Updated on 4th Sep, 2023

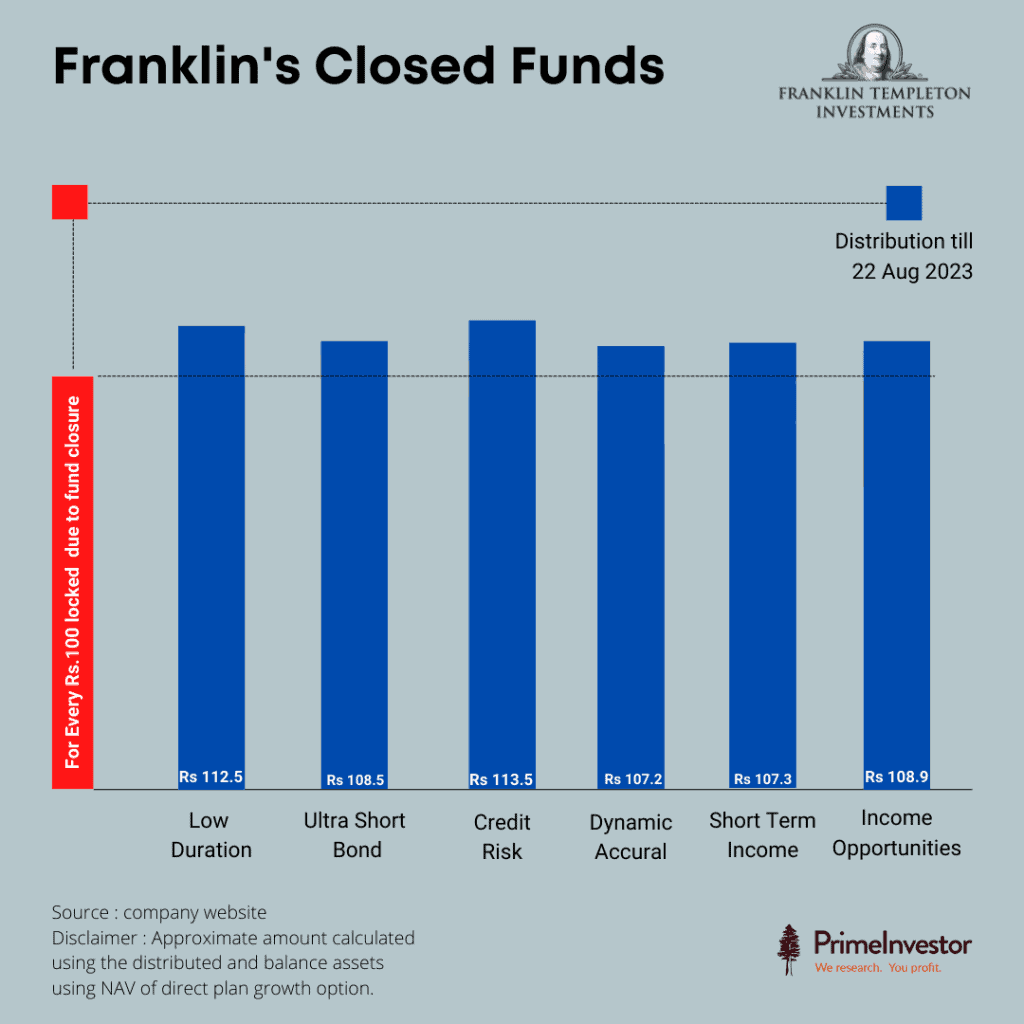

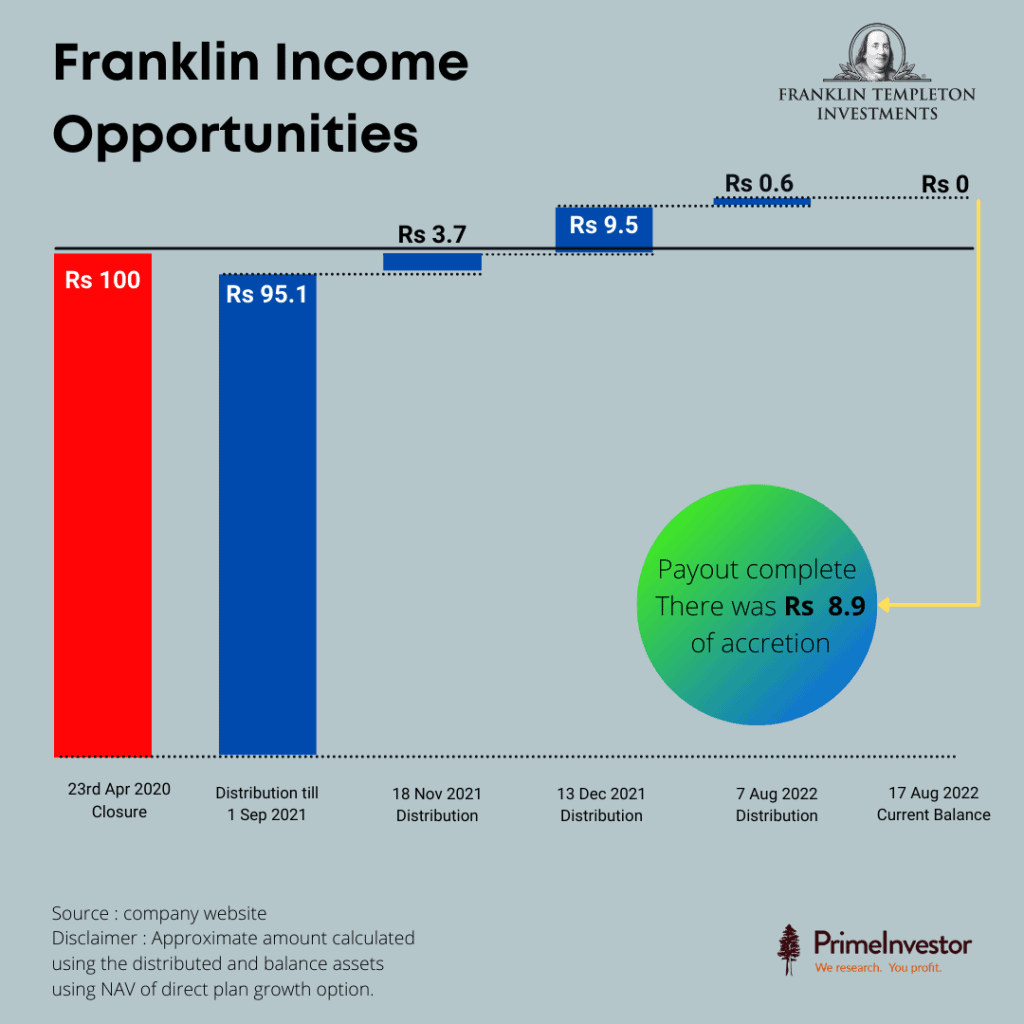

Franklin Templeton has made another tranche of repayment to investors in its six shuttered funds. Each of the six schemes have seen different amounts distributed – while those such as Franklin India Ultra Short and Franklin India Low Duration have seen a chunk of the amount due coming back, Franklin India Income Opportunities has seen only small payments still.

So you may be wondering how much was originally due to you, how much has been paid and what’s still left to be paid. Here’s the picture for each fund so you know where you stand.

