In the race to achieve 500 GW of renewable energy by 2030, India needs more than ambition – it needs action. Enter NTPC Green Energy’s landmark Rs 10,000 crore IPO. Backed by energy giant NTPC, will this listing be a bold declaration of the country’s commitment to powering a sustainable future? Let’s review the prospects of this company and its IPO.

The company and offer

NTPC Green Energy Ltd (NGEL), a fully owned subsidiary of thermal power player NTPC, is India’s leading renewable energy public sector enterprise (not including hydropower) based on operational capacity and power generation. The company manages a diverse renewable portfolio of solar and wind power assets strategically located across 6 states.

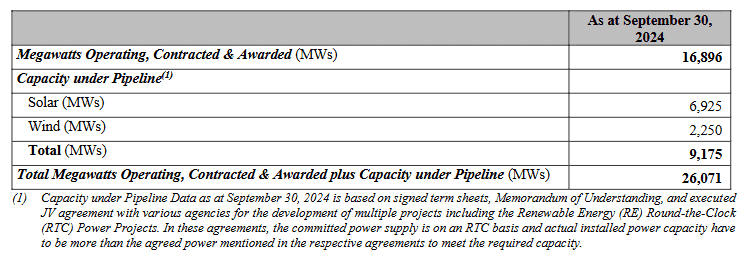

As of September 2024, NGEL’s portfolio consists of:

- Operating projects: 3320 MW, (of which 3220 MW is solar, and 100 MW is wind)

- Contracted & awarded projects: 13,576 MW

- Total projects operating, contracted and awarded: 16,896 MW (equal to 16GW)

The Power Purchase Agreements for the above have an average duration of 25 years.

The company is raising Rs 10,000 of fresh equity through the present offer. Rs 7,500 crore of the proceeds is planned to be invested in its wholly owned Subsidiary, NTPC Renewable Energy Limited (NREL) for repayment/ prepayment of borrowings. The remaining will be used for general corporate purposes.

The details of the offer are given below. It is noteworthy that the parent company NTPC has sufficient skin in the game with Rs 75,000 crore of capital infused thus far. As PSUs have restrictions on capital infusion to subsidiaries (with some exceptions), this IPO is necessary for the company to fund its growth. As can be seen from the table below, a majority is to be raised from QIBs. In short, this is not an offer where the parent or external investor are offloading their stakes.

The company's financial highlights are as follows:

- Revenue grew at a 47% CAGR from Rs 910 crore in FY22 to Rs. 1963 crore in FY24.

- EBITDA margin stood at 89% in FY24. EBITDA expanded at 48% CAGR between FY22-24 to Rs 1747 crore.

- PAT stood at Rs. 345 crore for FY24 compared to Rs. 95 crore for FY22 – an annualised growth of 90.5%

- Return on Equity (RoE) for FY22/23/24 was at 5.8%, 13.4%, 6.2% respectively

It is noteworthy that the company’s financials as a new entity are captured only from FY24. The earlier years’ numbers are carved out from the parent. Also, given that the company is at a nascent stage, the high pace of growth should not be taken as an indicator for sustained future growth.

Industry and business positives

#1 India’s renewable energy growth – more than just promises

The debate on fossil-fuel dependence versus adoption of clean energy may continue to be a hot-button topic in the international arena. But India has been quietly acting on the clean energy front, recognizing it as an essential component of its development strategy, beyond meeting global climate change commitments. Increased urbanisation and industrialization have necessitated the supply of clean energy in a highly populous country like India.

