If you needed any proof that India’s urban consumers are drastically changing their spending patterns, you got it from the September ‘24 earnings calls of FMCG and retail companies. Firms from HUL and Nestle to D-Mart talked of how affluent customers were relying more on quick commerce to meet their daily needs, with this channel growing 30-40% while traditional retail stores struggled.

This tells you why the IPOs of tech-enabled platform companies like the Swiggy IPO are worth a serious look, despite their lack of profits

The offer

Swiggy is making a fresh issue of Rs. 4,499 crore in this IPO, with an offer for sale of Rs. 6,828 crore. This totals to an issue size of Rs. 11,327 crore at a price band of Rs.371 to 390 per share.

Post IPO, the founders’ stake will dip slightly from 7.11% to 6.75%. Among the private equity investors, Softbank is not participating in the offer for sale. Naspers is the major seller, reducing its stake from 31% to 26%. Tencent’s stake will dip from 3.64% to 3.3%, Accel’s from 4.71% to 4.2% and Norwest’s from 3.16% to 2.9% post-IPO.

The bulk of the proceeds of this IPO are going to defend Swiggy’s position in the newer quick commerce business. Of the fresh issue proceeds:

- Rs 1,178 crore is proposed to be invested in Swiggy’s material subsidiary Scootsy for expansion of the dark store network critical to the scaling up of quick commerce.

- Another Rs 165 crore will go to repay Scootsy’s debt.

- Rs 703 crore will be invested in tech infrastructure while Rs 1,115 crore will be set aside towards marketing expenses.

The Swiggy IPO will open on November 6th and close on 8th.

Business

First generation entrepreneurs Sriharsha Majety and Nandan Reddy made their entrepreneurial debut with a technology start-up to solve the problems of small businesses with the name “Bundl”.

The founders soon spotted opportunity in online restaurant aggregation and food delivery and embarked on this venture called Swiggy in 2014. By signing up a large network of restaurant partners, investing in an in-house logistics fleet and thus delivering a better customer experience, Swiggy vanquished other rivals such as Foodpanda, Tinyowl, Justeat and so on to become the market leader just before Covid.

After attaining a $3.6 billion valuation by 2020, it smelt opportunity in grocery delivery during the pandemic. This flagged off the quick commerce category, which has since managed scorching growth rates.

To capitalise on its long presence in the platform business, Swiggy is placing big bets on a unified app approach, where it aggregates customers for its Instamart (quick commerce), Swiggy (food delivery), Dineout (restaurant booking business) and Genie (parcel pickup) verticals. The Swiggy One membership programme strengthens the network effect by allowing customers to seamlessly avail of discounts in food delivery fees, restaurant bookings, quick commerce delivery fees and products, nudging customers to stick to the Swiggy app and transact across its verticals.

The Swiggy IPO – what matters

Swiggy is banking on two key verticals – food delivery and quick commerce – to propel growth. On this front, there are three main points to observe:

- One, both businesses are high-growth potential and directly play into changing consumer spending habits. To this end, Swiggy will benefit from the overall expansion in the market size.

- Two, in the food delivery sector, the playing field is pretty level with only Zomato and Swiggy being the contenders. Both companies have also demonstrated profitability in this business and entry barriers are high.

- Three, the quick commerce business is the bigger growth driver but is also by far a newer sector. Swiggy faces Zomato and Zepto as its primary competitors, both of which are also armed with a large funding base. The quick commerce sector is an evolving one with more players set to enter the field. Challenges for all players lie in improving profitability at the EBITDA and net levels.

The Swiggy IPO needs to be looked from these perspectives.

Swiggy was the first mover in quick commerce. But disruption is the name of the game in new-age businesses. Zomato, entering both food delivery and quick commerce after Swiggy, has managed to pull ahead of it.

During Covid, Swiggy scaled down its presence beyond top cities anticipating a slowdown in orders. Zomato slipped neatly into this gap and benefited from the wave of workers returning to their hometowns during the pandemic. In quick commerce, Zomato acquired Blinkit and challenged Instamart’s 30-minute delivery with a 10-minute promise. It also deployed its massive proceeds from its IPO in 2021 to expand its geographical presence, open more dark stores, sign on more restaurant and merchant partners, and accelerate its user base in the last 3-4 years. It has also turned EBIDTA positive while Swiggy remains loss-making.

For Swiggy, whether funds raised from this IPO and other business course-corrections will help it claw back to its leadership position is hard to call.

But even as a number-two player, Swiggy is still a strong contender in two sectors (food delivery & quick commerce) with a huge growth runway over the next 5 years. Swiggy holds a 45% market share in the food delivery business and a 27-28% market share in quick commerce positioning it well to capitalise on the overall expansion in these two sectors.

MTU: Monthly transacting users. GOV: Gross order value. AOV: Average order value

Duopoly in food delivery

Hockey-stick growth in India’s digital adoption has brought about watershed changes in consumption patterns, leading to completely new consumer services grabbing a sizeable share of the consumer wallet. Food delivery and quick commerce are two such big segments.

