In our article about the semiconductor industry and India’s opportunities, we have discussed the various stages of value chain involved in semiconductor chip manufacturing and how Indian electronic manufacturing service (EMS) companies fit into this broader picture.

This article will review an Indian company that operates across multiple segments within the EMS industry, which is also making inroads into the semi-conductor ecosystem.

The EMS segment has been in the limelight in the market in recent times with increasing thrust on domestic manufacturing. It has seen a few success stories as well, that demonstrated scalability. The company we are reviewing here is one. Please note that this is review and not a recommendation on the stock.

About the company

Kaynes Technology (Kaynes) is a leading Indian EMS provider offering a full range of services from product design to reverse logistics (after-sales support), thereby operating across a wide range of the value chain. It offers various services, from design and prototyping to full-scale manufacturing and support. With over three decades of experience, the company serves diverse sectors including automotive, aerospace, defence, nuclear, railways, industrial, healthcare, and IoT.

It is primarily into PCBA (printed circuit board) assembly and Box Build, that contribute to major share of its revenues, catering to the needs of a range of end user industries.

PCB Assembly: At the heart of the electronics industry is Printed Circuit Board or PCB. A PCB with components mounted on is called an assembled PCB and the manufacturing process is called PCB assembly or PCBA for short. The copper lines on bare board, called traces, electrically link connectors and components to each other.

PCB assembly is a major activity and normally outsourced to ESDM companies. Out of overall PCBA demand in India, approx. 80% demand is met through importing or domestic manufacturing of bare PCBs and then local assembly in India. Rest of the PCBA demand is met through imports.

Box Build: In this, OEM outsources complete product manufacturing to an ESDM company and the ESDM company, manufactures the final product, puts in the OEM logo and dispatched to the OEM warehouse for selling. This model is largely used in HVLM type of products such as Mobiles, Computer Hardware and industrial segments.

Box-Build Assembly requires availability of integrated infrastructure for doing major processes in-house by the ESDM companies. The objective is to produce products in high volume with best possible economics and least interruptions.

