When you see a houseful of seasoned and budding investors looking for newer opportunities to invest, you are all respect for their efforts to invest well. A recent event on stock ideas that I attended had such a gathering. And what most looked for was undiscovered stocks, and more so the potential undiscovered multi-baggers! Now, I have a problem to pick with those who believe that they can strike it rich only if they can discover such stocks and that nothing else will do.

Such folks have tremendous conviction that small caps cannot go wrong for the following seemingly logical reasons: one, small cap companies are under-researched and hence underpriced. Two, small cap companies are riskier and therefore should deliver more. Three, low base effect works beautifully to produce multi-baggers.

The truth about small cap companies

Sorry, but small-cap stocks are, well, stocks. The above points do not provide them any fillip unless they pass through every sound filter that applies to all stocks. And some filters apply more for small caps. For example, your entry price can really be the make or break for your small cap stock’s return. This may not always be the case with larger stocks.

Two, the profits you see on books is never the profit you really get with small caps. When liquidity dries up, it does so in no time, leaving a yawning gap between what you thought was your profit versus what you really make.

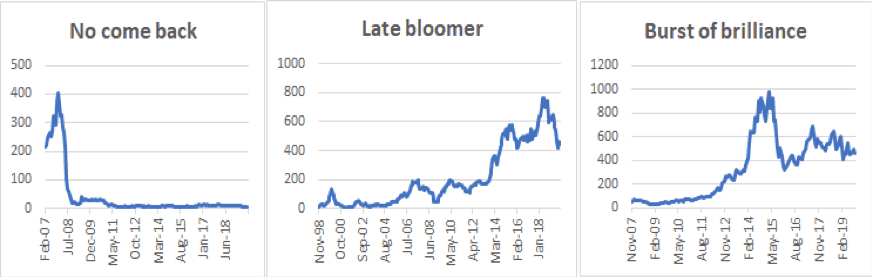

And third, beyond all, is a fact few small-cap supporters will admit: that the period of brilliance in performance of small caps is limited and can shift very swiftly. Larger companies have a much longer staying period in terms of returns they can deliver. Look at the three graphs below. I have removed the name of all the 3 small and micro caps (turned penny stocks too). Most retail investors tend to participate in a story like the one in the ‘no come back’ graph and get hurt very badly. The ‘late bloomer’ is a wonderful example for small cap brilliance. But look at the time frame over which the stock has bloomed. How many have the staying power and what is the opportunity loss? And the return is an annualized 19% over 20 years. This is a return that stocks that were already large-cap managed to beat over this period. The third is the classic burst of brilliance and then quickly slipping to middle path.

Why the success stories are hard

Stocks work wonderfully when picked from the bottom of a bear market. This is most true of small cap companies because this segment takes the brunt of the bear hit and when they bounce back, show higher momentum from a low base.

But here’s the problem. Many of them are beaten down in a bear market. How do you pick the ‘best value’? Let us take the recent example of the correction in small caps. Since the January 2018 peak, 77 of the 100 Nifty Small cap index stocks are in losses. The average fall for these stocks is 41%.

Now, the problem is if you had a quality large cap with a steep fall, you know the stock of a sound established company will make a comeback when the economy stabilizes; be it a bank, an engineering or auto company, provided its fundamentals remain intact.

I am not a large-cap campaigner, nor do I believe that small caps are useless. My simple point is – do not be lured by the ‘5 multi-baggers for 2019/forever’ story done to death in media and by punters.

However, the challenges are multiple in small cap companies : first, the fundamentals can change quickly when a small company fails to recover from a macro issue. Second, the multi-baggers in small caps are often driven by themes. If the last success story was a retail chain, then recency bias of picking such a stock in the current beaten down market sets in. The problem lies there. If you do not know what the next emerging theme is, picking on a lost theme is hardly value. In fact, you end up buying at ‘peak’ valuation despite a price correction. If you are unlucky then you will be holding a ‘no come back’ stock. Or with some luck, you might hold a stock that delivers marginally like the ‘burst of brilliance’ graph (post the fall from grace, that is).

Third, the problem is compounded when the stock you picked as ‘value’ falls more. In the process of averaging, there is more good money thrown after bad. The accumulation of small-cap stocks is one of the hardest decisions and often where you really lose.

I am not a large-cap campaigner, nor do I believe that small cap companies are useless. My simple point is – do not be lured by the ‘5 multi-baggers for 2019/forever’ story done to death in media and by punters. Build a boringly solid portfolio and add a few small caps or small-cap funds for zing. You can free up your time spent on poring over numbers and instead watch a nice cricket match or a walk on the beach. Trust me, you will still build wealth.

This article first appeared in The Hindu dated October 14, 2019.

Also Read : Blue Chip India Stocks