royalty to the parent for the LG brand, patented technology, technical know-how, and other IP rights. Under the agreement effective from January 1, 2023, LG India pays royalty fees of:

- 2.30% of net sales for products excluding LCD televisions and monitors

- 2.40% of net sales for LCD televisions and monitors

While the current agreement is perpetual (unless terminated by either party) and royalty payments have historically remained below 2% of revenue, there could be future increases in the royalty, which will pose a risk to profitability. With the removal of regulatory caps on royalty payments, Indian arms of MNCs have tended to raise these payouts over time.

Source: RHP

#2 Demand disappointments

The Sri City plant represents a significant capacity expansion. Any shortfall in anticipated demand could lead to poor utilisation and pressure profitability and return metrics. This risk is heightened by intensifying competition in the consumer appliances space in the domestic market from Chinese brands, retail chain private labels, and new-age businesses. Competitors increasingly differentiate through innovation or aggressive pricing.

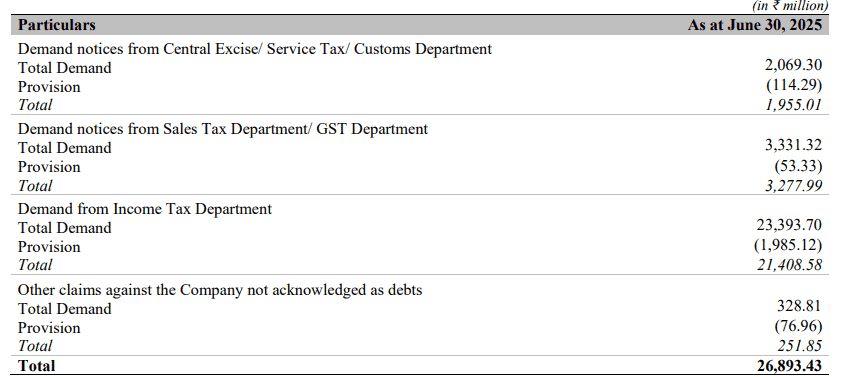

#3 Contingent liabilities

LG India carries contingent liabilities of ₹2,689 crores, predominantly demands from tax and excise authorities. While partial provisions have been made, the majority remain off-balance sheet. Should these contingencies materialize into actual payouts, they could temporarily strain the company’s cash position.

Source: RHP

Valuation

The LG India IPO is priced at ~38 times TTM PE. This is lower than peers such as Blue Star, Voltas, Havells and Whirlpool especially considering its market dominance and quality financials. The offer is also at a discount to Crompton Greaves Consumer, Orient Electric and V-Guard that operate in the highly competitive small appliances market.

The stock may also enjoy scarcity premium post-listing given the lack of strong listed players in large appliances, which is an important segment in discretionary consumption.

One of the few comparable listed players is Whirlpool (with similarities in product offerings and MNC parentage). In February 2024, Whirlpool Corporation (the parent) sold a 24.7% stake in Whirlpool of India through block deals for approximately Rs. 4,039 crore ($451 million). The transaction involved ~3 crore shares at a base price of Rs. 1,230 per share. This translated to nearly 100 times PE on depressed earnings, highlighting that the asking price for LG India is reasonable.

Our recommendation

LG India ticks the boxes for a high-quality stock that would make a good inclusion to long-term portfolios. The investment thesis rests on three pillars:

- Market dominance across major appliance categories

- Industry-leading financial metrics supported by a robust balance sheet

- Growth catalyst in the Sri City plant expansion

The IPO pricing offers reasonable value given the company’s competitive positioning and growth trajectory.

Recommendation: SUBSCRIBE

Please note that this report does not take into consideration listing gains.