If momentum index funds and ETFs have garnered your attention in recent times, you probably missed noticing another high-risk index that not only delivered high returns but also outperformed the momentum index in recent times. We are talking of alpha-based passive funds.

What is an Alpha index

Like momentum-based factor investing, Alpha investing also involves picking stocks with strong recent return performance. Alpha in simple terms means excess return generated over the expected market return, adjusted for risk. For this purpose, indices use the Jensen’s Alpha using CAPM model. Stocks with highest Jensen’s Alpha within the universe are selected and weighted based on their proportion of Alpha.

The universe can be any parent index or combination of indices. But an Alpha index fund will vary significantly from its parent in terms of sector and stock allocation. This also means that like the momentum index this index can be highly cyclical and volatile.

(Please note that in momentum, only stock price returns adjusted for their deviation is considered. There is no concept of risk-free return, beta or expected return using CAPM model, which is what Jensen’s Alpha is all about. You can read our earlier report on momentum investing here.)

By their very nature, both Alpha and momentum chase returns. So, you will see them deliver high in any bull market.

Alpha funds

In this report, we will only stick to pure alpha factor as we are looking at the high performance of this single factor. We will not explore a combination of alpha and other factors such as Alpha-Low Vol or Alpha Quality.

At this time, there are two kinds of Alpha indices that have one or more index funds or ETFs.

- One is the Nifty 200 Alpha 30 index – this has just one ETF, the Mirae Asset Nifty 200 Alpha 30 ETF. The Nifty200 Alpha 30 index consists of 30 stocks selected from its parent Nifty 200 based on Jensen’s Alpha. Stock weights are based on their alpha scores. This means the index can have large and midcap stocks.

- Second is the Nifty Alpha 50 ETF – this has Kotak Nifty Alpha 50 ETF and Bandhan Nifty Alpha 50 Index Fund tracking it. Nifty Alpha 50 index tracks the performance of 50 stocks with high Alphas in last one year. The universe is the entire NSE listed space. This means this index can have large, mid and small-cap stocks.

The third Alpha index Nifty 100 Alpha 30 does not have an index fund or ETF as of now.

Performance of alpha indices

The data below will tell you that the returns of Nifty 200 Alpha 30 is higher than even the broad market index Nifty 500 despite the index being derived from the Nifty 200, which has fewer midcaps, and no small caps compared with the Nifty 500. It beats the parent Nifty 200 TRI nearly all the time. Compared to a more aggressive Nifty Midcap 150, though, the index does not manage as well.

The Nifty Alpha 50 TRI, given that it is derived across market caps, has managed to beat the Nifty Midcap 150 TRI. The Alpha 50 TRI outperforms the Midcap 150 index 72% of the times (for the same rolling 3-year return period).

However, as can be seen both the indices are significantly more volatile than the rest, vowing to the fact that they go behind performance.

Now moving to Alpha’s closest peer – momentum, the data below will tell you that Alpha strategy has beaten momentum 87% of the times on a rolling 3-year return basis.

While this may force us to conclude that the Alpha strategy is the invincible one, it may not be the case. Momentum does beat Alpha over longer periods – if 5-year rolling returns are considered from 2010 (the first available 5-year data begins then).

So, if you ask us which is better, we would think it is a toss of coin at this point 😊 Remember both are based on recent price return performance and both have limited live history. A good part of the data provided is only back tested (before the indices went live). The only difference is that Alpha considers the excess returns over expected return while momentum is simply a stock on an uptrend. It is possible that the former (Alpha) may be able to show relative outperformance in sideways market and shallow bear markets that are not hit by significant events (like financial crisis).

Also, one edge that Alpha has is that the index is rebalanced quarterly as opposed to the semi-annual rebalancing in Nifty 200 Momentum 30.

Reasons for Alpha outperformance

Logically, anything that is picked with superior return performance and dropped when such performance dips should do well. And both Momentum and Alpha strategies are able to do that.

Alpha varies significantly from its parent in terms of the sector and market cap changes that it undergoes as a result of its Alpha factor.

