India’s electric two-wheeler market has transformed dramatically, growing from zero to a million units annually in just six years. What started as a subsidy-fueled market flooded with cheap imports has matured into a quality-driven ecosystem dominated by four key players: newcomers OLA and Ather Energy alongside incumbents Bajaj and TVS, who together control 85% of the market.

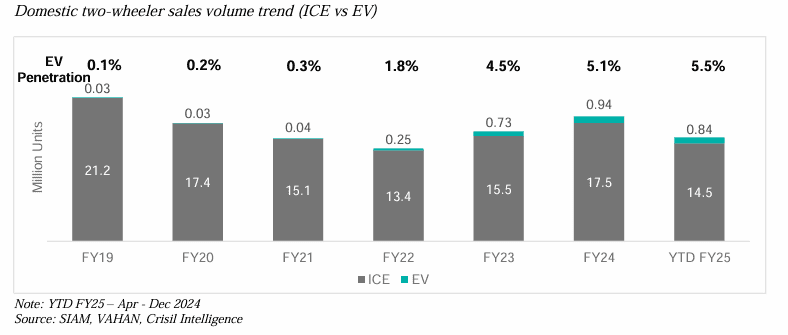

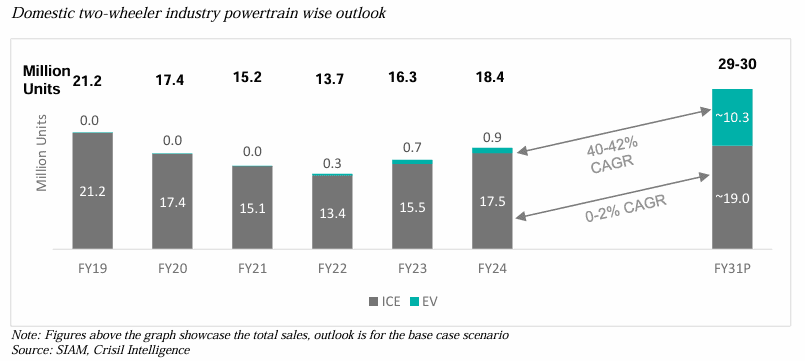

The sector’s ability to achieve million-unit sales in FY25 with minimal subsidies (less than 10% of vehicle price) demonstrates genuine consumer adoption rather than policy-dependent growth. With industry projections suggesting EV penetration in two-wheelers will surge from the current 6% to 25-30% by 2030, the market stands at a critical inflection point. It is at this take-off point that Ather Energy is coming up with its IPO.

Ather’s IPO will open for subscription from April 28 to 30th 2025 with a price band of Rs.304 to Rs.321 per share of Re.1 each. The company aims to raise approximately Rs.2,626 crore through a fresh issue of shares, along with an offer for sale of about Rs.353 crore, totalling Rs.2,979 crore. The proceeds from the IPO will be mainly allocated in following ways:

- Rs. 927.2 crore for setting up a new manufacturing facility in Maharashtra.

- Rs. 750 crore for investment in R&D.

- Rs. 300 crore for marketing initiatives.

Hero Motocorp is one of the promoters of the company and is not selling in the IPO. It will own 31% post IPO while founders Tarun Mehta and Swapnil Jain will together own 10.5% post IPO, keeping the total promoter stake at 41.5%

Business

Ather Energy, founded in 2013 by two IIT Madras graduates, has transformed India’s EV 2W market with its grounds-up approach to product development. The company has designed both the vehicle and its key components and built its own software (Atherstack), delivering robust innovation and high quality. Walk into an Ather showroom and you have proof of this grounds-up approach in its unconventional products which are head-and-shoulders above conventional 2 wheelers.

Ather’s current lineup includes four electric scooters; three sporty and performance oriented 450 Series and the family-focused product, Rizta. These models cater to a range of customers, from biking enthusiasts to families, while maintaining a premium brand image and good customer engagement. With a cost-effective, flexible distribution model and an expanding charging network, Ather has quickly become one of India’s top EV 2W makers in terms of user experience and rapid growth.

