Luggage from VIP industries are a household name and chances are that at some point in our lives, we have owned one of them. Established in 1968, the company is the market leader in the organized luggage space in India and among the largest luggage makers in Asia. It is also one of the only two listed luggage makers in India.

The stock has, however, been languishing for a bit plagued primarily by uncertainty at the top management and loss of market share. But at the end of March 2024, the stock suddenly saw a sharp run-up of over 12% in a single day. This was following an analyst meet that VIP held on March 27, during which they laid out the way forward for the company. Going by the reaction, clearly some investors (and brokers) were pleased by this.

Given this resurgence of market interest as well as a boom in the travel and holiday segments, we are picking the stock of VIP Industries for a comprehensive review.

What are Prime Reviews in stocks? In our stock reviews, we look at potential stock ideas. Stocks we choose for review could be in the news, or be seeing significant price action, or could be under-researched or could be emerging growth companies or those showing signs of turnaround. In these reviews, we take a detailed look at their business and industry fundamentals to check what has gone well, what is evolving, what could be the risks to the growth, what key metrics or parameters may need to be watched and more. These stocks are NOT a recommendation to buy, hold or sell the stock.

How do you use Prime Reviews in stocks? You can use these detailed stock reviews to get ideas for your own research, or to add to your watchlist, or to know more about under-researched stocks or even to understand about stock analysis & research. Note that we would not be providing regular updates on reviewed stocks, unlike our Prime Stocks.

Will these stocks become Prime Stocks? Some of the stocks we pick for review may find their way into Prime Stocks if parameters line up. We take an idea to Prime Stocks only if we feel that the risk-reward equation is highly in favour. However, it is certainly not necessary that we eventually shift all reviewed stocks into our recommendation list. Note that these stocks may form part of our smallcase portfolios – we may have such stocks in our portfolios as we can control allocations and the portfolio approach allows us to take tactical calls, unlike in Prime Stocks.

The luggage industry in India – multiple tailwinds

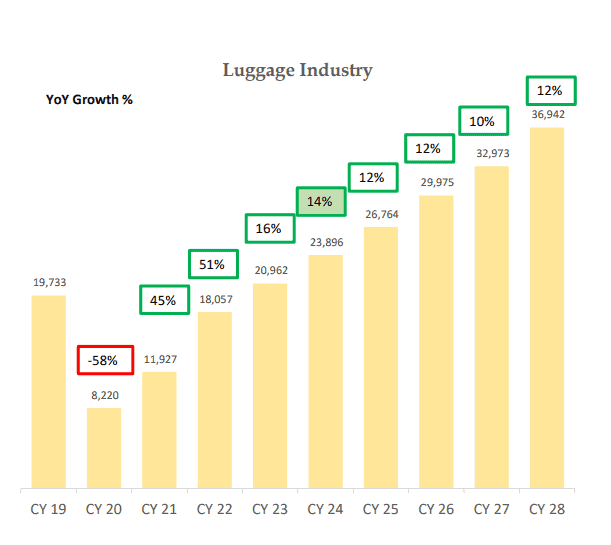

The Indian luggage and backpack industry is one of many that took a hit during the pandemic and then emerged stronger. Estimates currently place it at a Rs. 15,000 to 20,000 crore market that is projected to have grown 15% in FY 24. What’s more, double digit growth is estimated to continue till 2028!

Source: Company presentation dated March 2024

The industry is comprised of organized and unorganised players. While pre-Covid, the balance was tilted in favour of the unorganised players, things have changed and now the organized (branded) players account for 54% – 55% of the industry. A number of factors contributed to this shift. Mainly, the implementation of GST which led to evening out of the price difference between organized and unorganised players, supply chain disruptions (unorganised players were largely sourcing soft luggage from China) during the pandemic and a growing preference for branded luggage played spoilsport for the unorganised players.

This growing preference for branded luggage bodes well for the organized players – VIP Industries, Safari Industries and Samsonite – which account for the lion’s share of the organized space. But that’s not to say that these are the only players around! The luggage market hasn’t gone unnoticed by start-ups and names like Mokobara, Assembly and Nasher Miles have caught consumer attention in the D2C space.

The industry is also benefiting from the following tailwinds.

