When stock markets are expensive and you get bombarded with stock ideas, finding companies with strong fundamentals and staying off those with mediocre and suspect financials can be tough. Screening for companies paying consistently high dividends is a good way to identify survivors.

As PrimeInvestor members, we know you’re not just looking for stock picks – your analytical minds would love diving deep into research. That’s why we’re thrilled to introduce ‘Prime Screener Series’, your new companion in stock discovery!

Think of this series as your toolkit for identifying potential buy candidates. They could sometimes also be your alerts to stay away from some stocks! We’ll combine powerful screeners with real-world market insights to help you spot great stock ideas. From fundamental powerhouses to emerging champions, our qualitative and quantitative filters will help you identify them all.

Perfect timing? You bet! Starting with our High Dividend Screener – just what this choppy market needs!

Why high dividend paying stocks?

High dividend paying companies can be good bets in expensive markets for two reasons.

- One, when reporting their numbers, there are n number of ways for companies to manipulate their accounting profits, but no way for them to manipulate dividend payouts which entail actual cash outflow. Remember the quote – ‘Profit is an opinion, cash is a fact’? Therefore, high dividend paying companies are likely to be qualitatively superior to companies that pay no dividends.

- Two, when markets sink, companies with a high dividend yield contain downside better as defensive investors will tend to buy them. Accumulating consistent dividend payers can also be a good way to build a passive income portfolio for the long run.

Here, we used the Prime Stock Screener to get to a list of high dividend yield companies. This can be a good starting point to build a passive income portfolio or for further research into individual names. The top dividend payers we identified are in the table below. You can download our full excel list of 32 stocks that made the cut here.

32 top dividend paying stocks in Excel

When arriving at these names, we filtered out:

- Companies with special or exceptional dividends in one year that are out of sync with their normal payouts

- Cyclical companies with fluctuating dividends

- Highly leveraged businesses like financials, where a bad year can mean skipped dividends

- Small-cap companies where volatile earnings lead to lower dividend predictability

Guide to running filters for dividend paying companies

You can run our High Dividend Payers screener anytime by yourself on Prime Stock Screener.

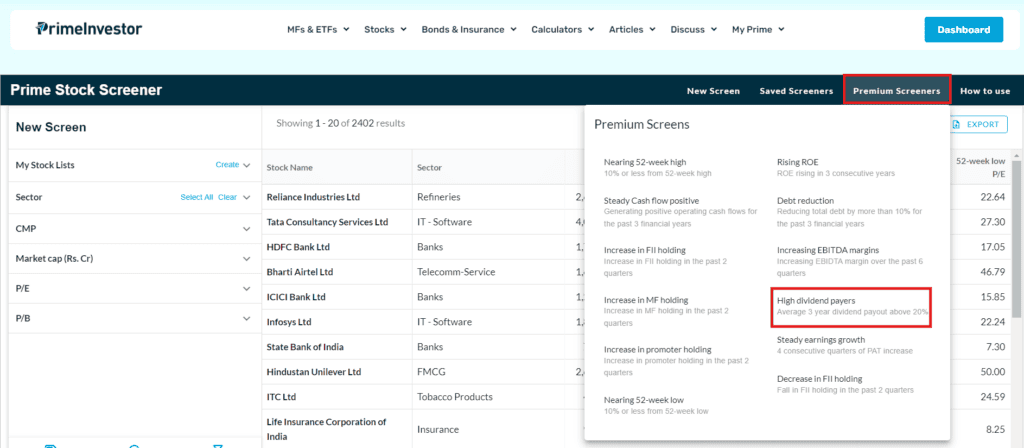

This is how the Prime Stock Screener will look when you log in (not a PrimeInvestor? Subscribe to our Growth plan today to screen stocks like a pro)

The tab called "Premium Screeners" will allow you to choose various pre-built screeners. Here, choose "High Dividend Payers." This Premium Screener will filter out companies that are paying 20% of their net profit as a dividend to their shareholders on a 3-year average basis.

You can now run the following steps to filter out a set of high dividends paying companies

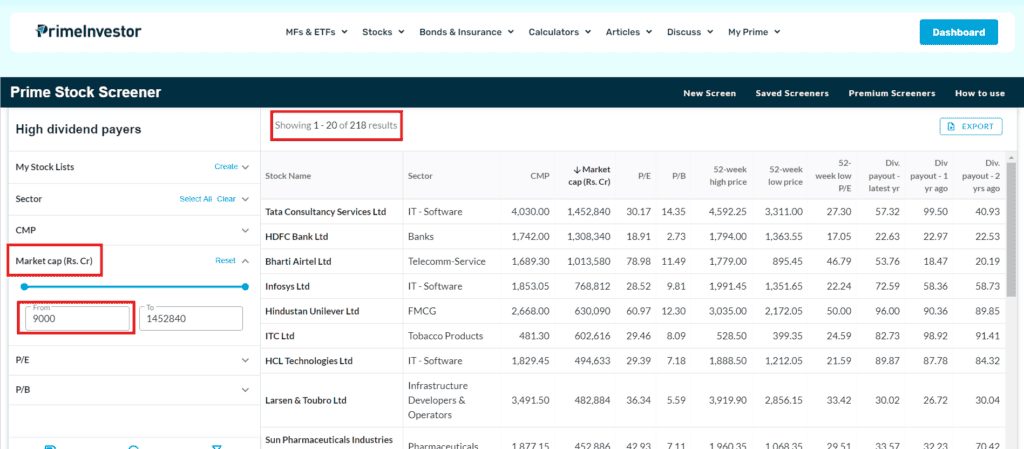

1. Market Cap filter – To categorize companies based on Large Cap, Midcap, and Small Cap, we use the Market Cap filter from the extreme left. We included only mid-cap and large-cap stocks, with a market cap above Rs 9000 crore (~500th Company by market cap).

