‘How can I get Rs 1 lakh a month in passive income?’ is now a common question at online forums. And the answers range from outlandish to impractical.

Some folks suggest online gaming, starting a business from scratch or becoming a YouTube influencer overnight to rake in passive income and quit your day job. These are hardly usable ideas as your odds of success at these ventures are about the same, as winning a lottery. Other intrepid people recommend P2P lending and F&O trading. These options can decimate your capital, forget regular income.

Therefore, the only workable solution is to see if you can get to a Rs 1 lakh per month passive income from conventional (and regulated) investment options. You can, but it is not easy. It requires an elaborate financial plan with disciplined investing over many years.

Passive income from debt

To understand why, let’s start with a simplistic proposition.

Mr Passive, a 40-year-old, wants to earn Rs 1 lakh monthly income from investments, preferably in debt options like fixed deposits or government bonds, where his lumpsum will be safe. Today, fixed deposits with good banks and 10-year government bonds offer a return of 7.2% pa.

But interest income is taxed at Mr Passive’s slab rate, which is 30%. Therefore, a 7.2% interest will translate into a 5% return in his hands, once the taxman has taken his pound of flesh. To earn an income of Rs 12 lakh a year at a 5% post-tax return, Mr Passive needs to invest a lumpsum of Rs 2.4 crore in those FDs or bonds.

Suppose Mr Passive had a rich uncle who bequeathed him Rs 2.4 crore. Can he simply park that money in a bank FD and quit his day job? Well he can’t, because he can run out of money quite easily, thanks to inflation and reinvestment risk.

Inflation

A Rs 1 lakh monthly income may look like a princely sum at today’s prices. But if you account for inflation, will it support your lifestyle say, 20 years from now? What about 40 years later? The answer obviously, is no. Here’s what Rs 12 lakh will turn into, at an annual inflation rate of 6%, over different time periods.

If Mr Passive quits work at 40 and wants to survive just on passive income for the rest of his life, he will need an annual income of Rs 21 lakh in 10 years, Rs 38 lakh in 20 years and so on, going up to Rs 2.16 crore in 50 years’ time, when he is 90. This assumes 6% annual inflation. Therefore, when investing for passive income, he needs to invest in such a way that his corpus generates Rs 12 lakh in the first year, going up steadily to Rs 2.16 crore by year 50.

Falling rates

A second googly he will need to contend with is reinvestment risk. A bond or bank FD in India typically allows you to invest for a maximum of 10 years at a time. Once this term runs out, you will need to find fresh FDs/bonds to reinvest your principal at the rates prevailing at that time. If interest rates are much lower then, you will need a much bigger corpus to earn the same passive income.

Let’s suppose interest rates on FDs and bonds dips from 7.2% to 6.2% in the next 10 years, then Mr Passive’s post-tax returns will dip to 4.3% from 5% today. Do remember though that, in 10 years’ time, Mr Passive will need Rs 21 lakh and not Rs 12 lakh to maintain his current lifestyle.

If he targets Rs 21 lakh in passive income when rates have fallen to 4.3% post-tax, he will need to invest a whopping Rs 4.8 crore to get this income. If rates keep falling over the next 30 or 40 years (as they have in the West), his lumpsum investment will need to keep rising to maintain his lifestyle. That’s clearly not going to be possible, unless Mr Passive rejoins work, or has a healthy supply of rich uncles!

Why not equities?

But why rely on boring fixed income? With a bull market on for some time, many folks have full faith in equities to deliver much higher returns. So, let’s assume we have the dynamic Mrs Passive urging her husband to forget boring bank FDs and to invest his corpus wholly in equities for passive income. A Nifty 50 fund will do. It has delivered 12.5% per annum in the last 20 years, she points out. As per tax laws today, equity gains are taxed at only 10% per annum after one year. So equities an help him get a higher post-tax return too.

The problem with this idea is that it assumes that equities will deliver 12.5% like clockwork every year, which they definitely won’t. If you try to get passive income from an equity-only portfolio, there will be years when your capital has taken a beating. Yet, you will need to withdraw from the beaten-down corpus to meet your passive income needs. If bear markets spring up in the early part of your retirement, you will have to generate your income with depleted capital.

We don’t know what the future holds for equity returns. But to understand how a Nifty 50 fund would work for a passive income seeker, let’s assume Mr Passive quit his day job in 2003 at the age of 40 with a handsome Rs 1 crore corpus (it was handsome then). He parked this entirely in a Nifty 50 index fund and began to withdraw money from it every year. The illustration below tells us how his corpus would have moved over the last 20 years.

In the first five years after retiring, Mr Passive would have been thrilled with his decision. Thanks to a lengthy bull market between 2003 and 2008, he could manage his annual expenses easily by withdrawing just 6-12% of his corpus. But as the years wore on and his income needs shot up due to inflation, his annual withdrawals would have climbed sharply. He would have needed to withdraw as much as 22% of his corpus to meet his needs in 2023! That’s bound to have given him some sleepless nights, as he was only 60 in 2023!

This is in a scenario where there has been no big market correction recently. If a correction were to start now, with the Nifty 50 dropping by 15-20% for a couple of years, Mr Passive would be even more nervous.

Income from Dividend yield stocks?

