- A debt fund for long-term portfolios

- Maintains a steady portfolio maturity, taking neither duration risk nor credit risk

- Beats debt funds across different categories including corporate bond and medium duration.

What if you want your debt fund to have two things – safety and predictable strategy? Most funds have either of these but not both. Funds that don’t take credit risk are still open to changes in portfolio maturities and one-off events. If you want an option where you take absolutely nil credit risk, not compromise much on returns, and not be subject to surprises in strategy, then pick this one.

SBI Magnum Constant Maturity is the fund that fits these features. This fund invests only in government securities, meaning you get zero credit risk. It maintains an average portfolio maturity of around 10 years, and this address the problem of funds taking different duration calls.

SBI Magnum Constant Maturity (SBI Constant Maturity) is a good fit for portfolios with a timeframe of at least 5 years and above. It will not suit shorter timeframes as volatility in the short-term is higher owing to bond price fluctuations.

In fact, the fund is in essence a proxy to holding a 10-year government bond. With retail participation in g-secs still difficult, the fund provides an opportunity to hold a low-risk, predictable strategy.

This is the reason SBI Constant Maturity features in our recommended list and in our long-term portfolios. The role of a debt fund in 5-7+ timeframes is simply to provide safety and a hedge to equity. The limited exposure to debt in such portfolios additionally removes the need to have multiple debt fund strategies. This may seem at odds with our debt outlook for this year where we are wary of taking long duration calls. Please note that our debt outlook is geared more for those who wish to capitalise on opportunities that present themselves this year and those who have a shorter-term holding period than 7-10 years.

Steady strategy

A constant maturity fund mixes gilts of different longer-term maturities such that the average portfolio maturity stays at 10 years. This strategy has two key benefits. The first and obvious is the absence of credit risk. By investing purely in gilt securities, these funds are less risky than even high-credit-quality debt funds. For instance, an event such as the IL&FS catastrophe can hurt such high-quality debt funds, but will still leave gilt funds unharmed.

The second benefit is that there are no risks of wrong duration calls. Gilt funds, unlike constant maturity funds, will change their portfolio maturities based on the stage of the interest rate cycle. That is, they may go for short-term gilts, or medium-term or even very long-term 20+ years of gilt papers. Dynamic bond funds similarly switch between duration and accrual based on the direction of the interest rate cycle.

This introduces uncertainty in how well they can capture market opportunities. A dynamic duration strategy needs to get its calls correctly in order to book profits made from bond price rallies. Missteps here can hurt returns. Since constant maturity funds stick to a specific duration, this risk significantly reduces. The strict maturity also ensures that the fund can book and realize the gains made on price appreciation. As an investor, therefore, you get both the accumulated coupon and the capital appreciation.

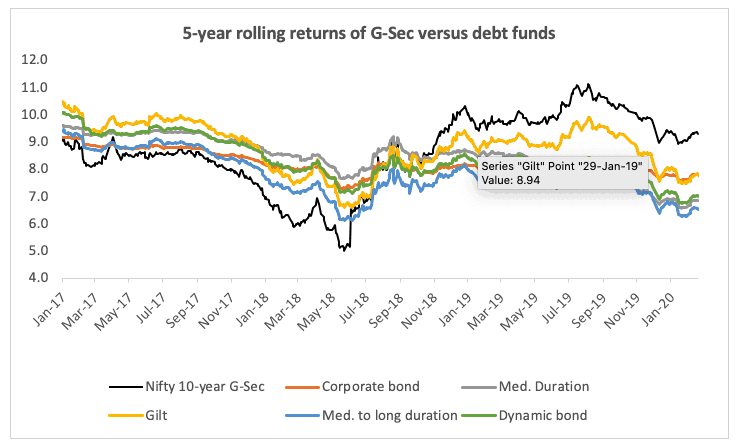

Constant maturity funds have the ability to beat other debt fund categories such as corporate bond, medium duration, medium to long duration, and other gilt funds especially over a period where interest rates are overall trending lower.

Consider the 5-year rolling return for period between 2011 to date, of the Nifty 10-year Benchmark G-Sec. While most debt funds from categories such as corporate bond, dynamic bond, short duration, and medium duration beat the benchmark return, just about half were able to do so more than 60% of the time. That is, the 10-year benchmark G-Sec index was able to beat funds with a good degree of consistency.