218 companies out of 2402 listed on the NSE made the market cap cutoff of Rs 9000 crore. We also screened for companies paying >20% of profits as dividend, to ensure the company was a material dividend payer.

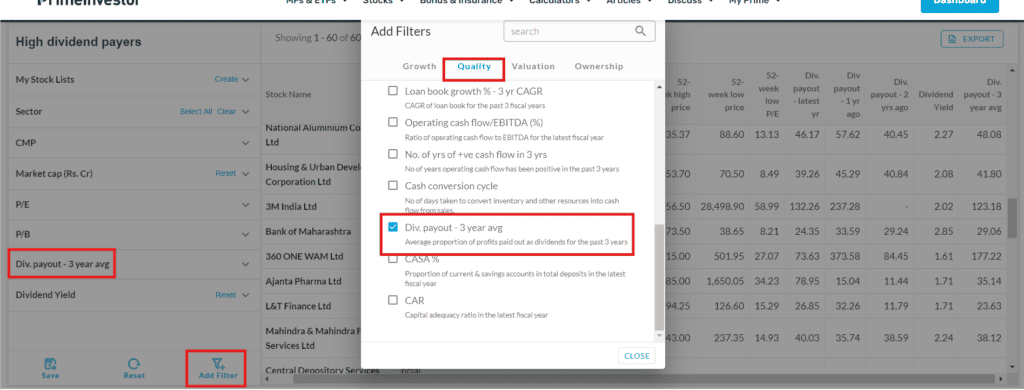

2. Dividend Payout 3 Year Average – To add Company’s average dividend payout in the excel, choose the quality filter and select Dividend Payout - 3 Year Average.

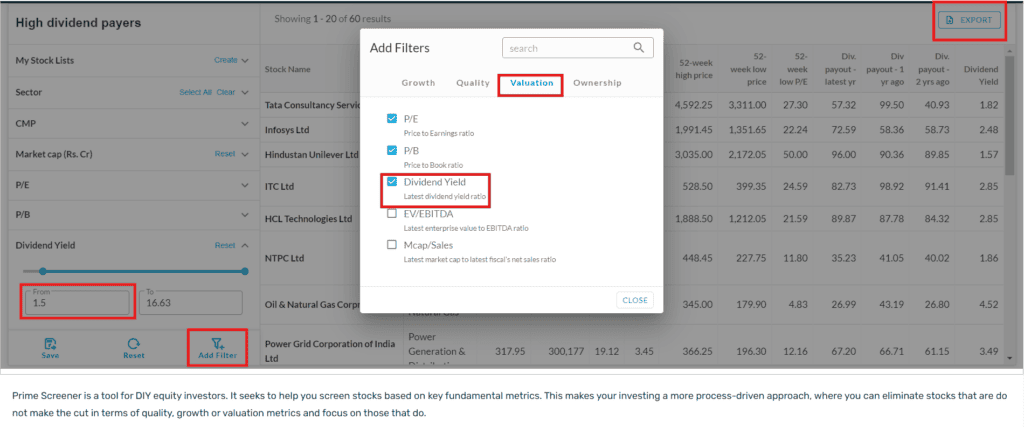

3. Dividend Yield Filter – To get to companies that paid out significant dividends at their current market price, we filtered for Dividend Yield from the left menu and set the desired range, at or above 1.5%,

Export the outcome to Excel or Google sheets for further filtering process.

Out of the 218 companies, we were left with 60 companies after filtering out for 1.5% dividend yield.

4. Manual check for special dividends: Some companies may have given special or one-off dividends in the latest or previous financial years to celebrate an anniversary or to pay out windfalls from corporate actions. For egs, Vedanta has given special dividends in the latest year and the previous year, which has boosted its dividend yield compared to the past. However, this higher yield may not be sustainable in the long term. So, we weeded out such companies.

5. Removing finance and cyclical companies: Financing/ lending business is generally a capital consuming business where sustaining dividends in bad times can be tough. Similarly, companies in cyclical sectors such as commodities, capital goods, commercial vehicles, auto parts, etc may show high fluctuation in their cash flows and hence may not be able to pay high dividends on a sustainable basis. We removed companies with cyclical dividends to arrive at a handful of companies with a consistent dividend record combined with decent dividend yield.

After going through steps 1 to 5 using our “High dividend payers” screener, we are now left with a handful of 32 high-dividend-paying companies that you can bank on.

Mind you, the rich valuation of our stock market combined with richer valuation for companies with steady earnings growth, clean balance sheets and cash flow has had the effect of moderating dividend yields. That’s why most companies in this list today are at 1-2% yield. During market falls, you may find much healthier yields using the same screener.

This data is derived by running filters. The Stock mentioned herein should not be construed as recommendation or advice by PrimeInvestor.

General disclosures & disclaimers

The securities quoted are for illustration purposes only and are not recommendatory.

2 thoughts on “Prime Screener: Over 30 Top High Dividend Paying Stocks in India”

I am holding decent number of BPCL shares. I have been getting good dividends every year from the Company. I have recovered all my investment in BPCL by dividend pay outs only. Also thanks to their frequent bonus issues.

Surprisingly, it is not in the list.

Yes sir, It just missed out on our 20% dividend pay-out “filtering criteria” for one out of 3 years. That’s why.

Thanks.

Comments are closed.