Please note that debt fund taxation has changed with effect from July 2024. Please refer to this article for updated tax rules.

We have had a number of queries asking if you should choose hybrid funds with indexation benefit, instead of debt, in the wake of removal of indexation benefit for debt funds since April 2023. The alternatives that you considered ranged from aggressive hybrid, balanced advantage, multi asset, arbitrage to more recently, the balanced hybrid category.

It is not uncommon for Indian investors to go where the tax benefit lies. And it is not without logic, since the net gain, post-tax, is the actual return that you earn from an investment. But what seems to be ignored by most is whether the tax benefit alone will suffice to meet the objective of a portfolio.

For example, if your idea of having debt is to have asset diversification and lower portfolio volatility, then you need to ask whether a different category of fund will help meet that objective.

When you base your investment decision only on tax benefit, here are the downsides:

- By substituting debt with another asset class, you are changing the risk profile of your portfolio and making it vulnerable to falls.

- You are counting on high inflation (a factor not in your control) to provide you with high indexation benefit.

- You are also betting on tax laws (which is an extraneous factor that can change for any asset class at any time) to help you keep tax outflows in check.

So, when you choose hybrid funds instead of debt how much are you altering the risk profile of your portfolio? And does the lower tax outgo work all the time if you have indexation benefit? Let’s analyse to understand.

SEBI’s categories of hybrid funds and their tax status

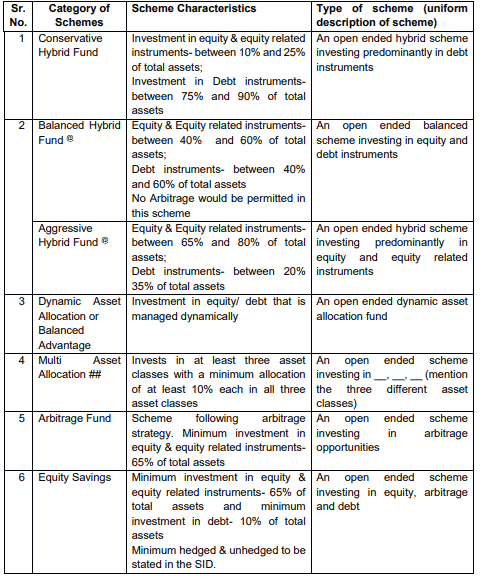

Before we move to taxation volatility and risk profile of hybrid funds let us first try to understand the SEBI classification for these funds and what tax status they get.

When you look for a debt substitute with tax efficiency, you either look for hybrid funds that give you equity taxation or which give you at least indexation benefit. Now let us first look at SEBI’s definition of each category of hybrid funds.

Source: SEBI Categorisation and Rationalisation of Mutual Fund Schemes

#1 The Tax laws on equity exposure

Do note that SEBI does not decide whether a fund qualifies for equity or debt taxation or indexation benefit. It is the Income Tax Act that decides. And based on equity allocation this is what the Income Tax Act says on taxation, for the above class of funds:

- Where the equity allocation is above 65% – long term is holding for greater than 1 year, and capital gains here are taxed at 10% with the first Rs 100,000 of gain being tax-exempt. Short term capital gains are taxed at 15%. For the 65% proportion, equity derivatives are also considered as equity instruments. This is where aggressive funds, most BA/DAA funds, equity savings funds and some multi-asset funds get their equity tax status, depending on whether they have a gross holding of 65% in equity.

- Where the equity allocation is between 35-65% –short-term capital gains on holding period of less than 3 years will be taxed at your slab rate and holding beyond 3 years will be taxed at 20% with indexation. The categories that fall into this set primarily would be the Balanced Hybrid category, where there only a couple of new funds launched recently. Some multi asset funds may fall in this tax bucket while others may retain equity tax status, depending on their equity holding.

- When the equity allocation is lower than 35% – the gains are taxed at slab rate for investments made from April 1, 2023. For investments made before April 1, 2023, LTCG (over 3 years of holding) would be taxed at 20% with indexation. Conservative hybrid funds would fall under this (similar to debt funds). STCG would be at slab rate. We will leave this fund category out of our purview in this discussion, since they don’t give you any better tax status than debt funds.

#2 Knowing the equity allocation in hybrid funds

Here are the points to note when it comes to identifying a fund’s tax status based on their equity allocation:

- SEBI classification clearly requires a minimum of 65% equity for hybrid aggressive, arbitrage and equity savings funds. So, by way of such holding, these funds will always be treated as equity for tax purposes. Their tax status is therefore clear.

