Indians love bargains. This is perhaps why whenever we review Indigrid InvIT, investors get back to us asking about Powergrid InvIT. Optically, Powergrid InvIT which trades at Rs 91 looks cheaper compared to Indigrid InvIT which trades at Rs 159.

The market values InvITs based on their distribution yield. A simple comparison shows that PowerGrid (PG) InvIT which distributes Rs 12 per unit annually, trades at a yield of 13.1% while Indigrid which pays Rs 16 a year, trades at a yield of 10%.

But in our view, it is Indigrid InvIT which is the more attractive bet. This is because Indigrid InvIT is head and shoulders above the public sector PG InvIT in efficiently managing its portfolio of assets to deliver rising payouts to investors.

PG InvIT has seen its assets stagnate since listing and can see moderating payouts if it fails to act on asset acquisitions. Here’s our analysis of PG InvIT.

Portfolio

PGInvIT is sponsored by Power Grid Corporation, India’s leading PSU building and operating power transmission infrastructure.

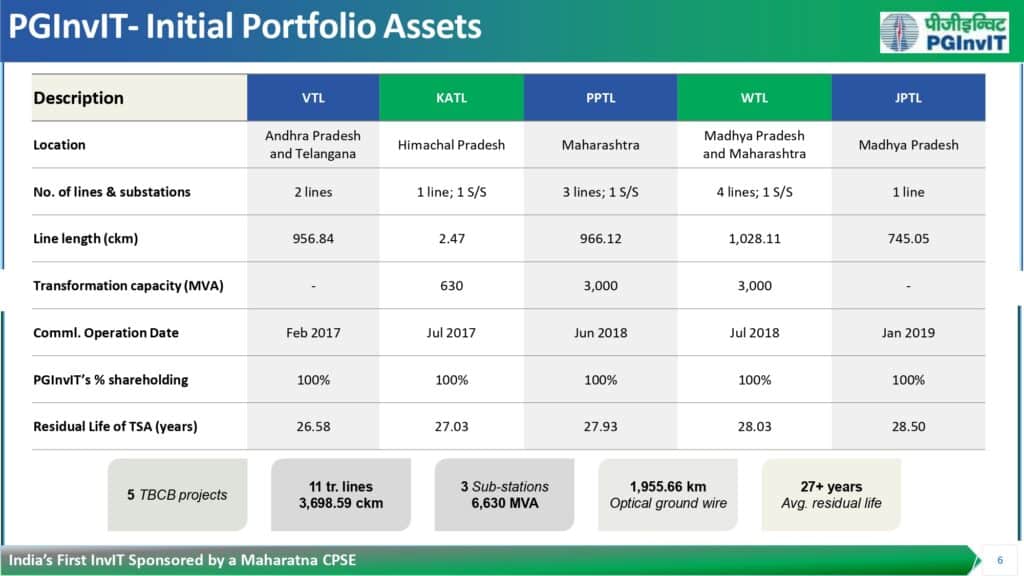

PGInvIT’s units were issued at Rs 100 at the time of IPO in May 2021. Just prior to the IPO, as part of PowerGrid’s asset monetization plan, PG InvIT acquired a 74% equity stake in five TBCB (Tariff Based Competitive Bidding) transmission projects from its sponsor. It has acquired the residual 26% stake in FY25 and now holds 5 special purpose vehicles (SPVs) with 100% equity ownership in transmission assets across five key locations. The remaining life of the transmission service agreements (TSAs) for these assets is an average 27 years. The following table captures the asset portfolio as of June 2025.

Source: Investor presentation

Besides this, PG InvIT is constructing a 400 kV Line bay at 765/400 kV Parli along with new substations, at a project cost of Rs 25 crore. This will add to its portfolio of assets when complete.

Positives: Stable assets and cash flows

The above asset portfolio and having PowerGrid as sponsor, endows PG InvIT with some definite advantages.

- The InvIT stands to earn predictable tariff income from its transmission assets for the residual life of the TSAs currently averaging 27 years. Transmission focused InvITs have more visible and stable cash flows than InvITs focused on toll-road or other assets.

- PG InvIT’s tariff income is earned based on the availability of transmission assets not their actual usage. Therefore, as long PG InvIT maintains availability above 98%, it stands to earn guaranteed tariffs as per the TSA. In the four years since listing, PG InvIT has consistently maintained availability of over 98%. Given that the transmission assets are managed by PowerGrid Corporation, the risk of glitches on availability or interrupted income, is low.

