Seniors often give a standard piece of financial advice to folks born in the 80s or after – ‘Max out your Voluntary EPF contributions.’ That’s because their own retirement planning began and ended with the EPF (Employees Provident Fund).

But with tax laws changing and much better investment options emerging, there is no longer any need for investors to rely on EPF for their retirement needs. We recommend keeping your EPF contributions to the minimum permitted by your employer, or even skipping it, if possible, for five good reasons.

#1 It’s employer-dependent

A big flaw in the EPF is that it forces you to put your retirement savings at the mercy of your employer. Your enrolment, KYC process, deposit of contributions, transfer of your EPF account when you switch jobs and processing of your maturity proceeds – all of these are routed through your employer and are dependent on the co-operation and competence of HR in the organisation you work with.

Employees across India who have worked with dubious companies ranging from Kingfisher to Byjus have lost out on both their pay cheques and their provident fund contributions when their companies ran into governance or debt troubles and decided to default on PF dues. EPFO’s FY23 annual report (its latest) records ₹13,953 crore in dues from defaulting organisations.

Crooked employers apart, recording errors by HR can also leave your money stuck with the EPF. The EPF is a peculiar investment organisation which has four times more dormant accounts than active ones. The EPF had 29.88 crore subscriber accounts as of March 31, 2023, but only 6.85 crore belonged to active contributing members.

The EPF’s large collection of inactive accounts is mainly due to employees switching jobs and being unable to access their past balances. Organisations create new UANs (Universal Accounts Numbers) when employees join them, fail to transfer PF balances of leaving employees or forget to officially close accounts. All of this results in employees’ EPF accounts becoming inaccessible later.

While the EPF may have worked smoothly in an earlier era where employees were sworn to a single organisation for life, it has proved a bad fit for employees of this generation who are mobile and frequently switch jobs for better prospects.

#2 Tax breaks are going away

Fans of the EPF hard-sell the scheme based on its ‘unique’ EEE (exempt-exempt-exempt) status which once made contributions, returns and maturity proceeds completely tax-free. But the EPF’s EEE status is now history due to recent changes in tax laws:

- From April 1 2020, employer contributions to the employees’ EPF account exceeding Rs 7.5 lakh a year were made taxable in the employees’ hands as a perquisite.

- From April 1 2021, tax laws were amended to say that if the employee’s own contributions to the EPF exceeded Rs 2.5 lakh in a year, the interest on the excess contribution would no longer be tax-free. This partly revoked tax breaks on contributions and returns.

In addition to all this, your EPF contributions are not eligible for section 80C benefits under the new tax regime. Today, opting for the new tax regime is a good decision for most taxpayers, with a standard deduction of Rs 75,000, wider slabs and low surcharge. Sticking with the EPF for the sake of wanting its tax breaks can prevent you from making this beneficial switch.

#3 The 8% return is unsustainable

One of the oft-repeated arguments for EPF is that no other vehicle can give you a guaranteed return of 8.25% (tax-free). It is true that the EPF has ‘declared’ returns of 8.1% to 9.5% in the last 15 years.

But fixed returns at these levels are not sustainable in the long run. EPF’s portfolio choices are guided by the investment pattern mandated by the government. Currently, guidelines require EPF to invest 45%-65% in central and state government securities, 20%-45% in other top-rated bonds, up to 5% in short term debt and 5%-15% in equities via Exchange Traded Funds.

The EPF is thus mainly a debt vehicle which sticks to sovereign and AAA rated debt for over 85% of its portfolio. While it has been investing incremental sums in ETFs (Sensex, Nifty, CPSE ETF, Bharat 22 ETF) since 2015, these account for just Rs 2.34 lakh crore, under 10% of its Rs 24.75 lakh crore portfolio. This cannot move the needle much on returns.