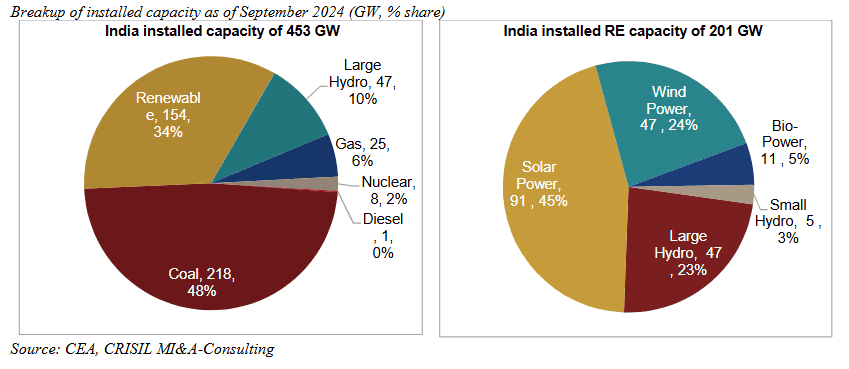

Installed capacity: Traditional thermal power, led by coal and lignite-based plants, remains India's primary energy source at 48% of total capacity as of September 2024. However, Renewable energy has emerged as a powerful contender, with total capacity including large hydro, reaching 201 GW - a 45% share of total installations. This marks a significant jump from 114 GW in March 2018. Solar power stands out as the star performer, with capacity quadrupling from 22 GW to 91 GW in the same period, showcasing India's swift transition toward sustainable energy sources.

According to the RHP’s ‘Industry Overview’ section, projected power capacity additions (FY25-29) in the country will stack up as follows:

- Conventional Power: 32-35 GW

- Nuclear: 5-6 GW (from Kakrapara, Kalpakkam, and Rajasthan projects)

- Hydro: 15-16 GW (including 7-8 GW pumped storage)

- Renewable Energy: 180-190 GW

By FY29, the non-hydro renewable energy share of total installed capacity is expected to reach 50% (from 34% now). This ambitious expansion, particularly in renewables, is backed by government initiatives, competitive tariffs, and supportive infrastructure development.

NGEL, with a strong backing from its parent and a formidable bid-win ratio of 46% (average) in the past 3 years ending FY24 is well placed to capitalise on this transition. While it has serious contenders in private players like Adani Green Energy and international players like RePower, the pie is large enough for more than one big player. NGEL’s edge, outside of competitive bidding would be its clear focus on solar power besides making strides in storage solutions and green hydrogen.

#2 Focus on solar energy – an edge

We like NGEL’s clear focus on solar energy with a 90:10 mix of solar energy and wind energy capacity operating and planned. Among the listed players, Adani Green Energy has about 67% of its portfolio in solar with the rest in hybrid and wind, while Suzlon Energy is a wind-focused player. KPI Green Energy, a much smaller player also has a mix of solar and hybrid. It is worth noting that hybrid wind and solar projects (called WSH) at present require the plants to be co-located in order to inject power into the same pooling station.

It is not an easy task to find such locations. Besides, the average tariff for WSH projects is Rs 3.15-3.20 per kWh today (closer to wind power tariffs) — higher than solar tariff, which has dropped to Rs 2.55-2.56 per kWh in recent bids – making solar the more competitive and sought after source by buyers (offtakers).

Besides, global solar module prices have seen a dramatic decline, dropping 73% from $1.78/watt-peak in 2010 to $0.47/watt-peak in 2016, and further falling to $0.22/watt-peak by August 2019. This decline, representing an 85% reduction from 2015 to 2024, stems from technological advances, economies of scale, and global manufacturing overcapacity. In India, price drops may be lesser than global arena partly due to the ALMM rules (Approved list of models and manufacturers- which are presently only domestic OEMs).

Geographic and environmental adaptability gives solar energy another edge. Solar panels can function effectively in most climates and locations in India without specific terrain requirements. They have minimal environmental impact with no noise pollution, negligible wildlife disruption, and easier decommissioning processes. This makes them particularly suitable for distributed generation systems and allow them to operate in areas where wind energy might face restrictions.

#3 Clear ramp up plans

NGEL’s ramp up plan is clearly detailed. The image below from the RHP suggests a total portfolio of 26GW.

Of the above operating and planned capacity, the management (in a media interview) has clearly indicated a ramp up of 3GW, 5 GW and 8 GW over FY-25, FY-26 and FY-27. This provides visibility for a total capacity of 19GW by FY-27. If these capacities are indeed installed on time and offtake happens as per schedule, then a rough calculation suggest a 75% growth in revenue and over 100% growth in profits between FY24 and FY27.

