Psychology of Money: What we think about when we think about money

Most best-selling books on investing and personal finance are from the west (mostly US). With such publications, readers in India will need to do some

Most best-selling books on investing and personal finance are from the west (mostly US). With such publications, readers in India will need to do some

We’re happy to get started with a new, experimental section in the PrimeInvestor platform. We are calling it ‘Prime Cuts’ – short essays published in an ad-hoc fashion (meaning, whenever we feel like 🙂 ) about things we find interesting.

Are Indian investors starting to buy into the GME hype? How risky is it, and what could happen with this company’s stock? The background story and how it is playing it currently.

We are delighted to announce the launch of Prime Stocks – our list of recommended stock picks that investors can use to build an equity portfolio and augment their investment returns.

This offering will complement our core investment recommendations across mutual funds, ETFs, and deposits.

Choosing a mutual fund investment platform – is it an important decision to make when you are starting to invest?

Yes it is.

And the reason is simple – mutual fund investing is a long-term activity.

A few days ago, we conducted a survey among our (paid) subscribers. We got a fantastic response for it from our audience. Typically, for such surveys, a response of 5-10% is considered good. We got a whopping 25%+ response rate. That in itself shows how engaged and committed our customers are. Thanks to everyone who gave their opinion!

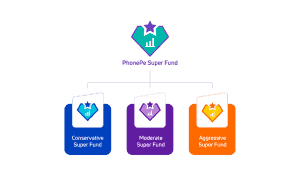

When PhonePe announced last week that they were expanding their mutual funds offering on their app by offering so-called ‘Super Funds’, I was actually quite excited. I was an early adopter of the UPI app, and till date, it is my primary app for money transfers. They probably have the cleanest UX among all UPI apps and I was keenly watching their entry into MF services.

At PrimeInvestor, we provide research backed recommendations about various personal finance products, especially relating to investments. We publish them in the form of recommendation lists

It has been 7 years since SEBI came out with direct plans in mutual funds and a lot has happened during this period. At this time, how should an investor decide which plan to go for – direct or regular? What are the factors to consider? Srikanth Meenakshi distills 11 years of FinTech experience and working with investors to provide a roadmap.

The financial services marketplace is getting reshaped by three forces – a push to financialization, increasingly complex products, and digitization leading to the emergence of self-serve customers

Consequently, there is a need for providing cost-effective research and guidance to a new class of consumers

PrimeInvestor with its totally independent setup and a remarkable team, seeks to do that as a subscription-based, product-first, digital-channel service.

It’s a unique service – so, need a lot of feedback, and a lot of support 🙂

Hold On

You are being redirected to another page,

Elevate Your Wealth with Professional Portfolio Management