The author is an external contributor. Views are personal and do not reflect the opinion and views of PrimeInvestor.

Precious metals have been relatively subdued amidst the recent escalation in geopolitical tensions in the Middle East. Though Comex silver has displayed some bullishness recently, Comex gold has remained relatively flat over the past few weeks.

But with the rising interest in these two precious metals, let’s take a quick look at their price charts to decipher what is in store.

Comex Gold

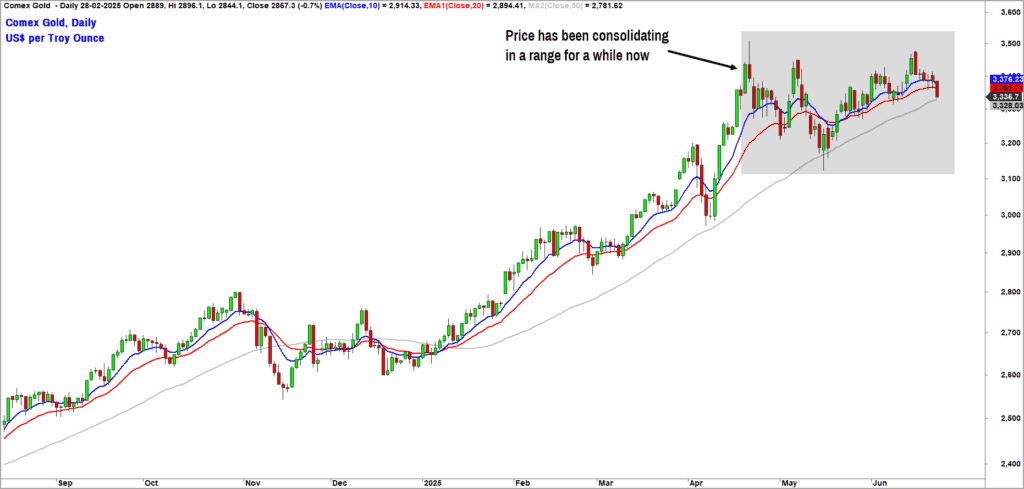

Comex gold has been an outperformer in relation to silver and the yellow metal has managed to post year-to-date gain of about 26%. The Comex gold price is also trading close to its all-time highs of $3,510 per ounce, recorded on April 22, 2025. Here is the daily candlestick chart of the comex gold futures price.

As highlighted in the chart, the price has been consolidating in the $3,120-3,510 range for over a couple of months now. A breakout from this range would set the tone for the next directional move in gold. A breakout above $3,520 or a fall below $3,100 could be a trigger that could set the ball rolling again for gold.

Technically, the trend is still bullish, and the recent consolidation appears to be correction within the overall bullish trend. Above $3,520, Comex gold price can head to the next target of $3,610-$3,700. We can discuss about much fancier targets once the price reaches the immediate target mentioned above.

A fall below $3,100 would warrant a relook at this bullish outlook.

Comex Silver

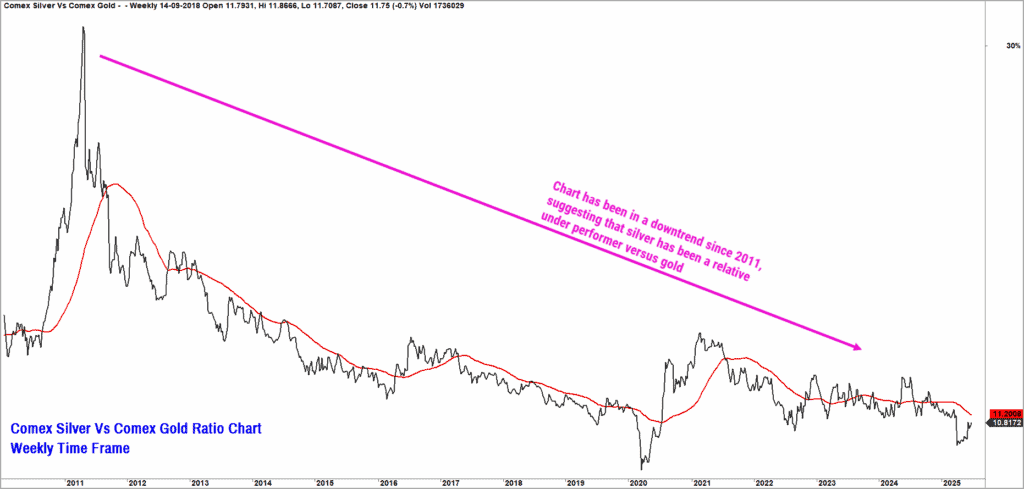

Unlike gold, Comex silver is yet hit all-time highs. The price has struggled to sustain upside momentum and silver has been a relative underperformer versus gold. Here is the relative performance chart of Comex silver and Comex gold.

