In these reviews, we pick stocks that have rallied, or where businesses are interesting or changing, or where companies may be relatively unknown and so on. We present an analysis of these stocks, covering what has driven them, business prospects, threats and more. These reviews are meant to give you an understanding of a stock. They are not our recommendations.

When it comes to the infrastructure space, it is often only construction stocks that come to our mind. But there are many segments such as the gas pipeline network, power grid, LNG terminals that qualify as important segments in infrastructure. One of the major infrastructure projects that has been commissioned recently is the Dedicated Freight Corridor (DFC) and a section of it has been opened for freight movement in January 2021. When a freight corridor opens, there are multiple other industries that thrive and grow on it. While the DFC is owned and operated by Indian Railways, here is a mid-sized company that is a proxy play on the DFC.

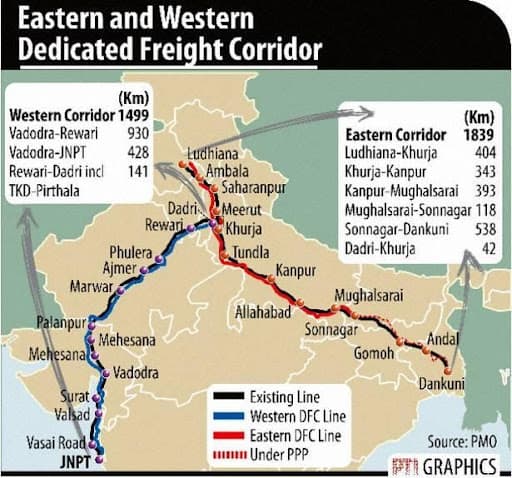

Dedicated Freight Corridor (DFC): DFC is a railway transport corridor meant to decongest traffic in the regular railway network. It is meant for fast, safe and efficient freight transportation of goods to and from industrial areas to ports. The project involves two freight corridors; 1506 Route km long Western Dedicated Freight Corridor (WDFC) and 1875 Route km long Eastern Dedicated Freight Corridor (EDFC). The WDFC will provide connectivity from Dadri in the state of Uttar Pradesh to Jawaharlal Nehru Port (JNPT) in the city of Mumbai, Maharashtra.

It will traverse through Haryana, Uttar Pradesh, Rajasthan, Maharashtra and Gujarat. The EDFC will start from Sahnewal, located near Ludhiana in the state of Punjab and it will pass via Uttar Pradesh, Punjab, Haryana, Bihar and Jharkhand before terminating at Dankuni in the state of West Bengal. While the ~650 Km stretch of the WDFC from Rewari to Palanpur is operational, the entire WDFC is expected to be operational by June 2022. It is the key stretch from Vadodara to Nhava Sheva (JNPT) that has been facing significant delay.

The freight corridors will increase the average speed of goods trains from the existing 25 kmph to about 100kmph, allowing heavy haul double-stack container trains that can carry higher load and bring down cost of transportation. The DFC project is also expected to increase the share of rail transportation from the existing 30% to 45% due to dual benefits of faster turnaround and lower cost of transportation

Gateway Distriparks (GDL) is a prominent company in the logistics sector. What started off as a single container freight station (CFS) facility to serve containerized imports of paper rolls to India in 1994, post the economic reforms of 1991, transformed into a key logistics player in India’s export-import (EXIM) trade. The company has gone through many ups and downs in the past since its listing in 2005, but its fortunes seem to be reviving with the commencement of Western Dedicated Freight Corridor (DFC). With its presence along the Western DFC, GDL seems to be in a sweet spot to play a bigger role in India’s EXIM trade.

Business

GDL is an integrated multi-modal logistics player with CFS, rail-linked ICDs, movement of containers over rail to major Indian ports and also movement of goods by road to final destination.

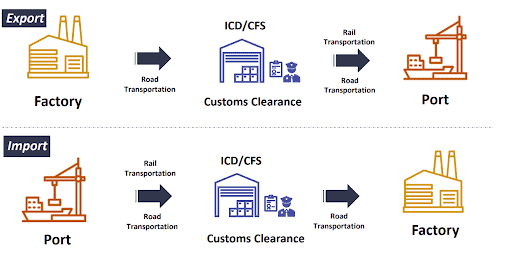

Container Freight Station (CFS) AND Inland Container Depots (ICD): CFS is an off-dock facility located near the servicing ports which helps in decongesting the port by shifting cargo and customs related activities outside the port area. An ICD, on the other hand, is generally located in the interiors (outside the port towns) of the country away from the gateway ports. ICD is formed to help importers and exporters to handle their shipments near their place of location.

