In these reviews, we pick stocks that have rallied, or where businesses are interesting or changing, or where companies may be relatively unknown and so on. We present an analysis of these stocks, covering what has driven them, business prospects, threats and more. These reviews are meant to give you an understanding of a stock. They are not our recommendations.

In India, storage batteries find application not just in the automobile sector but also in other industries, UPS for homes and offices, data centres, cell phone towers, AC compartments in the Railways, warehouse applications and solar power storage cells. Currently dominated by lead acid batteries, the market size for storage batteries stands at over Rs. 35,000 crore. About 65% of the market is controlled by large organised players, 25% by SMEs and 5% by small-scale industries.

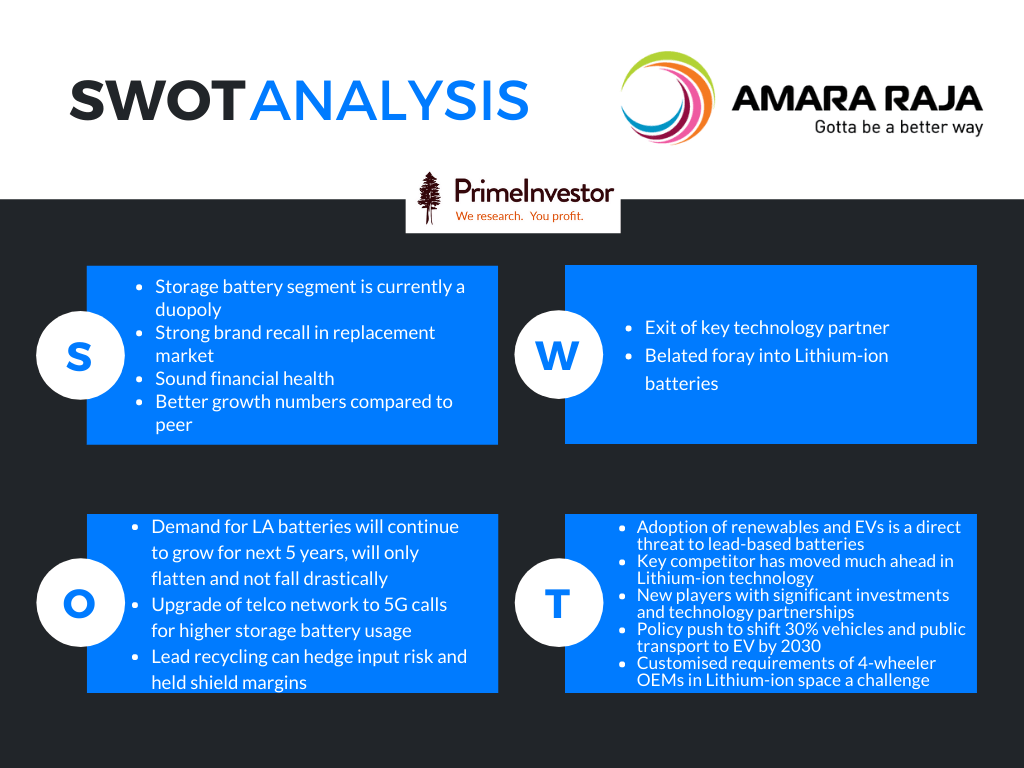

Primarily, storage batteries can be of tubular LA (lead-acid) type – these are large and mostly seen in the home UPS setups – or VRLA (valve regulated lead-acid) batteries found in passenger vehicles. According to the sixth edition of India Energy Storage Alliance report (2020-2027) the Indian market is currently using 53% LA batteries 44% VRLA batteries and 3% Lithium-ion batteries. But over the course of the next five years, market share numbers are predicted to skew towards lithium-ion batteries with a declining share for LA and VRLA batteries. It is difficult to put precise numbers to relative market sizes at this point in time. The shift is expected to be driven by the government’s intent of transitioning all public transport to EV mode, to have 30% of all vehicles sold as EVs by 2030, and the PLI (Production Linked Incentive) scheme for companies in the storage battery segment to promote new and niche cell technologies.

Pluses

Amara Raja Batteries Limited (ARBL) is the second largest storage battery manufacturer in India by revenue. The organised sector is a duopoly structure with two major players, ARBL and Exide Industries.

