In April 2023, we added a new category in our Prime Funds (our list of recommended active and passive mutual funds) – called Equity – high-risk turnarounds. This report gives the rationale for introducing this category, what funds belong to this category and how they can be utilized.

Equity – high-risk turnaround category

As you will be aware, Prime Funds (except strategic/thematic) under the active fund categories, predominantly holds funds that are tested across market cycles. We prefer consistency and usually prefer to wait for funds to prove the same, even if they exhibited high performance, before adding them to this list. Similarly, we wait halfway before calling a turnaround in performance. However, some time ago, we introduced a category called ‘tactical’ within the Equity – aggressive set, to provide options for those who wish to take risks with funds showing early signs of outperformance/turnaround in performance.

We’ve now streamlined our approach to this by creating a new category under Prime Funds: Equity – High-risk Turnarounds. This allows us to be more proactive in identifying funds showing early signs of improvement.

Our goal is to capture the high returns that can occur during a turnaround, without waiting for long-term confirmation of sustained performance. Traditionally, we’ve been more cautious. However, with average outperformance margins for stable funds shrinking, strategic short-term calls like these can enhance your portfolio’s overall returns.

Prime Funds will allow for quicker exits if the performance of funds in this category falters. It’s important to remember that these funds therefore carry higher risk. Their improvement may not be permanent, and they haven’t yet established a consistent track record.

Now, let’s move to the funds that are currently nested under this category.

The high-risk funds

The three funds presently in this category are Quant Active, Bandhan Core Equity and JM Value.

#1 Quant Active

This fund was already present under our Equity -aggressive category since April 2022 and then moved to the tactical category. This multi-cap fund, like many other Quant funds, follows a momentum approach to stocks. This fund was head and shoulders above peers due to this strategy. However, as a result of the volatility in the market in 2023 peers from Nippon India, Franklin India, ITI, Mahindra Manulife and ICICI Pru caught up in performance. As of March 2024, this fund held 26% and 25% respectively in mid and small cap stocks making its portfolio a high-risk one. It also has the highest portfolio turnover among the 3 funds.

Despite a roaring track record, this fund is presently underperforming the other 2 funds in this set, although still outperforming its benchmark comfortably. It is hard to attribute a reason to this considering its high churn strategy. It also has a marginally lower exposure to mid and small-cap stocks presently, compared with the other 2 funds. The fund has high weights to metals and mining and oil and gas sectors, more likely as tactical calls than fundamental. For example, the stock of Hindustan Copper rallied 239% in the past 1 year.

#2 Bandhan Core Equity

This fund was added in our April 2024 review, when we introduced this new category. Bandhan Core Equity is a large and midcap fund – which means it needs to mandatorily invest at least 35% each in large cap and midcap stocks. As of March 2024, it held 39% in large-cap stocks while 56% was in mid and small-cap stocks. The fund uses a combination strategy of predominantly high-quality growth stocks, with some exposure to cyclical themes as well as value (turnaround or corporate action).

Among sectors, the quality part appears to be made up of private financials, consumer discretionary, including consumer auto and internet technology at present. The fund is underweight traditional IT. On themes, capital goods and power equipment are present while on value, select oil and gas, PSU banks and holding companies were seen as of March 2024.

Given that this fund has a higher proportion of (mandatory) large cap, over rolling 1-year periods (data for 3 years) it is less volatile and also contains downsides better than the other 2 funds mentioned.

After periods of poor performance, the fund turned around in late 2022, beating its benchmark steadily since. The margin of outperformance over its benchmark has also since moved up steadily. Seasoned fund manager Manish Gunwani took over the helm in this fund in early 2023, offering comfort on possible continued performance.

#3 JM Value

This fund is nested under SEBI’s Equity – value category. While it can be market-cap agnostic, it has predominantly been small-cap focused. The fund held 44% of its portfolio in small-cap stocks as of March 2024, significantly higher than the 19% and 25% holding by Bandhan and Quant funds mentioned above.

JM Value seeks to profit from potential re-rating and profit growth by finding opportunities in companies that are mispriced temporarily due to transitory issues. It uses a top-down approach to select sectors with growth prospects and then uses a bottom-up approach to choose stocks within the sector.

On a rolling 1-year basis, the fund has beaten its benchmark S&P BSE 500 TRI 75% of the times. The average rolling 1-year return (for a 3-year period) was 32% as opposed to 24% for the index. After a period of underperformance in 2022, the fund picked up in 2023 (fund manager Satish Ramanathan joined in late 2021). Considering its small-cap bias, its weight to financial services is much lower than the other 2 funds we have mentioned above. The fund exhibited higher volatility (standard deviation) than the other 2 funds over rolling 3-year periods. In terms of market-cap the fund has a far higher risk profile than the other two.

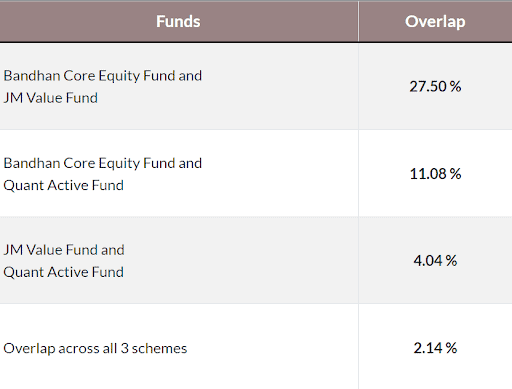

The overlap in the above 3 funds can be sourced here: PrimeInvestor MF overlap tool.

Suitability

- You should only use these funds in smaller amounts and not as a main part of your portfolio.

- These are also more suitable for those who want to be more active with their portfolio and not for those who buy and hold for the long term.

- If you are new to mutual fund investing or do not regularly track your portfolio, you should skip these funds.

- Also, periodic profit booking is necessary if the weight of the fund in your portfolio moves up significantly from your original allocation. Although the 3 funds have low overlap, it is best not to take exposure to all 3 and stick to 1-2 funds. At this point, SIP route or buying in phases is best preferred.

- We may choose to give an exit call on these funds in short periods too. However, profit booking is a call that you would need to take based on the returns for your investment period.

3 thoughts on “Prime Funds: 3 high-risk funds recently added”

Thanks Vidya for the nice recommendations.

With regard to Quant Active Fund, which mainly plays on momentum, isn’t it better to invest in the alternative from same fund house – Quant Momentum Fund, which is a pure momentum play?

All other schemes of Quant MF AMC play on momentum as a main factor. Why shouldn’t one just invest in Quant Momentum fund?

We look for stocks with some fundamentals in a portfolio. Most of Quant’s funds have that with the timing being momentum. But the momentum fund is simply based on purely ‘momentum’ and not by fundamentals. Hence the quality of stocks may not always fit our expectation. We would not be comfortable with such an approach in an MF that too in an active fund. thanks, Vidya

Useful Article Vidya ! Thanks

Comments are closed.