As a mutual fund investor, most of you would have confronted this dilemma:

- your fund is underperforming or has received a Sell recommendation, but you’re sitting on substantial unrealized gains.

- The looming question is whether to cash out and face the tax implications and switch to another fund, or hold steady.

- Since you lose a good chunk on tax, you think the new investment has to make up for the entire loss of tax plus earn more. Is your concern overstated?

This article will equip you with a clear strategy for navigating this common yet challenging scenario, ensuring you’re prepared to make informed decisions when it matters most. A downloadable excel that we provide with this article will also help you make an impact analysis on the impact of switching funds or holding on.

Different scenarios with switching funds

When making financial decisions, we often focus on short-term outcomes, potentially overlooking crucial long-term implications. This tendency can cloud our judgement, especially when considering a fund switch. Let’s examine several scenarios to better understand and evaluate the extended consequences of such a move.

Case 1: Switching an Equity Fund

- You hold an equity fund with a market value of Rs.10 lakh.

- Your original cost was Rs.3 lakh. Unrealized capital gain is Rs.7 lakh.

- You’ve already used up the Rs.1.25 lakh exemption for equity capital gains, so any redemption will attract a 12.5% tax on gains.

You decide to move out of your poor performing fund to another fund (using lump sum). This switching will leave you with a tax bill of Rs.87,500 for the above scenario, shrinking your corpus by 8.75%. You invest this post-tax corpus into a new fund.

Now, let us see how this decision pans out 5 years from the new investment, as opposed to not making the switch at all and holding on to the old fund. We’ll assume:

- You plan to redeem the fund 5 years from now.

- The 12.5% tax rate and Rs.1.25 lakh exemption remain unchanged for equity capital gains.

- You expect to use up the Rs.1.25 lakh exemption by other investments, so future redemptions will be fully taxed.

- Both the old fund and the new fund you have switched into generate the same returns (11% per annum) over the next 5 years.

No Switch: If you had not moved out of the old fund in the first place, then your pre-tax corpus will be Rs.16.85 lakh, and after paying Rs.1.73 lakh in taxes, you’ll have Rs.15.12 lakh.

Post switch: You invested Rs.9.12 lakh (after Rs 87,500 taxes) into the new fund. In 5 years, your pre-tax corpus will be Rs.15.38 lakh if it grows at 11%. After paying Rs.78,000 in taxes, you’ll have Rs.14.59 lakh. This is about 3.5% lower than what you would have had you not switched in the first place. Please remember, in this case, we have assumed that the fund you switched into, earns the same return as your original fund (in reality you switch for better returns).

But if returns were unchanged, then you would have thought that your net loss is the tax paid the first time around – Rs 87,500 – or 8.75% lower corpus. But it turns out your corpus is lower by only 3.5%. Why is it so? This is because when you book out of the first fund and enter the new fund, your new investment cost (for tax purpose) is much higher at Rs 9.12 lakh, as opposed to the Rs 3 lakh in the case of no-switch. So since your cost base is higher, the tax you pay in the new fund is much lower. This partially makes up for the dent of tax outflow you had 5 years ago.

To summarise, in a scenario of switching to a new fund with the SAME returns, here’s what happens:

- Actual impact : Your market value of the new fund is lower by 3.5% on a post-tax basis. The corpus is lower simply because you had removed Rs 87,500 for paying tax (cash outflow) and reinvested only the rest. So this amount could not compound itself for 5 years, whereas it was comfortably seated in the corpus in the scenario of not switching at all.

- Tax efficiency : Since you paid 8.75% out of the corpus as taxes, you may have thought your new fund should make it up by earning that much more. However, even if the new fund delivers the same return, your corpus is lower by only 3.5% and not 8.75%. This is simply because of lower tax outflow in your new fund (higher cost base). So your loss is much lower than you feared.

