The COVID 19 pandemic has put healthcare stocks in the spotlight with investors’ attention tilting towards pharmaceutical makers and healthcare service providers. While the pandemic has seen health insurers complain of high claims payouts, in the long run such events boost awareness and improve product sales for the sector. The SARS outbreak in China during 2003-04 led to 40% growth for the country’s leading insurer while the MERS spread in the Middle East in 2013-14 pushed business for the region’s largest health insurer by 45% following the pandemic.

Star Health and Allied Insurance Co Ltd (Star Health), India’s leading standalone health insurer, is making an IPO worth Rs. 7,249 crore comprising a fresh issue of shares valued at Rs.2,000 crore and an offer for sale of Rs.5,249 crore. The issue will open on November 30 and close on December 2 at a price band of Rs. 870-900 per share. At the upper end of the price band, Star Health will be valued at Rs. 51,800 crore (~$7 billion).

The proceeds from the fresh issue will go towards augmenting the company’s solvency ratio.

Industry

Health insurance accounted for 32% of the gross premium of the general insurance industry in India in FY21, while in the first six months of FY22, it accounted for 37%. Health insurance is sold by general insurers and standalone health insurers, with certain variants like critical illness offered by life insurers.

There are five specialised standalone health insurance companies – Star Health, Care Health, Max Bupa, Aditya Birla and Manipal Cigna of which Star Health is the largest. Apart from that, all the major general insurers offer health insurance products as a part of their core portfolio. In the context of the Star Health IPO, let’s consider the growth drivers of standalone health insurance industry first.

De-Jargonizer

Below are the key terms used to understand the profitability, underwriting quality and capital adequacy of insurance companies

Gross Written Premium (GWP): It is the total premium (direct and assumed) written by an insurer before deductions for reinsurance and ceding commissions.

Incurred claims ratio: It is the percentage of claims costs incurred in relation to the premiums earned.

Combined ratio: The sum of net incurred claims divided by net earned premiums. The combined ratio is a measure of profitability of a non-life insurance company’s underwriting business.

Solvency ratio: The ratio of available solvency margin to the required solvency margin. For General Insurers, the IRDA prescribed margin is 150% or 1.5 times.

The number of lives covered under the health insurance sector has increased from ~290 million to ~500 million between FY15 and FY20. Government sponsored schemes (including RSBY – Rashtriya Swasthya Bima Yojana) accounted for more than 70% of the total number of lives covered. During this period, the number of lives covered has increased at a 12% CAGR increasing the proportion of lives covered to population to 36% from 22%. This is further expected to increase to approximately 670 million accounting for approximately 46% of total population by FY25. CRISIL Research estimates that 63% of Indians will be between 15 and 59 years by 2031, providing a favourable demographic for growth of the health insurance industry.

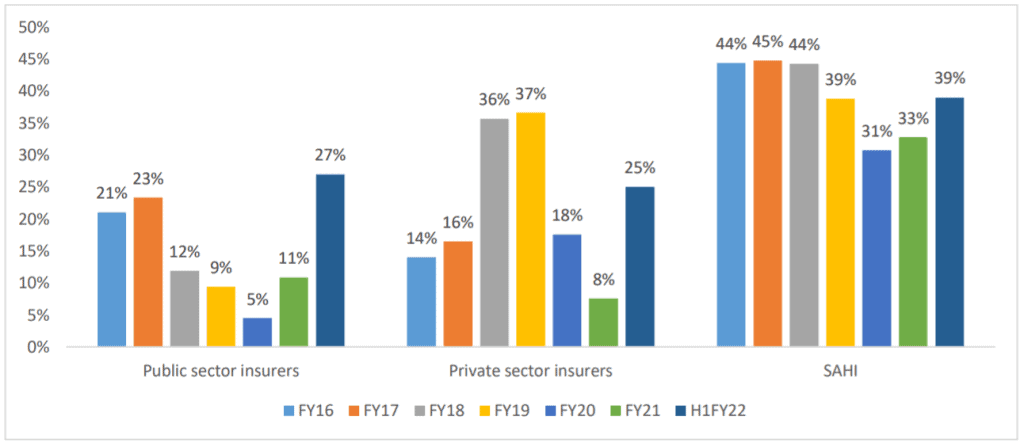

The standalone health insurance (SAHI) players have been growing at much higher pace compared to PSU and private insurers. Below is a graph of year-on-year growth by these categories.

