Muthoot Fincorp, a non-deposit taking NBFC, registered with RBI, has come up with a public offering of secured non-convertible debentures (NCDs) for an amount aggregating to Rs.200 crore with an option to retain oversubscription up to Rs.200 crore, aggregating to Rs.400 crore.

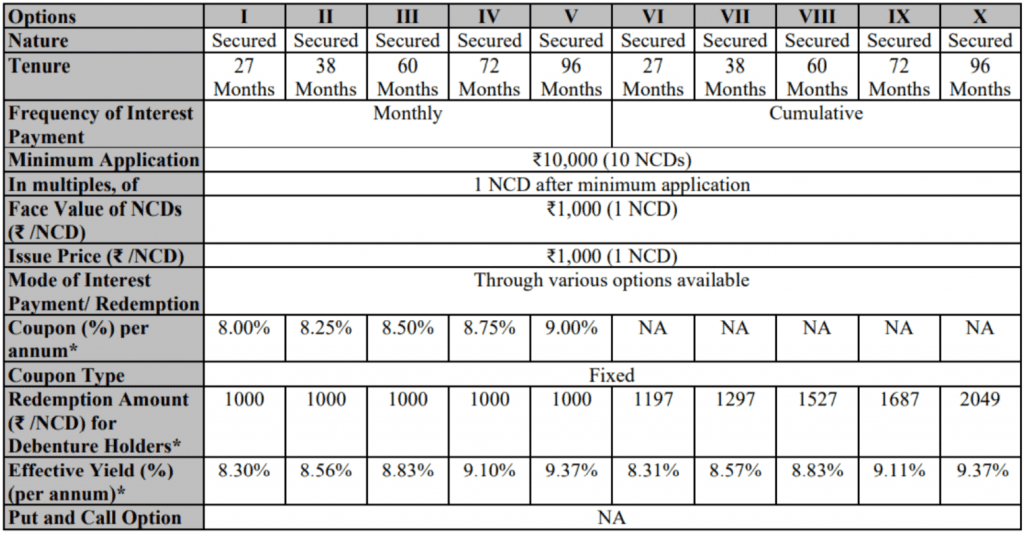

The minimum subscription should be for 10 NCDs and multiples of 1 NCD, which means a minimum investment of Rs.10,000 and in multiples of Rs.1,000 thereafter. The NCDs are proposed to be listed on the BSE and the tradable lot is 1 NCD. The issue opens on January 5 and closes on January 28, 2022.

Rates and terms

Investors have ten options to choose from in this bond offer. There are five tenures – 2 years, 3 years, 5 years, 6 years and 8 years and a monthly and cumulative interest pay-out option under all five tenures. The accompanying table provides details of coupon rates on the regular options and effective yield on the cumulative options.

Business

Muthoot Fincorp (called in the industry as Muthoot Blue) is part of the “Muthoot Pappachan Group” which has diversified business interests ranging from hospitality, financial services, inflight catering, infrastructure for information technology, automobile sales and services and real estate. Muthoot Fincorp is one of the three largest NBFCs engaged primarily in the gold loans business in India. It operates a network of 3658 branches across 24 states, although South India accounts for ~62% of the loan portfolio. At standalone level, gold loans accounted for ~95% of the loan portfolio while SME loans accounted for the rest at the end of September 2021.

The company has two other lending subsidiaries – Muthoot Microfin (63.61%) and Muthoot Housing Finance (80.66%) engaged in the business of micro-credit and affordable housing loans, respectively. Below is a detailed break-up of AUM of Muthoot Fincorp and its subsidiaries as on September 30, 2021.

While gold loan business has traditionally been a strong hold for the company, it has of late diversified into SME loans, micro finance and affordable housing finance. The gross NPAs at the standalone level stood at 2.87% as on September 30, 2021, against 1.92% as on March 31, 2021. The NPAs are primarily in the SME portfolio wherein the performance was affected due to slowdown in the sector. However, the company has been consciously reducing the SME portfolio, which stood at just 4% of assets at the end of September 2021. In the gold loan segment, the company has maintained healthy asset quality over the years with loan yields of 20-22%.

The group’s micro finance business, housed under subsidiary company Muthoot Microfin, has been an area of concern with deterioration in asset quality, similar to many other micro finance companies post pandemic. Gross NPAs stood at 9% at the end of September 2021 while it was at 8% at the end of March 2021. This is in-line with the stress reported by other Microfinance companies.

At the end of September 2021, Tier 1 CAR for Muthoot Fincorp, on a standalone basis, was 14.28% (12.09% at the end of March 2021) - comfortably above the prescribed Tier 1 capital of 12%. On a consolidated basis, Tier 1 CAR at the end of September 2021 is 12.09%. This is significantly lower compared to the top two listed gold loan companies.

Credit rating

CRISIL Ratings has assigned a ‘CRISIL A+/Stable’ rating to this Rs 400 crore NCD. It is noteworthy that this is an upgrade from the A- rating afforded in 2020 to Muthoot Fincorp.