- Break-even point : In reality, in this illustration, if your new fund earned just 11.85% (as opposed to 11% for the old fund), you would comfortably match the corpus of a ‘no switch’ scenario. Any return in the new fund over 11.85% means your switched corpus will be higher. In other words, the new fund has to generate just 0.85% more return per year to make up for the lost tax outflow.

Use the Excel sheet here to do your own numbers based on different scenarios

Case 2: Equity fund switch with different tax assumption

- You hold an equity fund with market value of Rs.10 lakh.

- Your investment was Rs.3 lakh. Unrealized capital gain is Rs.7 lakh.

- You’ve used Rs.75,000 of the capital gains exemption this year, leaving Rs.50,000 of the gains exempt from tax.

- You plan to redeem the fund 5 years from now.

- Assume the tax rate increases to 15% post (from 12.5% now) and you get an exemption of Rs.1.5 lakh (from Rs 1.25 lakh now) for equity capital gains in the future. Of this assume you have an unutilised amount of Rs 75,000.

- The current fund will generate 11% annually, and the new fund will generate 11.5%.

Use the excel sheet provided above for this scenario. You will see that switching will reduce your corpus by 8.13% today. However, in 5 years, your post tax corpus will be 0.43% more compared to holding the existing fund.

Case 3: Switching a Debt Fund

- You hold a debt fund worth Rs.10 lakh.

- Your investment was Rs.8 lakh. Unrealized capital gain is Rs.2 lakh.

- You’re planning to redeem this fund 5 years from now

- You’re in the 30% tax bracket now and expect to be in the same bracket in 5 years.

- You expect your current debt fund to generate 7% annual returns in the next 5 years

- You expect your new debt fund to generate 7.5% annual returns in the next 5 years

Switching will reduce your corpus by 6% today. However, your final post tax corpus will be 0.4% higher compared to holding the existing fund.

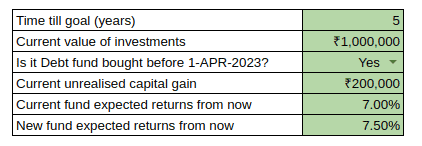

Case 4: Debt Fund Purchased Before April 2023

- You hold a debt fund worth Rs.10 lakh.

- Your investment was Rs.8 lakh. Unrealized capital gain is Rs.2 lakh.

- You’re planning to redeem this fund 5 years from now

- You bought this debt fund before April 1, 2023, making it eligible for a 12.5% capital gains tax.

- You’re in the 30% tax bracket now and expect to be in the same bracket in 5 years.

- You expect the current debt fund to generate 7% annual returns in the next 5 years

- You expect the new debt fund to generate 7.5% annual returns in the next 5 years

Switching will reduce your corpus by 2.5% today. Your final post tax corpus will be 4.14% lower compared to holding the current earlier fund without switching. In this case, the higher returns couldn’t make up for the losses, instead the losses expanded.

Case 5: Switching a Debt Fund while retirement is on the horizon

- You hold a debt fund worth Rs.10 lakh.

- Your investment was Rs.8 lakh. Unrealized capital gain is Rs.2 lakh.

- You’re in the 30% tax bracket now.

- You’re planning to redeem this fund 5 years from now

- To estimate tax slab and tax rates at the time of redemption:

- You’re planning to retire in 4 years

- You assume that your only taxable income will be interest income of Rs. 5 lakh 5 years from now.

- You expect maximum tax exempt income to be Rs.9 lakh (the slab up to which there is no tax) 5 years from now (this is Rs.7 lakh at present under New regime)

- Based on the above, you expect debt capital gains up to Rs.4 lakh will be tax free for you, rest to be taxed at 10%

- You expect your current debt fund to generate 7% annual returns in the next 5 years

- You expect your new debt fund to generate 7.5% annual returns in the next 5 years

Switching will reduce your corpus by 6% today. Your final post tax corpus will be 2.44% lower. The higher returns couldn’t make up for the tax lost in this case.

