New investors are often told that one of their first steps to financial freedom is to open a Public Provident Fund or PPF account. This is mainly owing to PPF’s 8% plus returns historically and its EEE tax status.

But PPF returns have dramatically declined in recent years. Plus, the tax breaks on PPF contributions are no longer relevant to many investors because their 80C quota is already full, or because they are in the new tax regime.

So, does investing in PPF still make sense? Who should invest in the PPF? Here’s a review.

PPF basics

Many people think of the PPF as a fixed income vehicle for retirees. But PPF is actually a debt investment for younger folk looking to accumulate money for their retirement.

Any individual can open a PPF account either at India Post branches or with leading banks such as SBI, ICICI Bank, HDFC Bank and so on. Before discussing its pros and cons, here are its basic features.

- A PPF account has a 15-year maturity. Once this 15-year period ends, your PPF account can be extended in blocks of 5 years.

- Only one PPF account is allowed per individual. Apart from an account in their own name, parents or guardians can open an additional account in the name of a minor.

- Your investment in PPF is capped at Rs 1.5 lakh per financial year. You can invest this in a lumpsum or via instalments. Any investment beyond Rs 1.5 lakh a year will be returned to you.

- The minimum amount you need to invest every financial year to keep your PPF account active is Rs 500. If you fail to make it, the account will be treated as discontinued. You can revive discontinued accounts by paying Rs 50 as a fine, along with Rs 500 for every year of skipped investments.

- Your PPF account earns interest at a floating rate. The interest on your PPF balance is decided by the Government, which announces the PPF interest rate along with other small savings schemes at the beginning of every quarter. Once a new rate is announced, all your accumulated PPF balances will earn only this interest until the rate is revised.

- The PPF does not pay out interest like other small savings schemes. The declared interest is credited to your account and compounds until maturity.

- Your initial investment in PPF is exempt under section 80C of the Income Tax Act, if you are under the old tax regime. Under the new tax regime, there is no exemption on your contributions. But the interest earned and your maturity proceeds on PPF are exempted, both under the old and the new regimes.

- To calculate monthly interest, the PPF considers the lowest balance between the 5th and the end of the month. Therefore, depositing money before the 5th earns you full interest.

Poor liquidity

Apart from returns, a key feature you should look for in any investment is liquidity. The PPF is not a very liquid product. It offers only two ways to take out your money before the end of 15 years.

#1 Partial withdrawal

The PPF allows you to take out part of your balance with the scheme after completing 5 financial years from the end of the first year. However, there are complicated rules on how much you can withdraw. The PPF rulebook says that you can withdraw 50% of the balance in the previous year, or 50% of the balance four years before – whichever is lower.

That is, if you opened your PPF account in FY21 you can make your first withdrawal in FY27 and after. If you choose to withdraw in FY27, the amount you can withdraw will be 50% of your balance at end of FY26 or FY23 (four years before), whichever is lower. Obviously for most people, the relevant number will be 50% of the balance they had in FY23. If you withdraw in FY28, you will need to compare the balance in FY24 with FY27. Why this strange rule exists, only the babus can explain. But you can refer to the rules here.

#2 Genuine hardship

You can also apply for premature closure of a PPF account on grounds of “genuine hardship” under Rule 13. But what “genuine hardship” is, is left to the discretion of the Department of Economic Affairs, Government of India.

It has been clarified that migrating abroad, marriage, purchases of property, ceremonies, loan repayment, loss of job etc do not qualify as “hardships” for early closure of your PPF. Only medical reasons such as life-threatening diseases will be considered. This application has to be made in prescribed format, after the completion of 6 years in the scheme, as is the case with partial withdrawal.

In effect, only a fraction of your PPF balance in any given year can be withdrawn. Therefore, you should not count on the scheme for liquidity in emergencies. But the PPF’s rigid lock-in rules do ensure that your compounding doesn’t get interrupted easily. For folks who have trouble staying the course with their investments, the PPF’s rigidity can be a positive.

Floating returns

Historically, the biggest attraction of the PPF was that it used to offer 8% plus returns, along with sovereign backing and EEE status. But after the PPF was transformed into a floating rate scheme, its interest rates have headed steadily south.

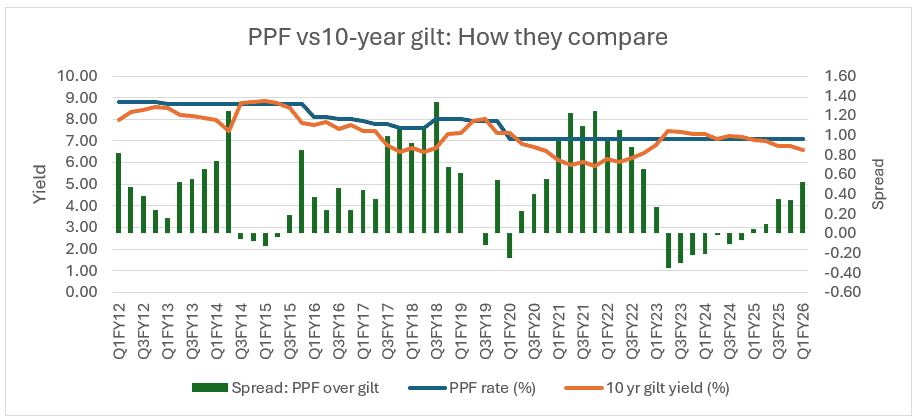

While rates on other small savings schemes such as the Senior Citizens Savings Scheme and NSC have broadly tracked yields on government securities, the PPF interest rate has “decoupled” even from this.

When PPF interest rates were made floating on a quarterly basis, the rate was supposed to be set at a 25 basis point premium over the 10-year g-sec yield (recommendation of the Shyamal Gopinath Committee on small savings). But this link has been broken too. Though the 10-year g-sec yield has experienced swings in the last five years, the PPF rate has not budged.