- The steady portfolio of assets with stable cash flows have allowed PG InvIT to keep up distributions of Rs 3 per unit on a quarterly basis and Rs 12 on an annual basis, since listing.

- While transmission InvITs run the risk of delays in payment by counter-parties (State utilities), for PG InvIT this risk is mitigated by the fact that its tariffs are collected by PowerGrid through a central pooling mechanism. This reduces counter-party losses and delayed payments.

- The backing of a PSU gives PG InvIT the ability to borrow on favourable terms to expand its assets. For instance, in FY25, it spent Rs 506.6 crore to acquire the remaining 26% stake in four transmission assets mainly financed through floating rate loans. PG InvIT’s overall debt of Rs 1070 crore is pegged entirely to floating interest rates, based on the 3- month T-bill yield or repo rate. PG InvIT thus stands to gain from falling interest rates.

- As PG InvIT has not made any material acquisitions post listing except for the residual 26% stake in its original assets, it has suffered no equity dilution and has very low leverage. Its net borrowing ratio was just 5.2% in end-June 2025 against the SEBI-allowed limit of 70% for InvITs. Therefore, should it identify promising acquisition candidates, it has a lot of leeway to raise debt to fund such buyouts.

Negatives: Stagnant portfolio, moderating income

A key worry for investors in PG InvIT though, is whether current distributions of Rs 12 a year can be sustained.

Starting out with transmission assets acquired from its sponsor Sterlite Power in 2017, Indigrid InvIT went on to aggressively participate in market auctions of transmission assets, tied up with foreign investors to invest in greenfield transmission projects and forayed into solar energy and Battery Energy Storage Systems, to steadily hike its payouts. These forays have resulted in Indigrid InvIT’s portfolio expanding 6-fold in 8 years. Its distributions have risen from Rs 11 per unit to Rs 16 per unit currently.

No portfolio growth

PG InvIT on the other hand, has not seen even a single asset acquisition after listing. Its portfolio expansion plans have remained at a standstill on two counts.

# 1 Its PSU sponsor PowerGrid, which initially announced plans to monetize its transmission assets by selling them to PG InvIT has since put these plans on hold. In its conference calls in the past couple of years, PowerGrid has stated that it prefers to securitize its assets to raise capital rather than transfer them to the InvIT for monetization. This has deprived PG InvIT of its main avenue for asset acquisition – its sponsor.

# 2 While PG InvIT can bid in open market auctions to acquire new transmission assets, it has made no headway on this so far. Though its investor presentations have repeatedly talked of the Rs 9 lakh crore pipeline of transmission projects set to be built under the NEP, it has bemoaned “limited acquisition opportunities”. It has obtained in-principle approval from its Board for consortium with PowerGrid and other bidders, to participate in 2 tariff-based projects worth Rs 500 crore.

But there seems to be no action on the ground. The management when questioned in concalls about asset acquisition plans has not provided any concrete guidance. The Rs 25 crore transmission project under construction does not have the potential to add materially to cash flows.

Shrinking retention

With expenses inching up every year even as its income has fluctuated, PG InvIT has not found it easy to keep up its Rs 12 per unit annual distribution recently. As the table below shows, the InvIT’s Net Distributable Cash Flows (NDCF) has been barely enough to sustain its annual payout after expenses. While the total income earned has seen mild moderation in the last four years, expenses have at times spiked due to lumpy impairment charges. Regular expenses are also inching up due to rising operational costs and escalation in management fees.

This has forced the InvIT to dip into its reserves to sustain its distribution for FY25. The situation has improved in Q1 FY26, but PG InvIT is clearly unable to add to its reserves. The negative reserves position makes for no buffer against any future fall in income.

Dip in tariff income

Even as PG InvIT has struggled to keep up its Rs 12 per unit distribution with its current income and expenses, it faces a sharp decline in its income from FY28 onwards. As per its TSAs, PG InvIT’s revenues from key assets at Parli, Warora and Jabalpur are due for a lower reset in FY28, resulting in a significant Rs 250-odd crore drop in cash flows from that year.