EPF returns depend mainly on yields on government securities and bonds from AAA companies, which are currently in the 7-7.5% range. Yet, the EPF has been declaring and distributing returns of 8% plus year after year. In 2022-23 for instance, while it declared returns of 8.15% to subscribers, its portfolio earned a weighted average yield of 7.78%. (Source EPF Annual Report 2022-23).

This is possibly because of administrative charges levied by the fund from employers and the large number of inoperative accounts, where retiring employees have failed to claim their balances within 36 months.

In the long run, the EPF cannot afford payouts that are much higher than yields on g-secs and AAA bonds which make up the bulk of its portfolio. Yields on g-secs and AAA bonds have trended down from over 8.5% to 7% in the last decade or so and are likely to head further south as India transitions into a more developed economy.

#4 It has archaic accounting

When you invest money in mutual funds or the NPS, your contributions go to buy units at the prevailing Net Asset Value (NAV) declared by the fund. Your returns are also calculated based on the mark-to-market value of the portfolio which is reflected in the NAV. This lends transparency to how and where you are earning your returns from such vehicles.

However, EPF operations are a black box. It pools contributions from subscribers, invests this in a common portfolio and pays claims out of this pool to subscribers who are retiring or exiting from the fund.

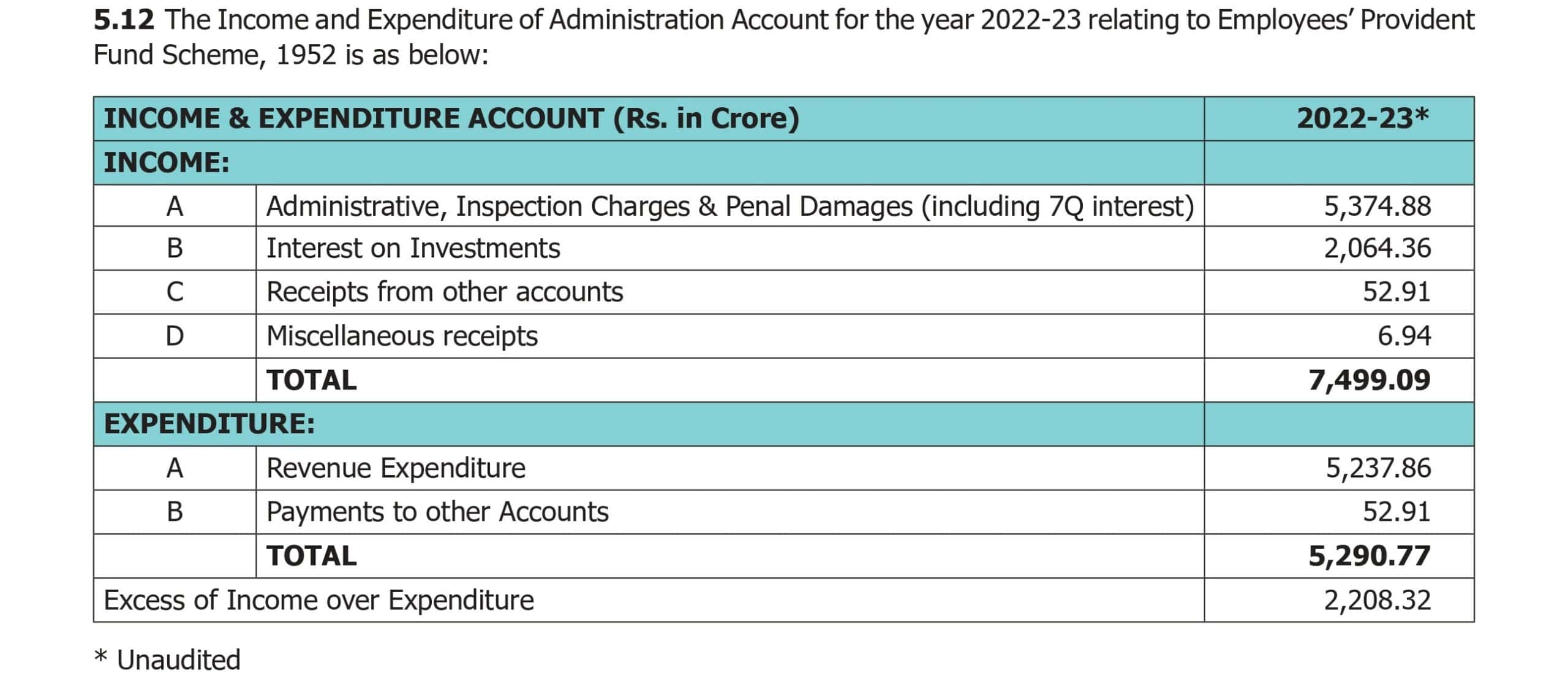

To decide its annual “returns”, the EPF prepares a simple income and expenditure account every year where excess of its income from administrative charges & interest over its expenses are treated as a ‘surplus’ and paid out. It is also not clear how often the EPF does a mark-to-market valuation of its portfolio, as its investments are captured at face value in its annual report. Substantial delays in publication of its annual accounts and reports (2022-23 is the latest one in the public domain) also make it hard to fathom the state of its finances.

The EPF also does not follow unit accounting. Unit accounting makes it possible for investors in mutual funds, NPS and other market vehicles to time their entry and exit into the vehicle to favourable bond or stock market conditions and ensures that portfolio returns are fairly distributed to investors.

In fact, the lack of unit accounting seems to be the reason why the EPF has found it so tough to credit interest dues to individual subscribers on time, since the change in taxation policies in 2021. While the fund claims that subscribers will be given due credit for their accumulated interest for compounding purposes, the interest credit often does not reflect in member passbooks for several months after the end of each financial year.