Rising inter-city migration for work, a large GenZ cohort and the growth in double-income families has given birth to a large class of affluent urban consumers who now prioritise convenience and time saved over value-for-money, in their consumption habits. This has led to online food delivery services taking off.

The food delivery business holds good potential for sustained growth, based on the following factors:

- Redseer estimates that the food services market in India will expand from $70 billion in FY23 to $115-120 billion by FY28. This will ramp up the online food delivery market from $8 billion in FY23 to $17-21 billion by FY28, based on online food delivery taking a 15-17% bite of food services. This seems quite plausible given that online food delivery has ramped up from $1.4 billion to $8 billion in the five years from FY18 to FY23.

- Though Covid provided the trigger for urban consumers to ramp up online food orders, the service has since proved habit-forming - many urban households are now substituting in-home cooking with frequently ordering in. It appears unlikely that this trend will reverse in the foreseeable future.

- Growth drivers can come from several levers. Players can expand their presence both within the top 60 cities (which account for 75-80% of current user base for online food delivery) and beyond them. They can nudge more of the current users on its platform into ordering more frequently. Currently only 25-29% of the 85 million users registered on food delivery platforms transact monthly. It can also nudge users old and new to raise their Average Order Value (AOV).

Drilling down to players, the food delivery sector today is a clear duopolistic business with Zomato and Swiggy. Other market players have either dropped out or been acquired. With the vast network of restaurant and delivery partners already built up by Swiggy and Zomato, it will be difficult for new entrants to challenge their duopoly. Therefore, any growth in this sector will be effectively captured by both Swiggy and Zomato. Here’s how these two compare.

- Swiggy has a higher Average Order Value than Zomato

- However, it lags Zomato on metrics such as number of restaurant partners, transacting users and total orders. As a result, Swiggy’s Gross Order Value was about Rs 6,800 crore versus Zomato’s Rs 9,300 crore (Q1FY25), with its monthly transacting users at 14 million behind Zomato’s 20 million. It also had fewer restaurant partners at 2.2 lakh compared to Zomato’s 2.7 lakh.

However, it has managed to narrow this gap over the past year. It is doubling down on its loyalty programme Swiggy One to add users and has started charging a platform fee of Rs 10 in select markets, like Zomato, to improve contribution margins. It has also rolled out Swiggy Bolt, a new 10-minute food delivery vertical to meet the urgent food needs of urban folk and push user numbers and orders. The food delivery segment has turned EBITDA positive in the June 2024 quarter.

Quick commerce - trickier turf

If the food delivery business is settling down into a two-horse race, the quick commerce business is still wide open. Flagged off by Instamart as a convenient way to do your grocery shopping during the pandemic, quick commerce has taken flight in the last three years with Zomato acquiring Blinkit and scaling it up and Zepto managing successive rounds of fund-raising. While Swiggy launched Instamart with a 30-minute delivery promise, Blinkit and Zepto upped the ante by shrinking delivery times to 10 minutes.

There are several aspects to the quick commerce business that make it an uncertain call as to which player can gain the upper hand.

#1 Market opportunity

Quick commerce has turned an addictive habit with urban consumers who have been turning to these platforms for everything from their dairy and vegetable shopping to buying festival decorations and electronics. A category that exists in no other country, quick commerce works in India’s highly populated metro centres because of the large catchment area of population that can be catered to within a small radius, and the availability of a large population of part-time gig workers who can deliver on the 10-minute promise.

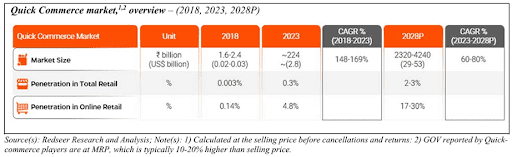

Redseer expects the quick commerce opportunity to be even larger than the food delivery opportunity in the next five years, expecting the $2.8 billion market (by GOV) in FY23 to expand to $28-53 billion by FY28.

Recent earnings calls from FMCG giants and retailers pointing to 40-50% growth in consumer products offtake from quick commerce, disrupting both modern and kirana retail, suggest that this category is at an inflection point.

#2 Capital intensity

Quick commerce is highly capital intensive. To fulfil the ’10-minute’ delivery promise, quick commerce platforms invest in multiple “dark stores” in high-density urban localities to cater to the catchment area of proximate customers. They also own dedicated fleets to refill dark stores with the appropriate stock keeping units (SKUs) sourced from merchant and brand partners.

Given that these dark stores need to be located in proximity to high demand centres in the metros, they entail high cost by way of lease charges apart from subsequent investments to equip them to stock both dry and fresh products. Rough estimates peg the current set-up costs at Rs 65-85 lakh per dark store.

At the end of the June 24 quarter, Swiggy had a network of 557 dark stores spanning 32 cities (Zomato is ahead with 639 dark stores across 44 cities). Swiggy will use IPO proceeds to add 741 new dark stores to its existing count of 557 by FY28.

#3 Competitive intensity

Competition in the quick commerce space, unlike the food delivery business, is intense and is likely to only heat up further. For one, the large market opportunity in the quick commerce business is an attraction. Two, players such as Blinkit and Zepto have begun to encroach on the territory of e-commerce biggies such as Amazon and Flipkart by moving beyond produce and everyday groceries, forcing these players into action.

