The author is an experienced content writer and editor. She specializes in simplifying complex regulatory developments across tax, law, and finance for professionals and businesses. Her expertise spans domestic and international taxation, VAT, and financial regulations, with a focus on India, the UAE, and global markets. Views expressed are personal and not necessarily the views of PrimeInvestor. This article is educational in nature .Consult an expert for your own tax and regulatory needs.

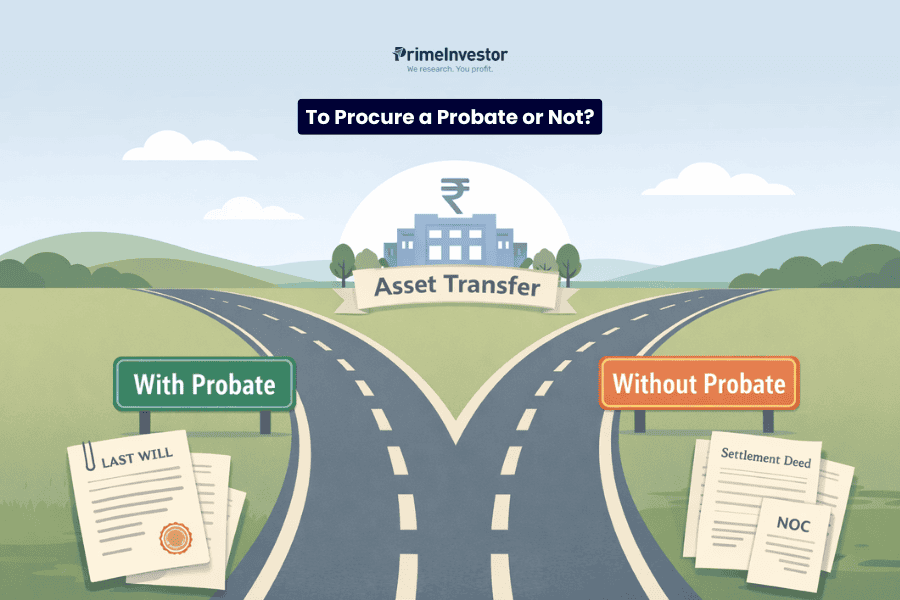

As heirs or beneficiaries, many of us have faced hiccups in transfer of assets inherited. For instance, legal heirs residing overseas may wish to sell off an inherited land parcel. However, the sale could not be executed in a few days for want of probate. Similarly, many of you may have experienced delays in the closure of bank/deposit accounts or transmission of shares after the demise of a loved one. This is particularly true in the metro cities of Mumbai, Kolkata and Chennai.

These hiccups and delays are largely faced because various institutions (banks, brokers, registrars etc.) require the “probate” as a document evidencing inheritance. It is a strong proof of evidence and also protects these institutions from any claims / disputes. Needless to say, this requirement created procedural hurdles for the common man. Even simple cases of inheritance were impacted by the need for a probate.

To ease this pain-point, the government has abolished the mandatory requirement to procure “probate.” Let’s understand the importance of probate, the recent amendment to abolish this mandatory requirement, and its impact.

The Significance of Probate

Inheritance and passing on the family legacy must be seamless. In most cases, it is. For instance, passing on of assets from one spouse to another, or from a parent to children and so on where families are aligned.

However, in some cases, the passing on of assets must be managed efficiently to ensure that the deceased’s assets are transferred as per the Will. This is particularly true in case of multi-generational or complex families, centralized businesses and asset holding, high value asset holdings or simply in case of high net worth individuals (HNIs) and ultra-high net worth individuals (UHNIs).

The “probate” is a document that proves that the Will is valid and genuine. It allows the executor to officially manage the deceased’s estate and distribute assets as per the Will. As it is issued by a Court after reasonable checks, the chances of future disputes or claims are significantly low and the beneficiaries can enjoy peaceful possession of the assets.

Many intermediaries like banks, brokers, insurers or co-operative housing societies insist on the availability of a probate as evidence that the beneficiary has rightly inherited the concerned assets.