TEU: In container transportation, the volume of containers is measured in Twenty-foot Equivalent Unit (TEU). One 20-foot container equals one TEU whose internal dimensions measure about 20 feet long, 8 feet wide, and 8 feet tall. Large container ships typically transport more than 18,000 TEU.

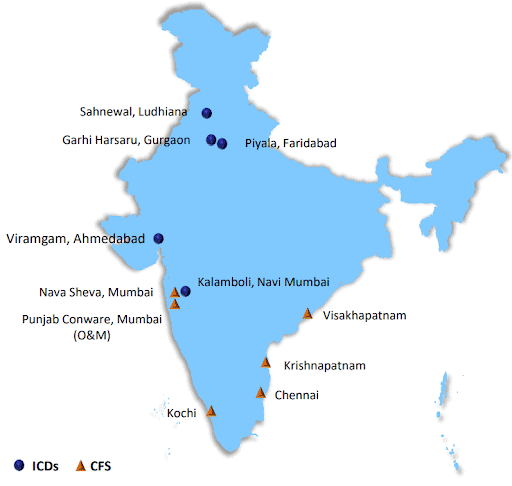

Source: Company presentation

GDL operates two CFS at Navi Mumbai and one each at Chennai, Krishnapatnam, Kochi and Visakhapatnam with a total capacity of over 700,000 TEUs. Its rail freight business, housed under wholly owned (99.93%) subsidiary Gateway Rail Freight Limited (GRFL), is emerging as the key growth driver pursuant to commencement of Western DFC. It provides inter-modal logistics and operates its own rail-linked ICDs at Garhi Harsaru (Gurugram, Haryana), Ludhiana (Punjab), Piyala (Faridabad, Haryana), Viramgam (Ahmedabad, Gujarat) and Kalamboli (Navi Mumbai).

The company provides rail transportation of containers to and from ports, stuffing & de-stuffing of cargo at the ICDs, bonded warehouse for container storage and dispatch, air-conditioned warehouse for temperature sensitive cargo, transit facilities, customs clearance and also office space to customs agents, freight forwarders, and transporters at all its terminals.

GRFL owns and operates a fleet of 31 trains and 531 road trailers at its rail linked terminals. It operates regular container train service from these ICDs to India’s major ports at Nhava Sheva (JNPT), Mundra and Pipavav, transporting import and export as well as domestic containers.

With the reverse merger of Gateway Distriparks into Gateway Rail Freight, as approved by shareholders on 28th September 2021, the company will become an integrated multi-modal logistics player with all infrastructure and assets under one company.

GDL also offers cold chain logistics with 35 temperature-controlled warehouses in 15 cities through its 40% associate Snowman Logistics. Its clientele comprises brands from industries like pharmaceuticals, meat & poultry, seafood, fruits & vegetables, ice cream, dairy products, quick service restaurants, processed foods, etc. The company was also engaged in vaccine distribution recently.

Positives

#1 Positioning along the Western DFC

GDL is well positioned across the Western DFC with its ICDs as shown to the right of the map image below. The ICDs are located at strategic points that cover the entire industrial corridor of Northern India from where GRFL operates container trains to JNPT (Nhava Sheva), Mundra and Pipavav ports. The Western DFC will connect Mumbai with Dadri in UP along the route shown in map on left, below.

The ICDs at Gurgaon, Ludhiana and Faridabad are strategically located to cover the industrial hubs in National capital region (Gurugram, Manesar, Faridabad, Ghaziabad), Punjab and Northern belt (Himachal Pradesh, Chandigarh, Jammu & Kashmir) and Uttar Pradesh (Faridabad, Ballabhgarh, Palwal and Noida). Gateway Rail Freight runs frequent services to Nhava Sheva, Mundra and Pipavav from these terminals. The ICD at Ahmedabad will act as a hub for the company in the Western Region from where it can divert containers to JNPT as well as Mundra and Pipavav ports. It is also strategically located at the new industrial development of Ahmedabad and is equipped to handle 100,000 TEUs per annum.

Even before commencement of DFC, GRFL was a key logistics solution provider to exporters and importers in the North. While it has a market share of ~13% across key industrial hubs in the North, the market share is as high as ~35% in the upper North belt comprising Haryana, Punjab, Jammu, Himachal Pradesh and UP. With its positioning along DFC, the company is well poised to gain further dominance in this space.