- A change in attitude to travel – what was originally thought to be ‘revenge travel’ post pandemic is apparently here to stay. The travel industry is on a growth trajectory and volumes are back at pre-pandemic levels. ‘Growing overseas-travel aspirations of people, especially after the pandemic and rising demand for short getaways’ are the factors behind this. A similar uptick is seen in business travel as well. This naturally translates into more demand for luggage.

- Luggage as lifestyle – Gone are the days when one held on to a suitcase for a decade and replaced it when it was falling apart. Not only does each family member get their own piece of luggage (maybe even more than one piece), this is also replaced every 2 -3 years and are viewed more as lifestyle products.

- Premiumisation – Rise in affluent middle income group that don’t just want any piece of luggage but are partial to branded products are feeding a growing premiumisation trend.

- Preference for hard luggage – An interesting shift that has started to take place post-pandemic is a growing preference for hard luggage and this too has worked well for the organized players. Hard luggage is less labour intensive and more amenable to design and detail innovation.

- Lastly, customers are no longer those that buy luggage just before a trip but include groups such as wedding parties and students heading out to university.

All of the above bodes well for VIP Industries as well as the other players in the organized space.

VIP – attractively positioned

In an industry that is on an uptick, all players are likely to benefit. But here, VIP Industries has a clear advantage as the market leader in terms of revenue, market share and capacity. VIP Industries has also been around the longest and is also one of only two listed players in an industry where there are only three dominant players at the moment.

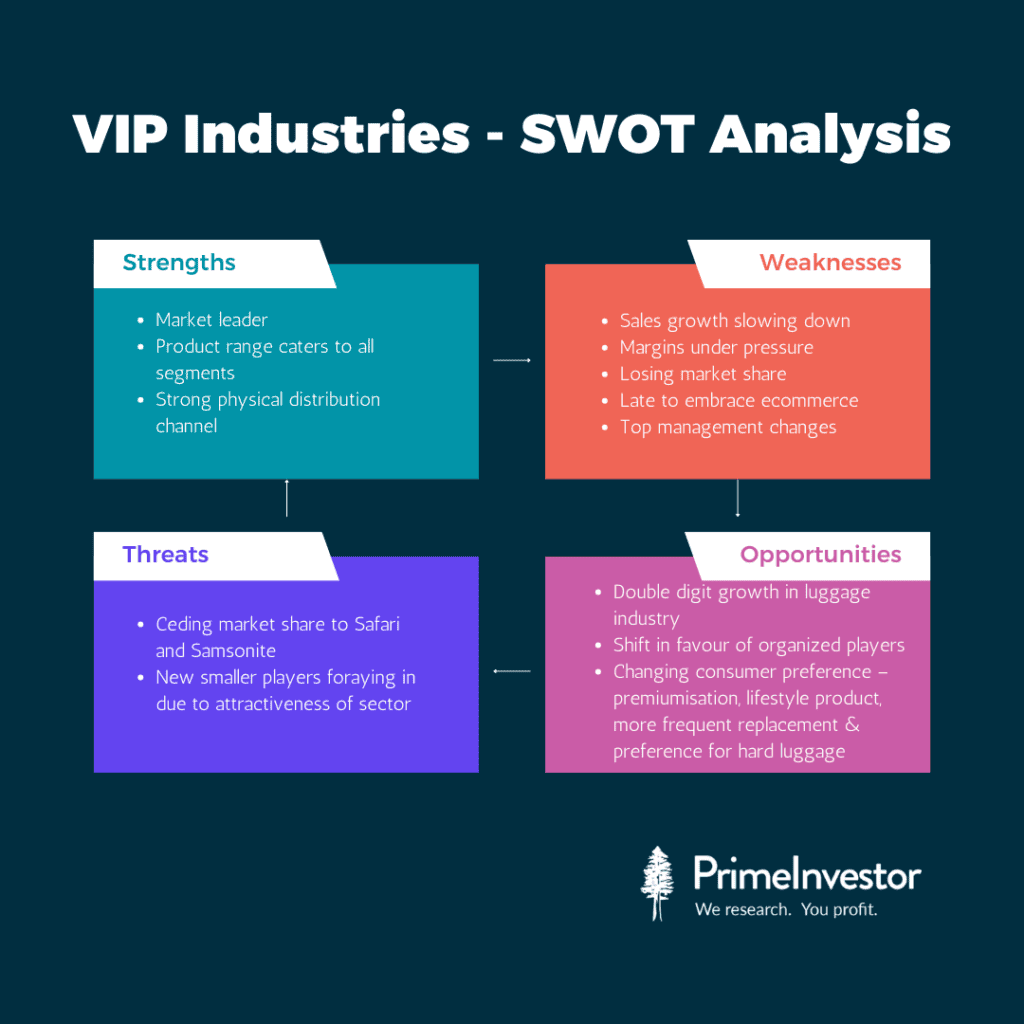

So, what’s the problem? Quite a few, actually.