How to use the ‘Fund switch and tax impact analysis’ spreadsheet

If the calculations sound complicated, don’t worry—you can do this with minimal inputs using the spreadsheet we have mentioned earlier. Here’s a brief guide to using it:

Fund switch and tax impact analysis

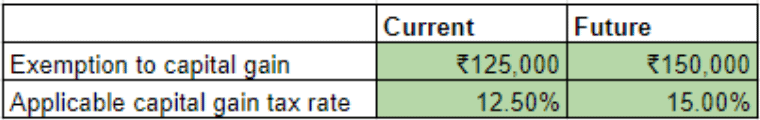

1. Define Tax Estimates

- Enter the applicable exemptions and tax rates for your investment, both current and expected.

- For debt funds, if your income is taxable, enter the current exemption as 0 and input your income tax slab rate where the text capital gains tax rate is mentioned.

Notes:

Equity exemptions: Here, enter the capital gains exemption applicable to the particular investment in consideration. For example, currently exemption for equity capital gains is Rs.1.25 lakhs. If you already have Rs.1 lakh capital gains from selling stocks this financial year, enter Rs.25,000 that is available, as current exemption. Similarly, for future exemption also, you may enter a lower value to account for any other capital gains you may have.

Debt exemptions for retirement period: In the retirement period, if you think you will be in the 0% tax bracket; enter the exemption to capital gain as a value which is the estimated difference between tax free income and your taxable income at retirement. For example, if you estimate the income up to Rs.10 lakh will be having 0% tax payable at the time of your retirement and you expect to have an annuity income of Rs.7 lakh per year, and do not have any other taxable income, enter Rs.3 lakh as the exemption to capital gain.

If you think you’ll be in a specific tax bracket during the retirement period, enter exemption as 0 and enter the estimated tax slab in the tax rate.

Tax rates falling on multiple slabs: Sometimes, it is possible that the debt capital gains will push the marginal rate to the next slab; making parts of capital gains to be taxed at different rates. Accounting for this would further complicate the calculation, as a workaround, you may adjust the tax rate accordingly. For example, if you’re estimating the tax slabs applicable to you will be both 10 and 15%, you may enter 12% or 13% to account for that.

2. Define Investment Estimates

- Enter the holding period, current value, unrealized capital gains, and return estimates for both funds.

- For debt funds, purchased before April 1, 2023, select “Yes” in the dropdown. Set it as “No” for all other cases

The sheet will show the final post-tax corpuses and the change in corpus due to switching.

Conclusion

Switching triggers taxes, but in most cases, you’re paying part of the tax in advance, reducing future taxes. Whether to switch or not is a decision personal to you. It may seem that you’ll have to make a lot of assumptions to correctly estimate whether a switch is worth it and these assumptions may not materialise also. These assumptions broadly are:

- The capital gains tax rate or your own tax rate as applicable for different classes of funds

- The capital gains exemption available in future

- How much the new fund returns as opposed to the old fund

However, the key is not to make exact predictions, but to try various assumptions and arrive at a conclusion like “For this switch to be beneficial for me, the fund would likely have to generate 0.5% more!” Hope the method explained in this article will help you reach such conclusions.

31 thoughts on “How much do you lose by switching between funds?”

Thanks Bipin for the insightful analysis.

Just a query from me for you.

Would it be right to say that for debt mf investment made before Apr 2023, it is better to stay put in the same fund/scheme rather than switch out to another debt mf (with marginal increase in return) for most scenarios ? Is there a time limit on the taxation front as to how long the pre-apr2023 fund can held and redeemed sometime in future ?

Thank you!

Yes, switching for marginal increases in return may not be beneficial for those already in higher tax brackets, especially if they are expected to remain in these brackets at the time of future redemption. You can try with some return estimates using the spreadsheet.

Thanks Bipin for this article.

