One of the big put-offs in annuity plans (insurance plans that promise lifelong pension) is that they offer a fixed annuity, which will not compensate for inflation. So are “flexible” annuities or annuities with escalation clauses the answer? We review ICICI Prudential’s Guaranteed Pension Plan Flexi plan, a relatively recent offering, which promises increasing income. Does this deserve a place in your retirement plan? Read on to find out.

Policy basics

Let’s start with understanding the basic features of the ICICI Pru Guaranteed Pension Plan Flexi (ICICI Pru GPP Flexi). These are as follows:

- ICICI Pru Flexi is a deferred annuity product without any bonuses or market linkage. Its returns are guaranteed and not subject to any market or reinvestment risks.

- The policy can be availed by those aged 40 to 70, with an option to add a second person as young as 30 years in the joint life option.

- You need to pay premiums for anywhere between 5 and 15 years. After premium payments end, policyholders can defer (i.e., delay) annuity payments up to a maximum of 15 years from the policy purchase date. For instance, if you opt for an 8-year premium payment term, you can opt to receive annuity payments anytime between that year and the 15th year from the purchase of the policy.

The policy offers two variants:

- Without Return of Premium: Provides a higher annuity payout at a flat rate.

- With Return of Premium: Includes an increasing annuity option.

Death Benefits: The life cover on this plan applies only before your annuity payments start. After annuity payments begin:

- Without Return of Premium plans: The policy terminates upon the policyholder’s death and nominees receive nothing

- With Return of Premium plans: The premiums paid are refunded to the nominee upon the death of the policyholder (or the last surviving person in joint life policies).

The policy offers other benefits like return of premium on critical illness and permanent disability, top up of premiums, ad hoc withdrawals, and loan facility. To see all policy features, refer to the policy brochure.

How does an annuity differ from other policies?

Before we evaluate the ICICI Pru GPP Flexi policy plan, let’s revisit how annuities differ from traditional insurance policies.

At first glance, annuities and traditional insurance policies might appear similar, with fixed premiums, payouts, and death benefits. However, the primary goal of an annuity is to provide a fixed pension in exchange for your premiums, eliminating market and reinvestment risks.

Unlike traditional insurance, annuities don’t deduct a high mortality premium from your investment. This is because they don’t offer significant death benefits like traditional insurance policies do. As a result, a larger portion of your premium is allocated towards generating returns.

What is the return?

When you buy annuity plans, insurers usually talk about the annual (or monthly) payout per lakh of premium, which is also called the annuity rate. But to really evaluate annuity plans as investments, you need to strip out this jargon and calculate the IRR (Internal Rate of Return) you will get on your cash flows.

This ICICI Pru GPP Flexi plan offers multiple options (you can see all of the options on the brochure, page 4). However, all of these come down to 3 kinds of payouts

- A fixed payout without return of premium

- A fixed payout with return of premium

- An increasing payout with return of premium

Let’s explore these options in detail. For the examples below, we consider a 50-year-old male investing Rs.25 lakh and applicable tax, with annual periodicity of premiums and payouts for simplicity.

#1 Fixed payout without return of premium

In this option, after the premium payment term and the deferment period, the annuity payout starts and continues till the death of the policyholder. After that, no payouts are given and there is no lumpsum payout either. Accordingly, in our illustration:

- The premium payment term is 5 years (the minimum period required)

- No additional deferment period is opted

- The first year’s premium, including 4.5% GST is Rs.5,22,501

- The premium from year 2 till year 5, including 2.25% GST is Rs.5,11,251

- The yearly annuity payout will be Rs.1,85,973

While the number of payouts will depend on the lifespan of the policyholder, assuming the policyholder lives till 86, collecting 30 annuity payouts, the XIRR of this option will be 4.71% This is clearly a sub-par return, especially as it is pre-tax with annuity income being taxed at your slab rates.

#2 Fixed payout with return of premium

In this option, after the premium payment term and the deferment period, the payout starts and continues till the death of the policyholder. Upon death, the premium paid (excluding tax) is paid back as a lumpsum to the nominee and the annuity payout stops. Accordingly, in our illustration:

- The premium payment term is 5 years

- No additional deferment period is opted

- The first year’s premium, including 4.5% GST is Rs.5,22,501

- The premiums from year 2 till year 5, including 2.25% GST is Rs.5,11,251

- The yearly annuity payout will be Rs.1,57,526

- Upon death, a lumpsum of Rs.25,00,000 is paid

Continuing with the above example, assuming the policyholder lives till 86 and collects 30 annuity payouts, the XIRR of this option will be 5.62%. Do note that the annuity payout in this option is 15% lower than the option without return of premium. This is the insurer adjusting your annuity payout for the lumpsum that he has to pay to your nominees. If we exclude the lumpsum pay to nominees from calculations (since you will not be receiving the money), we get the XIRR 4.09%

#3 Increasing payout with return of premium

In this option, after the premium payment term and the deferment period, the payout starts. This payout will increase every year till the death of the policyholder. Upon death, the premium paid (excluding tax) is paid back as a lumpsum and the annuity payout stops. Accordingly, in our illustration:

- The premium payment term is 5 years

- No additional deferment period is opted

- The first year’s premium, including 4.5% GST is Rs.5,22,501

- The premiums from year 2 till year 5, including 2.25% GST is Rs.5,11,251

- The first annuity payout will be Rs.1,05,296

- Annuity payouts will increase by Rs.5,265 per year. Do note that the increase is a fixed amount per year (5% of first year’s payout). It does not compound. Inflation in real life though, does compound. Therefore, the increasing payouts from this plan will be quite inadequate to compensate for real-life inflation.