The graph below compares the quarterly interest rates on PPF with the 10-year government security yield.

The data can be downloaded in this excel sheet as well.

The government dropped the PPF interest rate from 7.9% to 7.1% in Q1FY20, just before Covid. It has held it at 7.1% for the five years since then. In FY21, the 10-year g-sec yield plunged to 5.8% but the PPF rate remained at 7.1%. In FY23, the 10-year yield shot up past 7.4%, but the PPF rate remained the same.

This total delinking from market interest rates has made it very hard to predict how PPF yields will move in future. It looks as if the government, aware that the PPF interest is tax-free, will not be hiking it as much as other small savings schemes (which have taxable interest) during uptrends in the rate cycle. But whether the PPF rate will come down further as 10-year yields tumble is hard to say. The next few quarters will be a good test of this, as the 10-year gilt yield is now at 6.24%.

Given its floating nature and downward bias in rates, the PPF will not protect you from reinvestment risks when rates fall. If you expect interest rates in India to head steadily down over time, you should expect PPF returns also to dip in tandem. Unlike debt mutual funds or bonds, the PPF also does not give you capital gains when rates fall. Today, if you invest in a 15-year bond or a debt fund with medium/long duration, you will reap capital gains if rates fall to 6% or 5%. But you will not make any such gains with the PPF.

On the positive side, the one factor that compensates for the unpredictability in PPF rates and their floating nature is their tax-free status. Today, there are hardly any fixed income instruments left in India where the interest income is completely tax-free.

The PPF’s 7.1% tax-free interest is therefore equivalent to much higher interest from other taxable debt instruments. With taxable debt vehicles, investors in the 30% tax bracket (with cess) would need to earn 10.31% to receive post-tax income of 7.1% and those in the 20% bracket would need to earn nearly 9%. Earning such high returns from debt instruments would entail taking credit risk. PPF, being sovereign-guaranteed instrument, is free of credit risk.

Use-cases for the PPF

The above features suggest that the following classes of investors may NOT find the PPF very useful:

- Income-seeking investors (no payout, only interest accumulation)

- Investors with income of upto Rs 12 lakh a year (can enjoy-free income from higher-return debt instruments due to rebate)

- Young folks looking for wealth creation (while compounding is a plus, the floating rates are a minus).

- Retirees seeking predictable returns/income (no payout). SCSS is a better avenue for stable income seekers. The GOI Floating Rate bonds work for income seekers who don’t mind variable returns.

- Investors looking to lock into long-duration instruments as they expect interest rates to decline in the long run (falling returns due to floating rates)

- Investors looking to park emergency money (no liquidity)

- Investors looking for wealth creation through debt instruments (debt MFs do this job better)

PPF can however be quite useful for the following investors

- Investors who are not savvy with money (offers capital protection with inflation-beating returns, without any active management)

- Investors seeking to protect wealth already made (capital safety with inflation-beating returns)

- Investors seeking a debt vehicle for the last 10-15 years of their working life.

- Investors in higher tax brackets, for part of the debt portion of their long-term goals such as children’s education or retirement. PPF’s tax-free compounding feature makes it a good long-term vehicle. Should PPF rates fall significantly in future, you can discontinue large investments in it and keep your account alive with Rs 500 a year. But remember here that you will not be able to use the PPF amount for rebalancing purposes, as liquidity is low.

9 thoughts on “Who should invest in the PPF? ”

One important point to be added is that PPF works as perhaps the only safe investment specially for proprietors and partners in firms , having unlimited liability . The amount in PPF account will not be liable to attachment under any order or decree of any court in respect of any debt or liability incurred by the account holder.

Yes thank you. That’s an important point

Hello mam, NRI here…. I started my PPF account when I was a resident Indian and then became an NRI… I tried to close my PPF account immediately after attaining NRI status but bank manager tried & told she could not… since then I have been investing in it 1.5 lakhs per year… now recent budget have made some changes regarding marking NRI Please F accounts as irregular? Any idea on that? Wat should I do to this PPF?

NRIs are no longer allowed to open PPF accounts. But per our understanding, existing accounts can be continued till maturity when the proceeds will be transferred into a NRO account. It may be best to keep your account active with minimal contributions. However we are not tax experts and we advise you consult a tax expert on this issue.

Thanks. Madam

A very timely and lucid as usual article.

If you can give your views on following

1. If one has a large accumulated balance in PPF and no tax liability fro fy 25-26 as limit is now 12L

2 However does not need additional interest income from PPF corpus.

3 objective is to protect against PPF interest rate decline to ensure better returns on corpus.

4 Investment horizon at least 15 yrs

5 PPF account is 30 yrs old

Can any debt fund be better alternative to withdraw money and park in it at this point in time? or any other debt instrument? Since in past even when repo rate was around 4% , PPF rate remained at 7.1%. Hence

one should remain invested

If you want to compound returns and not withdraw, then you can try corporate bond funds or gilt funds recommended by us for 5 year plus horizons

PPF has surely lost some of its charm with the new tax regime. I remember the feeling when, not too long ago, for the first time, I could deposit a full 1.5 lakh in a year.

How were the rates decided before it was transformed into a floating rate scheme, especially when the rates were higher than 10%?

How do you differentiate between investors “looking for wealth creation through debt instruments” and “seeking a debt vehicle for the last 10-15 years of their working life”?

Why wouldn’t debt funds (including G and C in NPS tier 2) do a better job for the latter?

Earlier rates were just fixed by govt without market linkages. Wealth creation refers to investors in early stages of career. Not necessarily. In the 20% plus tax brackets, it is not easy to get to a 7.1% post tax return today. May be similar in future.

Comments are closed.