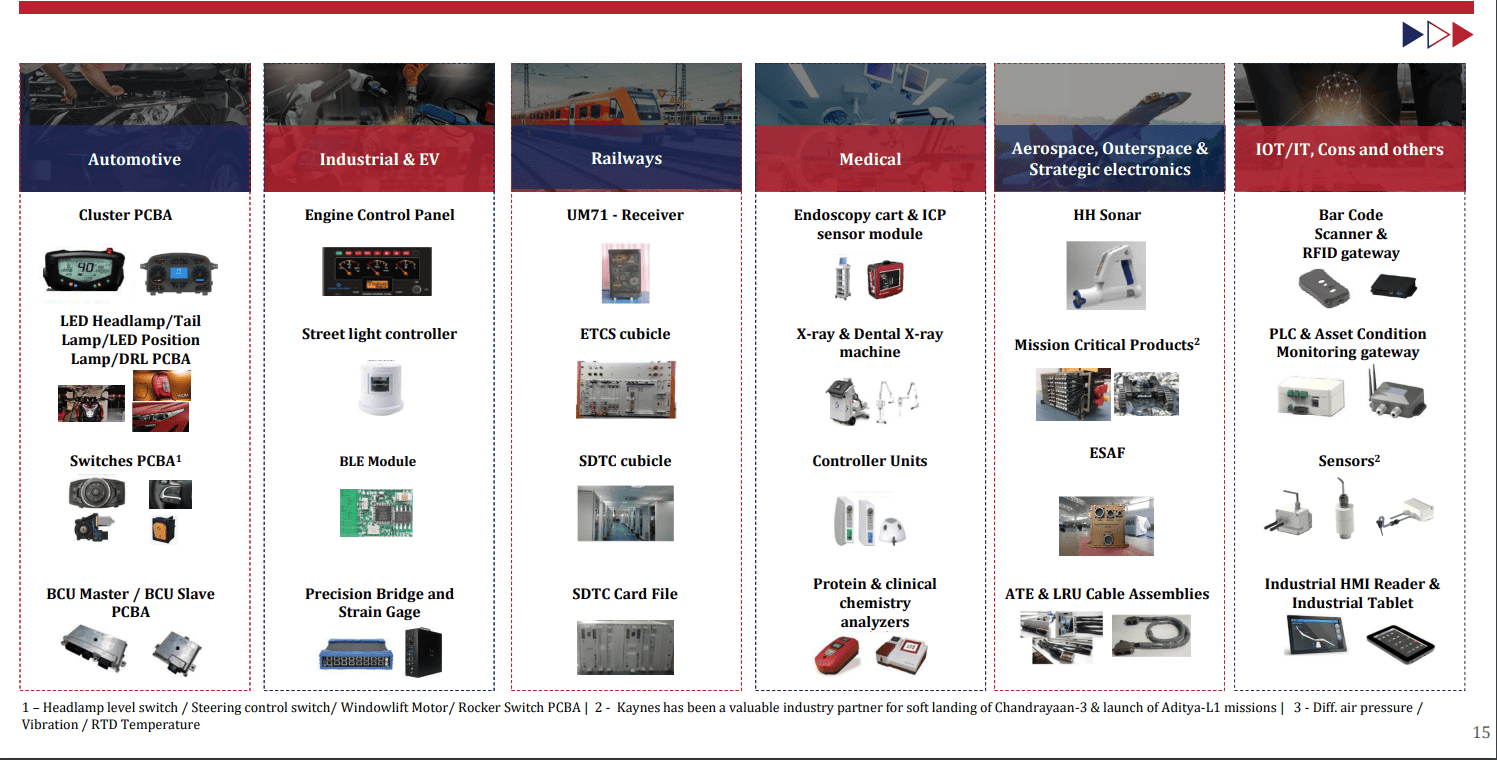

Here’s a glimpse into the user industries and applications to which it caters, to better understand what its fortunes are tied to:

The company has a marketcap of Rs 30,400 crore at present, on a trailing 12-month revenue base of Rs 2,011 crore. The share of the various segments in its revenue are as shown in the below graph.

While Automotive segment has been the company’s mainstay, it has been, of late, diversifying into emerging areas due to increasing thrust on domestic electronics manufacturing, adoption of sophisticated technologies in several user industries and increasing thrust on domestic sourcing.

With its entry into Outsourced Semi-conductor Assembly & Testing (OSAT), Kaynes is looking to become an integrated player across the entire EMS value chain. This may have been a trigger for the market’s upbeat mood with the stock, giving it a whopping 150 times earnings.

Industry

As per Ministry of Electronics and Information Technology (“MeiTY”), electronic imports accounted for ₹ 3.9 trillion (USD 56 Billion) in Fiscal 2021, which is 21% of the total electronics market in India. Imports are expected to reach USD 68 Billion by Fiscal 2025, accounting for 12.6% of total electronics market demand. This means a lot of manufacturing has to be done domestically.

According to a Frost and Sullivan report (produced in the RHP of Kaynes), Electronic production in India (including components) is expected to grow from Rs 8.1 lakh crore crore in FY21 to Rs 15.5 lakh crore billion in FY26 (14% CAGR). That is on the production side.

On the consumption side, India’s electronics market was Rs 6.7 lakh crore as of FY21 and expected to grow to Rs 20.8 lakh crore by FY26. Of this the total Electronics System Design and Manufacturing (EDSM) addressable market was Rs 2.65 lakh crore as of FY21 and estimated at 9.9 lakh crore as of FY26.

The EDSM space is expected to be driven by government initiatives and increasing local demand. This growth is supported by the overall Indian electronics market, which was valued at Rs. 10.86 lakh crore in FY23, with domestic electronics production standing at Rs. 8400 billion. The EDSM addressable market, contributing significantly to this expansion, was Rs. 4392 billion in FY23.