- SEBI does not state what proportion of equity BA/DAA funds should hold. SEBI simply allows this category of fund to hold derivatives. So, it is up to the fund to decide how it wants to position the scheme and what equity allocation it has. Therefore, these funds may either have equity taxation or have taxation with indexation benefits. At present, BA/DAA funds have equity taxation because they have generally maintained equity holding of over 65% (i.e., gross equity before hedging is 65%; the post hedging can be lower). However, newer ones like the Parag Parikh Dynamic Asset Allocation fund seek to lower equity and perhaps get indexation benefit (as mentioned in their presentation). If more funds decide to adopt such a strategy – whether it is a new or old fund – you may see more funds in this space shift into taxation with indexation benefits.

- SEBI mandates just a minimum 10% holding for multi asset funds across equity, debt and commodities. So, these funds give themselves long leeway in their scheme information documents on equity and debt holding. So, unless these funds clearly state their minimum intended equity, their tax status is always subject to interpretation based on their 12-month average holding in equity.

- SEBI requires balanced funds to hold between 40-60% of equity/debt and mandates that they should not use arbitrage. This automatically qualifies them for indexation. Thus far, no AMC was interested in launching this category of funds since an equity-tilted allocation structure with debt taxation was not appealing. However, post the tax change in March 2023, there are now a couple of funds in this category. Note that an AMC can have either a balanced hybrid fund or an aggressive hybrid fund but not both. Therefore, it will be only newer AMCs or those without aggressive hybrid funds in their fund line-up that may launch such funds.

To sum up, when you are looking at superior taxation in hybrid funds – hybrid aggressive, equity savings and arbitrage fit in automatically as equity funds for tax purposes. BA/DAA also get equity tax status for the most part but you need to check the SID and presentations and present allocation before you conclude.

Multi-asset funds can be anything – equity tax status, debt tax status or taxed with indexation benefit – depending on their asset allocation. You definitely need to check the SID to know if the fund intends to maintain specific cut-offs, or look at its asset allocation in its portfolio (use the MF Screener). The multi-asset fund we have in Prime Funds enjoys tax status and the fund clearly states its minimum equity intention.

Volatility and loss risk

Now, let’s get to how much weight to place on taxation alone. When you hold a debt fund, you hold it for its ability to contain downside and cushion your portfolio against equity falls in bear markets. It would be imprudent to assume that hybrid funds will automatically do the same for you. Most of them don’t and the data below will tell you this.

The table shows how volatile most classes of hybrid funds are (see standard deviation) compared with debt funds. And this data is over a one-year rolling return basis. If you plan on holding a hybrid fund over shorter periods, the risks are much more elevated. For example, there is a 17% chance that BA/DAA funds deliver negative returns over 6-month periods (in the 5-year duration below). The same jumps to 23% over a 3-month period!

Since we do not have balanced funds with any track record, we simply built a 50:50 equity debt blend (Nifty 50 and ICRA Composite Bond) to look at its volatility.

From the above you will be able to largely classify the hybrid funds in the order of least risk to highest risk (not considering conservative hybrid here) as follows:

- Arbitrage funds come close to debt (as low as equity and even slightly less volatile than short duration) in terms of low risk profile. However, there are issues with performance and we have discussed that in this article: Should you replace debt funds with arbitrage funds to save tax?

- Equity savings funds are far riskier than debt but are less volatile than BA/DAA/multi asset/Aggressive in terms of volatility and loss risk.

- BA/DAA and balanced funds (based on sample constructed) score higher on risk than equity savings but better than aggressive and multi asset funds.

- Aggressive and multi asset are the relatively highest risk ones in this category.

So, you need to weigh the quantum of risk you can take for tax benefit purposes. Aggressive and multi asset funds certainly don’t make the cut unless you have a holding period of at least 3 years to ride the volatility.

Is the 20% indexation a boon?

Many of you are already aware of the equity status of BA/DAA funds but now want to retain the indexation benefit wherever possible.

In our view, taking a hybrid fund other than arbitrage is never a direct substitute for debt in terms of risk profile. If you still take a fund with equity tax status, you need to understand the risk of downside. Further, remember that every time you substitute debt with hybrid, you are also increasing your portfolio’s equity allocation also.