Source: RHP

Given that individuals offer the least penetrated segment of the industry, the market share for SAHI players, who focus more on retail business, has increased from 10% in FY15 to 26% in FY21 and is further expected to increase. CRISIL Research expects the retail business to grow at a CAGR of 23% between FY21 to FY25 as compared to 15% and 11% CAGR in the Group and Government business respectively. The retail health insurance segment, which accounted for 9% of the total number of lives covered in FY20, contributed 45% of the total gross written premium (GWP) generated in the overall health insurance market in FY21 according to CRISIL. Retail health covers result in higher premiums per person compared to other health insurance segments.

When it comes to key ratios, SAHI players have better claims ratios and combined ratios driving better profitability. Their combined ratio has hovered between 100-104% between FY15-FY20 while it has hovered between 105-133% for private general insurers and 123-133% for PSU general insurers during this period. Claims ratios have hovered between 58-66% for SAHI players compared to 80-84% for private general insurers and 102-122% for PSU general insurers. That said, in FY21, the combined ratio and claims ratio for SAHI players shot up to 112% and 78% respectively, as the pandemic resulted in an unusual spike in health claims.

Star Health is the leading player in the health insurance space with a significant lead and a track record of making underwriting profits.

Positives

#1 Dominant position and wide menu

Star Health Insurance is the largest player in the SAHI space with 16% market share. The company has a pan-India network across 25 States and 5 Union territories with North, West and South contributing a fairly well-diversified ~28%, 32% and 27% of its GWP in FY21. It is the leader in retail health insurance with 31% of the GWP collected in FY21 followed by HDFC Ergo at 10% and PSU general insurers in the next three positions.

About ~90% of the premium for Star Health comes from the retail segment. The key edge that SAHI players enjoy over general insurance peers is their wide menu of options customised to the needs of retail buyers. Star Health has the widest menu among health insurers and offers 17 policies under various categories.

Family floater policies led the premium contribution in FY21 with 60% followed by individual policies at 28%. Among other leading players in SAHI space, Max Bupa, Care Health and Manipal Cigna have a retail premium of 68% to 81% while among other private general insurers, HDFC Ergo has a retail premium of 73%. For all other players including PSU insurers, retail premium is less than 50% of total premium. While PSU insurers still have a market share of ~48% at the end of FY21, they are less profitable than private players as 70% of their premium collections come from non-retail channels comprising group insurance and government schemes While the PSU insurers score in terms of offering economical premiums, they offer all kinds of general insurance along with health, tend to have restrictive policy terms and rely on third party customer service, all of which serve as a deterrent to new insurance buyers. SAHI players thus stand a good chance of gaining retail market share at their expense.

Star Health has adopted the strategy of not aggressively expanding its group health insurance business due to competition and aggressive pricing. This has paid off well for the company especially during the pandemic year.

#2 Clear business model

A battalion of agents to drive sales, a wide network hospital coverage and in-house claim processing form the back-bone of Star Health’s business model. While 60% of business in FY21 came from agents for SAHI players, it was 79% for Star Health. Of the 7,72,000 agents that SAHI players had at the end of FY21, Star Health has 4,62,502 agents representing ~60% of the agent force. Even though awareness of health insurance has increased, it still remains a complex product for consumers who can easily get unnerved by the plethora of options and covers made available by insurers. The agent model not just helps simplify the choice but also allows for human support at the time of crisis in processing and settlement of claims. The IRDA rule allowing an agent to tie up with only one health insurer also leads to stickiness of agents.

Star Health has also acquired one of the largest hospital networks in India comprising 11,778 hospitals, which plays an important role in maintaining its dominant market position. Almost 65% of its hospital network has agreed packages facilitating cashless treatment. These hospitals offer negotiated package-based pricing and the average claims amount is lower than in non-agreed network hospitals. Star Health has developed in-house claims management and this enables it to control the consumer experience better at the moment of truth. A poor claims experience is the key barrier to most folks to acquiring their first policy and later topping it up.

