In this final budget before the elections, there is little by way of big-bang announcements. There are, however, several announcements in the Budget 2023 that do bear implications. There are two aspects to the Budget impact – on one side, there are the provisions that impact your investments and taxes specifically. On the other, there are proposals that have a bearing on prospects for different sectors. Therefore, we’ve broken down our Budget 2023 analysis along these lines.

Budget 2023 – Impact on taxes

In this first part, we cover those measures that relate to your investments and taxes. Do note that we have picked only the more important announcements and which carry a heavier impact rather than an exhaustive list.

#1 Personal tax rates

In a bid to nudge individual taxpayers into opting for the New Tax Regime that came into being in 2020, Budget 2023 is adding more sops to the new regime. To provide some background: the New Tax Regime is a simpler, stripped-down version of the Old Tax Regime. The former does not allow any of the usual deductions you get with respect to house rent allowance or home loan interest, investments and insurance and so on. It instead tries to keep the slab rates more attractive for the middle-income earners, especially if they don’t have home loans or tax saving investments.

The changes in this Budget 2023 regarding the New Tax Regime are as follows:

One, proposal to introduce standard deduction for the New Tax Regime – The standard deduction of Rs 50,000, available as a deduction on salary income, was allowed only under the old regime. It is now available under the proposed the New Regime as well, giving it parity with the Old Regime.

Two, increasing the rebate under Section 87A of the Income Tax Act to Rs 7 lakh of total income from Rs 5 lakh earlier for the New Regime. A rebate is a deduction of the tax payable if you fall under a certain income limit – this limit is Rs 5 lakh under both the regimes at present. It is proposed to be increased to Rs 7 lakh under the proposed New Regime. That means if your total income is below Rs 7 lakh, you will not pay any income tax. This will turn out to be the regime to opt for by young and middle level salaried individuals. Do note here that this does not mean income up to Rs 7 lakh is tax-exempt. It just means that if your income is Rs 7 lakh or lower, the amount of rebate will nullify the tax that you would have to pay. The increase in income limits for this rebate to Rs 7 lakh has not been extended to the Old Tax Regime – it remains Rs 5 lakh of total income.

Three, a reduction in surcharge in high tax slabs in the case of New Tax Regime. Surcharge is levied on the income tax amount computed and the rate of surcharge depends on the slabs of income. Earlier, for the purposes of computing surcharge, there were 4 income slabs with the highest slab subject to a 37% surcharge. This has been reduced to 25% in the new regime – going forward, while the first two slabs remain unchanged, for incomes over Rs. 2 crore, the surcharge rate under the new regime has been set at 25%. The table below shows the surcharge rates that were in force and the surcharge rates that were announced in Budget 2023 for the new tax regime.

Four, the number of tax slabs under the New Regime has have been reduced and as a result, individuals in certain slabs will get to benefit more from the proposed New Tax Regime as opposed to the current New Regime. The new Tax regime has fewer slabs (see tables below) and makes it more attractive for those in some income brackets.

For example, someone with Rs 10 lakh of income would not even get to the 20% tax bracket in the proposed change as opposed to the current one! With the proposed new slabs, the tax payable for Rs 10 lakh of income would reduce to Rs 54,600 (including 6% cess) as opposed to Rs 78,750 currently. This reduction comes from both allowing standard deduction on salary as well as the rationalised slab rate proposed.

But how does this proposal compare with the Old Tax Regime? It would depend on the deductions you claim. If you had no house rent or home loan and make no investments or insurance, then your tax under the old regime would be as high as Rs 68,760 under the old regime, on an income of Rs 10 lakh. This is higher than the Rs 54,600 under the proposed New Regime.

On the other hand, let’s say you availed the full Rs 1.5 lakh Section 80C deduction, Rs 25,000 Sec 80D deduction, and Rs 1.8 lakh (max Rs 15,000 per month) of HRA. In this case, the tax under Old Regime is just Rs 32,760.

Hence, much would depend on what you intend to do with your income. But if you are going to take a home loan merely for tax deduction, you would need to think twice before you do so. Who knows if the Old Regime will be phased out with time!

It is to be noted that the default regime would be the New Tax Regime, unless you opt for the old one. As a salaried individual, you are allowed to choose this every year. But if you earn income from business or profession and you choose to opt out of the new regime, you can choose to opt in just once.

