Post IPO listing, we have a Hold call on this stock.

Even before its public listing, HDB Financial Services (HDB) generated significant buzz around its pricing, particularly among the 5% of investors who already owned its shares. Employee-allocated shares had found their way to the market and into retail investors’ demat accounts, creating anticipation.

HDB has been viewed through two primary lenses: as an HDFC subsidiary and also a comparable to Bajaj Finance. This dual perspective fuelled investor excitement to acquire the available 5% stake at any price ahead of the IPO. However, we believe these comparisons may be misguided, as we’ll explain further.

From our analysis, the IPO pricing seems to reflect appropriate price discovery when considering two critical factors: the company’s financial performance and existing regulatory challenges. Long-term investors without overexposure to the financial services sector may find this opportunity worth considering.

About the IPO

The IPO of HDB will open for subscription on June 25 and close on June 27. The issue is a combination of fresh issue and an offer for sale, totalling Rs.12,500 crore.

HDFC Bank will sell shares worth Rs.10,000 crore in the IPO while the fresh issue proceeds of Rs.2,500 crore will add to the capital of the company. The IPO is also pursuant to compulsion from RBI to list all upper layer NBFCs before September 2025.

The price band for the issue is fixed at Rs.700-750 per share of FV Rs.10/- each.

At the upper end of the price band, the IPO is valued at 3.3 times its post-issue book value. HDFC Bank’s stake will fall to 74% post the IPO.

Business

HDB, incubated by HDFC Bank, began its journey as an NBFC in 2007 to serve the unbanked and underserved categories, primarily MSME. It offers a large portfolio of lending products that cater to a diverse customer base through a nation-wide distribution network under three business verticals: Enterprise Lending, Asset Finance and Consumer Finance.

Its customers mainly comprise of salaried and self-employed individuals, as well as business owners and entrepreneurs.

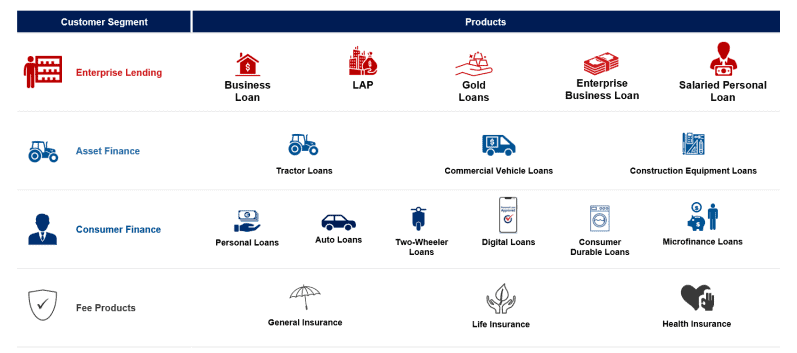

Below is a quick glimpse into the portfolio under different categories:

Source: IPO document

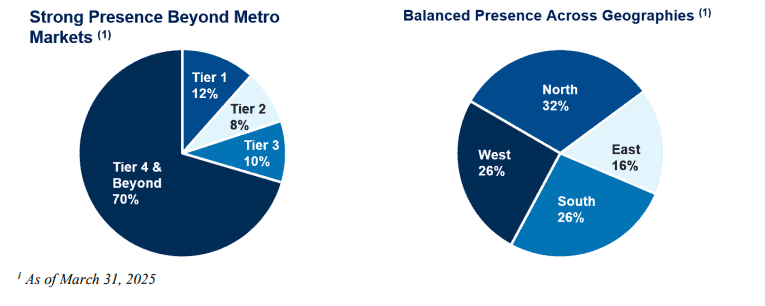

HDB has established a pan-India presence, with a branch network of 1,771 branches spread across 1,170 towns & cities in 31 States and UT with over 70% located in Tier 4+ towns. In addition, it has 80 OEM and brand partnerships and a network of over 140,000 retailers and dealer touchpoints.

The physical presence is also complemented with a digital distribution network composed of in-house and third-party channels.