Therefore, the quick commerce space is set to see new entrants such as Amazon, Flipkart, Reliance Retail and others. However, one positive for existing market leaders (Blinkit, Instamart, Zepto) is the immense investments required in dark store and dedicated fleet infrastructure, which they already have and which will be a challenge for new entrants. Right now, Swiggy’s Rs 7,000 crore war chest post-IPO and Zomato’s Rs 10,500 crore coffers after recent fund-raising may help to keep competition at bay for some time.

Next, quick commerce is a very different ball game from food delivery on customer loyalties. Customers are prone to juggling actively between platforms based on discounts, waiver of delivery fees and the availability of the products they seek.

Therefore, the key success factors for market share gains in quick commerce are quickly shifting from 10-minute delivery to the assortment of products listed on the platform, a dynamic changing of listings based on needs and seasons (such as festival needs), discounts being offered on products, and delivery fees.

Third, the intensifying competition in quick commerce suggests that discounting and delivery fee waivers may be the order of the day. This makes it a rocky road to profitability for all players, including Swiggy and even Zomato.

For all these reasons, it is uncertain how the quick commerce space will evolve. While Zomato has established a path to profitability here, rising competition can squeeze margins. With all players vying for market share, leadership positions may also shift.

For Instamart, about 25% of its listings are non-grocery products. This perhaps explains the big gap in AOV as well as GOV between Instamart and Zomato, besides profitability.

Dark store expansion and cross-selling to Swiggy One users may help Swiggy expand its user base in quick commerce. However, it will have to ink far more tie ups with merchant and brand partners to fix the gaps in its product listings, which is the route to higher AOV as well as profitability.

#4 Regulatory risks

Apart from the business risks arising from intensifying competition the quick commerce business is also subject to regulatory risks. With quick commerce disrupting traditional supply chains for consumer products like FMCGs, there has been a barrage of protests lately from the traditional distributor lobby on quick commerce hurting kirana stores.

Recent media reports suggest that quick commerce has led to the shut-down of 2 lakh Kirana stores. There has also been political rhetoric about quick commerce players violating FDI in retail norms by ‘controlling inventory’ via their dark stores. FDI regulations in India prohibit inventory-based models for foreign-funded retail players and only allow marketplace models.

Should this rhetoric lead to the government halting approvals for dark stores or imposing penalties or fees on quick commerce players, that could be a body blow to both scaling up plans and profitability. However, such risks threaten most sunrise sectors that disrupt traditional business models for growth.

Valuations and IPO call

To summarize, Swiggy is present in two high-growth sectors. The food delivery is the more established between the two where the company is a dominant player and likely to remain so. The quick commerce business, which Swiggy is actively pursuing, uncertainties are high.

The bet on the Swiggy IPO, therefore, boils down to the asking price. On this score, the answer is a ‘Yes’ compared with Zomato if you go purely by rough-cut relative valuation. At the upper end of the price band of Rs 371 to Rs 390, the Swiggy IPO has marketcap-to-sales ratio of about 7.7 times (on a post-issue equity). This is sizeably lower than 18-19 times for Zomato. Zepto, the third-largest quick commerce player, has raised $340 million at a $5 billion valuation in August 2024. This sets a reasonable floor case for Swiggy’s valuation given that it has an entrenched food delivery business.

But the valuation for this industry, per se, still seems high considering the uncertainties. The ability to command the valuation that they both do hinges on multiple factors at play. Should any aspect of this change, valuations for both Swiggy and Zomato can take a hit. The nascent nature of this business, therefore, makes it a highly risky bet, and one only for investors with a high-risk appetite.

For others, we think such high-return, high-growth opportunities are best played in a more portfolio-oriented structure where allocations are controlled and risk distributed among other stocks.

Our consumption-themed smallcase – Prime Trends Consumption, is a good example, where exposure to these emerging businesses (including this business) are balanced by holding more established players. You can use the coupon code FESTIVAL10 to subscribe to this smallcase, if you’re interested.

4 thoughts on “Swiggy IPO: Should you place the order?”

Where is the growth going to come from. From the Covid days until now, the urban folks in metros are already using this service. Will growth come from T2 and T3 cities?

Welcome your query sir,

In food delivery, t2 and t3 are actually delivering growth already. In food delivery, growth should come from a combination of factors than one key driver – be it order frequency, penetration and even pricing decisions

High growth is mainly coming from Quick commerce at this point of time

Thank you

Thank you. Good analysis. I think the regulatory overhang – in this case (of dark store), is not like a general regulatory challenge. We have seen various uncoventional approaches in the past for inventory management/ selling by Amazon/ Flipkart. We will have to see whether the regulators will move fast or will these people move fast to keep looking at the next hole in the regulation.

The other challenge could be how do they price for very quick services vis-a-vis quick services. It’s not an issue now because everybody is just trying to capture the quick commerce market (and unit economics is still not kicking in a big way).

Thank you for the timely article. Another risk that needs to be considered is government promoting ONDC framework that will impact all aggregator based platforms.

Comments are closed.