Here is an excel sheet (linked below) for calculation of income tax with basic deductibles such as HRA, home loan interest and Sec 80C and 80D. The sheet will show you whether you are better off with the old or new tax slab. Please note that you need to fill the basic pay, actual HRA received and add any other components of your salary in other allowances. Also choose the place of employment (metro or non-metro).

Overall, the Government is now trying to slowly move away from the compulsive saving and insurance habit that it created through the old tax regime. Under the new regime, the onus of saving with discipline, without tax sops and incentives, would be in your hands!

#2 Deductions relating to house property

This proposal caps the limit available to claim long term capital gain tax deduction when you reinvest the proceeds from sale of your property under sections 54 and 54F under the Income Tax Act. Section 54 comes in if the original asset is a residential house property. The condition to be satisfied for benefits under this section are that within a year before the transfer or two years after the transfer, the assessee should have purchased a residential property in India OR within three years after the transfer, should have constructed a residential house property in India.

If the above criteria are met, the assessee gets benefits in the following forms:

- Where the capital gain is greater than the cost of the new residential house, the excess amount will be taxed.

- If the capital gain is lower than or equal to the cost of the new asset, it will not be taxed at all. If the proceeds of sale of the original asset are not used immediately, it has to be deposited in a bank account specified under the capital gains account scheme and has to be used within the time frame allowed failing which, it will be taxed.

Section 54 F offers similar benefits but where the original asset is not a residential house property. Long term capital gains are taxed at a flat rate of 20% and surcharge / cess will be levied as applicable. For a more detailed look at how these provisions work take a look here.

What has changed: The Budget 2023 has made a change to this in order to curb misuse of this provision by high net-worth assesses who purchase very expensive residential houses. What the change does is limit the maximum deduction that can be claimed under these sections to Rs. 10 crore. In effect, even if your new property costs Rs. 12 crores, for the purposes of these sections, it will be capped at Rs. 10 crores only.

This change will take effect from the financial year beginning April 1, 2023.

The second proposal is to curb double-deductions on loan used for acquiring, renewing or reconstructing a property.

Acquisition and modifications of property are largely funded through loans and the Income Tax Act, 1961 provides benefits for the same in several ways.

- Firstly, the interest is allowed as a deduction under the head ‘Income from House Property’

- The principal repaid can also be claimed as a deduction from income under Chapter VI A.

- The interest cost also forms a part of the cost of acquisition / improvement when the same is computed for capital gains purposes.

What has changed: Section 48 will be modified so that, if the interest has already been claimed as a deduction under ‘Income from House Property’ or under Chapter VIA (point 1 above), the same interest cost cannot be included in arriving at the cost of acquisition / improvement for capital gains purposes (point 3 above). This is being done to avoid an assessee getting multiple benefits for the interest cost.

This change will take effect from the financial year beginning April 1, 2023.

#3 Non-ULIP life insurance policies to be taxed

Section 10 (10D) of the Income Tax Act allows tax-free withdrawal of insurance policy maturity proceeds. Proceeds received on death of the policyholder are tax-free and continue to be so.

However, for proceeds received on maturity, provisions were already amended for ULIPs to make then tax free only if the below conditions are met. Else, they become taxable. The condition for tax-free status are:

- Premium should be less than 10% of sum assured

- Yearly premium should be less than Rs.2.5 lakh

However, life insurance policies outside of ULIPs were not subject to any such conditions. The Budget 2023 seeks to amend this. Starting 1st April 2023, maturity proceeds on non-ULIP life policies will be tax-free only if:

- The yearly premium is less than Rs. 5 lakh

- To plug the loophole of individuals investing in multiple policies with premiums less than Rs. 5 lakh, additional amendments are added that premium will be calculated at the aggregate level (all such policies you hold, put together), and not per policy.

Do note that this provision affects only fresh policies issued and not existing policies.

So how will the maturity proceeds taxed? This will be taxed under the head ‘Income from Other Sources’ where the only exemption applicable is the purchase price, provided that hasn’t been claimed under any other provision of the act. Essentially, the proceeds will be added to your income to compute your total taxable income and your tax slab.

Endowment plans and money-back plans, two of the most popular non-ULIP plans are unlikely to see a major negative impact as most of these policies are purchased by individuals as a regular saving product, where yearly investment is likely to be less than Rs. 5 lakh. However, guaranteed income plans, which have been popular among high-ticket investors, are likely to be the hardest hit as not only their tax advantage has been removed, as things stands now, they will be taxed much worse than competing products.