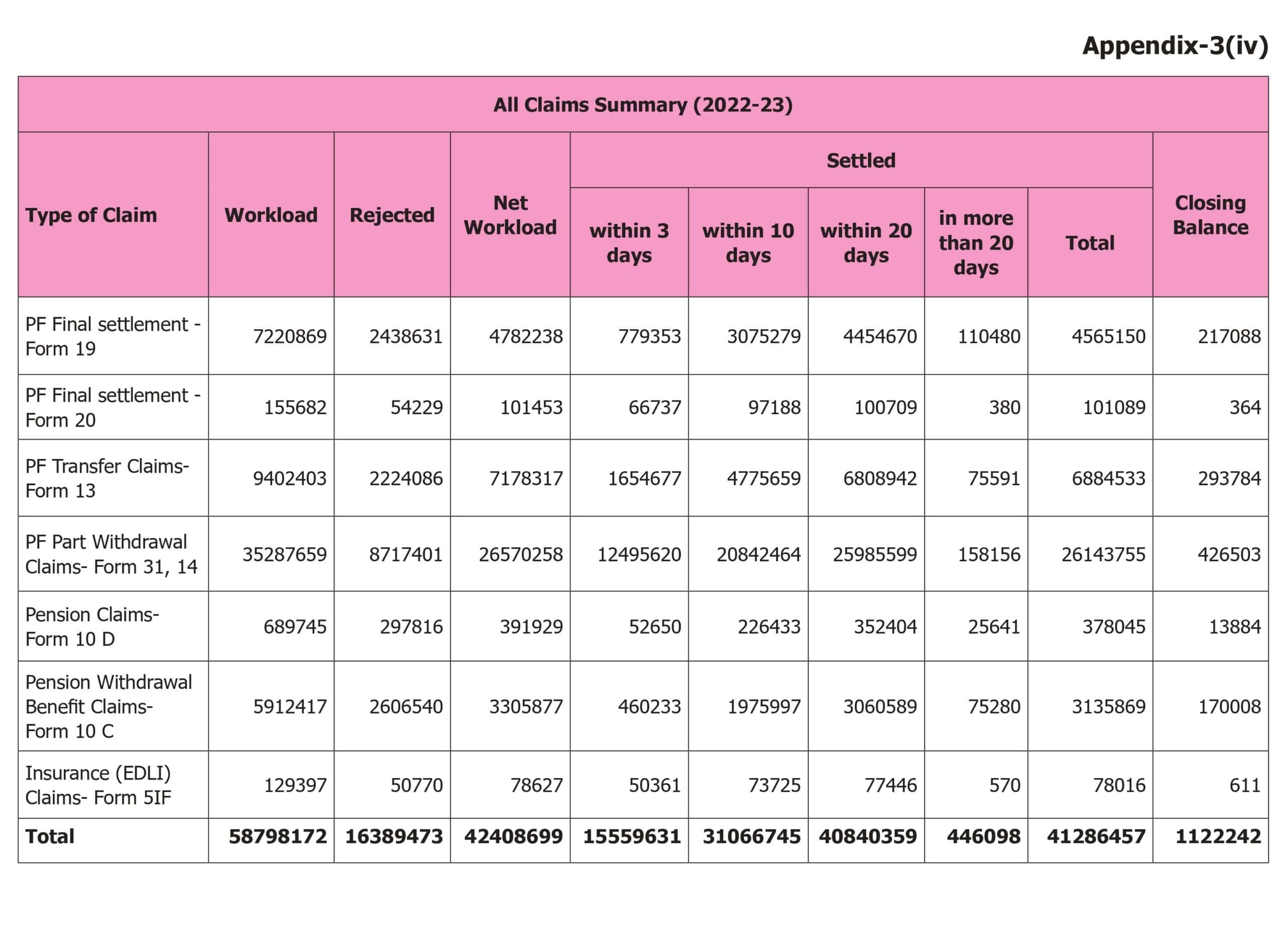

#5 It rejects a lot of claims

There’s nothing new about the EPF’s accounting methods or investment patterns. But a disturbing feature of the fund lately has been a rising rate of claim rejections. Though the EPF’s user interface has become friendlier in recent years, with subscribers able to access their balances and passbook through the Umang App, the back-end seems to be mired in problems.

The X handle of the EPFO (@socialepfo) is rife with complaints from subscribers whose maturity claims or advances from EPF have been delayed or denied. This particular issue has also been getting media coverage of late.

Subscribers trying to withdraw their balances say they are stymied by minor name mismatches between their EPF records and their Aadhar, multiple UANs created in their name, lack of proper Aadhar seeding or UAN allotment and so on. They also complain of being made to run from pillar to post due to jurisdiction issues, inordinate delays in responses from EPF offices and more. These experiences are not one-off, as the EPF annual report for FY23 reveals that it rejected 33% of the final settlement claims filed in that year.

Given that an employee makes lifelong contributions to the EPF and cannot easily withdraw prematurely, claims rejections in this vehicle need to be taken much more seriously than is the case with other investments.

Bottomline

All this makes a good case for opting out of the EPF if your employer allows it. The EPF is supposed to be optional for employees earning over Rs 15,000 a month in basic pay. If your employer organization insists on enrolling you, you can still keep your contributions to the minimum of Rs 1,800 a month (based on 12% of Rs 15,000).

Given that retirement is a long-term goal for most folks and a tough one at that, investments towards it are best made in equity-oriented vehicles rather than debt-oriented ones like the EPF. While you minimize your EPF contributions, it’s important to start building a corpus with mutual funds or other equity vehicles, to ensure your retirement goal is met.

43 thoughts on “5 reasons to give EPF a miss”

You can withdraw 1L for illness. However, it takes a month to settle the claim and you have to wait another month (from the date of claim approval) to raise a new claim. I guess its worth the challenge and empty the employee contribution for your personal needs.

Hi Aarati,

Nice article that looks beyond tax and current returns.

I am a victim of point #5. There are 2 UANs created by previous and current employer with minor name mismatch. I am trying to get it resolved for the past 2 years without success. Hoping to get it resolved before i retire:). All that you said is true about subscribers made to run from pillar to pillar.