As far as India is considered, the ESDM market is at an evolving stage since the supply chain for most of the electronics goods still exist in China and other east Asian countries. Globally, mobile phones, IT Hardware and Consumer electronics & appliances and telecom form ~70% of ESDM market and the supply chain for it still largely exist outside of India, with China being the dominant source.

On the other hand, segments like automotive, medical, lighting, etc contribute the rest 30% and these are segments where domestic EMS players have built their foothold traditionally. But with Production Linked Incentives (PLI) for mobile, laptops, IT and telecom hardware kicking in, the component ecosystem for these should also evolve over a period, with scale, providing immense scope for domestic EMS players to diversify and scale up.

The EDSM industry is also being shaped by emerging technologies such as 5G, AI, and edge computing. With Govt. focus on areas like advanced computing, space research, etc growing, these are opening further avenues for domestic EMS players.

Meanwhile, the Govt. has also realised the importance of developing a semi-conductor ecosystem in the country to ensure that the industry evolves with significant value additions as well and has announced incentives up to $10 billion to attract companies, for manufacturing as well as building assembly and testing facilities in the country.

Now, let’s look in to in detail on the strengths and weakness of Kaynes, its valuation and risks.

Strengths

#1 Strategic presence across the value chain

ESDM companies are equipped to provide a gamut of services which includes design, assembly, manufacturing and testing of electronic components for the original equipment manufacturers (OEMs). These companies can be contracted at different stages of the designing and manufacturing processes. While large companies have the capability to offer entire range of services starting from design, sourcing of components, assembly and testing (also known as ODM), smaller companies offer primarily assembly and testing services.

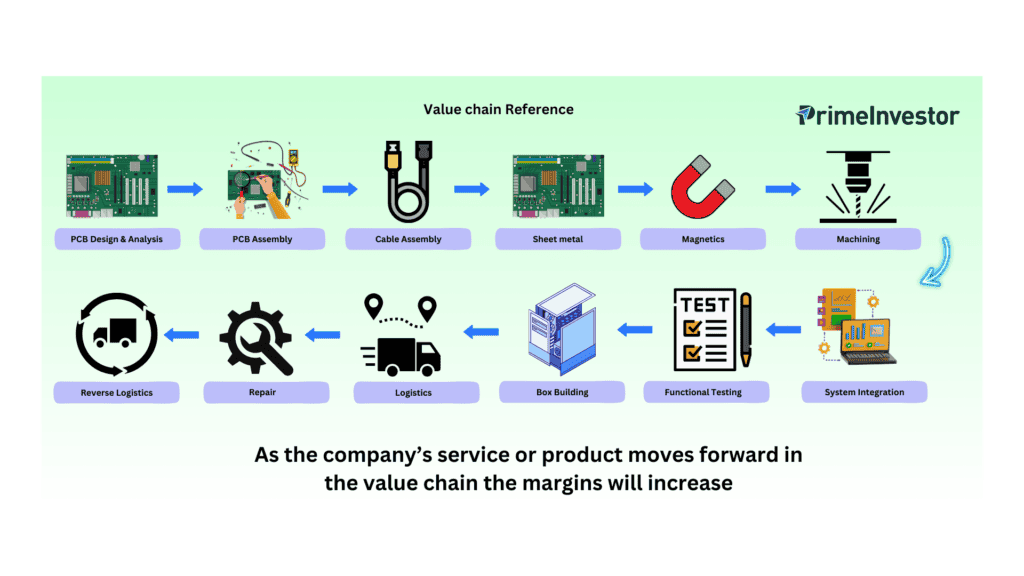

Kaynes is present across the value chain, including reverse logistics, as given in the image below:

This positions it well in the evolving EDSM landscape in India, driven by increasing thrust on domestic sourcing and manufacturing

#2 Conscious strategy to move up the value chain

Kaynes operates across six verticals, as explained earlier, and has historically manufactured a variety of products. Automotive has been its mainstay vertical for long and it’s now changing with newer opportunities opening in domestic electronics manufacturing.