#4 Distribution under REITs and InVITs

REITs and InVITs are both income-generating vehicles, through the distributions they make to their unit holders. While there is potential capital appreciation on REITs and InVITs, this income distribution is the primary draw for these instruments. Now, distribution can take different forms and each form is taxed differently:

- Dividends

- Rental income in the case of REITs

- Capital gains on property sold

- Income from interest on loans given to SPVs

- Cash flows from payback or redemption of loans given to SPVs

REITs and InVITs enjoy pass-through status – meaning that this income is taxed only in the hands of the unitholder and not the REIT or InVIT itself. To this end, the tax treatment so far assumed that the nature of income for the REIT/InVIT in the distribution will hold the same nature for the unitholder.

For example, if a REIT distributes its rental income, it’s treated as rental income for you as well and therefore added to your total income and taxed at your slab rate. If it pays out dividends received, then it is considered dividend income for you, too.

But when REITs or InVITs distributed cash received from payback of loans they extended, this was not really treated as income in the hands of the unitholder. For the REIT, it was simply treated as a loan redemption and not an income. This meant that part of a REIT/InVIT distribution was essentially tax-exempt.

It is this anomaly that the Budget 2023 proposes to close off. Accordingly, where the distribution of a REIT/InVIT is not in the nature of rent, interest or dividend (and not capital gain on redemption of units), that will be treated as ‘Income from Other Sources’ and taxed accordingly.

This proposal therefore increases the tax outgo on distributions received. Going by distribution trends so far, this is likely to impact REITs more than InVITs. For example, Embassy Office Parks REIT has paid between 35-55% of its total distribution in the past 8 quarters as amortisation of SPV debt. For Brookfield REIT, this share has climbed to nearly 50% in the past couple of quarters. IndiGrid InVIT, on the other hand, has either had no debt repayment component to its distribution income or has typically been on the lower side at less than 20%.

#5 Taxes on market-linked debentures

Market linked debentures (MLDs) are listed hybrid instruments whose returns are linked to market or to the performance of a benchmark. This is unlike pure NCDs where a fixed coupon is stated upfront.

MLDs thus far enjoyed long-term capital gains (LTCG) taxation status similar listed bonds – at 10% on the LTCG. The government sees these instruments as being similar to derivatives and does not see merit in taxing it otherwise.

Accordingly, the Budget proposes all gains – short-term or long term from MLDs to be taxed as short-term capital gain for debt. That means they will be taxed at your slab rate. This move is a big blow for MLDs that yielded higher than regular debt returns and enjoyed huge tax arbitrage as the ‘income’ was taxed as LTCG (for over 1 year).

#6 Income from online game wins

Winnings from playing of online games has come under a heavier tax burden according to Budget 2023 proposals. So far, net winnings on winnings from activities such as horse racing, card games and so on, had a threshold of Rs 10,000 after which taxes were applied.

This threshold resulted in avoidance of tax deduction by splitting a win into smaller sums of less than Rs 10,000. Therefore, the Budget 2023 proposes to apply the tax on aggregate net winnings during a fiscal year instead of individual wins.

Further, for net winnings on online games, the Budget specifically proposes that:

- one, taxes be applied at the time of withdrawing the winnings from a user’s account

- And two, for the net winnings still held in an account at the end of the fiscal, tax needs to be paid as well.

Besides, the tax rate applicable for income from online game wins stands at a flat 30%. You can deduct this income from your total income to arrive at tax payable on your remaining income.

#7 Taxes on overseas remittances

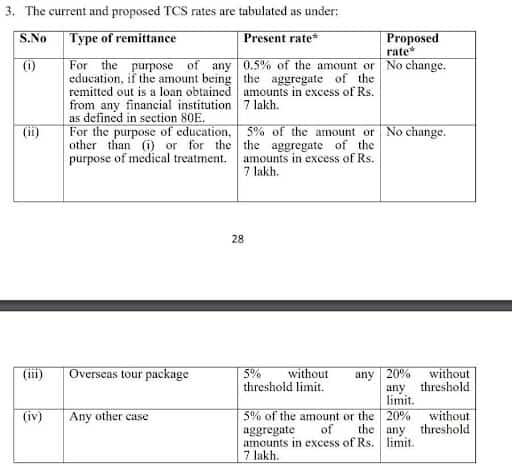

Overseas remittances under the Liberalised Remittance Scheme (LRS) and sale of overseas tour packages had to bear a Tax Collected at Source (TCS). That means, on the amount you remit overseas for any purpose – education, gifts, investments, medical treatment, going abroad on employment, etc - you had to pay a certain proportion as tax. You could later set this off against total income tax you owe.