The insight that just 0.85% extra returns needed from the new fund to beat the existing ones is an eye opener.

However, we cannot predict whether the new fund will perform better than the existing ones in the future. Will it still makes sense to make the switch since the past returns are not guaranteed to continue in the future?

Also, if one is happy with the current return in the existing fund and not interested in chasing the higher returns then also the switch won’t be necessary, I feel.

Thank you for your feedback!

Do note that the 0.85% figure applies to a specific scenario. The article’s goal was to encourage investors to explore potential ranges for their own cases.

And you are right, while we can’t predict outcomes, we can make informed estimates.

About the case for one who is not interested in chasing returns. I believe a portfolio constructed predominantly of passive funds will suit such an investor.

Thanks

You are right that some investors might be interested in getting potential higher returns when switching funds since I believe their corpus might be comparatively low to begin with and they don’t want to miss the opportunity to increase their corpus wherever and whenever possible.

Now that you have mentioned that passive funds will suit better for investors who don’t chase higher returns, I might have to revisit my portfolio and switch wherever possible to avoid giving unnecessary expense ratio to active funds.

Thank you once again !

Simple, effective & much needed handy tool to have! Thanks a lot!

Thank you!

Really insight analysis – thanks so much!

Thank you!

You’re wrong. The problem here is CAGR or annualised returns or return per year that you’ve used. MF don’t give compound interest. If you take only absolute values you will find that switching between MF costs anda/0/nada/

Here it’s proved the MF has no compounding. If there is no compounding, then having a larger corpus doesn’t give exponentially better returns. Thus your post is refuted.

source: freefincal[dot]com[slash]mutual-funds-no-compounding[slash]

Hello,

Market-linked products do not offer fixed returns like deposits. It is important to understand the common fund return metrics to avoid any misinterpretations.

For example, when we see that the Parag Parikh Flexi Cap Fund (G)-Direct Plan has delivered a 26.59% CAGR over the past 5 years (as of 18th Oct 2024), it means that if ₹100 had been invested 5 years ago in an instrument compounding at a fixed annual rate of 26.59%, its current value (₹325) would be equal to the value of ₹100 invested in the Parag Parikh Flexi Cap Fund (G)-Direct Plan 5 years ago. However, this does not imply that the investment in the fund grew consistently at a fixed 26.59% annual rate.

Similarly, if we assume an equity investment of ₹100 today will achieve a 12% CAGR over the next decade, our best estimate is that the final value will be ₹311. However, this does not mean that we should expect the investment to grow to ₹112 in year 1, ₹125 in year 2, and so on.

The article below will help you understand various mutual fund return metrics:

Understanding Mutual Fund Returns

Thanks

Sir your entire thesis depends on the postulate of compounding. It’s because of the belief MF has compounding that we are even talking about this.

A person investing 5 rupees in market will grow his money at the same rate as of the person investing 5 crores. Why? Because there is no compounding. There are just absolute returns.

A person switching, paying some tax, reinvesting a lower amount and redeeming after 5 years

is literally equal in returns post tax

to a person not switching and redeeming after 5 years

if you only consider absolute returns.

Hello,

I can explain the theory in detail, but it will take a lot of time for both of us, so let’s just cut to the chase this time.

Argument 1:

“A person investing 5 rupees the market will grow his money at the same rate as of the person investing 5 crores. Why?”

Because you are talking about 2 points: entry point and exit point and looking at absolute return between the points.

Compound interest formula for final value = principal * (1+ interest rate)^duration

Let’s say one invests Rs.5 in a bank FD for 10 years at 7% interest rate

Final value = 5*(1+7/100)^10 = 9.835756786 – (1)

Now let’s say another person invests Rs.5,00,00,000 in bank FD for 10 years at 7% interest rate

Final value = 50000000*(1+7/100)^10 = 98357568 – (2)

Person 1’s Rs.5 grew at 1.967 times and Person 2’s Rs.5 crore grew at 1.967 times. Both grew at the same rate. Will you consider this as proof that Bank FD does not compound?