Despite a sharp recovery in revenues post-pandemic which the market acknowledged and rewarded as well, the subsequent quarters saw significant plateauing of revenues and a decline in margins.

Let’s dive deep in to the problems:

#1 Revenue growth has slowed down

Between FY 19 and FY 23, the topline of VIP Industries only grew by a CAGR of 3.9% as against Safari that marched ahead at a CAGR of 20.3%. Safari likely benefited from external factors such as a preference for branded players in the value segment which is its original focus area and implementation of GST. But it was also an early adopter of ecommerce as a distribution channel which VIP took a while to embrace.

Incidentally, the MD of Safari Industries, Sudhir Jatia, is a former MD of VIP Industries who left to make way for the next generation to take over at VIP, and bought Safari Industries in 2011.

#2 Declining market share

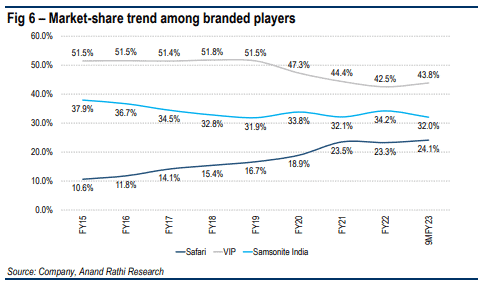

The above has naturally led to an inevitable drop in VIP’s market share that has been ceded to Safari and Samsonite and maybe even some smaller new entrants - a disruption that is only to be expected in an industry that is attractively positioned and dominated by only a few large players.

Source: Anand Rathi research report

As per the analyst meet held in March 2024, VIP’s market share currently stands at 38% as against the 48% 5 years ago.

#3 Margins have not improved

Gross margins (margins based on direct costs of production alone) have benefited from favourable raw material prices; raw material cost comprises around half the cost. While this has been an industry-wide phenomenon, in the case of VIP, raw material costs that were 47% - 48% of sales in FY 23 and FY 22, peaked at 50.5% in Q1 before settling at around 44% in Q2 and Q3. This has remained well above 50% for Safari, who focusses on the mass / value segment of the organized luggage sector. VIP’s in-house cost optimization efforts too helped improve gross margins.

However, the benefit of cost controls didn’t translate into better EBITDA margins. The company attributes this to higher freight costs and accelerated spends on e-commerce, where VIP let Safari get ahead. This apart, the company seems to have forked out a handsome sum for consultant BCG, hired to advise on e-commerce strategy.

#4 Frequent changes in top management

Uncertainty at the top has also weighed the company and the stock down. Neetu Kashiramka, the current MD was appointed in August 2023, when her predecessor, Anindya Dutta resigned with ‘immediate effect’ and due to ‘personal reasons’. He had joined the company in 2021. His predecessor, too, had occupied the MD’s position for only three years.

The newly-appointed MD has been its CFO since April 2020. Her previous stints were largely in the consumer industry as VP Finance at Jyothi Laboratories Ltd. and then CFO at Greaves Cotton Limited. More recently, a further rejig of the senior level positions at the company has been carried out to bring in ‘fresh blood and fresh thinking’.

Can VIP reinvent itself or are its best days behind it?

Though the VIP stock hit a new high on the back of post Covid recovery, it kept giving up easily with each quarter throwing up fresh challenges through FY24 as explained above. Now, the management is on a war footing to address these challenges and bring the business back on track.

Going by the analyst meet on March 27th (and subsequent media interactions with the MD), the management is not taking things lying down.

Changing the way the world sees VIP’s brands

VIP Industries has under its umbrella the following brands: Carlton (premium); VIP (mid-range, family), Skybags (mid to lower end range, aspirational), Aristocrat (mass) and Caprese (handbags).

