If you are an income seeking investor in India, commercial real estate is far more lucrative than residential property. But only the very rich can afford to buy an entire office building, warehouse, multiplex or a mall. Fractional ownership platforms, which sprang up to help retail investors buy bits of commercial property, turned out to be opaque and unregulated.

This is why SEBI gave a go-ahead to Small and Medium Real Estate Investment Trusts (SM REITs) early this year. SM REITs are allowed to own a single piece of commercial property and pass on the rental income to their unitholders.

The first SM REIT – Property Share Investment Trust – is launching its first scheme Propshare Platina on December 2, 2024. The offer will close on December 4, 2024. The price band has been set at Rs 10 lakh to Rs 10.5 lakh per unit, with the offer set to raise Rs 353 crore at the upper end of this band. This will also be the minimum application and trading lot size. Here we review this REIT and tell you whether to go for it.

Scheme overview

Propshare Investment REIT proposes to launch several schemes, of which Propshare Platina is the first. It is a single-property REIT scheme, which proposes to acquire 0.25 million square feet of office space across 6 floors in Prestige Tech Platina, a LEED GOLD office building located in Prestige Tech Park at Outer Ring Road, Bengaluru.

The seller is a US-based (Indian-promoted) technology company – 24/7 ai – which has been owning and operating from this building since 2016.

Propshare Platina plans to deploy the Rs 353 crore raised from this offer to acquire six floors in Prestige Tech Platina, through six individual Special Purpose Vehicles (SPVs). Of the Rs 353 crore, Rs 35.3 crore will be infused as equity into the SPVs, Rs 211.8 crore as investments in optionally convertible debentures and Rs 105.9 crore as loans. The market value of this property has been certified at Rs 353 crore by an independent valuer (Kzen Valtech).

The SPVs will lease this back to 24/7 ai as office space, in a sale-and-lease back arrangement. Sale-and-lease back transactions are used by companies to monetize their fixed assets and generate immediate cash flows. In this case, the sale-and-lease-back ensures continuity of operations for 24/7 ai and minimal investments in refurbishing the property for Propshare Platina REIT.

Leases for all six floors are expected to start in November 2024 and end by November 2033, a term of 9 years.

Propshare REIT does not propose to acquire any further assets under this scheme. It is also not taking on any debt. Therefore, its cash flows and distributions will be wholly dependent on the single tenant 24/7 ai. The property will be managed by Propshare Investment Manager.

In line with SEBI rules, Propshare Investment Manager has been captalised at Rs 20 crore. Its management team carries 7-8 years of individual experience in the real estate industry, with prior stints at Blackstone, SBI Real Estate Fund and Piramal Capital. As per SEBI’s skin-in-the-game rules, the investment manager will hold 5% of units in this REIT scheme for the first five years.

Like AMCs, investment managers of REITs charge annual fees which can take the form of property management fees and portfolio management fees. Propshare Platina’s investment manager proposes to charge no management fees for FY25 and FY26. It will charge fees at 0.25% of gross proceeds in FY27 which will rise to 0.30% from FY28 onwards. These fees are low in relation to the diversified listed REITs. It is also charging a one-time fee of 1.5% on the acquisition value of the property.

Offer details are available on SEBI and details of the REIT are available in this PDF.

Positives

The positives of this offer are as follows.

#1 Prime location

In property investing, there’s an adage that only three factors matter – location, location and location. Propshare Platina REIT has got this feature right, by investing in property in the most buzzing office hub in Bengaluru.

Prestige Tech Platina is located in Outer Ring Road – Southeast, which is well-connected and a sought-after location for multinationals. Prestige Platina’s immediate vicinity features offices of Adobe, JP Morgan, Oracle, Genpact, Juniper Networks, Nutanix, Deloitte and Schneider Electric. The location somewhat reduces the risk attached to a single-property REIT, as PropShares may be in a position to find alternative tenants if the current one vacates.

Bengaluru is home to Inda’s largest and most thriving office market, accounting for 35% of all-India demand for office leasing in 2023 (all data from JLL research, as provided in the offer document). Despite insane traffic and other problems, Bengaluru remains the destination of choice for India-bound tech companies, startups, multinationals, flex-working companies and the up-and-coming GCCs (Global Capability Centres).