#2 Significant growth opportunity with higher asset utilization

GRFL has enough capacities available at its major ICDs to handle additional volumes with growth in manufacturing and trade. While it will have to invest in additional equipment, the land is already available at existing locations. The company is planning two more satellite terminals in North India in the next two years, to enable aggregation of cargo through its flagship terminal at Garhi Harsaru, at a capex of Rs. 120 crore.

Below are the details of potential capacity (design capacity) of ICDs and present container handling capacity (installed capacity). The company has room to double its installed capacity across its major terminals in the North with improving demand.

While GRFL has increased its rail container volumes by 52% to 1,57,000 TEUs in the first half of FY22 over the first half of FY21, it is eyeing further increase in volumes over the next 2 years due to commissioning of the entire Western DFC. This is despite container shortages and high container rates at this point of time. The container volumes are set to cross over a lakh TEUs soon from ~82,000 TEUs at present. While this will come mainly on the back of DFC roll-out and shift from road to rail transportation, the long-term growth will come from shift to rail transportation, containerization of cargo and overall growth in India’s merchandise trade.

- Shift from road to rail transportation: On 15th August 2021, the Indian Railways ran first train under new “freight express scheme”, which assures transit times from ICDs to ports with GRFL. The train from its ICD at Garhi-Harsaru can reach Mundra port in 22 hours & 10 minutes, down from 40 hours earlier. High speed double-stack container trains will lead to significant operational efficiencies for train operators as well as industries by providing significant advantage on cost and time. Along with this, increase in containerisation of goods will also aid in volume growth going forward.

- Growth in merchandise trade: India’s merchandise export has been stagnant for the last decade, at around $300-340 billion. But the same is expected to take off with recovery in the global economy and the Rs. 2 lakh crore PLI scheme for electronics, automobile parts, textiles, etc. While the government has set a target of $400 billion exports for FY22, exports have already touched $198 billion in the first six months giving signal that the target is achievable. The government is now looking for a significantly higher target of $450-500 billion for FY23.

With strategically located infrastructure and ability to provide total logistics solutions, GDL is well placed to benefit from the growth in India’s merchandise trade.

#3 Early mover in rail freight with improving performance

GRFL started operations as early as in 2008 and has been offering services for more than a decade. It has also created the valuable ICD infrastructure across Northern India by rolling them out one by one since 2008, adding to its early mover advantage. According to management, it takes anywhere between three to four years to set up an ICD comprising land acquisitions, getting approvals from railways and setting up the terminals.

In its first full year of operations in FY09, the company posted revenues of Rs 182 crore with an EBITDA of Rs 14 crore while reporting loss of Rs 25 crore. The business has come a long way since then and is one track to touch Rs.1,000 crore in revenue with EBIDTA of Rs. 300 crore and PAT of nearly Rs.200 crore in FY22. The margin on the business has also moved up towards desired levels per TEU while the EBIDTA margins are stabilizing around 30%.

Below is the standalone financial performance of GRFL

#4 Cold chain expansion through associate company to add value

GDL owns 40% of listed play Snowman Logistics, a PAN-India integrated temperature-controlled logistics service provider. It offers 5 temperature zones between +25 degrees and -25 degree Celsius in both warehouses and trucks. The company has been one of the players involved in vaccine transportation. Snowman has lined up aggressive expansion plans with an investment of Rs.425 crore over the next 3 years to augment its capacity by almost 80% from 107450 pallets to 200000 pallets.

Snowman Logistics listed post IPO in August 2014, but the stock price is still languishing near its IPO price. While the warehousing business is highly profitable, the transportation business eats into the profits. The company has directed its future investments towards warehousing while it has launched an online refrigerated truck aggregation platform “Snowlink” to reduce investments in this area in future. The company has decided to go with debt and internal accruals to fund its expansion while putting its QIP plans on hold.

Expansion plans with focus on profitability may make this business valuable to GDL in the long run. Snowman reported revenue of Rs. 240 crore and EBIDTA of Rs.69 crore in FY21, while it has a market Cap of Rs.750 crore. GDL may also look to hike its stake from 40.25% to 51% and make it a subsidiary. If it does, it will become revenue accretive to GDL on a consolidated basis.