Accretion and repayment

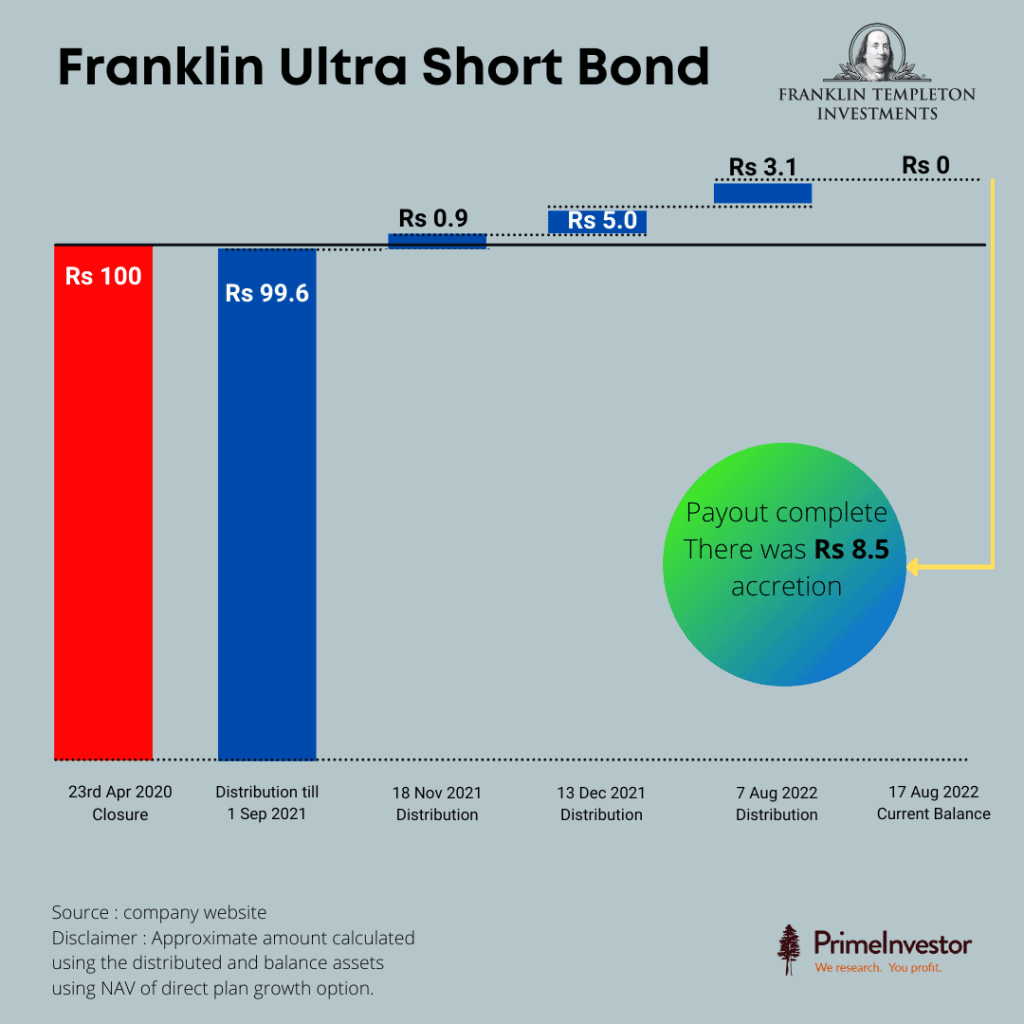

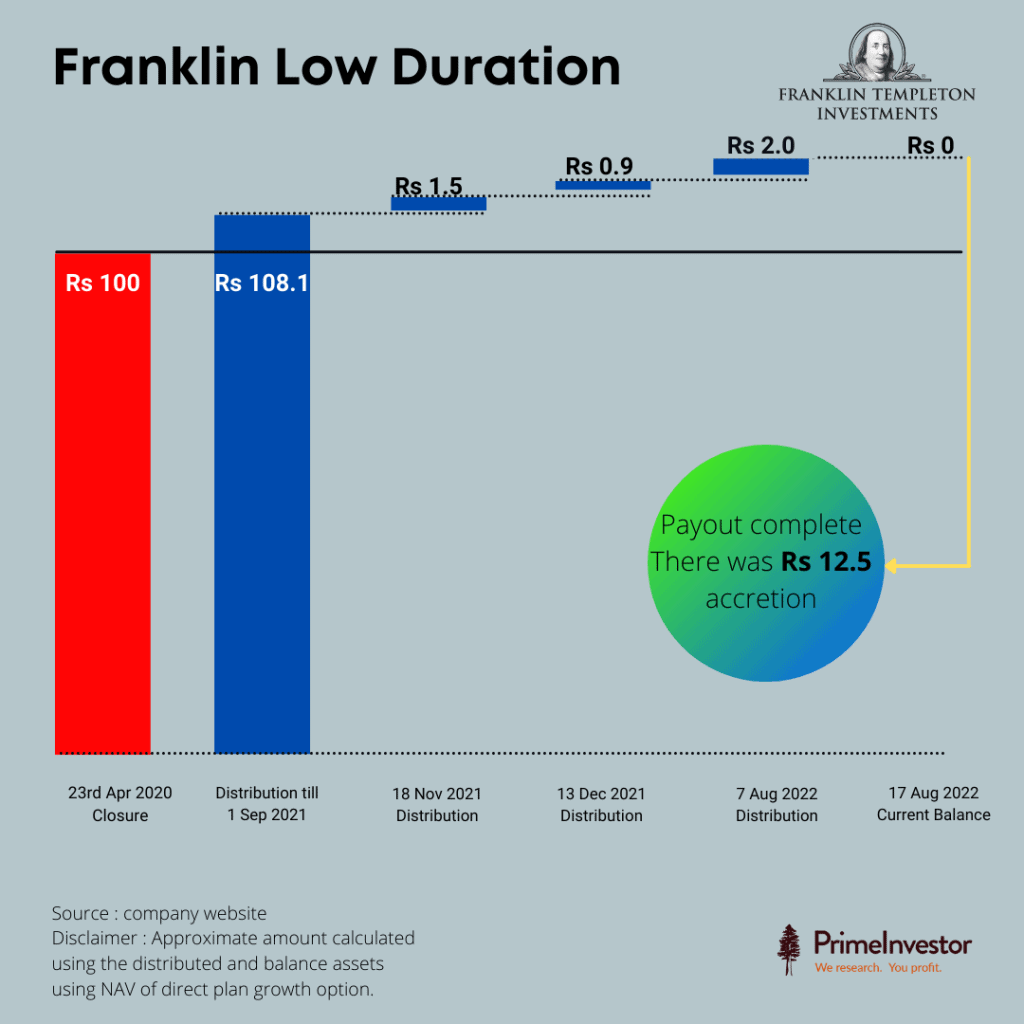

There are two aspects to working out how much is due to you – the accretion and the repayments.

By accretion, we mean the normal returns that the fund would have accumulated through collecting interest and maturity amounts on the papers it holds. Remember that while each fund was closed, the underlying portfolio continued to accrue such returns. Therefore, the amount that is owed to you would be higher than your investment value at the time of closure in April last year.

Repayments are, obviously, the cash distributed in each fund. This distribution is dependent on the cash levels for each fund, and has not been uniform across funds. Since the repayments are coming in batches, return accretion would continue on the remaining amount in the fund.

And in terms of AUM – distributed and still locked:

Franklin debt funds - Fund-wise picture

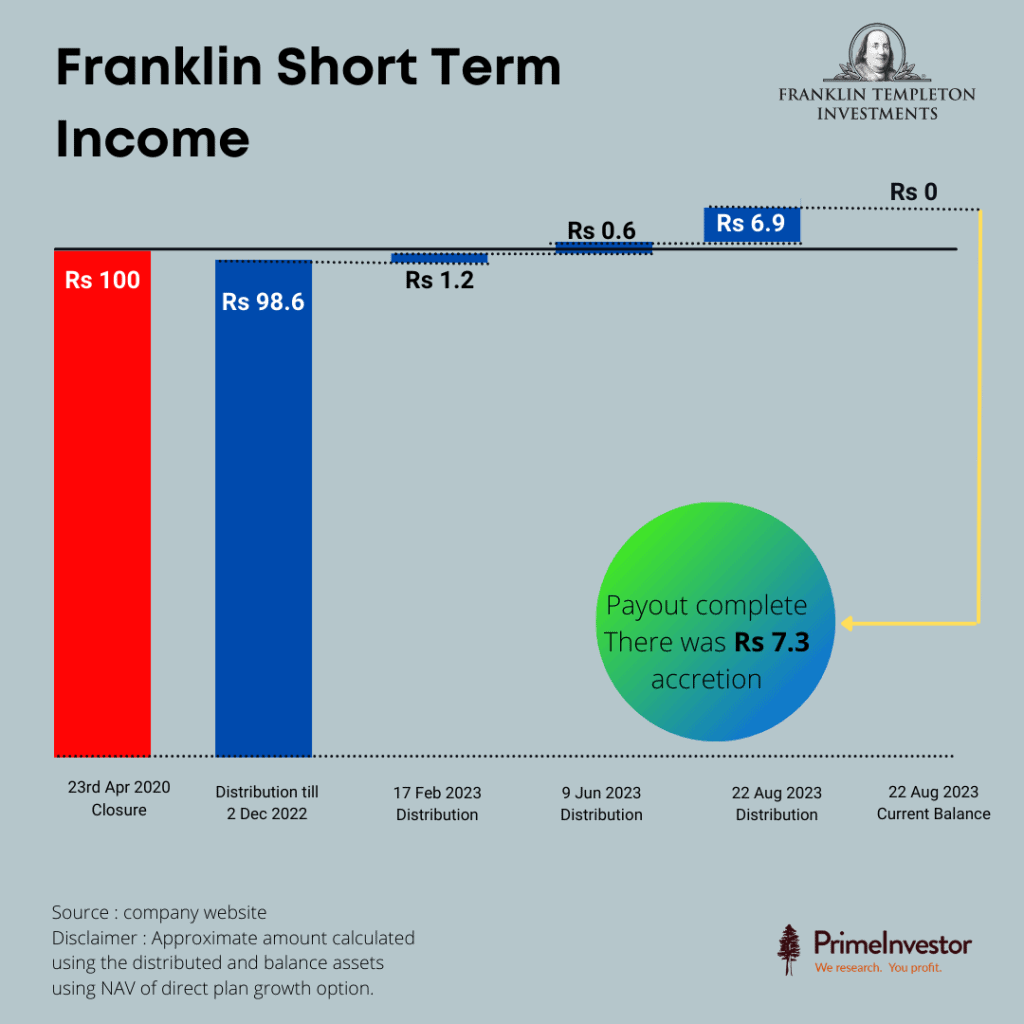

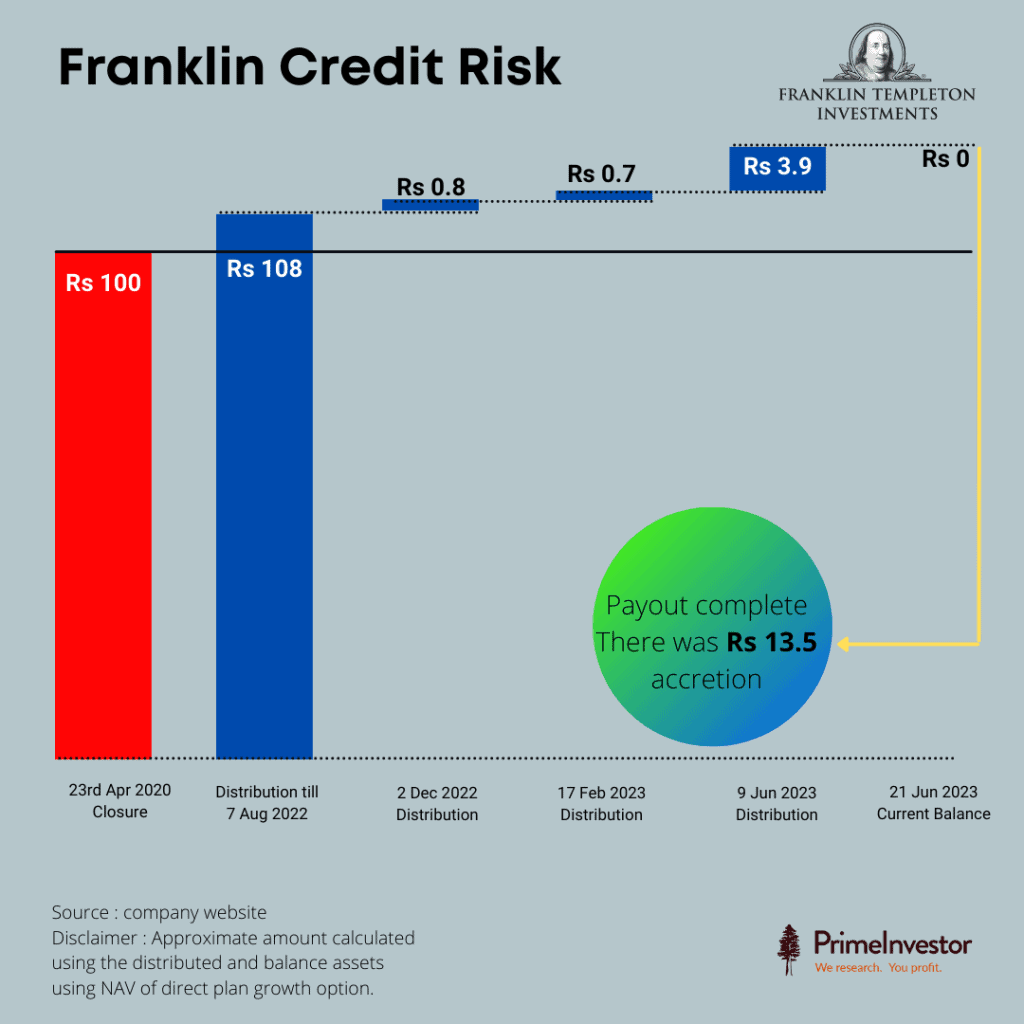

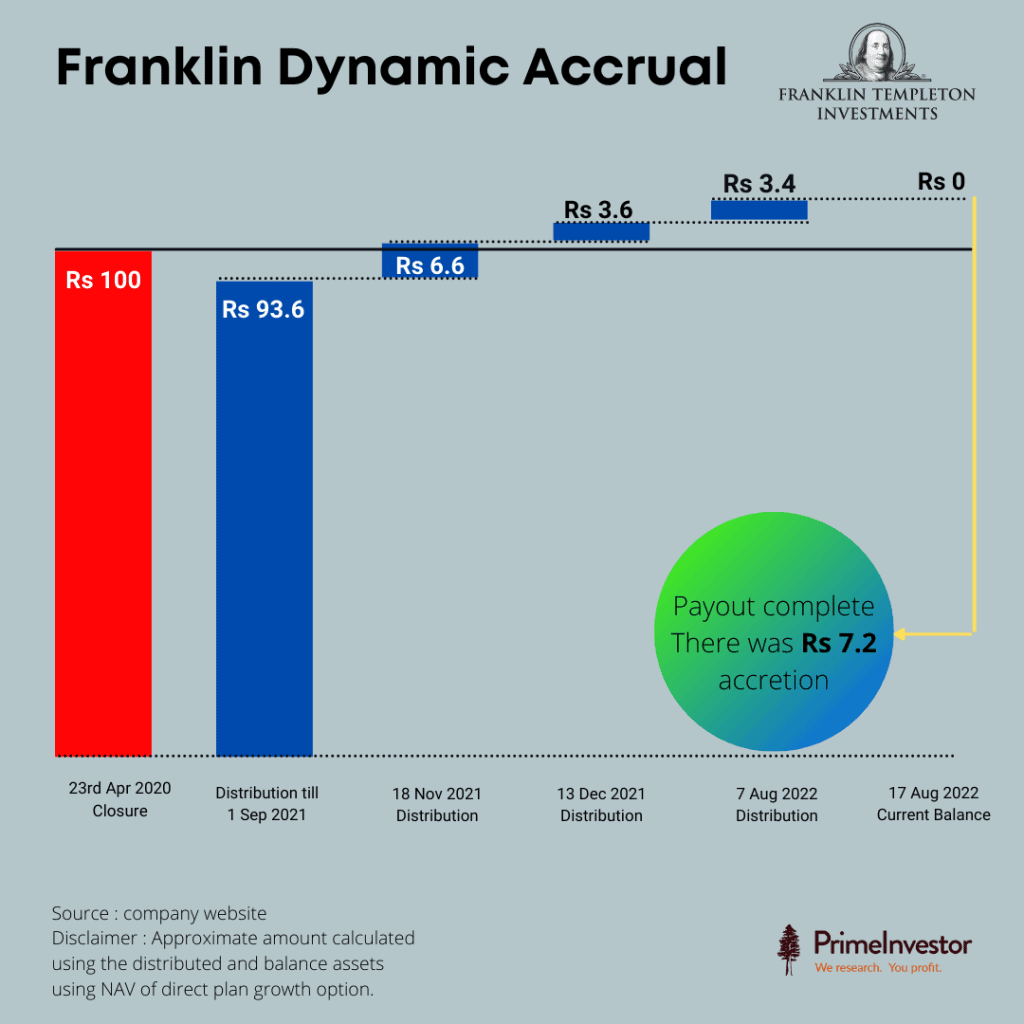

So, here’s the picture for each fund. We considered the original investment value at the time of closure (April 2020), and then worked out the return accretion and repayment amounts for each fund based on the NAVs (direct plan, growth option) and AUMs. This is shown in each graph below.