To get to a passive income portfolio, some folks on social media suggest accumulating vast quantities of dividend yield stocks. With dividend yield stocks, one can get the best of both the worlds, capital gains and regular income by way of dividend - or so they say.

But there are two problems with this. One, to rely on stocks for long-term passive income you need to find companies that can pay steady dividends for the next 20, 30 or 50 years. Very few businesses in India offer that kind of stability and visibility in earnings and dividend payouts. If they do, then their dividend yield tends to be in the 1.5-3% range.

To earn a Rs 12 lakh annual income from a 3% dividend yield stock like ITC, you will need to invest Rs 4 crore in it – even ITC is not safe for that kind of concentrated investment.

If you hunt for stocks with the highest dividend yield in the market (6-7% yield), they usually hail from cyclical businesses (Coal India, ONGC), are value traps or have dodgy governance (which is why they trade at rock-bottom PEs). The last two types of stocks can wipe out your capital.

Two, there’s also no guarantee that dividend yield stocks will protect your capital in a bear market. Dividend yield funds lost 7-13 per cent in 2018 and 4-5 per cent in 2015, two not-very-negative years for equities. Therefore, dividend yield stocks can subject you to the same risks as equity funds, you may be forced to withdraw from depleted capital.

Takeaways

The above points show that your passive income portfolio needs to have three features:

- Your portfolio cannot lean only on bonds and FDs, as they carry reinvestment risk and can undershoot inflation after taxes. Your need equities in this portfolio to deliver inflation beating returns, but not so much that it contributes to large capital draw-downs. This argues for an asset-allocated portfolio, based on your return needs.

- To generate enough passive income on an inflation adjusted basis, you can’t just withdraw the returns on your portfolio every year. You will need to withdraw part of your capital too. But you need to do it in such a way that the corpus runs out only when you bid adieu.

- Given the difficulty of generating enough passive income, you need to withdraw from this portfolio in a tax-efficient manner. Systematic Withdrawal Plans (SWPs) from mutual funds meet this requirement better than interest or dividend income (check our Varsity to know how to generate income through SWP).

Creating a portfolio

This suggests that your passive income portfolio can be constructed on following lines.

- Given that both equity and debt mutual funds allow you to defer taxes until withdrawal and not pay it every year, the majority of your passive income portfolio needs to be made up of debt mutual funds. Accumulate long-duration debt mutual funds when rates are high. You can choose your fund from our 5 years plus recommendations from Prime Funds as well as the tactical calls we give from time to time.

- Park a portion (the allocation will depend on your return needs) of your portfolio in equity funds, with primary chunk from Equity – Moderate active and passive categories in Prime Funds to kick up your returns and beat inflation. (This earlier article tells you how you can handle the debt/equity mix in your retirement portfolio)

- Have add-on allocations to long-dated government bonds. These are not tax efficient but ensure capital safety and protect against reinvestment risks. G-secs now come with 20, 30, 40- and 50-year tenures and we expect liquidity in them to improve over time. We track the rate cycle closely and alert our subscribers to good entry points in g-secs. Check out our recommendations here.

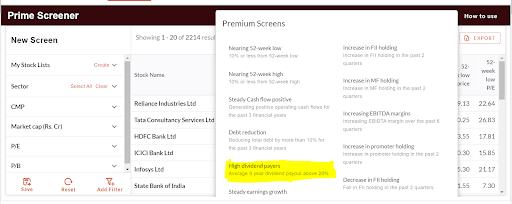

- Accumulate quality stocks with long business visibility and the possibility of rising dividend yield, to supplement the above. Track our Dividend Earners recommendations here or use our Prime Stock Screener and go to Premium Screener > High dividend payers . But do ensure you apply other quality filters before you choose a stock.

Finally, to get back to Mr Passive, what if you don’t have any rich uncles and need to accumulate the corpus you need for passive income by yourself? This is a tough task but you can do it.

Our retirement calculator shows that a 25-year old who wants to retire at 45 and has no legacy, will need to accumulate about Rs 13 crore corpus (assuming inflation of 6.0%, and lifespan of 80 years) to generate a passive income of Rs 12 lakh per annum at today’s prices. The calculator will also tell you how much you need to save monthly to achieve it.

But here we have assumed an inflation rate of 6%, investment returns of 10% pre-retirement and 6% post-retirement. If you bump up the return assumptions (which will need a higher equity allocation), you can get by with a lower corpus.

That’s why we warned you at the outset that setting up a passive income is not easy. The only way to lessen the burden on yourself is to work for more years, start investing very early and take on equity risks early in your career, to max out compounding.

We will be exploring the subject of retirement planning further in future articles.

21 thoughts on “Looking for Rs 1 lakh passive income? Here are the dos and don’ts”

Could you please elaborate on the following:

Given that both equity and debt mutual funds allow you to defer taxes until withdrawal and not pay it every year, the majority of your passive income portfolio needs to be made up of debt mutual funds.

I thought it was because of the low volatility in debt, and a lesser impact of the sequence of returns risk.

Would you not have recommended debt funds if we had to pay taxes annually like with the FD?

Yes I am trying to say that as making passive income is so tough,tax efficient vehicles like debt funds are preferable to FDs

As usual good article from PI.

Comments are closed.