In the Budget 2023, both the tax rate and the amount threshold beyond which the tax applied have been revised – which results in a massive cash flow impact. For those sending money overseas for education or for medical treatments, there is no change.

- For those spending on overseas tour packages, you will now have to fork out 20% TCS on the entire amount. Earlier, this stood at 5%.

- For those sending money overseas for any purpose other than for education and medical treatment, you will have to pay TCS at 20% on the total amount. Earlier, it was 5% on the amount exceeding Rs 7 lakh. This includes amounts you remit to make investments, too!

You can definitely set this off against tax dues. However, both sharp hike in the TCS rate and the removal of thresholds can create a cash flow issue for you and make it far less appealing to remit money overseas for any purpose. Effectively, you will need to have this additional amount at the time of remittance; if your TCS outgo is more than the tax you owe, you will have to wait until tax filing season ends for a refund. This provision kicks in from July 1, 2023.

As we understand the provisions, the LRS does not extend to credit card spends – spends that you may make to buy services or products overseas on your credit card. However, there appears to be some confusion regarding this; we’re looking for more clarity and will update this section if required.

#8 Other tax proposals

There are smaller announcements in the Budget as follows:

- Exemption of TDS on interest payments for listed debentures has been removed.

- For NRIs, so far TDS has been deducted at 20% on income from redemption of mutual funds. the Budget proposes that, if the tax treaty between India and the country in question provides for a rate lower than 20%, then the TDS applicable would be this lower rate. Effectively, the TDS rate would be the lower of 20% or the applicable treaty rate. While it is not clear how AMCs would approach this, you may have to provide a tax residency certificate to the AMC in order to facilitate the differential TDS.

Budget 2023 – Impact on investments

- Increase in Senior Citizen’s Savings Scheme (SCSS) limits: The maximum deposit amount has been hiked to Rs 30 lakh from the Rs.15 lakh currently. This is a good development for income-seeking senior citizens as the SCSS offers among the best interest rates and highest safety. Current interest rates on the SCSS stand at 8%, revised recently.

- Increase in post office Monthly Income Scheme limits: The maximum deposit amount under the post office MIS scheme has also been hiked to Rs.9 lakh from the current Rs.4.5 lakh. This also offers a good route for individuals seeking low-risk income streams. While banks currently offer higher deposit rates, MIS rates have been higher than bank rates in the past. The interest rate as of now is 7.1% p.a. The government notifies the interest rates every quarter.

- Introduction of a new scheme – the Mahila Samman Bachat Patra/ Mahila Samman Saving Certificate: While finer details about this scheme is yet to be had, this is a new one-time small savings scheme for women. This scheme will be available till March 2025. The tenure of this scheme is 2 years and will carry a fixed interest rate of 7.5% p.a. Partial withdrawal from the investment will be allowed.

Budget 2023 – Impact on markets: sectors & stocks

While one would usually expect a populist Budget in a pre-election year, Budget 2023 turned out to be a fiscally prudent one even as it tries to balance it with growth. Thrust on manufacturing, services, consumption can benefit a good number of sectors even as there were negatives for sectors such as the insurance industry.

#1 Capex spends all the way

When we look at the capex allocation details, it is a massive 33% increase over the previous year at Rs 13 lakh crore! This is about 3.3% of GDP and also 4 times over FY-16. Railways and road transport saw allocation moving up by 60% and 28% respectively over FY23 revised estimates. In absolute terms, Railways is set to get Rs.2.4 lakh crore while road transport could get Rs. 2.6 lakh crore. Railway capex is proposed to grow across the board with a sizable allocation to wagon acquisitions apart from new lines, widening, signalling systems, etc

It was a bit of a disappointment for defence sector with just 8% increase in allocation for capex at Rs 1.6 lakh crore. But do remember, that in total terms it is still huge spending on defence, at Rs 6 lakh crore (capex and non-capex).