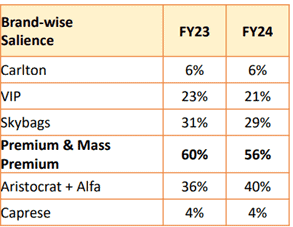

With this suite of brands, it pretty much caters to every customer segment. However, Aristocrat, the mass brand, accounts for the biggest chunk of revenue followed by Skybags. With the revenue mix skewed in favour of the products with the lower price points, margins too will be limited. While these brands command strong recall, the question is whether customer preference for them can remain strong – towards addressing both the reliance on these brands and a possible dent in customer preference, the management is aiming to reduce reliance on these brands and turn around their image.

Source: Company earnings presentation

Management has articulated that changing the brand perception is high on the agenda with a focus on premiumisation. Soon after taking over, the new MD identified key issues were relevance of designs and a need for timely inventory filling.

To address the design issues, an award-winning international designer has been roped in and over two dozen new launches[BA1] were lined up starting from Q4 FY 24. In addition, a change in the revenue mix by brands is also being targeted which if successful, could be revenue and margin accretive.

VIP: This progressive, family focused brand will have an image upgrade through tech-led and smart products.

Carlton: Currently a Rs. 140 crore brand, the company hopes to get it to Rs. 500 crores in three years. New collections under this brand will be launched at higher price points and the range will be refreshed frequently to motivate customers to upgrade. Focusing on aesthetics, luxury and style, the possibility of international warranties for the brand too will be explored. Plans are also underway to add 25 Carlton stores by the end of the year.

Skybags: The company intends the Skybags brand to be edgy, fun, premium and aspirational going forward with the mass / value range to be limited to Aristocrat and Alfa. More frequent refreshes too are in the works for the Skybags brand targeting a younger customer segment.

Aristocrat (and Alfa): Aristocrat which is a Rs. 1,000 crore brand offers durability and affordability and targets travelers who use trains and buses. Apart from adding a new range of bags under this brand and a gifting range, management sees this brand’s contribution dropping to 25% to 30% of revenue, even while it grows at 10% as the other brands grow at a faster clip.

Caprese: This trendy handbag brand will get a push with a new brand ambassador who has already been appointed. Further, to keep the trendiness on point, changes will be made per fashion season. This year, 50 additional Caprese stores (including kiosks) will be added.

Getting the product to the customer

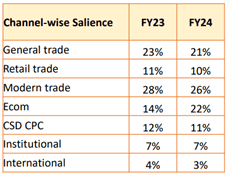

One of the reasons that led to market share erosion was the relative late adoption of ecommerce as a distribution channel. While in terms of touchpoints VIP Industries is ahead of its peers, it fell behind in adapting to ecommerce. A break up of VIP Industries revenue by channel looks like this. While for the 9M FY 23 ecommerce brought in 14%, it was already well over 20% for Safari at that point.

Source: Company earnings presentation

This is one of the areas that is being targeted along with variations in product range to make the ecommerce channel more attractive. Based on the numbers, the company is already improving on this front. It started at 6% revenue share pre-pandemic which then rose to 10% and presently over 20%. The targeted level for this is 25%.

Meanwhile, supply chain issues are also being addressed. This apart, the company is working on better relationships with dealers and channel partners, adding new stores and new EBOs under a franchise model.

Overall, the company expects revenue to grow at ~2% faster than the industry. Q4 FY 24 revenue, as promised, has grown 15% YoY. Market share too is expected to show improvement on account of these measures from Q4 FY 24 and eventually the company aspires to hit the 45% mark.

Getting the margins back up

The first part of measures to boost margins is growing the top line and this is going to be driven via premiumisation and a change in product mix. For example, Carlton is a higher-margin brand and as its share in revenue grows, margins too will benefit. Cost optimization measures too are expected to help.

- Consulting fees being paid to BCG (ecommerce) will stop as the assignment concludes which will bring down costs.

- Distributed manufacturing and outsourced warehousing (which is being tried out on a pilot basis) are expected to aid margins.

- Management is exploring the possibility of savings to the tune of Rs. 100 crores (4% - 5% of current year’s revenue) as per the latest earnings update. This is under the head other expenses and includes items such as freight and ecommerce.

- All of this coupled with quicker decision making on non-performing products and clearing up of inventory (mostly soft luggage) is expected to buoy margins.