Positives

#1 Strong and sizeable presence in niche segments

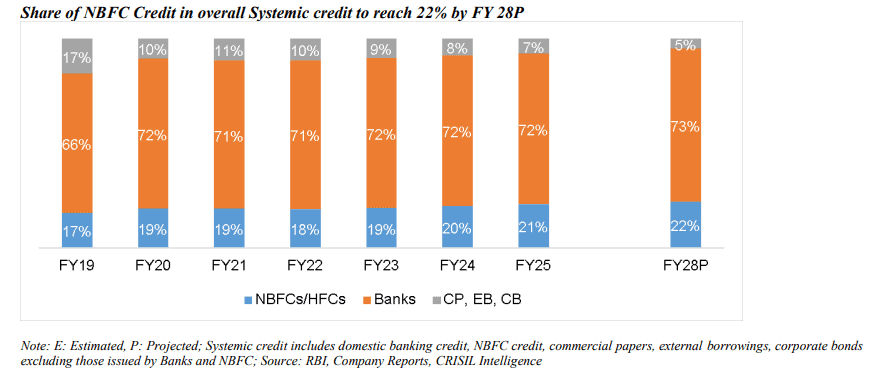

NBFCs in India have proven their right to have a profitable existence by serving the needs of niche unbanked/underserved categories with excellent underwriting skills over decades. NBFC’s share in systemic credit (overall credit including banks, NBFCs, bonds and debentures) is estimated to have increased from 12% in FY08 to 13% in FY14 and further to 21% in FY 25

This is also visible from the market value of NBFCs Vs banks. There are 4 private banks in India with Market Cap of over Rs 1 lakh crore and there are 4 NBFCs as well.

Some of the areas where NBFCs have established their niche include vehicle loans, mortgage loans (LAP) and small ticket gold loans while affordable home loans and MSME loans are also emerging as their forte. Here’s a quick glimpse into their share of business in those segments

In gold and housing loans, NBFCs hold a major chunk of low-ticket gold loans whereas the entire affordable home loan space is dominated by them. In categories like consumer durable financing, NBFCs have taken the market in their hands with ease in estimation, sanctioning and disbursement of loans within minutes at the point of purchase.

The only area where NBFCs blew up was in prime home loans and real estate developer loans that didn’t anyway suit their competency.

HDB has established its stronghold in some of these areas, that are the forte of NBFCs, over its 17 years of existence with mortgage loans (LAP) and vehicle finance being two dominant segments contributing to a major share of its secured portfolio.

The entire portfolio is bucketed under three segments as below

- Enterprise Loans is the one that HDB originally started with in 2008, mainly catering to the needs of MSMEs. In this segment, it is the mortgage loans (LAP) that makes a dominant share of this portfolio at 55% followed by unsecured business loans at 30%.

- Asset Finance was the second vertical that it started in 2010 and it is the Commercial Vehicle (CV) book that dominates the book with 65% share followed by construction equipment at 28% and tractors at 7%.

Within CV, the new CV loans are at 66% and remaining is used CVs. - Consumer Finance was a late entry that happened in 2016 and this mainly comprise of auto loans, personal loans and consumer loans. Auto loans for cars, used cars and two wheelers dominate this segment with a 48% share followed by personal 34% and durable loans at 16%

For the overall book, the average tenure is 4 Years with 73% of the book being secured in nature. Within this, the high value mortgage loans (LAP) have a tenure of 9 Years whereas most other products have a tenure of 2-4 years, bringing down the average to 4 years. There is also very high granularity as the book traverse down from enterprise loans to asset finance and consumer loans as HDB is the second largest NBFC in terms of number of consumers catered to, which stands at 19.2 million at the end of FY25.

A stronghold in well established segments of NBFCs with a a history of over a decade in each of the stronghold segments, combined with a granular book and a robust secured vs. un-secured mix holds well for HDB to deliver healthy financial outcomes on a sustainable basis.

#2 Growth and scalability is not a challenge

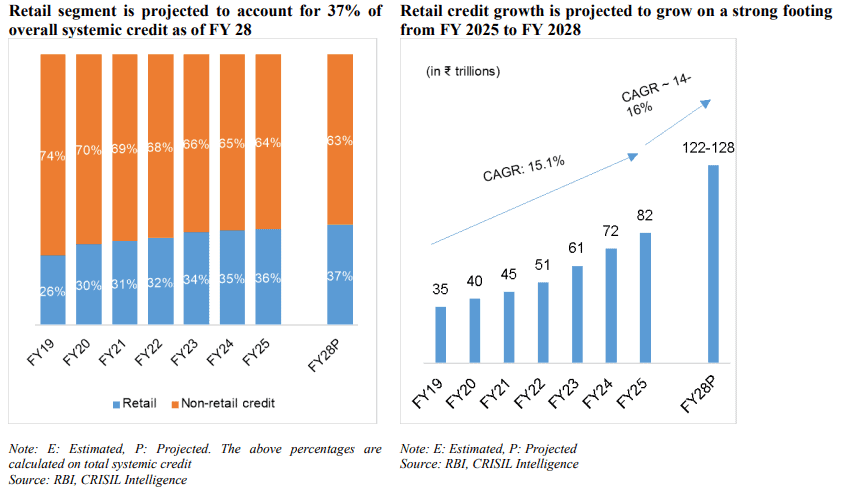

With NBFCs dominating niche segments and HDB establishing itself as a major player in several of these areas, overall growth hinges on performance in these key segments. India’s retail credit market—where NBFCs primarily operate—reached Rs. 82 trillion in FY25, encompassing small-ticket loans across housing finance, vehicle finance, gold loans, education loans, consumer durables, personal loans, credit cards, and microfinance.