Argument 2:

“A person switching, paying some tax, reinvesting a lower amount and redeeming after 5 years

is literally equal in returns post tax”

The below is PPFAS Flexicap fund’s latest NAV as on 3 particular dates

2014 Jan 1: 11.1989

2019 Jan 1: 24.1411

2024 Jan 1: 70.4621

Case 1: Switch and reinvest

Let’s assume a person invests Rs.1 lakh at 2014 jan 1

Units = 100000/11.1989= 8929.448

He redeems the full amount on 2019 Jan 1, pays tax and reinvests it.

Redemption value pre tax: 8929.448*24.1411= 215566.71

Capital gain: 215566.71-100000= 115566.71

Tax (assuming no exemption and 12.5% rate): 115566.71*0.125= 14445.84

Post tax capital: 201120.87

Now let’s say he reinvests this in the same fund on the same date

Reinvested units: 201120.87/24.1411 = 8331.057

Now let’s say he redeems the whole amount on 2024 Jan 1.

Redemption value pre tax: 8331.057*70.4621= 587023.74

Capital gain: 587023.74-201120.87=385902.87

Tax (assuming no exemption and 12.5% rate): 385902.87*0.125=48237.86

Post tax capital: 587023.74-48237.86= 538785.88

Case 2: Holding

Now assume another person holds the investments from 2014 Jan 1 till 2024 Jan 1

At 2014 Jan 1

Units purchased: 100000/11.1989= 8929.448

At 2024 Jan 1

Redemption value pre tax: 8929.448*70.4621= 629187.69

Capital gain: 629187.69-100000=529187.69

Tax (assuming no exemption and 12.5% rate): 529187.69*0.125=66148.46

Post tax capital: 629187.69-66148.46= 563039.23

I request you to do this this calculation by yourself and understand why final post tax capital is higher in case 2

I appreciate your willingness to challenge what you see on the Internet. It is also important to understand the core concepts of things before shifting a perspective about something 180 degrees. In this particular case, what is imperative is to understand how things work on the ground and then you can decide whether to call it compounding or not.

Hope this helps.

Thanks

Hi Sir, what will be scenario for NRI customers ? if current holding is with gain 30% from last two years of holding and no need of the funds from now till 5 years ?

Hello,

You can use the sheet; as explained in the article, enter taxation, current value, and current unrealized gains.

In case you’re unsure of current unrealised gains; you can get this from Portfolio Review Pro. Do review your mutual fund portfolio and select the Export to Excel option. In this file, the ‘Detailed Review’ sheet will show unrealised capital gains for all your funds. This is in the column K (Abs P&L).

Do note that there is no separation of short term and long term gains in this sheet.

Thanks

Very interesting article. It is such articles which adds real value to subscription.

Thanks a lot!

This is Gold.

I always had an intuitive sense that the alpha required for a new investment need not be very high to beat current tax outgo.

But your analysis and some conclusions that even 0.85% alpha on old return of 11% can break-even is

eye-wide-opening.

The excel sheet is a cherry on the cake.

Thanks & Congratulations.

Thanks a lot!

Great one, and much needed. BTW it would be great to have a expense ratio comparison during the switch.

Thanks

Devang

Thanks!

Do you mean an option to see expense ratios of current and new funds? You may use the Mutual Fund Expense Ratios – Direct vs Regular tool.

Both XLS files are for debt funds ?

The same file can be used for both debt funds and equity funds. Just define the tax estimates as required, as explained in the section ‘How to use the ‘Fund switch and tax impact analysis’ spreadsheet’

Thanks

Thanks !

This is very simple and interesting tool. i am sure it will be of help to lot of investors.. These are the kind of articles that help readers in thinking and acting in a structured way, rather than guessing.. appreciations !

Thanks a lot!

Comments are closed.