Ather’s factory in Hosur, Tamilnadu, has a total annual installed capacity of 420,000 units.It is in the process of building the first phase of a new factory in Aurangabad, Maharashtra, to expand its capacity to 1.42 million, in two phases. This is complemented by 233 Ather Experience Centres for sales and services in an asset-light dealership model.

Positives

#1 The EV take-off is real

During the initial stages of EV adoption, the apprehension over risk of vehicle failures outweighed the cost savings for the consumers. Government subsidies then lured buyers as the total cost of ownership (TCO) of an EV 2W with subsidy was 55% less than a Petrol (ICE) 2W. In terms of initial purchase price, EVs were available at the same price as an ICE 2W.

But with subsidies sharply withdrawn from FY25 (From Rs.55,000 per vehicle at peak to less than Rs.10,000 now), the upfront cost of EV 2W has moved 20-40% higher than an ICE 2W in FY25. While this was unfolding, the 2-3 years of EV experience combined with superior products addressed consumer fears on reliability and performance and made them embrace EVs. Sales have zoomed to move past a million units (11.5 lakh) in FY25, without meaningful subsidies (<10% of cost).

Source: Ather Energy RHP, Page 222

As we move forward, the gap with ICE 2W is expected to narrow further as battery prices fall and unit economics for EVs improve. CRISIL projects that the EV 2W penetration will reach 28%–32% within the domestic 2W segment by FY30. The TCO is attractive enough to drive penetration from 6% to these levels despite the withdrawal of subsidies and higher upfront costs. For EV players, this would translate to a 9X growth and a robust 40+% CAGR during this period.

Source: Ather Energy RHP, Page 228

#2 A robust head start and still in the lead

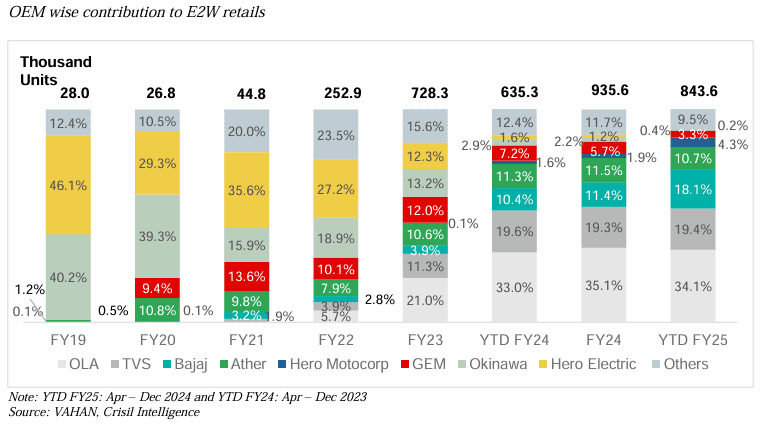

Ather is one among the new entrants into India’s EV boom with a sophisticated product designed in-house. But, during 2019, a few OEMs like Hero Electric (unlisted) and Okinawa dominated the EV 2W market, holding more than 80% market share, with basic products built on cheap Chinese imports. Ather was the most expensive of the lot at that time. But with Govt. tightening regulations on imports and quality for EV makers, these players have dwindled in number and share. The last 3 years have seen new entrants like Ather and OLA and incumbent ICE 2 wheeler companies like Bajaj and TVS conquering the market and establishing a new order in terms of market share.

This order is likely to be here to stay with some reshuffling of shares among these players. The past churn in the industry offers clarity on the market share evolution and brings in more predictability for investors.