Constant maturity funds do not have too long a history. However, their 5-year returns in the past six-year period have beaten funds across debt categories. It is noteworthy that rate cycles have not only become shorter in the past 6 years but have also turned trickier to forecast and manage. This makes constant maturity a strategy devoid of the uncertainties of all other duration categories.

Fund and performance

At present, there are 4 constant maturity funds and SBI Constant Maturity is our recommendation. The fund was earlier a short-term gilt fund that became a constant maturity fund post new SEBI categorisation in 2018. However, the fund scores better than peers.

Its average 1-year return since 2018 stands at 9.9%, second only to IDFC G-Sec Constant Maturity Plan. It has not suffered a 1-year loss in this time, unlike the funds from DSP and ICICI. On volatility too, SBI Constant Maturity manages lower volatility than peers, a factor in its favour as IDFC Constant Maturity can clock very high and very low return. SBI Constant Maturity’s lower deviation also helps it deliver higher risk-adjusted returns.

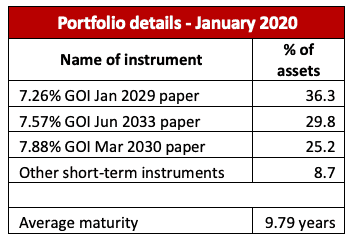

The fund additionally has a much larger asset size at Rs 508 crore; peers are all less than Rs 150 crore. It does not stick only to 10-year papers, but mixes different long-term maturities of 8-13 years such that the overall average maturity remains around 10 years.

Suitability

The fund should be used only for holding periods of 5 years and above. Shorter periods have high volatility where long-term gilt papers are concerned.

SBI Constant Maturity suits any investor. But it should be used only for holding periods of 5 years and above. Shorter periods have high volatility where long-term gilt papers are concerned. Prices of these papers react much more sharply than corporate bonds or shorter-maturity gilts to potential interest rate changes. This can cause low 1-year or 3-year returns; for example, 3-year 10-year g-sec index return has been as low as 3.8%. Holding for the long term irons out these fluctuations and you earn, at the minimum, the underlying gilt coupon.

46 thoughts on “Prime Recommendation: A debt fund with no credit risk and yet beats all others”

This fund is still relevant in falling interest rate scenario?

Hello sir,

The fund is specifically meant to avoid trying to take duration calls based on interest rate scenario. It’s mainly for very long-term portfolios (that’s why we’ve said 5-7 years minimum), for those who just want a simple debt allocation to balance equity, and with zero credit risk. So if you want a fund that is the best fit for say the next 2-3 years and this current rate climate, go for those we gave in our strategy last week.

Thanks,

Bhavana

Dear Bhavana,

Thanks for the article. Could you please clarify query below. Lets say I need money for a goal in 7 years time. I would like to invest in this fund as part of debt portfolio. I plan to invest every year certain amount in this fund. Can I redeem all the amount at the end of 7 years with out credit loss and interest rate loss ? Would you recommend this type of approach with this fund? Or Do you recommend each year investment to wait (before redeeming) at least 7 years to get better returns?

Best Regards

Subbarao

Hello sir,

No, you will not suffer credit risk as the fund invests in government bonds only. If you hold for seven years, minimum, you can redeem your investments even if some portion of it will have been held for shorter periods. The returns from the portion held for long can cushion effects of interest rate hikes at the time of your redemption. If you do not need the investment proceeds at one go, then yes, it is best to redeem in tranches as and when you require – and this holds true for any investment you make.

Thanks,

Bhavana

Hello Bhavana

Thanks for an exellent commentary. Would it be a good strategy to invest lumpsum in SBI constant maturity or take a SIP route. My horizon is 7Years minimum.

Hello sir,

Either would be fine. SIPs in debt funds have fewer benefits in terms of averaging than equity. Gilts may be volatile in uncertain times, so there may be a little opportunity in SIPs at this time.

Thanks,

Bhavana

What parameters you have used to analyse this Fund ?

Hello,

Our reasoning for the fund is explained fully in the article 🙂 We’ve gone by the returns of the 10-year g-sec index to analyse the strategy itself and other metrics such as volatility and risk-adjusted returns.

Thanks,

Bhavana

You mean to say that you are suggesting this fund on the basis of Past Performance ?