The off-takers (Central and state utilities, PSU customers and corporates) too are lined up with contracts mostly on fixed price and some on a cost plus basis. While one might wonder whether fixed tariff (competitive bid) would leave any room for growth without capacity additions and compensate for cost rises, the running costs (no raw material) for renewable energy are significantly lower than conventional sources and have been coming down with efficient ways to operate and maintain. This is evident from NGEL’s average operating profit margin of 89% in the last 3 years.

Even so, we believe that NGEL would have planned to make up for this fixed tariff revenue with its forays into other energy solutions including battery storage and green molecules explained below.

#4 All things green

NGEL is looking at itself as the group’s arm to house all its green forays (other than hydro and nuclear which are separate arms). Towards this, it is investing in hydrogen, green chemical and battery storage capabilities and solutions as well as associated technologies.

According to CRISIL Research, Battery Energy Storage Systems (BESS) has emerged as a prominent storage technology, characterized by high energy density and fast, simple installation. The technology excels in providing various grid support functions, including energy time shift, distribution deferral, and energy arbitrage. Looking ahead, the CEA projects that India will need 41.7 GW/208 GWh of BESS capacity and 18.9 GW of pumped storage hydroelectricity by Fiscal 2030.

While we are not factoring any contribution from these segments, the company’s broad plans are as follows: The company is establishing a green hydrogen hub in Pudimadaka, Andhra Pradesh, where it is currently finalizing electrolyzer partnerships.

(Green hydrogen is an environmentally friendly form of hydrogen energy produced using renewable electricity such as solar and wind to split water into hydrogen and oxygen through a process called electrolysis).

NGEL’s other expansion plans include implementing a grid-scale battery storage facility to support FDRE (Firm and Dispatchable Renewable Energy) and RTC (Round-the-Clock) projects. This storage system will complement existing solar and wind power operations while also enabling participation in grid balancing through standalone battery storage tenders. While detailed capital expenditure plans are still being drafted, the company has already secured 1,200 acres of land at Pudimadaka with a capital advance payment of Rs 700 crore.

NGEL thus has a clear vision of what will be pursued in-house and what areas it will explore for tapping future green energy opportunities. We believe these will supplement any pressure arising from competitive tariffs and help keep operating margin in the over 85% territory.

#5 High credit rating

Renewable energy generation calls for high fixed capital investments and low working capital. Generation capacity can be built only through financial leverage. On this score NGEL’s biggest strength is its easy and low-cost access to debt, as a sovereign-backed entity. The company’s own superior debt servicing metrics as well as it’s parentage gives it an edge over perhaps any other green energy company in India when it comes to accessing funds at competitive cost. NGEL enjoys Crisil’s AAA Rating for borrowings and enjoys the same rating as the sovereign for foreign borrowings (NTPC has a BBB- stable from Fitch Ratings with stable outlook).

Most renewable projects are highly geared and NGEL follows a 80:20 debt:equity plan for its project funding. Its own vision of 60GW of capacity by FY-32 pegs its capex size at a whopping Rs 3 lakh crore (at Rs 5 crore per MW), of which debt will amount to Rs 2.7 lakh crore for the 80% proportion. Hence the cost of debt plays a very important role in its net margins (which is already superior to the likes of Adani Green Energy. More of this in the valuation section).

Risks to business

NGEL’s biggest risks come from the industry in which it operates rather than any limitations of its own.

- Incentive phase-out: The entire industry is incentive-driven , including viability gap funding for PSUs, focusing on self-consumption or power distribution to government entities through Discoms. While there is little reason to believe that the government would withdraw any of these incentives in the medium term, fresh renewable energy capacities would face feasibility challenges in the event incentives are withdrawn or phased out in future. However, there is a silver lining as far as solar is concerned. Its competitive and affordable tariff, prompts many off-takers to make it their first choice.