Gross margins closed at 52.6% for the whole year (this is also the guidance for the next financial year) but dropped to 50% in Q4 FY 24. EBITDA margin that the company is targeting is 15% by second half of FY 25. This seems like a stretch from the 9.1% clocked for FY 24; it needs to be seen if the targeted action as detailed above will bear fruit.

Since the company has been able to maintain gross margins at or above the 50% mark despite challenges, the management may just be able to bring back EBIDTA margins to desired levels as the expenditure side undergoes tweaks.

Valuation

At 133 times PE, it appears that VIP Industries is getting a higher multiple awarded by the markets. However, this is primarily on account of the low ‘E’ - TTM EPS has been at its lowest in the last four quarters. The market cap to sales ratio or EV/EBIDTA when compared to Safari Industries tells a different story.

However, working on the assumption that the plans laid out by the management of VIP Industries do bear fruit and FY 25 revenue grows at 15% and margins come in at 15%, this translates to ~ 44 times FY 25 earnings. This would be reasonable IF the new rejigged top management team delivers – and that is the key to this stock’s success at this point.

Disclosures and Disclaimers

The following Disclosures are being made in compliance with the SEBI Research Analyst Regulations 2014 (hereinafter referred to as the Regulations).

1. PrimeInvestor Financial Research Pvt Ltd is a SEBI-Registered Research Analyst having SEBI registration number INH200008653. PrimeInvestor Financial Research Pvt Ltd, the research entity, is engaged in providing research services and information on personal financial products. This Research Report (called Report) is prepared and distributed by PrimeInvestor Financial Research Pvt Ltd with brand name PrimeInvestor.

2. PrimeInvestor Financial Research Pvt Ltd, its partners, employees, directors or agents, do not have any material adverse disciplinary history as on the date of publication of this report.

3. I, Pavithra Jaivant, author/s and the name/s in this report, hereby certify that all of the views expressed in this research report accurately reflect my/our views about the subject issuer(s) or securities. I/We also certify that no part of my/our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report. I/we or my/our relative or PrimeInvestor Financial Research Pvt Ltd do not have any financial interest in the subject company.

I/we or my/our relative or PrimeInvestor Financial Research Pvt Ltd do not have beneficial ownership of 1% or more in the subject company at the end of the month immediately preceding the date of publication of the Research Report. I/we or my/our relative or PrimeInvestor Financial Research Pvt Ltd do not have any material conflict of interest. I/we have not served as director / officer, etc. in the subject company in the last 12-month period.

4. I, Pavithra Jaivant, do not hold this stock as part of my investment portfolio. I/analysts in the Company have not traded in the subject stock thirty days preceding this research report and will not trade within five days of publication of the research report as required by regulations.

5. PrimeInvestor Financial Research Pvt Ltd has not received any compensation from the subject company in the past twelve months. PrimeInvestor Financial Research Pvt Ltd has not been engaged in market making activity for the subject company.

6. In the last 12-month period ending on the last day of the month immediately preceding the date of publication of this research report, PrimeInvestor Financial Research Pvt Ltd has not received compensation or other benefits from the subject company of this research report or any other third-party in connection with this report.

4 thoughts on “Prime Review – Can VIP Industries shed the baggage that is weighing it down?”

Great article. Turnarounds are usually hard, arent they? As you have shown, even post turnaround, the valuations are not exactly cheap. Hence my question – How do you see Safari at current levels instead of VIP if one wants to take a bet on this sector?

Hello and thank you for your comment.

Yes turnarounds are hard but not impossible 🙂 Safari itself is a case study in turnarounds. It was already a ten-year old brand when Sudhir Jatia acquired it and revitalised it. Safari’s strength lies in the value segment (though now it plans to spread its wings and venture into the other segments as well). Given its erstwhile focus on the value segment, it would have no doubt also benefited from tailwinds such as shift toward branded players and GST implementation which would have helped it clock a more rapid growth. But this focus on the value segment also meant that margins were under pressure historically (though this changed in FY 23 and FY 24).

Of late, especially post Covid, the sudden shift in demand trends have been affecting different Cos in different ways. Some happen to be at the right place at the right time to reap it.

What VIP has going for it in this business is a diversified product portfolio, identification and acknowledgement of issues by management (product gaps, fill rates, inventory) and charting a sensible and practical revival plan (no major capex, it’s largely product, design and opex).

Thanks Pavithra. Appreciate your feedback

Informative article. Thanks.

Comments are closed.