- Upon death, a lumpsum of Rs.25,00,000 is paid

Once again, assuming the policyholder lives till 86 and collects 30 annuity payouts, the last payout will be Rs.2,57,975. The XIRR of this option will be 5.73%. Without accounting for for the lumpsum payout, XIRR will be 4.44%

Essentially, while offering a simple escalation on premium, the insurer is compensating for this with a much lower annuity payout in the initial years. The first year annuity payout in this option is 33% lower than the fixed payout with return of premium option and 43% lower than the fixed payout without return of premium. The annuity payout from this plan will surpass that of the “fixed payout with return of premium” and the “fixed payout without return of premium” options only by the 10th and 16th year respectively.

What is the impact of deferment?

Now, let’s tweak the illustration a little and assume that you don’t opt for annuity as soon as the minimum 5 year period is up. To see how the deferment changes payouts and returns, we added an additional deferment of 5 years on top of 5 year premium paying term, then looked at two age scenarios:

Scenario 1: Premium payment starts at 50 years

Scenario 2: Premium payment starts at 45 years

The table below captures how the annuity payouts and the XIRR changes if you choose to defer the annuity start by 5 years. The premiums remain the same as in our illustrations above.

As you can see, Scenario 2 (age 45) will have a higher return due to receiving 30 payouts versus 25 for the 50-year-old. As in our illustration earlier, we have also given the XIRR if you remove the return of premium paid since only your nominees will receive that amount.

Our take on ICICI Pru Guaranteed Pension Plan Flexi

One of the big minuses of the ICICI Pru GPP Flexi policy is the compulsory deferment period. Even without you opting for an additional deferment period, this policy requires a minimum premium payment term of five years. As a result, your annuity income begins only after five years. .

While the annuity offered by insurers after deferment looks high, any investor taking moderate risks can usually beat the return offered by the insurer in the deferment period. By investing the corpus and buying an immediate annuity, you can enjoy much larger payouts.

A second problem is the deep cut you need to take in your pension just to ‘enjoy’ increasing payouts. The increasing payout option starts from a significantly lower base. The lack of compounding in the escalation renders it ineffective against inflation. It is better to go with a fixed payout and look outside the annuity to increase income for the future.

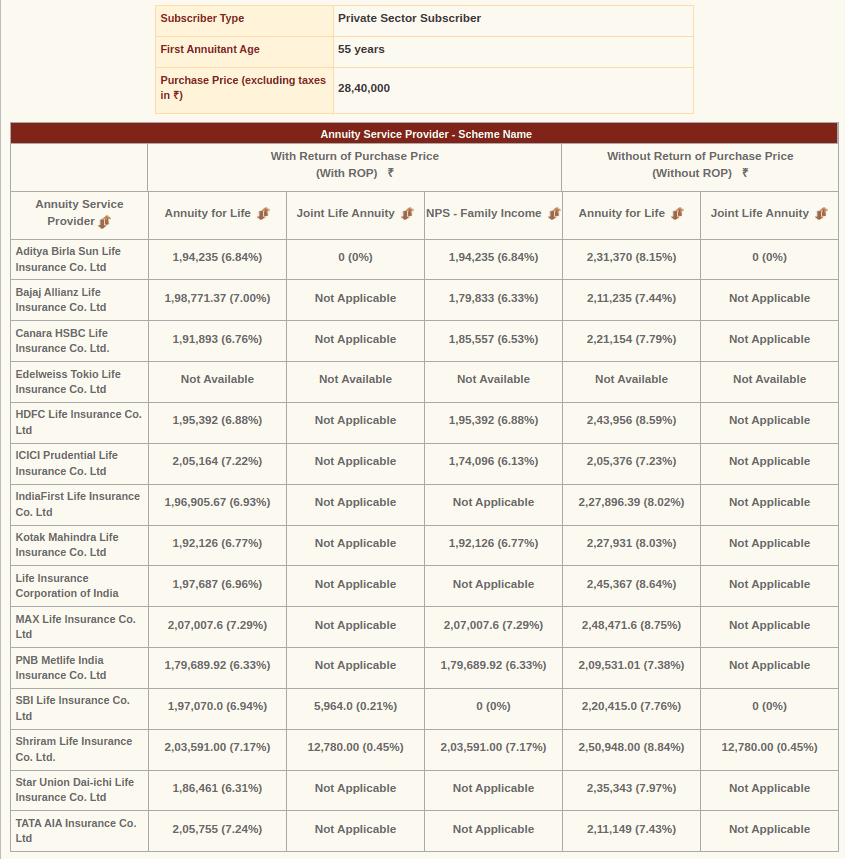

Three, this policy introduces too much complexity into an annuity plan, which is essentially a simple product. To put this in perspective, let’s compare it with simple immediate annuity plans. A 50-year-old investing Rs.5 lakh per year for five years in this policy receives the following annual payouts:

- Rs.1,57,526 (with return of premium)

- Rs.1,85,973 (without return of premium)

To find out the equivalents for an immediate annuity, we need to make 2 adjustments to our illustration calculations.

- Age: Since there is a 5 year delay in starting the policy and getting annuity, we need to check the immediate annuity benefits for a 55 year old

- Corpus: As we can invest the Rs.5 lakh per year set aside for premium, the corpus available to invest 5 years later can be higher than Rs.25 lakh. Let’s assume the Rs.5 lakh per year investment was able to generate a modest return of 6% per year (i.e., you’re investing in low-risk options). At the end of the period, this will create a capital of Rs.29.9 lakh. Let’s say 30% of the gain is paid as tax, leaving you with Rs.28.4 lakh to buy your immediate annuity.

Using these as inputs, we get the returns as shown in the image below.

Source: https://cra-nsdl.com/

Note: GST is applicable to both ICICI Pru GPP Flexi and the immediate annuities.

As you can see, all simple immediate annuity plans are able to beat the payouts from ICICI Pru Guaranteed Pension Plan Flexi. Investors are likely to be better off with managing the investments by themselves and buying an immediate annuity at retirement, to create an income stream. You can read more on immediate annuities here: Should you opt for immediate annuity plans?

Conclusion

In a developing country like India, where inflation is not yet under control; an annuity with a fixed payout may look inadequate. But there seems to be no good fix for this in the annuity structure. For an investor looking for a guaranteed income stream without worrying about falling rates, a simple immediate annuity is still the best option. To supplement your annuity income, you can allocate a portion of your portfolio to hybrid or equity instruments which can help beat inflation.

If you are concerned about annuity rates significantly dropping over the next 5 to 15 years, this policy can help lock in current rates. However, investing in higher-return equity instruments during that period and building a larger corpus could mitigate or even outweigh the impact of potentially lower annuity rates in the future.

12 thoughts on “Review: ICICI Pru Guaranteed Pension Plan Flexi”

A comparision with GSecs thru RBI direct portal and these Annuity products will be helpful.

Can there be a bucket recommendation list from Prime Investor team for Annuity products similar to MFs and stocks? Every individual will have to take Annuity at some stage. Either with Deferred payment or immediate and if one has this researched list it will help a lot of us.

Thank you

Praveen

Any guess as to why an Increasing payout without return of premium is not available?

Any guess why an Increasing payout without return of premium is not available?

The big question for this no return of premium option: If this policy holder unfortunately passes away within a year of taking this plan. They get only some 1 lakh change as per your calculation and the insurance company pockets the entire money. What’s the point of this? Will anyone opt for this plan? And why would someone want to go for these policies with 4% return when even an SBI FD gives better return and return of principal to nominee?

Early death would be the worst outcome in the case of no return of premium annuities. About who would opt for this; for the older people who do not plan to leave a legacy, they can consider no return of premium policies to get higher predictable income for life. There also, immediate annuities will be the simple option.

Another question as an NPS subscriber. At the time of retirement, do we compulsorily have to purchase one of these annuity products? After building all that corpus, taking such annuity policies with 4% return seems to be a very bad option.

You do have to buy an annuity for 40% of the corpus as per current laws; however, this can be delayed till age 75 and annuity rates are relatively better for older entry age. You can check this from the following link:

https://cra-nsdl.com/CRAOnline/aspQuote.html

Sir, delaying by 15 years isn’t a solution, you know. 🙂 We want income from 60. If you build 1Cr in NPS, you have to pay 40L and buy these 4% return products! This is really deflating. No one mentions this while mentioning benefits of NPS. They only talk about how you can build a huge corpus and how it is a low cost product. I am having second thoughts about NPS itself now, thanks to your review of this product.

My apologies; I should have answered it better the first time 🙂 You are right, there should be an option for income generation if they want to delay purchasing annuity; and the recently introduced systematic lumpsum withdrawal plan (SLW) of NPS seems to be addressing that. With this, you can create an income stream using systematic withdrawals as in mutual funds SWP.

https://npscra.nsdl.co.in/download/Systematic%20Lumpsum%20Withdrawal(SLW).pdf

Although, this would need some careful planning and we haven’t done a detailed analysis of this strategy.

Investing in sovereign backed long tenor g- secs and SDL s with about 7 %fixed return ( taxable) seems to be a better option!

Yes, indeed!

Comments are closed.