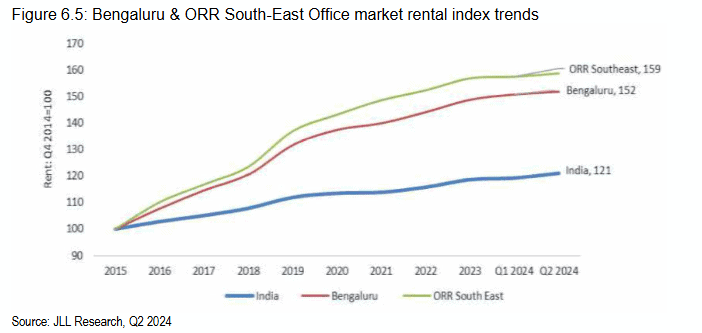

The Bengaluru office market has seen a 41% absolute rise in office rentals in the last 8 years, compared to 34% for Chennai, 30% for Hyderabad, 29% for Pune and 6-10% for NCR and Mumbai.

Within the Bengaluru market, Outer Ring Road (ORR) accounts for the lion’s share of office demand. ORR Southeast, where Prestige Tech Platina is located, accounts for 34% of the total office space in Bengaluru, featuring the who’s-who of lessors. This area has seen a much tighter demand-supply balance than the rest of Bengaluru, with its rents appreciating at 5% annually since 2016, despite Covid.

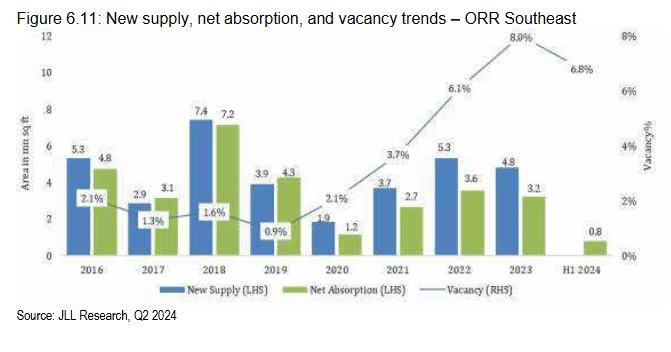

Though the Covid shift to work-from-home saw supply of office space overshoot demand in Bengaluru, the back-to—office trend and new demand for office space from GCCs and flex-working companies which are flocking to Bengaluru, is expected to tighten the demand-supply situation this year onwards.

ORR Southeast, where Prestige Platina is located has seen a faster rise in absorption vis a vis supply since Covid. While the city reported vacancies of nearly 14% in 2024, ORR Southeast had vacancies of just 6.8% recording a sharp fall from 8% in 2023.

This is the key reason behind office rent in this locality growing much faster than the rest of the city.

Moderate upcoming supply of office space is expected to keep vacancies low and rents high in this location.

The above market dynamics suggest that apart from healthy rental yields, Prestige Platina REIT may offer scope for capital appreciation, which will reflect in the Net Asset Value of the scheme over time.

On rental increases, Propshare Platina REIT’s lease agreement with 24/7 ai, stipulates rental payments at Rs 103.2 per sq ft for the first three years, after which there is a 3.8% escalation to Rs 107.1 in FY28 and a 15% escalation to Rs 123.2 in FY30.

#2 100% occupancy

Propshare Platina has only a single property to manage and plans to ink a leasing arrangement with 24/7 ai for all six floors. This will result in the REIT starting off with 100% occupancy, unlike larger listed REITs which have to juggle multiple properties across locations and are grappling with vacancies of 10-15%.

Being a single-property REIT also results in easier property management and simple financials. This allows for better visibility on cash flows and distributions to investors. PropShare Platina has projected its financials for the next three years are as follows:

The above projections show that Propshare Platina REIT expects to pass on almost all of its income from the six SPVs to its unitholders, with minor deductions for expenses. The 9% yield in the first year is the result of “other income” from interest earned on the security deposit from the tenant. The sustainable distribution yield is likely to be in the range of 8.6% until FY31 when a substantial rent escalation is on the cards.

#3 Low expenses

Propshare Platina REIT is projecting a distribution yield of 8.6-9% at a time when listed diversified REITs offer a distribution yield of 6-7%. The main contributing factor to this (apart from high rent in ORR Southeast) is the low management fee proposed to be charged by the investment manager. With the fee at zero per cent in FY26 and FY27, 0.25% in FY27, rising to a maximum of 0.30% from FY28 onwards, this REIT will be able to pass on most of the income from SPVs to its unitholders.

In contrast, diversified listed REITs have their managers charging much higher fees of 2-3% towards property and investment management, which lowers their distributions.

The low fees also make this single-property REIT a much cheaper route to owning commercial real estate than direct transactions in the market.

#4 Friendlier taxation

In addition to higher yield and the possibility of capital appreciation, one attraction for investors on income from REITs versus debt instruments is the former’s friendlier taxation. With recent Budget changes, income/capital gains from popular debt options such as debt funds – are taxable at one’s slab rate. Interest income from other traditional options were already taxed at slab rate.

Tax on income from REITs, though complicated, can be much lower for the investor, depending on how the REIT structures its distributions.