To make it easy to understand, we took the original investment value at Rs 100. The total accretion so far – that is, the returns each fund made from April 2020 to now – is shown in green. Please note that this is to show the accretion clearly; each repayment would in reality include part of the original investment and the accrued amount.

We'll keep this page updated as more disbursements are made.

Data source: Franklin Templeton website

Attribution: Data collation by Bipin Ramachandran, Infographic by Anush Raj.

Hope you found this data useful. If you did, please share it on social media and with friends/colleagues who may find it useful!

17 thoughts on “Franklin debt funds – How much has come in and how much is due?”

I have zero hopes of any fines coming to the hands of investors, knowing how twisted the ends are. FT will tapping into every channel to deny and the indifference from the powers will put the investor in soup. SBI MF did a good job liquidation but what no one is talking about is the STCG impact. Post the Gabbar taxes, the forceful extinguishing has ensured that the above calculations remain only on paper (the 100 shown as of the fateful day of closure to paid is only pre-tax…post tax is dependent on the individual’s tenure of holding but my intent was not to pay the STCG originally when investing in this. The forceful extinguishing of units has ensured that I pay the Gabber tax and surcharge and all other things on the top of that with interest. Net of taxes, surcharges, interest, the investor has to thank his stars that they have got back something in their hands but it is not even peanuts.

Fantastic. As soon as I delink from my current advisor, who got me into FISTIP when it already had issues which were known, I want you guys as my advisor, commercially.

Hi, what about the “if, when and how” of SEBI fines ordered to be paid out to investors? Is it AMC’s responsibility or the offending officials who misused their positions? Can they go to court and hold up?

We don’t know when the penalty will be paid. Yes, FT plans to go to SAT. It is the AMC’s responsibility.

Hi,

Can you help us in understanding how the ongoing recovery in the FT short term income plan, will impact the NAV of the FT Dynamic Asset Allocation fund as at the time of crisis, FT had provided 16% ‘illiquidity discount’ on the then NAV of FT dynamic Asset Allocation. My understanding is as & when recovery takes place in FT short term income plan, it should also impact positively or indirectly the NAV of FT dynamic asset allocation plan ??

Hello Sir, just as investors in FT Short term get money, FT Dynamic should get the distribution from FT short term. But a positive impact to NAV happens only when what was written off (the illiquidity discount you mentioned) is actually recovered on the sale. In this case, for eg if it wrote off Rs 16 out of every 100 in FT short term but got back not just 84 but the full 100, then NAV will be positively impacted. Otherwise not. We don’t know on what instruments in the underlying FT short term it applied the illiquidity discount and what it has sold thus far for us to conclude that it has got back the NAV written up. NAV jumps (just 2-3 occasions in the past 4 months) are also not proper indicators in this dynamic fund as it could be due to equity market upmove too. thanks, Vidya

Thanks for leading other media analysts again. This time in simplifying computations for us and promising to keep this updated as and when future disbursements happen

It quite fair on your part to pay the investors . Thanks for being responsive and responsible company .

Kindly inform personalised details

Paid and yet to be paid amount.

Do you mean how much you are owed on your investments? We can’t give personalised info in that manner. But you can use this data to work out your amount due – since we have assumed it at 100, it will make your calculation easy. – thanks, Bhavana

Fantastic graphs and clear visualisation. Great service by the PI team. Even the Franklin or SBI themselves have not provided this kind of visual clarity. Keep up the good work team.

Maam,

I hold Franklin Ultra Short Bond Fund & have received the third instalment today. Was, in fact, working out balance due to me, when I looked up and saw your article. Couldn’t have come across the data in a more timely & simplified manner. Your calculations confirm my own back of the envelope ones (with my limited understanding) entirely. Thanx a ton, ma’am, very grateful. Will be useful to many others like me. Just reaffirms my faith in Prime Investor’s wisdom and acumen in writing on issues of current concern to retail investors. Kudos. Anil

Thanks, sir! Glad you found it useful. Please do spread the word! – regards, Bhavana

Super.

Thank you.

Thank you for this sir/madam. It would be even better if you also add the payouts done by vodafone segregated portfolio.

There are multiple segregated portfolios, and payments in those are independent of the payments in the funds…but we’ll see if we can add that info at the end. – thanks, Bhavana

Comments are closed.