States, too, are encouraged to spend on capital expenditure. States are proposed to get increased allocation for capex under a 50-year interest-free loan proposal. This is 46% higher than the FY23 revised budget estimates. States haven’t fully spent their allocation of FY-23. The Budget has stated that the same must be used by FY-24. The money can be spent by Govt. departments for replacing vehicles and ambulance too under the vehicle scrappage policy.

Capex beneficiaries : A combination of fiscal prudence and high capex may keep interest rates steady while spurring the growth for lenders, commercial vehicle-makers, capital goods and cement players. Lenders, especially corporate lenders, may benefit in the later part of the year once private capex also picks up.

On the other hand, commercial vehicle manufacturers are expected to benefit from higher spend on road transportation. State Govt capex on vehicle replacement, including ambulance, may give some bounty to utility vehicle players. Ashok Leyland, M&M and Force Motors may benefit mostly from this. For Tata Motors, JLR remains an overhang and JLR’s India business may take a hit with increase in import duties on both CKD (30% to 35%) and completely built vehicles (60% to 70%)

It may be a show of strength for capital goods companies now, after several years of languishing. This is especially true of ones that supply to a range of industries such as auto, railways, renewable energy and Industries for both domestic and global markets. For such companies, the opportunity comes from a combination of global capex boom and domestic capex boom coming together in segments such as auto, railways and renewable energy. Such beneficiaries include players such as ABB, Siemens, SKF, Schaeffler, Bharat Forge and Ramkrishna Forgings.

#2 Continued support for domestic manufacturing

Encouraged by the pick-up in domestic manufacturing of electronics, the FM has proposed to cut import duties on camera lens and its inputs used in mobile manufacturing and also on the open cell of LED TV panels. Mobile manufacturing has been flourishing in India under the PLI scheme with exports crossing Rs.50,000 crore in April-Dec 2022.

In the listed space, the primary beneficiary from this proposal would be Dixon Technologies, which is a contract manufacturer of mobile phones for Samsung, Motorola and Nokia and that of LED Televisions for most of the leading players including Samsung.

The impact of doubling the import duties on electric kitchen chimneys (7.5% to 15%) while bringing down duties in the critical component used in the manufacture of the same, may boost domestic manufacturing while benefiting companies like V Guard which recently acquired the Sunflame brand, including a new manufacturing facility for stoves and chimneys.

#3 Thrust on mobility continues

With sale of over 6 lakh electric 2 wheelers in 2022, the EV boom is really catching up for the savings it provides over its petrol alternative. The Budget has proposed an allocation of Rs. 5,172 crore under FAME II (Faster Adoption of and Manufacturing of EVs) scheme, mainly for 2 & 3 wheelers, an increase of 78% from FY23. This was part of the Rs 10,000 crores scheme launched in April 2019.

An extension of the scheme beyond FY24 has not been mentioned. At the same time, the FM has extended customs duty concession on imported lithium-ion cells and capital equipment required for manufacture of Lithium-ion batteries for one more year, till FY24. Though these are positives, the extension of FAME II subsidies beyond FY24 could have given a boost to the industry without waiting until the next full budget.

#4 Setback for insurance players

If there was a basket of stocks that witnessed heavy selling post-Budget, it was life insurance companies. They also witnessed selling during the previous budget when tax changes on ULIPs were announced.

Starting 1st Apr 2023, non-ULIP policies will enjoy tax-free withdrawal under section 10 (10D) only if the yearly premium is less than Rs. 5 lakh. To plug the loophole of individuals investing in multiple policies with premiums less than Rs. 5 lakh, additional amendments are added that this will be calculated at the aggregate level and not per policy.

Guaranteed income plans will be hard hit their tax advantage has been removed, and they will be taxed much worse than competing products. This move can impact the topline of insurance companies, especially the new-age ones such as ICICI or HDFC which have popular guaranteed income plans.

23 thoughts on “Budget 2023 – Impact on your investments & the market”

> But if you earn income from business or profession and you choose to opt out of the new regime, you can choose to opt in just once.

Could you elaborate on this? This doesn’t seem totally clear.

Yes, basically you cannot keep switching like other salaried earners. Once you choose New Regime, you need to stick to it, if you have income from business or profession. Vidya

Thank you for the clarification!

Thanks for the excellent summary.