In-house claims processing is faster and enables quick redressal of grievances. In FY21 and H1FY22, ~87% of approvals of cashless claims were processed in less than two hours whereas ~90% of health claims settled were processed within 30 days. These look impressive considering the sharp surge in claims due to COVID in H1FY22. In general, the share of third-party agents (TPA) in claim processing in the industry has come down from 74% in FY16 to 69% in FY20 while in-house claims settled have increased from 42% in FY16 to 60% in FY20 as more insurers have started focusing on in-house claims processing.

#3 Poised for growth after the stress test

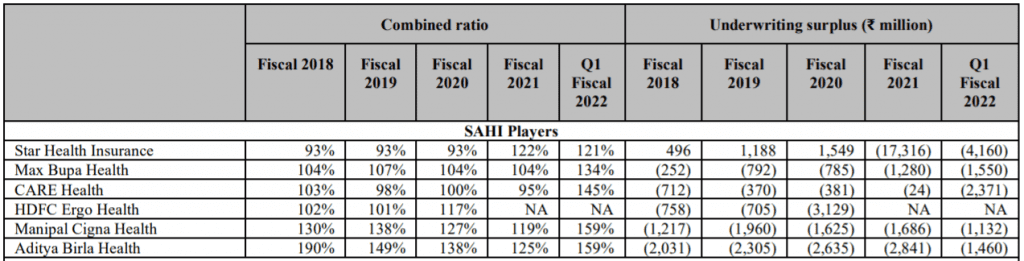

There couldn’t have been a better stress test for SAHI players than the COVID 19 pandemic. While Star Health has consistently generated underwriting surplus between FY18 and FY20, this changed during the pandemic as the combined ratio shot up from 93% in previous three years to 122% in FY21 and 121% in Q1FY22. But then this still compares well to other SAHI players as shown in the table below:

While the solvency ratio for Star Health at 1.52X has slipped close to regulatory limit at the end of H1FY22, capital from fresh issues will restore solvency ratio back to healthy levels of 2 -2.5. Since the events of the magnitude of COVID 19 pandemic have been rare, surviving this pandemic will position the company for healthy growth ahead.

The premiums for the company have grown at a CAGR of 31% between FY18 and FY21 Average sum insured also grew at a CAGR of ~12% between FY19 and FY21 indicating higher sum assured for new policies while existing policy holders also chose to upgrade during renewal. The average sum insured around Rs. 6 lakh per insured offers a lot of room for growth as policyholders realise the surge in medical costs and inadequacy of coverage. Renewals also remain healthy for the company with over 90% of the policies getting renewed in both value and volume terms at the end of FY21 as well as H1FY22. Retail health insurance premiums are expected to grow at 23% between FY21 and FY25 and SAHI players are at an advantageous position. Star Health being the market leader looks well placed for growth led by pandemic induced awareness, strong network and competitive products offerings.

Risks

#1 Competition

HDFC Ergo, ICICI Lombard and Bajaj Allianz are the key competitors among large general insurers while Max Bupa, Aditya Birla Health, Manipal Cigna and CARE Health are the major SAHI competitors. These players have been growing at the same or higher rate (31% -72%) than that of Star Health. These players have been maintaining healthy retention ratios in line with Star Health, while Manipal Cigna has a superior retention ratio.

Fresh competition is emerging from digital-only players such as Go Digit, Acko and Navi. Go Digit and Acko have become Unicorns in 2021 and are also backed by top PE players and investors. ACKO plans to scale its team and invest over $150 million in its health business. Navi, the new kid on the block, claims to have 5% share of total policies sold in Andhra Pradesh since May’21 while it has made significant in-roads into Telangana as well. Navi covers 528 hospitals in Andhra Pradesh and 548 hospitals in Telangana. It also claims to have processed cashless claims within 20 minutes. The new PE-backed players are trying to distinguish their product offerings in terms of a digital interface during the policy purchase and simplified fine print. While this may appeal to young first-time buyers, the ability of such players to offer claims settlement at scale will be the true test of their ability to challenge entrenched players like Star Health.

#2 Can’t take growth for granted

While the 31% growth CAGR between FY18 and FY21 appear impressive, the growth in FY21 and H1FY22 seem to be coming from significant increases in premium rates rather than customer acquisitions. So, the growth number can’t be taken for granted, though pandemic induced awareness could be a bonus in FY22 or FY23. While growth prospects remain upbeat, there have been concerns voiced around this sharp spike in health insurance premiums which may put pressure on pricing. The widespread customer disenchantment with the claims processes and records of insurers during Covid can also impede near-term growth.