For arriving at the ratings, CRISIL Ratings has combined the business and financial risk profiles of Muthoot Fincorp (issuer of NCD), Muthoot Microfin (Subsidiary), Muthoot Housing Finance (Subsidiary) and Muthoot Capital Services Ltd (Group Company, listed). This is because all the companies, collectively referred to as the MPG (Muthoot Pappachan Group), have significant financial, managerial and operational linkages according to CRISIL. Furthermore, Muthoot Fincorp has exposure to real estate assets which stood at Rs 540 crore (2.4% of total assets as of September 30, 2021).

Among other major factors considered for rating, CRISIL has highlighted the moderate capitalisation levels of the company and group. Muthoot Fincorp’s net worth, at standalone level, stood at Rs 3,442 crore as on September 30, 2021 as against Rs 3,201 crore as on March 31, 2021. Additionally, gearing stood at 5.5 times as on September 30, 2021 (5.9 times as on March 31, 2021). On a consolidated level, net-worth stood at Rs 3,595 crore as on March 31, 2021, against Rs 3,160 crore as on March 31, 2020. Adjusted gearing of the group stood at 7.2 times as on March 31, 2021, as compared with 7.6% as on March 31, 2020.

However, the rating agency also notes that capitalisation is supported by low asset-side risks (security of gold jewellery, which is liquid and in the lender’s possession).

Our take

Muthoot Fincorp is the third largest gold financing company according to Crisil’s report. Its gold loan business has a healthy asset quality and high liquidity (gold jewellery as a security being liquid) thus mitigating the risks that can typically be associated with instruments with a A+ rating. Hence, as a gold loan NBFC, its yield with a rating of A+ may be more comparable with yields of AA or AA- rated instruments in terms of average spread.

The 8% coupon rate offered by the Muthoot Fincorp NCDs for a tenure of 27 months appears attractive relative to yields prevailing in the market. Currently, 3-year A+ rated bonds have spreads of 4.34 percent while the AA- instruments have spreads of 3.42 per cent. The rates on Muthoot Fincorp’s 27-month NCDs (annual option) translate into spreads of 3.02 per cent. This spread is attractive, considering the retail options available in the bond market today.

While we would have looked at the 38-month NCD, we feel given the likelihood of an yield hike scenario, locking into longer duration can be avoided as the same issuer may well come up with better yields later. Consider the cumulative option for 27 months. Exposure should be limited to 5-10% of your debt investments. A buy and hold works best in the current rate scenario. Trading can result in losses due to rate hike or poor turnover.

Please note that this NCD is only for those with high-risk appetite. The risk stems from moderate levels of capitalisation at a group level (consolidated Tier 1 CAR of 12.09%) and the risk in the subsidiary business of microfinance post Covid. Also, if you are new to NCDs, please read about them here.

Investments can be considered after exhausting government-guaranteed options.

The NCDs being offered are proposed to be fully secured by way of subservient charge with existing secured creditors on all loan receivables (both present and future) of the company. The bonds do not carry any Put or Call options. They will however be listed on the exchange where investors can exit before maturity. However, such exit is subject to adequate trading volumes and the market price can vary from face value.

Taxation

Interest income on NCDs is taxable at your slab rate whether on pay out or under the cumulative option (if you hold till maturity). If you sell the bond in the exchanges in less than a year, short-term capital gains, at your tax slab, will be applicable. If you sell after a year of holding, then long-term capital gains tax of 10% without indexation will apply.

10 thoughts on “Prime NCD review – Should you invest in Muthoot Fincorp NCD?”

Hi Team,

Hope you all had a Happy Pongal. Read in one of your articles that ‘COVID Anna’ has visited quite a few of you. Hope you all are doing well and wish a fast recovery.

Just wanted a clarification. The article on Muthoot NCD recommends 27 months tenure with annual interest payment option. But in the table in the article, there are only Monthly and Cumulative options of interest payment.

In the ASBA of my bank also only the monthly option is getting displayed.

Can you please clarify?

Thanks.

Sorry sir, we got that wrong

You are right. There are only monthly pay-out and cumulative pay-out options

Based on your income requirement you can choose monthly pay-out, otherwise cumulative option.

Thank you

Thanks for the prompt revert 🙂

I think NCDs are debt instruments that when sold in the market are taxed at different rates compared to equity.

I think long term will be greater than 36 months. Short term rate would be slab rate and long term would be 20% with indexation or 10% without indexation.

No, short-term in a listed bond is less than 12 months, and long term is more than 12 months. As explained in the article, short-term gains are taxed at slab rates (equity is taxed at 15%) and long-term gains are 10% without indexation. The Rs 100,000 exemption limit that equity has does not apply here. – thanks, Bhavana

Thanks for the useful article. What is your view on NCD issue from Dhani Loans and Services Ltd? It has a AA/Stable rating from Infomerics. Coupon rate is 10.5% annual for 24 months.

We don’t recommend it. thanks, Vidya

Dear Sir,

Article is very clear.

Investments can be considered after exhausting government-guaranteed options. What it is. Can you please elaborate this point

Welcome your query sir.

The message is to NOT allocate the money intended to invest in risk-free instruments like Govt bonds into this NCD.

Only allocate from corpus set aside for investments in instruments that carry higher amount of risk into this.

Thank you

thanks for your input.

Comments are closed.