- Under income tax laws, interest and dividends received by REITs from their SPVs enjoy pass-through status and are taxable at slab rates in the hands of the REIT’s investors if passed on to them.

- Any other distribution is exempt from tax as long as the cumulative payout from the REIT does not exceed the original capital invested by the investor.

- However, dividends paid out by the REIT are exempted from tax in the hands of unitholders if the SPVs originally earning that income do not opt for the concessional tax regime under section 115BAA of the Income Tax Act.

Propshare Platina REIT has not specified whether its SPVs will opt for 115BAA. However, the management clarifies that it proposes to distribute income mainly as “other income” and interest payouts. While the interest portion of the income will be taxed at slab rates, the “other income” will be treated as return of capital and will be exempt until the distribution equals the original price of Rs 10 lakh.

In effect, this would mean that investors in this REIT may enjoy much lower tax incidence on their income than from pure debt vehicles.

Cons

While good location, low costs and healthy distribution yields are the pluses of participating in this offer, there are minuses too that investors need to weigh.

#1 Dependence on single tenant

One of the main advantages of investing in REITs to take property exposures is the diversification they offer. Listed REITs like Embassy Office Parks, Mindspace etc manage a large portfolio of assets spanning many cities and multiple locations within them. This diversification shields investors in these REITs from unexpected risks that hit the prospects or cash flows at one property. A natural disaster or a slump in the market may shut down one property but the rest of the portfolio will continue to deliver cash flows.

In the case of Propshare Platina (and all SM REITs), investor returns are entirely dependent on one property which can be impacted by external events. Moreover, the entire property is leased out to a single tenant – 24/7 ai. Should this tech company witness business disruptions, or report poor financials, or decide to scale down or relocate its operations, this can put the entire cash flows of the REIT and thus its investors at risk.

As 24/7 ai is a private company, the details available about it in the public domain are sketchy. However, the California-headquartered company has a long track record in its core area of providing customer support services to a roster of global firms. It is now deemed a leading provider of customer support services globally. Founded in the year 2000 by two Indians, the company has successfully scaled up with just one round of initial funding at $22 million from Sequoia Capital.

In 2012, Microsoft acquired an equity stake. Originally a provider of live agents for customer support functions, the company has integrated AI and machine learning into its support services from 2017, and now has 15 offices across 9 countries with 15000 employees on its rolls. Revenue estimates in the public domain vary from $400 million to $1.4 billion.

More about 24/7 ai here (https://www.247.ai/about-us/).

#2 Short lock-ins

Though Propshare Platina derives its visibility on cash flows and distributions from the 9 year lease with 24/7 ai for Prestige Tech Platina, the leases for individual floors feature differing lock-in periods, as detailed below.

This structuring of the lease agreement suggests that tenant has sought optionality to vacate three floors after 3 years, one floor after the 5th year and two more floors after the seventh year, despite signing a lease for 9 years.

In effect, 1.24 lakh square feet out of the 2.46 lakh square feet leased out carries only a 3 year lock-in period until November 2027. Should the tenant discontinue the lease after this lock-in, the REIT can suffer a setback to its cash flows amounting to 50% of its cash flows and distribution until it finds a replacement tenant.

The tenant may not take this call except in the case of a significant business setback, given that it has been operating from this location since 2016, will receive significant cash from its sale and has negotiated favorable rent terms with back-ended escalations.

For the REIT, though location in a prime office area mitigates this risk to some extent, finding a big-name client willing to take up just 3 floors of a property with 6 floors can pose a challenge. Investors in this REIT should factor in this risk and the limited visibility in cash flows beyond November 2027, when comparing this vehicle to alternative debt investments.

#3 Fading ORR charm

Though ORR’s charms for MNCs or tech companies seeking office space has remained undiminished so far, there can be no two opinions on the fact that it is congested and subject to frequent traffic snarls, apart from being prone to flooding in monsoons. This results in disruptions to work and long commute times for employees at the ORR.

This could well prompt IT companies and MNCs to look elsewhere for office space in future.

PropShare is pinning its hopes on Bengaluru Metro’s Blue Line becoming operational by June 2026. However, given that prior phases of the Namma Metro project have been delayed by as many as 4-5 years due to hurdles on land acquisition, changing project specifications and delays in acquisition of train-sets, there is limited certainty about the project being completed by this deadline. Nor is it a given that an operational Metro line will succeed in easing out traffic woes, as this article shows.

#4 High ticket size

Finally, the high minimum ticket size of this REIT (which is an inevitable feature of SM REITs) at over Rs 10 lakh, forces investors to assume all the above risks – tenant concentration, vacancy risk, location turning unattractive - on a sizeable chunk of their portfolio. With the listed diversified REITs, investors can take much smaller exposures based on their comfort levels.