#3 Regulatory risks

Risks from regulation is something that cannot be wished away and will always stay. IRDA has recently made life-time automatic renewal of policies compulsory while not putting any restrictions on premiums. Any decision to cap premium increases based on inflation can be a jolt to health insurers as it would underscore the current underwriting based premium calculation adopted by insurers as well as loading practices linked to lifestyle diseases. Also, IRDA has made standard policies like Arogya Sanjeevani mandatory which is a threat for growth of established players like Star Health. If the commoditized products gain market share then digital players will have an advantage to offer the same at lower cost. If IRDA comes up with more such standard policies it can make a dent on valuations of players like Star Health.

Ongoing wars between hospitals and insurers on the lack of standard tariffs for treatments and procedures also results in a poor customer experience. If both players can’t come forward and settle these issues amicably, then regulations may step in to cap healthcare costs by regulating premiums as well. This can impact the return on investment of insurance players.

Financial Performance

Below is a snapshot of the financial performance of Star Health for the last 3 years. Direct Written Premium gives a true comparison of growth in premiums over the last 3 years while net premium earned is adjusted for re-insurance and provisions. From FY21, pursuant to regulation change, the company is ceding only 5% towards re-insurance premium while it was 20-30% of direct written premium in the prior years.

While we have discussed the business so far in detail, the shape of the investment book is also very important as income from investments make a significant bottom-line contribution for insurance companies. As of September 30, 2021, out of total assets under investment, 41% by carrying value, was invested in sovereign bonds, 30%, by carrying value, was invested in AAA rated securities, 23% in AA+, AA and AA- rated securities. The overall yield has been close to 7% in FY21 and at the end of H1FY22. This return is healthy in the present rate scenario.

Valuation

Valuation has been the sticking point for most of the recent crop of IPOs and Star Health is no exception.

Acknowledging that Star Health has dominant position in its business and healthy growth prospects, the pricing could have been 25-30% cheaper for following reasons;

- At the higher end of the price band, Star Health is priced at 8.2X post issue book value and ~80X normalised earnings (assuming pre-Covid claims ratio) for FY22 (It made losses in FY21 and H1FY22 due to pandemic). ICICI Lombard is the only comparable listed player which trades at 8.25X book value and at 56X trailing earnings. It has traded at a PE band of 35 to 60 since listing in 2017. ICICI Lombard also has a consistent track record of 18-21% RoE in the last 4 years and paid dividends as well.

The four leading private general insurers ICICI Lombard, HDFC Ergo, SBI General and Bajaj Allianz have better (by 4-5%) and consistent RoE profile compared to Star Health. (See the table at the end of the article). Brokerage reports place the implied valuation (they are a part of the parent companies) of HDFC Ergo or Bajaj Allianz at 7 to 8x book value.

- Previous rounds of capital infusion into Star Health have happened at levels much below the IPO price of Rs.900. When it underwent a change of promoters between March and June 2019, new promoters acquired the stake at Rs 143 per share valuing the company at Rs.7,000 crore. Safecorp Investments LLP and billionaire investor Rakesh Jhunjhunwala are now the promoters of the company holding ~48% and ~15% stake respectively. Prior to IPO, the company has done preferential allotments of shares at Rs. 489 in December 2020 and March 2021 to various investors. Therefore, the valuation went up ~3.5x between June 2019 and December 2020 and it has further doubled since then, in the run-up to the launch of IPO.

The issue appears to be steeply priced to leave little on the table for investors in the long run. A market correction timed to the listing day could also quickly level grey market premiums and create uncertainty around a listing pop, which most retail investors in IPOs seem to look for.

Those who are looking to add a focused high growth insurance player to their portfolio can look to make token entry through the IPO, if they so wish, and add significant positions later on in declines.

With inputs from Anush Raj P and Bipin Ramachandran

Please note that this review does not take into consideration the possibility of listing gains.

4 thoughts on “IPO Review: Star Health and Allied Insurance Co Ltd”

Thanks for a great analysis of the IPO. Max Bupa is now Niva Bupa due to a change in ownership.

Thank you and also thanks for the info. Didn’t notice that change.

Timely article with a clear recommendation. Thanks

Thank you sir

Comments are closed.