This market delivered robust growth at 15.1% CAGR from FY19 to FY25, though it moderated to 14% in FY25 due to unsecured asset quality concerns and regulatory warnings. Despite this slowdown, retail credit is projected to recover and maintain 14-16% growth from FY25 to FY28.

With NBFCs growing at a tad higher rate Vs. banks, CRISIL expects NBFC credit to grow at 15-17% between FY 25 and FY 28, driven by growth across retail and MSME segments.

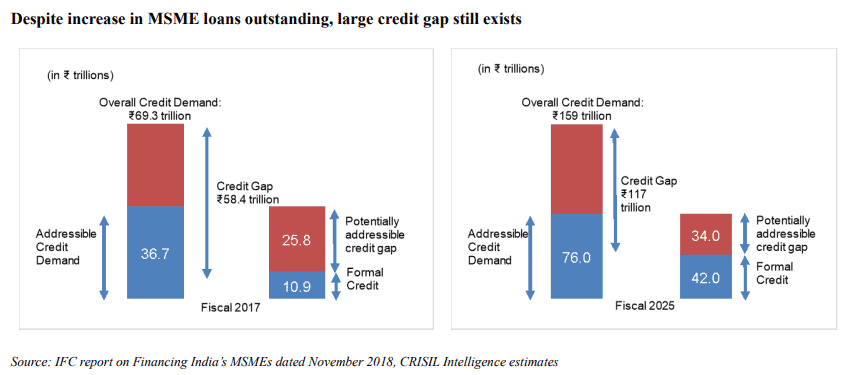

Out of these, the MSME credit growth has been growing at 18-20% in the last 5 Years and where the share of NBFCs have been growing.

Their share stood at 27% in FY25 at a total AUM size of Rs.42 trillion (Rs. 42 lakh crores).

CRISIL Intelligence estimates the total addressable credit demand at approximately Rs.76 trillion, out of which current formal financing stands at ~Rs. 42 trillion, leaving the credit gap at Rs.34 trillion. Though this credit gap has been reducing at a faster pace due to several government initiatives over the last decade, it still exists as shown below.

Inclusion of retail and wholesale trade under MSME category, registration under UDYAM portal, credit guarantee schemes, relaxion in SARFAESI act from Rs. 5 million to Rs.2 million for NBFCs in Budget 2021-22 and digital technology adoption have played a pivotal role in increasing the pace of formalisation of MSME credit.

With a large credit gap yet to be bridged, this segment will continue to be a focus segment for NBFCs like HDB Financial with higher than industry growth rate. This is further complemented by its strong nation-wide geographical penetration like its larger peers such as Bajaj, Shriram, Cholamandalam and Mahindra Financial.

Source: Page 251 of RHP

Beyond its forte of MSME, vehicle and consumer loans, HDB has not scaled up so far in areas like gold loans, micro-finance. The combined book of these two segments stood at Rs.1,500 crore or 1.5% of overall AUM and offers scalability potential. Affordable home loans is another scalable optionality that exists for this NBFC.

A combination of strong hold in key segments combined with a strong geographic presence and optionality to grow AUM in other smaller segments that are forte of NBFCs augurs well for HDB to grow at higher than industry growth rate.

#3 Strong parentage and credit rating aiding liability mix

Large NBFCs in India have been at an obvious advantage due to the high credit rating they enjoyed (mostly AAA long term rating), some of them on their financial health and some being part of large corporate groups. This have allowed them to enjoy very low cost of funds and be very competitive in lending to niche areas where there is even competition from some banks.

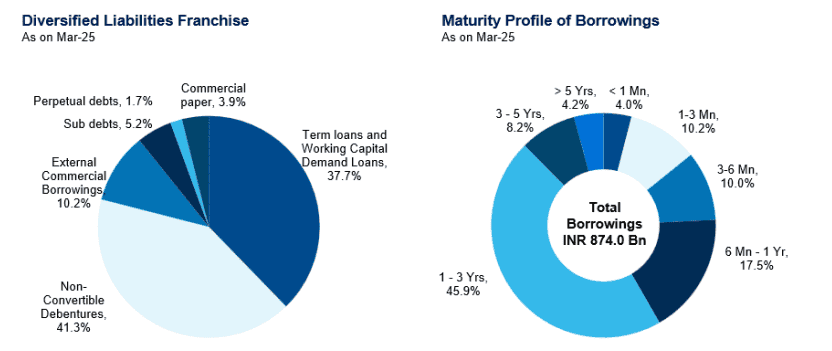

HDB is one that lends its AAA rating to a strong parentage and thereby reaping the advantage of a robust liability mix.