The Law – Then & Now

The probate of a Will or letter of administration was mandatory for Wills made:

- by Hindus, Buddhists, Sikhs, Jains, and Parsis – where the Will is made within the local limits of the ordinary original civil jurisdiction of the High Courts at Calcutta, Madras and Bombay; or

- where the Will is made outside those limits, but relates to immovable property situated within those limits.

If the deceased (testator) followed any other religion or lived outside these cities, the probate was not required, though the beneficiaries can voluntarily approach the Court for a probate. In December 2025, the government amended the Indian Succession Act to abolish this mandate. In other words, across India, it is not mandatory to procure a probate, though the heirs or beneficiaries are free to procure a probate voluntarily.

An immediate question may come to your mind – What happens if the probate proceedings are pending before a Court? What happens if the probate is already granted and the executor is in the process of effecting transfer of assets to the respective beneficiaries? The government has clearly stated that the abolition does not impact the probates already granted or under proceeding. They continue to be valid.

The abolition applies prospectively – i.e., procuring a probate of a Will is not mandatory. So, what will you do – procure a probate or not?

A Million Dollar Question – To Procure a Probate or Not

Remember, answer this question only after consulting with your lawyers! But in order to provide some idea for you, we present some illustrative situations where probate may or may not be required.

There is no one-size-fits-all solution to this question. Each family and its assets are unique. The executor and the beneficiaries must consult their lawyers to decide whether they must procure a probate or not. Additionally, families can also consult on alternate structures such as family trusts or family arrangements for passing on wealth from one generation to another.

Are the Intermediaries Ready to Implement?

The abolition of the mandatory requirement to obtain a probate is certainly a welcome development. It ensures that in simple cases of inheritance, the assets are transferred faster and at a minimal cost – which would otherwise take a minimum of 3 – 6 months for procuring the probate on payment of court fees, stamp duty, advocate fees etc. Besides, it eases the burden on the Courts.

However, a question arises – are the intermediaries like the registrar, brokers, banks and housing societies equipped to transfer assets without a probate? Let’s consider some real life examples:

- the housing society, as per its by-laws, may be hesitant to register the inherited flat in the names of two brothers in the absence of a probate;

- sale of inherited immovable property may not materialize faster where a probate is not available. Often, brokers or potential buyers do not show preference for such a property;

- banks may insist on the availability of a probate to renew or transfer deposits in the names of the beneficiaries;

- brokers and mutual fund houses may delay processing the transmission of shares and MFs;

- insurance companies may demand evidence before settling claims in favour of the beneficiaries;

- the taxman may require evidence of inheritance where the beneficiary claims the cost of acquisition and the date of acquisition of the previous owner for the purpose of indexation.

These intermediaries, especially in the cities of Mumbai, Kolkata and Chennai have extensively relied on “probate” as an important documentary evidence. As the probate was given by a Court, the risk of future disputes is mitigated. However, the abolition of the requirement to procure a probate casts a responsibility on these intermediaries to ensure that the Will is valid, genuine and the beneficiaries are rightly entitled to the assets.

Therefore, intermediaries may call for other documentary evidence like affidavits, NOCs, indemnities etc. in simple cases and may insist on procuring a probate – and rightly so, in complex cases or where the beneficiaries are not residing in India.

The Way Forward

The removal of the mandatory probate requirement marks a significant shift in estate administration. Beneficiaries, in consultation with their legal advisors, now have the option to decide whether to obtain probate or not. In straightforward cases—such as uncontested inheritances or simple asset transfers—the relaxation allows for faster and more cost-effective execution of the testator’s Will. It eases the burden on ordinary families and expedites the settlement process. However, for complex family structures, cross-border assets, or high-value estates, probate remains a prudent safeguard to ensure legal certainty and prevent future disputes.

That said, the practical landscape is still evolving. Banks, financial institutions, and property registrars have traditionally relied on probate as a conclusive proof. In its absence, they may now require alternative documentation and are likely to develop internal standard operating procedures (SOPs) to assess the validity of Wills. For this shift to be effective, other frameworks—such as property mutation procedures—must also align with the new regime. We may see some changes in the procedures and regulations at the ground level to effectively implement this measure.

1 thought on “To Procure a Probate or Not?”

déjà vu?