Concerns

#1 Port owners getting aggressive on logistics

Leading private logistics players have expressed interest to bid for the contract to build and operate private cargo terminals along the DFC during the pre-bid meetings since February 2021. This includes Adani Logistics, CONCOR, DP World, JM Baxi, PSA International, TVS Logistics and GRFL. According to the plan, the contract will be for around 30 years to handle freight loading and unloading for the DFC. In the first 10 years, the winning company will have exclusive rights to handle cargo at the station after which it will be opened to other users as well.

Aggressive entry of port owners and other leading logistics players is likely to increase the competitive intensity and whether port owners will eat into any business of the company need to be seen.

#2 Delay in commissioning of remaining stretch of Western DFC

While the currently rolled-out ~650 km stretch of DFC between Rewari in Haryana to New Palanpur in Gujarat connects Mundra and Pipavav ports with industrial hubs in the North, India’s largest container port JNPT (Nhava Sheva) is at a dis-advantage. It is losing market share on cargo from the NCR region as a result of this. Even Mundra Port has overtaken JNPT in FY21 on volume of container handled while JNPT has re-captured its pole position in H1FY22. The 738-km long Palanpur-Makarpura-JNPT section of the DFC is expected to be completed by June 2022. This is critical for the company to take full advantage of the DFC opportunity and grow its volumes while taking competition from port owners head-on.

#3 Policy threats

In 2016, India introduced Direct Port Delivery (DPD), a system that allows a select group of importers to clear cargo directly from the port within 48 hours of arrival. It is an alternative to the CFS model. The objective behind DPD was to reduce time and cost for importers, decongest ports and, in the process, facilitate faster trade. The DPD model was first introduced at JNPT and has since been extended to other ports. This has resulted in existential threat for standalone CFS players while those offering total logistics solutions will still survive. GDL also faced the heat from this policy although the business is recovering now as it has transformed into a complete logistics solution provider.

#4 Any ambitious expansion plans will come with high leverage and risk

The company has gross long-term debt of ~Rs.516 crore at the end of H1FY22 mainly comprising Rs. 180 crore of term loans and Rs.280 crore of NCD (maturity spread over FY23 to FY27). The NCDs were issued in April 2019 at 11.5% for Rs.440 crores. The company is just adequately placed for growth as well as its ability to fund its planned capex plans over the next 3 years. Below is a break-up of debt and capex plans over the next 5 years.

While the future looks bright for the company with better profitability and return ratios followed by gradual and planned debt-reduction, any ambitious expansion plans may have to be looked at with extreme caution. Below is a glimpse of corporate issues the company went through in the past.

Past Corporate Issues

GDL has gone through significant ups and downs in the past like many other infrastructure players. While its diversification to rail transportation in 2008 was rightly timed, resource constraints made it dependent on PE investors. Global PE major Blackstone invested Rs.300 crore in the company in FY2010 for 49.90% stake. The deal had riders (put-option) to buy-back stake after a certain period. After the global financial crisis and down-turn in CFS business, GDL had trouble honoring the commitment though it finally managed to buy-back Black-stone’s entire stake for Rs.850 crore at the end of FY2018. (Blackstone even initiated arbitration proceedings against the company).

As a result, GRFL became a wholly owned subsidiary of GDL. The Company funded this with borrowings through banks and NCD, and was exploring options to de-leverage. Consequently, it struck a deal to sell its entire stake in Snowman Logistics to Adani Logistics which was later called-off in the aftermath of COVID.

GDL is now a completely family-controlled business with experienced CEOs in the rail freight and cold chain businesses. While promoters own 32%, institutions, including mutual funds and FPIs own ~41% in the company.

Financial Performance

While the CFS business has been struggling since FY18, it is showing signs of recovery. Rail freight business is the driver for earnings growth. Overall earnings growth is picking up and is expected to continue on a growth path from FY22 with better return ratios.

Valuation

Shareholders have approved the merger of GDL into its wholly owned subsidiary GRFL in the ratio of 4 shares of Gateway Rail Freight for every 1 share of GDL. Consequently, GDL will get delisted while GRFL will get newly listed on exchanges. The process may take time so the stock may not be traded in exchanges for a period of 3 to 6 months.

The company is valued at ~19 times FY22 annualized EPS and 11X EV/EBIDTA at current price of Rs. 279. As opportunities stand, earnings and return ratios are poised to move higher from FY22. A planned debt reduction with no further mis-steps in corporate actions will be key to improving valuations. Post the proposed reverse merger, Gateway Rail Freight is expected to list around Rs.70 per share, subject to market conditions.