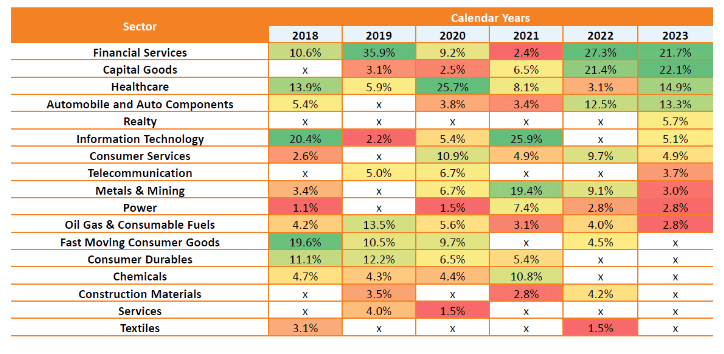

Consider the sector rotations first. Given below is an extract from Mirae’s Nifty 200 Alpha 30 ETF, at the time of its NFO. It will tell you that sector rotation can be very dynamic compared with what you will see in regular market-cap indices. For example, auto and capital goods’ exposure have increased when the sector rally started while realty has been picked rather early on the uptrend in 2023.

Data as of December 2023

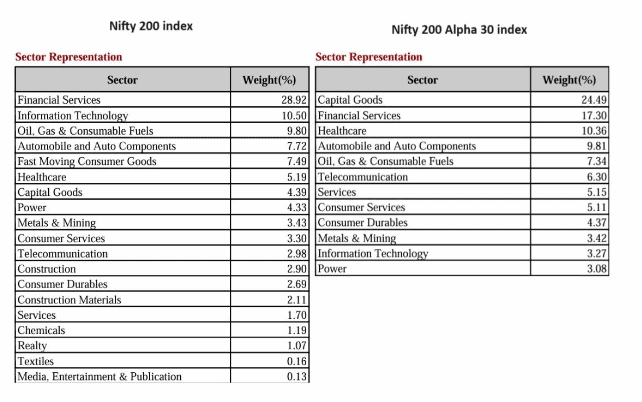

The image below will show you how the Alpha index significantly deviates from the parent index. This is because the Nifty 200 is weighted based on market cap (derived from Nifty 100 and Nifty Full Midcap 100 index) whereas the weight to the Alpha index is based on Alpha. The more popular sectors such as capital goods received higher weight while financial services received far lower allocation.

Source: Index factsheet as of July 31, 2024

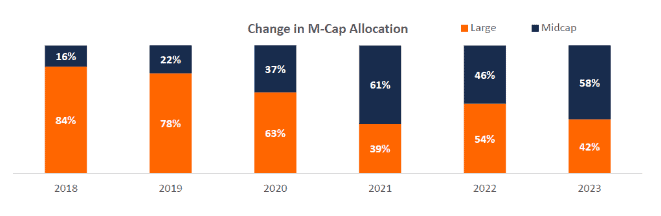

Next, take the marketcap allocations. As the image below shows, the shift in allocation to different market-cap segments is pretty high. You can see the swing in mid-cap allocation across the years.

The same trend in terms of different sector allocation and very dynamic market cap allocation applies to Alpha 50 index as well. As of July 2024, the market-cap allocation to both the indices stood as follows:

The funds and suitability

Both the Mirae Asset Nifty 200 Alpha 20 ETF and Kotak Alpha 50 ETF have high traded volumes in recent times. The tracking error data is available sufficiently for the Kotak ETF and this appears in line with other broad m-cap indices. The Bandhan Nifty Alpha 50 index fund, though, has limited record to comment on tracking error. What is evident is that the funds’ size growth and the ETF turnover indicate to heightened interest.

As you may know we do not have either the Momentum or Alpha indices in our recommended list as mere price-based nature of the index strategy makes it hard for us to assess sustainability of performance and given the recent nature of the market. We may look to add it at a later point.

The Alpha fund might suit you if you are looking for very aggressive exposure to your portfolio (sufficiently hedged with value, large cap funds in equity or with debt). They can also be limited substitutes for your mid and small-cap allocation (albeit with higher volatility). Here again, exposure needs to be limited as it is not easy to predict funds where fundamentals are not a driver for performance.