As an outcome, Kaynes is now finding opportunities to diversify into opportunities that offer higher margin profile. For example, revenue share from automotive has been declining while high-margin segment like industrial has been gaining traction over the years, both because of its conscious choice as well as the opportunities that have come across in industrial segment aided by government spending.

In FY24, OEM-turnkey PCBA solutions accounted for 55% of revenue followed by OEM turnkey box building at 42%. Product design and engineering and ODM accounted for 2% and 1% respectively.

Of the verticals mentioned earlier in the report, industrial vertical has been firing the growth as seen in the data provided. To be specific, smart meters is one of the key reasons for this. The company forayed into smart meters last year, and now has a built capacity of 40 lakh smart meters per year. Kaynes has guided for roughly Rs. 400 crore in revenue in FY25 from smart meters and expects to double this in FY26.

Kaynes is also expanding its capabilities in high-performance computing servers and has received orders from Centre for Development of Advanced Computing (CDAC). Additionally, the company is developing expertise in areas like train collision avoidance systems and onboard electronics for the railways sector.

Kaynes is also actively pursuing opportunities in the growing high-density interconnect (HDI) PCBs, and it is establishing HDI PCB manufacturing capabilities to meet the increasing demand for miniaturised electronics and smart devices.

With the EMS industry in India being at nascent stage, still dependent on imported supply chain, the journey through localisation is likely to provide abundant opportunities in the long term for players like Kaynes to diversify and move up the value chain.

#3 Ambitious Revenue Goal, riding on OSAT opportunity

Kaynes has set an ambitious revenue goal of $1 billion (~Rs.8,300 crore) by 2028, to be achieved through its existing EMS business and from its OSAT foray. The goal is to generate 75% of total revenue from the EMS business and 25% from OSAT and PCB.

Kaynes Semicon Private Limited, a subsidiary of Kaynes Technology, will be the vehicle for OSAT foray. The Government has just approved the Kaynes' OSAT project at Sanand, Gujarat, that will be set up at an investment of Rs.3,307 Crore. The capacity of this unit will be to assemble, test, mark, and packing of 60 lakh chips per day. While this was initially planned in Telangana with a Rs. 3,000 crore investment, the plans have changed. The advanced chips will be processed at the Gujarat plant, and the Telangana facility will be used for EMS services.

Kaynes has registered under the Rs. 76,000 crore Semicon India project and will receive incentives on capital expenditure (CAPEX): 50% from the Central government, 25% from the State government, and additional incentives for land purchase. For technology support, Kaynes has partnered with companies around the world, including Globetronics (Malaysia), Aptos Tech (Taiwan), Mixx Tech (USA), and A01 (Japan).

Meanwhile, this foray is already attracting customer interest with Ola Electric in talks with Kaynes to utilize its OSAT facilities in Gujarat for its EV Semiconductor chips. With all this plans in pipeline the company expects to achieve Rs 3,000 to 3,500 crore revenue from OSAT by FY30, starting with Rs.1,500 crores in FY28.

This will also make Kaynes an integrated player across the value chain, which may eventually make it a key partner of choice for many electronics manufacturing majors.

#4 Robust financial performance

Kaynes has grown its revenue and profit at a CAGR of 49% and 114% respectively, in the last 4 years, buoyed by the increasing opportunity in the EMS sector.

It has also started FY25 on a strong note with revenue and profit growing at 69% and 100% respectively, signalling that it is well on track to deliver its guidance of ~Rs.3,000 crore revenue in FY25 with similar profitability.

Kaynes ambitious revenue target of $1 billion (~Rs.8,300 Crore) by FY28 translates to a revenue CAGR of 46% over the next 4 years. This includes the revenue it is anticipating from its semi-conductor foray or OSAT project as well.

Kaynes’ order book has also risen to cross Rs 5,000 crore, up 22% from the previous quarter. Currently, 15% of the order book is for exports in industrial, medical and space and the company expects this share to increase to 20% by fiscal 2026.