As this is the first SM REIT to make a debut in the markets, there is also lack of clarity about how secondary market trading volumes will pan out for this large ticket size. The REIT is to be listed on both NSE and BSE but the actual volumes need to be seen in practise.

Our take

On evaluating the pros and cons, we feel investors must approach this REIT as follows:

- If one is looking for safety and predictability of income, long-term bonds issued by AAA entities such as banks and bluechip companies score over SM REITs as they offer greater certainty on cash flows and visibility of income for 9-10 years.

- The concentration risk in SM REITs makes them suitable only for investors with large net worth. Given the risks inherent in such REITs, it would be best to restrict this exposure to 5% of your portfolio. For investors who have smaller portfolios, Invits such as India Grid Invit offer similar yield with lower risk.

- However, it is the tax treatment of income from this REIT, on top of the healthy distribution yield, which is its main attraction relative to other fixed income avenues. If you decide to invest, you need to view this REIT as a substitute for your property investments or real estate exposures, rather than as part of your debt allocation.

This is not a recommendation on the REIT. Any investment should be considered based on one’s risk profile, investment need and present portfolio makeup.

10 thoughts on “Prime Review: Propshare Platina REIT”

Thanks for the nice article. ICIC Pru Office Yield Optimizer AIF (which is currently open for subscription) is offering a slightly different scheme. The first tranche for the scheme needs to be paid by 31st Dec 2024. Since this is an AIF, the minimum ticket size is Rs. 1 Crore. They claim to have generated about 15% IRR (taxed at 12.5% rate from the current FY) from their two earlier editions of the same one of which has matured earlier this year, taking advantage of the 12.5% tax rate. The difference from REITs is that this scheme buys out the office space properties with funds from AIF investors money, a bank loan and the fund house’s own contribution (though a very small portion, as mandated by SEBI) and leases them to grade ‘A’ tenants. Instead of distributing the rental income through the leasing period, they use the rental income to repay the loan, accumulate the annual increase in rentals, benefit from the expected lower loan interest rates and the property value appreciation over the minimum 6-years lock-in period of the scheme. At the time of maturity (after 6 years), the scheme aims to generate about 15- 18% IRR which is subject to 12.5% tax. If one can lock-in such huge sum of money for a minimum of 6 years (the full Rs.1Cr will be collected over the 18 months period starting Dec 2024) from the current month and not expect any cash payouts during these 6 years, this seems to be a better choice. From the cost perspective, the fund management fees are kept a 1.25% per year plus a few other charges that may amount to another 0.5 to .75 percentage points. Their private placement memorandum is available for prospective investors to evaluate and is in public domain. I’m sure similar AIFs are available from other AMCs such as Motilal Oswal, HDFC and Axis AMCs. Would be great if PrimeInvestor can bring out similar recommendation such as the current article as and when such schemes are open and it will be a great value add for the PrimeInvestor subscribers.

Thank you for the detailed info. However, we do not cover AIFs at present. Apart from being primarily high networth products for higher risk profile, our challenge lies in information. they are a lot more opaque for us to compare and contrast without free availability of data for analysis. In terms of regualtory guidelines too, REITs (I don;t mean SME REITs) are on a better footing. Thanks, Vidya

Can you review BIRET?

Brookfield?

Thanks for providing insights on this new avenue of investment.

there is more clarity needed

1. If NRE money is investable in this REIT ?

2. If yes; then whether dividend income received via NRE PIS account is taxable ? if yes; then at what percentage ?

3. You have mentioned in the article : “dividends paid out by the REIT are exempted from tax in the hands of unitholders if the SPVs originally earning that income do not opt for the concessional tax regime under section 115BAA of the Income Tax Act.” –> But whether there is any clarity whether the REIT has opted for concessional tax regime under 115BAA ?

NRIs can invest in REITs. On taxability of dividends with NRIs, you need to seek clarity from a tax practitioner please. The offer document does not mention if the REIT will opt for concessional regime. But their distributions will be mainly in the form of interest and return of capital which is exempted

very nice article. I am looking at the price appreciation angle of the property. How is it determined ? Does the bond value change like in Embassy REIT ?

Thank you. The units will be traded on NSE and BSE and can go up and down like other listed REITs. Appreciation can happen depending on data from the ORR, Bangalore market. Once a year the assets will be valued by an independent valuer. That too could contribute to capital gains.

Thanks for the detailed review, based on your review does the current valuation of the asset at 12k/sq feet leave any room for appreciation in 3-4 years ? If it does could you share approx percentage appreciation one can expect.

Sorry cannot make such forecasts about prices. The location however is promising

Comments are closed.