#3 New platforms and products to aid scale building

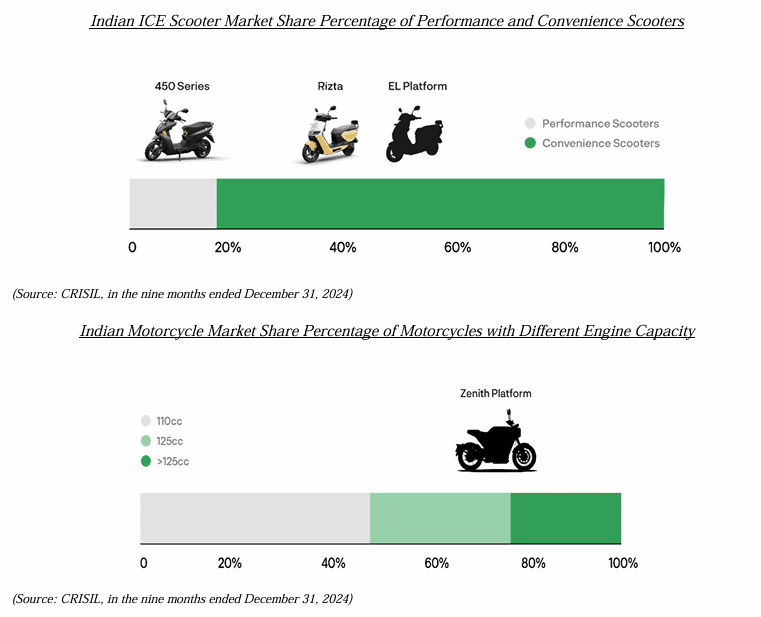

Ather started off with premium products Ather 450X and Ather 450S. These products carved a niche for build quality, technology and reliability. But for someone looking at EVs mainly for fuel savings and convenience, Ather was not then a compelling option. Ather 450X and 450S scooters were addressing just 20% of the market. Realizing this, Ather recently launched Rizta, a convenience scooter, at a much lower cost. With Rizta, Ather has expanded its addressable market substantially. One more platform is in the works to help Ather address the entire market.

Ather is also working on a bike platform, Zenith, to address buyers who prefer the “form factor” of a bike over a scooter. These new platforms will incorporate a new powertrain, electronics, and chassis, while utilizing elements of the battery and AtherStack.

Current debates highlight a puzzling statistic: EVs represent 15% of scooter sales but less than 1% of motorcycle sales. However, this comparison misses a crucial insight – many EV scooter owners previously rode motorcycles. The true picture shows consumers viewing EV two-wheelers as economical mobility solutions regardless of form factor. Consequently, the entire under-125cc segment (both scooters and motorcycles), which constitutes 75-80% of India’s domestic two-wheeler market, represents the actual addressable market for EV manufacturers.

Ather Energy is strategically positioning itself to capture this opportunity. The company is allocating a significant portion of its IPO proceeds toward a new manufacturing facility in Maharashtra, with an initial capacity of 0.5 million units, expandable to 1 million units. With its Rizta model, Ather aims to extend its reach beyond metropolitan areas into tier 2 and tier 3 cities.

Currently, Ather’s distribution network shows a strong southern focus, with 48% of dealerships and 61% of sales (in the first nine months of FY25) concentrated in this region. However, with southern India accounting for only 33% of total EV two-wheeler sales nationwide, there’s substantial growth potential in other regions. By leveraging its proven product capabilities alongside expanding its network into northern and western markets while deepening penetration in existing territories, Ather is well-positioned to match or exceed the growth rate of India’s booming EV two-wheeler industry.

#4 Path to profitability to be aided by battery cost, R&D benefits and Scale

Here’s a quick glimpse into Ather’s financial performance

Ather has been improving its gross margin and EBITDA and is eyeing an EBIDTA positive status by FY29 (10-11% margins) and near margin parity (13-14%) with other ICE 2 W manufacturers within a year or two after that.

This is going to be achieved through a combination of R&D initiatives, falling battery prices and manufacturing benefits from the new plant.

The following table gives a sense of the cost break-up of key components in EV 2W of its performance scooter.

Through R&D efforts, flagship model 450 has seen a 26% drop in Bill of Materials (BOM) cost, and another 450 variant by 12% since their launch. Apart from battery cells, every other part is sourced domestically. Since Ather is a performance EV 2W, NMC batteries are used. However, the company is working on LFP batteries, which are 15–25% lower in costs, for its new platforms.

According to Crisil and Bloomberg estimates, the global battery pack price as of FY25 is USD 115/kWh and is expected to decrease to USD 80/kWh by 2030.

Non-battery costs are also expected to decline, with the upcoming plant in Maharashtra benefiting from supply chain efficiencies, backward and vertical integration. All these provide a direction on the path to profitability for Ather.