Market seems to be believing the potential of the industry as well as Kaynes, and its valuation at 146 times is only next to Dixon at 184 times.

Meanwhile, Kaynes has also raised Rs1,400 crore through QIP towards the end of FY24, anticipating its capex needs ahead, for PCB and OSAT facilities, and has closed FY24 with net cash of close to Rs1,400 crore.

Risks

Generally, while break-neck pace of growth may happen in many companies in sun rise sectors, very few companies eventually showcase sustained execution success. So far, one company that has demonstrated this unbelievable scale of growth was Dixon, growing revenues at a CAGR of 42% in the last 4 years. On the face of it Kaynes seems to be following this style,when it comes to the rate of growth.

In the early 2,000s it has happened in the domestic IT Services sector with the IT Services majors demonstrating such growth. However, Kaynes growth story is not without its share of risks.

- The increasing share of revenue from industrials, especially smart meters, and railways comes with lumpiness and government driven orders, which may expose the company to volatility in revenues. Generally, government related projects or orders are expected to come with high working capital intensity as well, which is something to watch out for.

- The fortunes of Keynes is largely tied to the OSAT opportunity that has ~75% of the project funding coming in the form of subsidies, both central and state government combined. This may warrant timely execution, scaling up and may come with several riders as well. However, this is critical from a perspective of moving up the value chain and it term becoming value accretive from a stock market perspective. Success or failure in this may bring a make-or-break impact on the stock’s valuation.

When there are such risks to projects, especially in unchartered sectors, it would be prudent not to take on the risks until one is closer to the actual take-off, even if it means giving up on some returns. Just to give you an example of how things can move suddenly - in the same sector, Vedant’s ambitious semi-conductor project didn’t take off as its JV partner, Foxconn, pulled out of the project. With several riders and geo-political concerns in forming partnerships and technology transfers, these risks are difficult to judge.

To give one example from previous cycle, we had shortage of thermal power boilers (with BHEL being sold supplier) and four companies came forward to put capacity then. These were L&T, Bharat Forge, Thermax and BGR in tie up with foreign players. But those didn’t take off and the capacities were abandoned as the cyclical downturn left the demand in abeyance.

Meanwhile, market was building the growth from those ventures on their valuations during the upcycle. Even though the nature of the project is different here, we can draw parallels from the market’s tendency to discount everything positively during a bull market with serious consequences for investors in the event of setbacks.

- Any slow execution of the company’s ambitious capex plans can impact growth. Also, the capital allocation to OSAT and bareboard manufacturing can cause dilution in return on capital employed in the short to medium term.