Source: Page 256 of RHP

Having said, this advantage has not fully translated into cost of funds in FY25 as HDB was one of the largest issuers of NCDs in FY24. Cost of funds stood at 7.90% in FY25, a tad higher than some of its larger peers. So, it may be a slow translation to lower rates.

But this advantage still holds it in a strong footing when it comes to incremental borrowings to fund its high AUM growth.

Financial Performance

HDB has demonstrated consistent financial performance track record over a decade of its existence with consistent RoE of ~15% for a decade till FY25, barring the Covid years.

Having said, FY25 did not pan out as robust as expected on account of asset quality issues. After a robust FY24, stress is back in FY25 with credit cost rising to 2.14% from 1.33% in FY24 and 2% in FY23, primarily emanating from the unsecured book.

Meanwhile, NIM compression on account of higher cost of funds also hurt profitability and hence brought down RoA to sub 2.5% level.

Here’s a glimpse into the last 3 years’ financial performance:

Going forward, recovery in NIMs and normalising credit cost should aid profitability growth.

HDB’s model allows it to operate at close to 8% NIM, 2% credit cost and 2.5% RoA on a sustainable basis.

HDB operates at a tad higher cost-to-income ratio, another key driver of RoA, than many if its peers and bringing it further down could aid RoA expansion beyond 2.5%, which would be a key long term monitorable.

Key risk

HDFC subsidiary, RBI draft regulation and the Valuation dilemma

There is a draft regulation from RBI that says that banks and their subsidiaries cannot operate in the same lines of business.

Though it is still at a draft stage, its implementation can have effect on valuation of HDB.

If it loses its HDFC parentage and continues to do well on business, HDB will be able to stand on its own and can even get a leg up to its market valuations. But then HDFC Bank’s exit may not be easy at a large market value and may remain an overhang on valuations until that happens.

On the contrary, HDFC Bank may decide to merge this subsidiary with itself and this optionality will exist so long as it remains a material subsidiary of HDFC Bank.

This overhang can potentially cap HDB’s valuation at same price to book as HDFC Bank and prevent any re-rating so long as it continues to be a material subsidiary of HDFC Bank. This is one of the reasons why the IPO may have been priced lower than anticipated by the market.

Here is how HDB compares with its peers in terms of key financial performance metrics

It can be seen from above key metrics that HDB Financial lags Bajaj Finance on key metrics like RoA and RoE despite operating at a higher leverage (advantage for RoA and RoE) than it.

Meanwhile, it also lags Cholalmandalam on quality of growth as Cholamandalam operates at same yield at 90% secured book and at more controlled credit cost, churning out better RoA

Sundaram Finance, though operates a fully secured book at lower yield, scores on lower opex and credit cost to churn out superior RoA.

In terms of overall performance HDB Financial stands a tad lower in ranking compared to some of its peers that enjoy premium valuation in the market. The IPO price appears to have sufficiently discounted these limitations.

Valuation

The IPO is priced at 3.3 times post-issue book value. Given that we’re already in Q1 FY26, with NBFCs expected to deliver stronger growth and profitability this year, the forward valuation will compress to under 3 times book value.

This pricing appears reasonable when weighing HDB Financial’s financial performance against the prevailing regulatory headwinds.

Our Take

HDB s strong segment positioning, scalability potential, and reasonable valuation make it a good IPO opportunity for diversified portfolios. However, it is important for investors to anchor expectations to earnings growth rather than seeking valuation premiums based on its HDFC subsidiary status or inappropriate comparisons with Bajaj Finance, as detailed in our analysis.

Long-term valuation re-rating remains possible if regulatory pressures ease and HDB Financial delivers material improvement in financial metrics. The investment case rests on fundamentals, not market hype.

6 thoughts on “Should you invest in the IPO of HDB Financial Services?”

I bought 35 shares of this in the unlisted market @1270, as luck would have it, i didnt get my ipo shares 🙁

Ok thanks, i searched it, was not very clear. thanks again.

As always excellent report by Chandra!

Thanks for the detailed analysis. What is not very clear is, should we apply for the IPO or Not.

Yes, you can, if your stock portfolio does not already have a high exposure to finance companies. We have mentioned it in the analysis. – thanks, Bhavana

Thank you for the timely and useful article.