Could you please clarify the following – For policies such as HDFC Life Sanchay Plus, ICICI Pru GIFT etc., i.e. non-ULIP Guaranteed Plans, as I understand, the tax treatment is changing for policies issued after 01.Apr.2023 only. So if one purchases policies prior to 31st Mar 2023, the proceeds will continue to remain tax free on these without capping on premium. If these policies are issued after 01.Apr.2023 then upto 5L of premium is tax free.

Thus a person can have – policies issued prior to 31st Mar 23 with no capping of tax free premium + upto 5L of policies issued after 1st Apr 23.

Does that sound correct? Thanks – K

Hello,

Regarding the question: If the guaranteed income policy, purchased before 1st April 2023 is a one time purchase; that is, whole premium is paid before 1st April 2023; yes, the policyholder can buy another non-ulip policy with yearly premium upto Rs.5 lakh on or after 1st April 2023 and get tax free proceeds on both of the policies (as tax laws stand now).

As per the new amendments; if any policies issued on or after 1st April 2023 have premiums exceeding Rs.5 lakh on aggregate in any of the previous years, those policies are not eligible for tax free proceeds (seventh proviso to clause (10D) of section 10). This does raise some questions about how withdrawal from non-ulip policies will be taxed when there will be a payment on or after 1st April 2023 and also there were high value (greater than Rs.5 lakh) payments in any financial year upto FY23. We are on the lookout for any clarifications on this.

This has been clarified; a person can have non-ulip policies issued on or after 1st April 2023 with aggregate yearly premium upto Rs.5 lakh; along with non-ulip policies issued before 1st April 2023 with no cappting on annual premium; and maturity proceeds of all those policies will be tax free (as per how the tax laws stand now)

Thanks for the summary. Makes things clear on personal taxation front. I have a question on MLDs. Is the rule on applying the personal tax slab on returns irrespective of short or long term applicable only on MLDs bought from 1st April 2023 or even the older ones invested in the past?

Older ones also. Only the date of sale matters in any such change by the govt. thanks, Vidya

Will the budget impact the charges that parag Parikh mutual fund levies – since its technically like investing in foreign stocks!!!

That comes under a separate provision under RBI for such pooled investments and there are restrictions (as you have known from 2022). So not to worry. Vidya

Very good Article. Thank you.

Thanks for the in depth analysis.

Couldn’t get around the piece on InVits, though. I recall that IndiGrid was a recommendation in this space. Is it still good? If already bought, should one continue holding this? Would be nice if you could clarify in light of the budget impact.

Thanks

Yes it’s fine. It does not dole out much as repayment of principal. Vidya

Please could you outline why there was a gold price action ? What was the impact of budget on gold price?

There is a marginal reduction in customs duty. Ideally prices locally should fall a bit. None other than this.

Very good analysis with lots of practical points. The increase in SCSS limit from Rs 15 lacs to Rs 30 lacs is a welcome move for Senior Citizens. Couple of clarifications I wanted on SCSS :

a) If I invest in SCSS now, will the current interest rate of 8% be applicable for the entire 5 year tenor of the Deposit? Or will it change every quarter as announced by the Government?

b) If the Interest rates are fixed for the 5 year tenure at applicable rate at time of investment, is it prudent to invest now or wait for the next quarter with the hope that this will be hiked further?

All SCSS in general, are lock in products. Govt may revise every quarter but that will apply only for new deposits. If you are investing afresh now, you can get 8% through the tenure of the deposit. But we don’t know the effective date of this increased limit to Rs 30 lakh.

Please invest. Waiting is a long game and may or may not happen as inflation is also cooling. Vidya

whats your feedback on private small finance bank offering 8% FD rates for 888 days.

Can we keep / do you recommend to put more than 5 lacs in Small Finance bank offering 8% FD ?

tenure – 888 days.

Reason : Do u envisage capital erosion in next 888 days for reputed small finance banks having multiple branches within india ?

Yes the 888 day deposit is good but do not put over 10% of your surplus or Rs 5 lakh in a sfb.

ok noted thanks for your clear feedback.

Thank you for the excellent summary.

Dear PrimeInvestor Research Team;

Good Article and got better understanding of budget 2023 by reading it.

requesting you to also publish article; ie. whether any of your recommended stocks will have concerns or bright prospect after the budget ? whether you will remove the insurance company from your recommendation list ? any company will benefit much more in coming days -then provide its details also.

Thanks. Capital goods and EV focused ones will benefit. On insurance, we have only a general insurance company. It is not impacted. Vidya

Comments are closed.