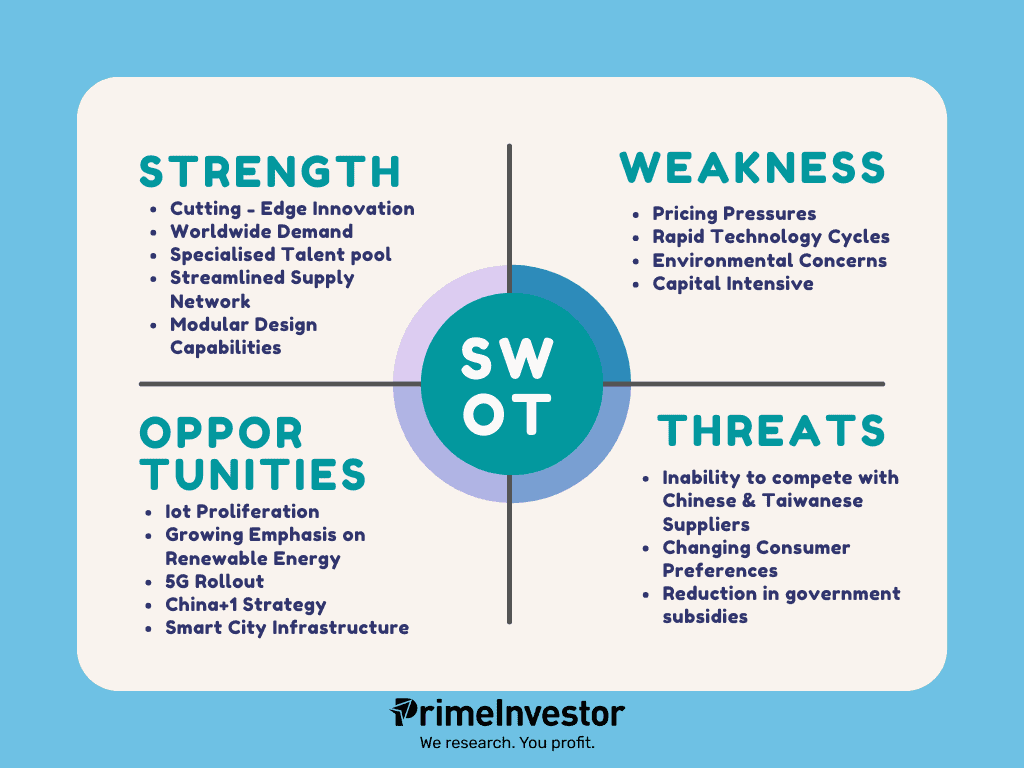

- The other threats as mentioned in the SWOT analysis image above stem from inability to compete with global Chinese and Taiwanese players in the

Valuation

At Rs.146 times earnings, Kaynes is quoting at a coveted valuation in the market, just behind the 184 times PE accorded for its larger peer Dixon Technologies. The key valuation driver has been the growth rate combined with continuing growth prospects and the EMS industry is allowing that growth.

If Kaynes meets its 60% growth guidance for FY25 with similar profitability, valuation may drop to <100-time earnings, still eye-popping for a new investor. Going by history, industries or companies that promise to or show potential to deliver 40% plus growth do receive a premium in the market. Whether such premium remains is a matter of what the company delivers.

Finding a growth stock at the right valuation is challenging both from the perspective of missing an opportunity as well as entering at a peak and take a hit.

Disclosures and Disclaimers

The following Disclosures are being made in compliance with the SEBI Research Analyst Regulations 2014 (hereinafter referred to as the Regulations).

1. PrimeInvestor Financial Research Pvt Ltd is a SEBI-Registered Research Analyst having SEBI registration number INH200008653. PrimeInvestor Financial Research Pvt Ltd, the research entity, is engaged in providing research services and information on personal financial products. This Research Report (called Report) is prepared and distributed by PrimeInvestor Financial Research Pvt Ltd with brand name PrimeInvestor.

2. PrimeInvestor Financial Research Pvt Ltd, its partners, employees, directors or agents, do not have any material adverse disciplinary history as on the date of publication of this report.

3. I, Sudharsan S, author/s and the name/s in this report, hereby certify that all of the views expressed in this research report accurately reflect my/our views about the subject issuer(s) or securities. I/We also certify that no part of my/our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report. I/we or my/our relative or PrimeInvestor Financial Research Pvt Ltd do not have any financial interest in the subject company.

I/we or my/our relative or PrimeInvestor Financial Research Pvt Ltd do not have beneficial ownership of 1% or more in the subject company at the end of the month immediately preceding the date of publication of the Research Report. I/we or my/our relative or PrimeInvestor Financial Research Pvt Ltd do not have any material conflict of interest. I/we have not served as director / officer, etc. in the subject company in the last 12-month period.

4. I Sudharsan S do not hold this stock as part of my investment portfolio. I/analysts in the Company have not traded in the subject stock thirty days preceding this research report and will not trade within five days of publication of the research report as required by regulations.

5. PrimeInvestor Financial Research Pvt Ltd has not received any compensation from the subject company in the past twelve months. PrimeInvestor Financial Research Pvt Ltd has not been engaged in market making activity for the subject company.

6. In the last 12-month period ending on the last day of the month immediately preceding the date of publication of this research report, PrimeInvestor Financial Research Pvt Ltd has not received compensation or other benefits from the subject company of this research report or any other third-party in connection with this report.