Therefore, unless it acts fast to acquire assets within the next three years, its annual distribution of Rs 12 per unit could be trimmed from FY28. Meanwhile, the InvIT’s Net asset Value (NAV) has remained well below par in recent times. The table below details the movement in equity, reserves, debt and NAV. The low NAV is perhaps the key reason why market prices for PG InvIT have seldom traded above the issue price of Rs 100 in recent years.

Investors looking to buy into the InvIT today should therefore recognize that this is a riskier bet than Indigrid. Yes, distributions may be kept up at Rs 12 per unit for another two years, based on the current portfolio. But the payout could suffer a cut thereafter, if asset acquisition fails to take off. The market price of PG InvIT meanwhile will continue to fluctuate based on its NAV and distributions. As FY28 approaches, the InvIT could also see selling pressure as investors exit it to shield from the falling distributions.

Yes, if the InvIT manages to get its act together on acquiring assets, then investors could see capital gains plus stable income. But this is a long shot. Investors looking to take this bet should avoid buying units at a premium to the NAV of Rs 94 and look to enter at a discount. Our call on Indigrid InvIT remains.

8 thoughts on “PGinvIT – a worthy investment option? ”

Nice article !

Do we have an article on Invit v/s REIT , to my knowledge Invit’s hold depreciating assets and Reit’s hold appreciating assets so in the long run Reit’s should be preferred to Invit’s . Your View’s Vidya

That is a very accounting view Shafakat. Two things: one income that an asset generates. Two the addl. assets that are added to the pool. In this Invits, certainly generate better yield in the Indian context than yield from real estate commercial buildings. Their offtake (road or pwoer) is more certain than commercial building offtake (where suddenly rent can fall in a downturn) and their asset addition – if run well – can be very healthy. REITs have to assessed based on tenure of occupency that has been leased, their location and the rentals and not merely the number of buildings.So as a business, Invit is far from being called an asset that falls in value. Vidya

Agree as regards current yield but looking at totality of returns including potential appreciation in NAV of Commercial real estate the chances of which might be negligible in case of Invit’s . Also the rents and property will get inflation adjusted which will not be the case for Invit assets . My point is REIT will be appreciating in value and Invit’s will not

Good call ..Indigrid is definitely better

Hi Vidya, Good analysis. I know rate offered to PGInvit will drop but not sure its around 250 Cr. There is no Inflation related annual increase in the charges paid to PG Invit which I thought its kind of given during initial stock analysis and purchases.

Every time I look at the price and kind of guaranteed return of around 10-12 Rs for next 30 years script (12 to 13%) makes it interesting.

Lets assume, at the end of 30 years trust value becomes 0.

So every year my capital is getting reduced nearly 3.3%. That means every year I will be getting 9 to 10% return irrespective of interest rate cycle for next 30 Years. There is no technology risk.

Is it not a good option.

I know in our Market – Script prices increases if either FII or MF accumulates. May be Power Grid stand of not giving future assets along with increase in Interest rate made the PG Invit drop from 140 odd level to current level or even less.

PG Invit mgmt is not acting much which means they are not adding much debt to the PG Invit.

Can you please confirm whether Indigrid managers are a private equity player and whatever asset they buy is as good as Power grid own assets.

The latest unitholding pattern is here: Yes it is held by various institutions and portfolio investors. https://www.indigrid.co.in/wp-content/uploads/2025/07/3.-uhp.pdf I don’t think I have the technical knowledge to say whether Indigrid has ‘superior assets’ but has larger assets and higher and superior revenue streams. You can go through the ppts: https://www.indigrid.co.in/wp-content/uploads/2025/07/Presentation.pdf https://www.pginvit.in/uploads/e8842810-c24f-496b-8ca3-72288f21c78b/Investor_Ppt_Q1FY26.pdf Also, when you talk of steady returns og 9-10 percent (assuming the price never moves), you need to take cognisance of the opportunity loss from the capital appreciation that has steadily happened in Indigrid apart from the payouts. Of course, the call clearly mentions, who it is suitable for. Thanks, Vidya

Thanks for your reply. At the end of 30 years, Indigrid also will become zero value if they do not do anything and simply payout the amount every year like PGInvit. Based on similar logic, return will be 7% ie losing 3% loss of capital every year. I see Indigrid management is active, they take both Equity and Debt route to get assets and that resulted in increase in revenue, NAV and that raises stock price too. Your advice to buy stock in discount compared to NAV is the right approach.