A friend of mine faces similar problem. He works at Bangalore, but his employer’s PF office is at PUNE.

The worst part of it is, there is no single office/person you can ask and no timeline…

Aadhaar seeding, UAN was supposed to simplify complications such as this. But, they have introduced more issues.

Very good article… there are few points to consider though

1. In my case, the amount of contribution made by me an equivalent contribution is made by the employer. If I opt-out of EPF, then employer will not provide me that money. I realize that over last few years that corpus became significant because of employer contribution.

2. We can not generalize new generation employees… there are still many employees who prefer to stick to same company for many years (I know of few in my company, who are 13 years of experience and its their first and only company)…

3. I believe that until finanncial knowledge is taught in schools, for new genration employees cash in hand by not contributing to EPF may not always translate to investment in mutual fund. The advantage of EPF is deduction before salary hits the bank (so creates discipline)… ofcourse a better way is have automatic deduction into mutual fund before salary hitting bank. Those who have self-discipline, they can anyway invest the remaining corpus to build wealth despite EPF investment.

Yes the EPFO as an organization and execution is pathetic but the concept may be good and useful even in today’s day and age.

BTW in case you plan to write a second part of this article, please include EPS contribution which seems to be a waste for most high earners.

Thank you. Those are good points indeed. That’s why any piece of investment advice can never be universal. It may suit some and won’t suit others. However on the first point alone, many employers look at pay on a CTC basis and I know of cases where the employers’ contribution was added to pay despite employee opting out of EPF.

Thanks Aarati for this, shall we say ‘disruptive’, write up! Your opening sentence was so on the mark (exactly what I told my daughter who started working recently). Some of the points were really informative and not something we would have noticed. Many of us have blinkered vision when it comes to anything”tax free”.

To be fair, I got my settlement a couple of years back & it was super smooth. Of course, I did my bit of prior spadework with updating IFSC code, Aadhar linking etc..

Thanks again. I am going to re- advise my daughter & am thinking of asking her to take out a subscription. Afterall, I will not always be there for advice…

Regards

Thanks so much! I myself used to invest a lot in VPF until a deeper look into EPF numbers and accounts made me change my mind. The recent spike in rejections was simply the last straw! There are after all far better options available today.

As you clearly pointed out the biggest issue of the lot is – opacity and non-unitization. That can help people get clarity on its performance…

Thank you for the eye-opening article. Can you please write one more article on next steps? I mean my PF contribution is more than 15,000 per month and I need guidance on how to reduce my contribution and guidelines on PF withdrawal. Thanks in advance

Will try n write..

Good insights, thanks! Could you also please share your views on PPF investing, especially for those who fall under New Regime.

Sure shall write on PPF

It was shocking to realize that EPFO has a rejection ratio of 33%. This article was nice and made me look at EPF in a new light.

Thank you. Yes it is a shocker!

Income from admin and inspection charges, and penal damages is more than twice the interest on investments??? How? Why?

Is there any more data available in the public domain about these charges and damages?

😁 it is a very mysterious orgn. But seriously as every enrolled orgn, which is effectively every firm with over 20 workers in India has to pay admin charges, that’s a large pool. Penalty etc is harder to figure out. You can check out their annual report here. https://www.epfindia.gov.in/site_en/Annual_Report.php

Thanks Aarati for the article.

Latest news is that EPF 3.0 is supposed to get launch by mid 2025. this is as per info from Money control. Key feature is allowing subscribers to withdraw their money through ATM’s.

ATMs?? what if i withdraw say 5L in a year. I have to deposit it back in bank. Wont that be a additional headache for me if IT guys come calling on me??

With this, isn’t the EPFO putting subscribers from one frying pan to another?

Your thoughts please?

https://www.moneycontrol.com/news/videos/business/epfo-3-0-subscribers-could-be-allowed-to-withdraw-pf-using-atms-12882825.html/amp

Would rather bet on vehicles like MFs that are already investor friendly.

Comments are closed.