Hello sir,

Fund analysis needs to necessarily look at past performance in addition to potential. If past performance is entirely ignored, it is not possible to draw any conclusion about whether a fund is good or not. By past performance, I don’t mean just the return numbers – I mean the consistency in returns, trend in returns, how volatile returns are, whether returns have beaten market and peers, what strategy the fund adopts that has enabled it to generate the kind of performance it has. This helps determine whether the fund can perform going forward as well. Past performance is an indicator of whether a fund’s current returns are just a one-off or whether there’s something more to it. Over and above this, factors such as current market scenario and portfolio come into play.

So yes, we have analysed this fund based on past performance as ONE of the factors. As we’ve mentioned, the fund doesn’t have a history. We have seen the behaviour of the G-Sec index itself and other debt fund categories. We have explained why the simple predictability of the constant maturity removes a lot of the risk in duration strategy – this isn’t past performance, it’s a strategy call. It is also a strategy call to use just a plain gilt buy-and-hold fund for long-term equity-heavy portfolios, instead of juggling around multiple other debt funds.

Thanks,

Bhavana

Thanks for your suggestion. I am already invested in Franklin Ultra Short Term Bond Fund so thought of a Liquid fund with minimum credit risk. So should I invest in Franklin Savings Fund?

Thanks and regards.

Hello Meenakshi,

You can find our recommended funds across different categories in Prime Funds. Please read the “why this fund” section to see if the fund suits you. You can hold short-term funds for any number of years – my point only was that liquid funds are too low-risk for 5+ year holdings. Whether you should hold SBI Constant Maturity, another accrual low-risk fund and your liquid fund depends on how much allocation you want and the amount you are investing.

Thanks,

Bhavana

Dear Bhavna, interested in buying gold ETF. Which gold ETF has the lowest expense ratio?

Hello sir,

Expense ratios are important, but in ETFs, trading volumes are also important. Tracking error is another key metric. Since expense ratios are subject to change, using only that to base your decision may not always work out.

Thanks,

Bhavana

Please suggest a good liquid fund for the debt part of my investment (long term). Quantum liquid fund is invested only in Government securities. Should I go for this? I also plan in investing in SBI Constant Maturity Fund ( long term)

Thanks.

Hello Ma’m,

You can find our recommended funds (including liquid funds) here: https://www.primeinvestor.in/prime-funds/. But please keep in mind that liquid funds for long term portfolios aren’t really a good fit, because their returns are low. You can consider going for high-credit quality accrual-based short duration funds instead, if you wish to avoid volatility, in addition to SBI Constant Maturity.

Thanks,

Bhavana

Good article. This is the type of articles we expect from you since after ILFS and Vodofone fiasco, debt market also unpredictable.

Sankar N

Thanks, sir!

Regards,

Bhavana

Hello Bhavana,

Thanks for a well written article. I would like to know how different is it from investing in NSC or Kisan Vikas Patra.

I could have one of them as debt assest in my portfolio as the time duration is nearly the same. How shall this fit then?

Regards,

Santosh

Hi Santosh,

NSC and KVP have defined maturity periods and fixed interest. If your goal exactly matches the maturity, then its fine, else you will have to reinvest the proceeds. The fund can be held any length of time – the fund maintains a duration of 10 years; you don’t need to hold it exactly 10 years – you hold for minimum 7 years and any number of years beyond this. With the fund, you also get the opportunity of capital appreciation based on rate cycle changes which can up the returns. In both NSC and KVP, your interest will be fixed. Interest income on these is also taxed at your slab rate. For the fund, you will have to pay capital gains tax at 20% with indexation benefit on holding more than 3 years. If you don’t need the security of fixed interest rates, the fund is the better option.

Thanks,

Bhavana

Is this a good fund to put in my three bucket strategy towards glide path to retirement in 6years time and then do SWP to liquid fund for yearly draw-down? If yes how to fund this till retirement and after?

Hello sir,

Not sure about what your questions are exactly, but will try to address: You need to invest and hold this fund for at least 7 years before you will be able to realise optimal returns. That means, you will be able to do an SWP from this fund only after such a period. If you are 6 years away from retirement and you want to use this fund for building up corpus, you can go ahead. However, start withdrawing only from 7-8 year onward. Use other funds for the years in between. Once you have held it for 7+ years, you can directly do the SWP from this – there is no need to shift to liquid and then SWP from there.

Thanks,

Bhavana

Comments are closed.