Key Risks

Ather’s ability to turn profitable is contingent on EV market growth meeting expectations of 40% CAGR and delivering economies of scale for the company. It is also reliant on Ather’s ability to drive down costs through innovation and a downward trajectory in battery prices.

There are two key challenges to the growth assumptions for the industry

#1 Policy disruptions

Lower GST of 5% on EV 2W Vs 28% on ICE 2W and the high taxation of petrol has made EVs lucrative for buyers despite higher upfront costs. If the government decides to increase GST on EVs from 5% to the next slab or significantly brings down the taxation on petrol, that can unfavourably affect the TCO for an EV buyer. This can affect the assumed growth rate for EVs.

#2 Income levels and financing options

With EV 2W being priced 20-40% higher , increase in incomes and financing options is critical to achieve EV penetration of 30% by FY30. More than 80% of ICE 2W in India are sold through loans, while financing penetration for EV 2W is at 40-45% only, though it has increased from 15–20% in FY22. A take-off is needed in EV financing at this stage.

Battery cost is another critical element. Battery prices are expected to trend downwards with expanding EV offtake. But should tariffs or trade disruptions lead to higher battery prices or disrupt supplies, Ather’s journey to profitability is likely to be delayed. Nearly 70% of lithium-ion battery production is concentrated in China and neighbouring Asean countries.

Valuation and suitability

Since Ather has not yet achieved profitability, traditional valuation metrics based on current performance are not applicable. Looking forward to FY29, when Ather is projected to become EBITDA positive, the IPO’s pricing equates to approximately 22x FY29 EBITDA—notably higher than established players Bajaj and TVS (13-18x) and Hero (11x).

Our projections conservatively estimate a 25% revenue CAGR for Ather. However, as a pure-play EV manufacturer, Ather’s volume growth potential is 3-4 times (compared to industry forecasts of 30-40% CAGR between 2025-30 according to Crisil). This extended growth runway in an increasingly EV-dominated future suggests significant terminal value potential.

This investment opportunity aligns well only for investors with a late-stage venture capital risk profile, given that EBITDA positivity remains four years away. This will therefore not be an option for moderate risk investors. Nevertheless, for investors seeking EV or renewable energy exposure in their portfolios, Ather presents a compelling case based on:

- Demonstrated excellence in product development capabilities

- A focused management team with strengths in technology, product innovation, and capital efficiency

- Established market share with expansion potential in a rapidly growing segment

- IPO structure primarily comprising fresh share issuance, with proceeds largely directed toward manufacturing capacity and R&D investments

Peer Comparison

Ather is a superior option to Ola which got listed last year. Ather is looking to become a major player in EV 2W rather than diversifying into capital intensive cell manufacturing and other areas like Ola is. It aims to be both capital efficient and focused.

This is reflected in Ather’s lean balance sheet Vs OLA’s bloated balance sheet with much higher debt. Here’s a quick glimpse of Ather’s balance sheet.

Our Take

Ather Energy represents a strategic opportunity to invest in India’s EV revolution at a critical inflection point. With its strong product development capabilities, focused management team, and established market presence, Ather is well-positioned to capitalize on the projected 40% CAGR in the EV two-wheeler space through 2030.

However, investors should approach this opportunity with clear eyes regarding the risks involved. The path to profitability is lengthy, with EBITDA positivity expected only by FY29 by our estimates (assumptions given in Valuation section). Market growth assumptions, policy stability, and battery cost trajectories all present significant variables that could impact Ather’s success.

For investors with high risk tolerance seeking exposure to transformative sectors like electric mobility, Ather Energy presents an opportunity at the forefront of India’s green transition. Conservative investors or those with shorter time horizons may want to wait for signs of improving profitability before considering an investment.

2 thoughts on “Charging Ahead: Should You Invest in the Ather Energy IPO?”

Dear Sir, What is the basis of the below sentence taken from the article ? Do we have any research or data published by the govt “However, this comparison misses a crucial insight – many EV scooter owners previously rode motorcycles”

Hi sir, Govt. doesn’t publish any data on automotive consumer behavior. This is based on comments from various sources including EV dealers, automotive publications and customer feedbacks on youtube channels on why they made a switch to EV and what did they previously own.

Thanks,

Sudharsan