16 thoughts on “Should you invest in Alpha index funds?”

Also, want to share that we were stuck when Adani storm hit the market and the rebalance was still 2 months away. We had been manually directly investing in a shadow Alpha 50 stocks portfolio and so we acted nevertheless.

Madam ,Can you kindly align any insight strategy similar to sectoral/thematic fund like hdfc defense fund that has yielded a whopping aggressive returns around 89% in less than 1 year and 40% returns in around 6 months so much so that it has to closed fresh submissions please.

Themes like Defence do not sport valuations that support future earnings growth. Their short to medium lumpy earnings growth caused the rally. We do not have a recommendation on the said theme now.

Madam, Thanks for the unique insight

Can I use parag parikh flexi cap fund as a proxy for value style and axis growth opportunities fund as a proxy for growth style. Thanks

Your understanding of the style of the 2 funds is right. Please check our MF review tool or Portfolio Review Pro and use funds that have a BUY call.

Hi Vidya

A really good article and very relevant data !

I’m a Rule based Momentum and Alpha investor myself in my direct stock investments and would like to add 3 points why this type of investment should never be done by way of a passive mutual fund.

1. Momentum (and Alpha) investing portfolios should have a mandate to go in cash very quickly and with no upper limit when your rules indicate to do so. This protects the downside in cases like the Covid crash. Passive funds have no such mandate and have to follow the underlying index blindly with zero cash mandate. They would bleed badly in downturns.

2. Momentum (and Alpha) indicators change very quickly and waiting for a re-balance in 3 or 6 months is really not the right way to be with the underlying strength.

3. One can get struck with a bad apple sometimes – like Kotak Alpha got badly hit by the Brightcom scandal – the stock kept hitting lower circuits for many days – and yet they could not exit as they were waiting for a rebalance. Kotak Alpha 50 fund gave a negative -30% returns in just 3 months in the first half of 2022. This was not even a market crash or anything. An average investor would not even be able to understand what hit them.

I feel that even the better aware investors that understand the risks of investing in Smallcap funds or Sector funds also do not have a good understanding of the risks involved in these type of passive funds and should stay away from these.

But that’s just my personal opinion 🙂

Excellent and relevant points. An index based on price movement has to be very dynamic in rebalancing. Keep sharing your thoughts. Vidya

Thanks, sure !

Excellent article. There is one factual error or oversight. Alpha 50 universe is not the entire market. It takes out stocks suspended and the ones included in BZ category. Thereafter the universe is restricted to the Top 300 stocks by market capitalization. You can download The Methodology document to confirm.

Hello Sir. Thanks. Nothing factually wrong :-). We have given the methodology document as link in the article itself 🙂 The universe I meant is the entire listed It is stated in the methodology. of these top 300 is one of the 9 filetring criteria. I have mentioned the first alone as I did not want to get into the other details and given the document link. And it is also correct that it has mid and smallcap stocks. Thanks,Vidya

Very informative article….keep doing good work👍

Excellent points Raspreet, very helpful. Thanks for sharing.

Thanks a lot Vidya Bala for a great article. Seems like one can experiment with small amounts just for the heck of learning how the Alpha strategy works over a period of time.

Very interesting comments @Raspreet, thank you. Not sure if Alpha index is very concentrated. If Kotak Alpha Fund crashed 30% in 3 months, the weight of Brightcom must have been extremely high. Was that the case? Or is it that several other Alpha stocks also crashed in tandem with each other? In any case, did the fund recover in a short time and deliver Nifty 500 beating returns in the following quarters? If so, how long did the recovery take? Additionally, I am not sure if there are any absolute momentum kind of passive funds which can move to cash in case of finding no opportunities. I do know that some smallcases move to cash but still even there a majority of smallcases are based on rotational momentum. Your comments would be very helpful to enhance my understanding thank you!!

Very insightful article.

Hello Vidya,

Fantastic article. I did not have any idea about how these Alpha Strategies ETF’s work, Maybe after reading the article I may now put some allocation to Alpha ETF’s.

Comments are closed.