As highlighted in the above chart, Comex silver has been a relative underperformer versus gold for a while now. A much closer look at the relative performance chart indicates that silver has displayed some strength in the past few weeks – but it is too early to conclude that silver has gained an upper hand. Featured below is the monthly chart of Comex silver.

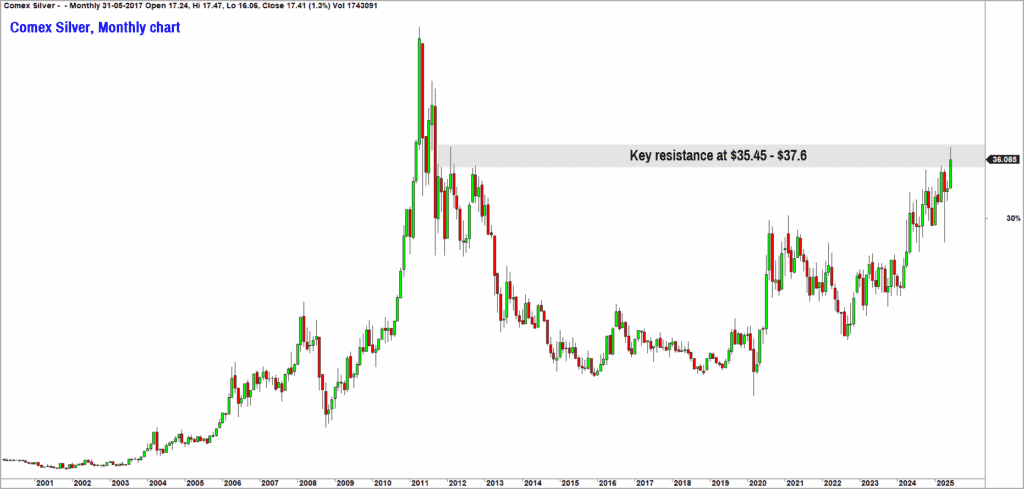

After the sharp uptrend that end in 2011, silver has been in a corrective phase for several years now. More recently, there are signs of bullishness and relative strength, but the price has to settle above the resistance level at $37.6 to trigger any sort of bullish momentum.

Above $37.6, Comex silver can head to the next major target at $42.5-$43. The chances of a rally to $42.5 would be invalidated if the price falls below $29.

For now, it would be advisable to play the wait and watch game with respect to precious metals. Look for signs of the recent outperformance of silver to sustain, before considering exposures in the white metal.

11 thoughts on “Technical outlook: What’s coming for gold & silver?”

Hello,

Any update on gold now that it has broken out about $3520?

Thanks 😊

Hello Ashish:

Both gold and silver have reached the targets mentioned in the post. The trend for both these precious metals is still bullish. I am looking at targets of $3,750-$3,800 for comex gold and $43-$44 for comex silver. We will come up with an detailed updated outlook soon.

Regards

B.Krishnakumar

Hello Krishnakumar:

Thanks for your prompt response.

With silver crossing $37.6, is it good to buy now?

Hello:

The breakout above $37.6 is a positive sign. The upside targets mentioned in the post gets activated now. The positive outlook for comex silver would be valid as long as the price sustains above $35.

B.Krishnakumar

What is your recommendation on MF SIP for multi-asset fund like ICICI. Do we continue or hold?

You can continue, if the fund fits your risk & timeframe. The IPru multi-asset fund is a lower-risk route to investing in equity and has delivered above-average returns consistently. Multi-asset funds should not be considered a way to dynamically alter your asset allocation. – thanks, Bhavana

How sensible is it to have only multi asset fund(s) in a portfolio, or DAA for that matter?

If it’s just one of other single asset funds, the asset allocation occurs only for that smaller proportion of the total portfolio.

Holding multi-asset/DAA funds only in your portfolio won’t give you optimal returns – unless your portfolio size is very small that doesn’t allow proper diversification in style, fund type etc. These funds will cap upsides and won’t let you gain from rallies in different marketcap segments. They are only lower-risk ways to hold equity or ways to reduce your downside risk. – thanks, Bhavana

Thanks.

So, besides a starter fund, there’s not much use of one?

Can it be used as an extended or additional emergency fund beyond what one has in say a liquid or money market fund?

The idea of an emergency fund is safety of capital and low volatility rather than higher returns. If you want better-than-debt returns, equity savings is an option. Multi-asset funds need at least a couple years’ holding period – even the less aggressive funds – and will be volatile in the short term. – thanks, Bhavana