- Grid infrastructure: India's National Grid has seen its inter-regional power transmission capacity grow from 99,050 MW in fiscal 2019 to 118,740 MW in fiscal 2024, achieving a CAGR of 3.7%. However, this kind of growth may be insufficient given the ambitious renewable energy expansion plans. Large-scale solar and wind plants are typically located in remote areas with limited existing transmission infrastructure. The challenge is compounded by the uneven distribution of renewable energy installations across States and its intermittent nature. Addressing these challenges requires robust transmission planning to optimize costs, utilization levels, and losses while efficiently connecting generation sites to load centers. To facilitate renewable energy growth, areas with high solar and wind potential need to be connected to the Inter-State Transmission System (ISTS). In recognition of this need, MNRE/SECI has identified Renewable Energy Zones (REZs) with a total capacity of 181.5 GW, targeting benefits by 2030. But if these plans do not fructify on time, then NGEL could suffer from delayed revenue generation after putting up capacity.

- Weak credit profiles of buyers: The sector faces significant counterparty credit risk due to weak financial positions of most State Discoms (distribution companies), though this is partially mitigated by competitive tariffs and payment security mechanisms. Besides, the management has stated in a media interview that this risk has come down significantly after the implementation of The Electricity (Late Payment Surcharge and Related Matters) Rules, 2022 (LPS Rules) and debtor days are well under control.

Valuation

IPO trackers have been flagging declining grey market premium for the NGEL offer and critiquing its “high”PE ratio. But grey market premiums are unreliable indicators of an IPO’s prospects and change with market whims. NGEL’s optically high PE ratio needs to be viewed in proper context. Using trailing or near-term forward PE ratio as a valuation metric for companies in the investment phase of a capital-intensive industry, with a long growth runway can be highly misleading. This is because their aggressive capital expenditure tends to be front-ended and results in significant interest costs and depreciation, while revenues are back-ended and flow in gradually once new capacity becomes operational. For perspective, even established players like Adani Green Energy have seen extreme PE ratios - moving from 3,192 times in 2020 to the current 183 times. Therefore, conventional PE-based valuations may not be appropriate for assessing companies in this nascent sector, during their build-out phase.

Enterprise Value to EBITDA (EV/EBITDA) offers a more meaningful valuation metric as it considers total firm value including debt relative to operating profits. Based on annualized FY25 estimates, NGEL would trade at 54 times EV/EBITDA, higher than Adani Green Energy's analyst-estimated 35-40 times. While international peers like RePower Energy Global trade at lower multiples (11 times), their growth and profitability metrics are not comparable to Indian players.

Looking ahead at FY27, considering NGEL's planned 16GW capacity addition (FY24-27), the EV/EBITDA would likely drop to an estimated 10 times, slightly below Adani Green Energy's analyst forecasts of 11-12 times. NGEL appears to be qualitatively superior to Adani Green on several metrics:

- Easy access to low-cost credit due to parentage (AAA Crisil rating vs Adani's AA- from Ind Ratings)

- Better interest coverage ratio (2.6x vs 1.1x in FY24)

- Healthier pre-IPO debt-equity ratio (2.1x vs 5.4x in FY24)

- Higher net profit margins due to lower funding costs

While NGEL's ROE may remain lower than Adani's due to the latter's higher financial leverage, the gap on return on capital employed is minimal.

Even considering all of the above, we concede that NGEL's valuations aren't particularly cheap. But 3 key factors stand out:

- Its potential for rapid growth during FY25-27 (if there are no significant time delays in capacities) can provide the upside even from the IPO price band.

- Its position as a high-quality player in India's renewable energy sector

- Its likely freedom from the corporate governance issues that have plagued some peers

For investors seeking exposure to the renewable energy sector in the medium term, NGEL represents a good choice among the options available today. However, it is important to note that this is not necessarily the best investment opportunity in the current market - its appeal is specific to the renewable energy segment.

Given the current market sentiment, the IPO might see a subdued listing, potentially offering better entry points later. Investors interested in the renewable theme could consider applying now and averaging down later, on market correction.

4 thoughts on “NTPC Green Energy IPO: Will this clean energy play power your portfolio?”

Given the current context and valuations, would it be prudent to look into NTPC GREEN now?

We continue to have it in our Buy. If your exposure is not high, you can. Vidya

Thank YOu

Thanks for the excellent research and commentary. Very helpful.

Comments are closed.