The trickier business is wanting a fund with indexation benefit. Now, let us say you understand the risk of a balanced fund (which is certainly not a substitute for debt) but want to go for it for the indexation benefit, and such a balanced fund has a 50-50 equity debt allocation. Can you be sure you are benefiting in terms of tax outgo for the risk you take? You cannot! The following factors will decide whether your net return is higher:

- The cost inflation index rise in the period

- The return of the balanced fund in that period (we have no track record now to assess this)

Now, what if you decide to take on the same risk but by taking separate exposure to equity and debt say at 50:50 each, instead of a balanced fund? We tried to do this with the simple Nifty 50 for equity and ICRA Composite Bond for debt taking their returns for the past 3 years for both options.

- The equity and debt portfolio would have 10% LTCG for equity and slab rate for debt (assuming investment is after April 1, 2023).

- The balanced fund (same Nifty and ICRA Composite Bond 50:50 blended) would get 20% indexation benefit.

Assuming a cost inflation index of 4.9% for the past 3 years, it turned out that the equity and debt portfolio did better than the balanced fund on a post-tax basis for 10% and 20% tax slab. For those in the 30% slab, the net value post tax was just 0.47% higher for the balanced fund than the equity-debt split portfolio.

However, this can easily reverse if you construct an equity portfolio with some careful blend of large and midcap with option to choose the best fund in each segment (which is not possible in a single hybrid fund) and choose the right blend of debt as well. In other words, a proper asset allocation should help balance risk and give a chance to even beat the tax status. This, to our knowledge, is a better way to build a portfolio than choosing funds for tax purposes.

10 thoughts on “Should you choose hybrid funds instead of debt funds for tax benefits?”

Kudos. Good informative article on SEBI classification of Hybrid funds and the associated taxation rules!! I wonder why you chose not to include conservative hybrid funds in the table when you included pure debt funds like short duration funds and money market funds.

Even though conservative hybrid funds are taxed like debt funds, I would be interested in knowing this category’s worst average returns, standard deviation, category instance of loss and the average loss during falls? Can you please share this data?

Regards

The purview of this report was to discuss hybrid funds with better tax status than debt funds. Since conservative hybrid funds do not get that, we left it out. You can use our screener to get details about this category https://www.primeinvestor.in/mf-screener/ Or you can look at slightly dated article on them to understand how they compare, here: https://www.primeinvestor.in/varsity/conservative-hybrid-vs-equity-savings-balanced-advantage-which-is-the-best/ thanks Vidya

Thanks. The MF screener wants me to be a Growth subscriber to be able to add filters. 🙁

How most things get back to the basics like asset allocation! Better learn to spend the time and mind space on one’s actual profession rather than optimizing finances to the minute details, unless of course that itself is one’s profession.

Hi,

Very informative and relevant article. Keep going.

I have big chunk of my portfolio with BAF (aggressive and passive), Equity Savings Fund and Multi asset . All with equity taxation. Is it wrong to assume 33% as your debt component here ? Plus arbitrage benefits.

Error for correction – “Further, remember that every time you substitute hybrid with debt, you are also increasing your portfolio’s equity allocation also” It should be debt with hybrid.

Regards

Hello Sir, thanks for pointing out the error. Corrected! Other than arbitrage, you would need to consider the others either as equity or apportion then (if you have few funds, based on their individual allocation) between equity and debt. Or you can use a broad proportion such as 65:35 for aggressive hybrid and multi asset, a 60:40 for BA/DAA, and a 45:55 (45 in equity and 55 others) for equity savings. thanks, Vidya

Is Parag Parikh Dynamic asset allocation fund (whose NFO is just closed) eligible for indexation benefit ? In Neil Parikh’s video he had told that this fund is for indexation.

Parag Parikh – we have mentioned it in the article that they seek indexation benefits. But their SID has a broad range of 0-100 for equity and debt. Vidya

With the changes in new budget, it looks like Parag Parikh Dynamic Asset Alloc Fund will be taxed at 12.5% if held for more than 2 years assuming they maintain <65% equity allocation? If yes, Is this applicable for funds bought from today onwards or funds bought in current FY from Apr-2024?

The Section 50AA amendment is effective only April 1 2025. So this will apply from then. And yes, if PPFAS does so, it will be taxed at 12.5% if held for more than 2 years. If it qualified as equity, then holding period will only be 1 year. thanks, Vidya

Comments are closed.