#1 Sound financials

The company is debt free, and has been growing its topline continuously for the last 10 years with steady margins, a decent ROE & ROCE profile averaging 17% and 23% respectively in the last three years

The slow-down in growth in the last couple of years is due to the deceleration in the automotive and telecom sector over the last 3 years. For FY20, sales of passenger vehicles in India fell by 18% and vehicle sales fell below 3 million units for the first time in three years. The telecom sector is also going through a consolidation phase. Despite these challenges with the OEM (original equipment manufacturer) market, Amara Raja Batteries Limited maintained decent aftermarket sales which not only compensated the loss of OEM sales but also grew the overall business.

#2 Expanding clients

The key concern surrounding storage battery makers like Amara Raja Batteries Limited is the likely obsolescence of lead-acid batteries given its adverse environmental impact. Amara Raja Batteries Limited has thus chalked out plans to manage a 15-17% growth rate in topline by diversifying beyond battery sales. For one, the company is broadening its focus to BMS (battery management systems) - integrated modules which will play a key role in integrated EV charging infrastructure and enable charging control, cell monitoring, battery safety and protection. Two, Amara Raja Batteries Limited is planning to set up an additional international base with a 6 million unit capacity to serve its export clients better. This may require Rs.700-800 crore going by the investment it has made recently for a greenfield plant of 6.5million units. The company should be able to fund this through internal accruals. Exports currently make up a small portion of Amara Raja Batteries Limited’s revenue at around Rs. 900 crore, but the export business has been growing at a ~22% CAGR in the last 5 years. Three, Amara Raja Batteries Limited is consolidating its position in the UPS market and solar segments.

Amara Raja Batteries Limited has also been steadily broad basing its customers adding more clients within the automotive segment too. From getting the preferred supplier status for Tata Motors cars in FY18, Amara Raja has managed to significantly add to its OEM customer base. In FY20, it added 2 large two-wheeler OEMs as its clients. The company has undertaken another major capex through a 6.5 million unit greenfield plant in phases from FY20 with an investment of Rs.700 crore. Pursuant to this, it has 14 million units of 4-wheeler and 20 million units of 2-wheeler battery capacity.

Though the perception is that the Indian battery market is mainly branded, there are pockets of opportunity in the fragmented market. While the OEM market is dominated by branded players, in replacement market organised players have a 80% share in the passenger and 2-wheeler segments and just a 40% share in the commercial vehicle, tractors and home UPS segments. This presents an opportunity for players like Amara Raja Batteries Limited to expand their sales. Competing in this market may call for lower pricing and may dilute margins while adding to the volumes.

#3 Conventional batteries here to stay

Even if Lithium Ion or other storage batteries take the place of conventional batteries, the demand for the latter is unlikely to decline immediately as availability of Lithium in sufficient quantities is a key constraint in transitioning all vehicles from traditional storage batteries to Lithium-ion batteries. The lifespan of an automotive battery is about 3 to 3.5 years, requiring vehicles with older batteries to regularly replace them. The replacement market is growing at about 7-8% CAGR. For the company, sales from this segment grew at 9.7% in FY20. As per current estimates by the company, LA/VRLA battery demand is expected to continue to increase until 2030 and flatten after that, but not decline.

LA batteries will continue to be the preferred product for most of the applications currently in use, as they are the most cost-efficient option. LA batteries will also find application in EVs for auxiliary power. Increasing share of E-rickshaw is another opportunity as these vehicles use four large LA batteries that need to be replaced every 9 months. Currently unorganised players have a higher market share in that space as the E-rickshaw segment itself is fragmented. With the entry of mainstream players and consolidation, battery sourcing could shift towards OEM suppliers like Amara Raja Batteries Limited.

The demand from telecom space is expected to increase with the adoption of 5G in the coming years as this will lead to higher requirement for power storage at the cell towers. China and the US, who mostly use 5G technology, consume about 6176 Twh and 3971 Twh respectively, while India consumes about 1243 Twh as of FY20.

#4 Lithium-ion foray

Amara Raja Batteries Limited is no stranger to product obsolescence threats and has diversified in the past to cope with it. Prior to 2016 it was mainly into automotive batteries. In FY17 it opened a new tubular battery unit which added home UPS batteries also to its product line. As the Lithium-ion tech grew in recent years, in FY19 ARBL set up a pilot unit for Lithium-ion batteries for two and three wheelers. It had bagged an order for a 500Kwh Lithium battery installation for a major telecom player in the year FY20. Beyond supplying storage batteries for telecom, it also started bundling telecom tower management services as an outcome of its R&D in the field of IOT. R&D spends stood at Rs. 16.9 crore in FY20 up by over 60% from Rs.10.29 crore in FY18.

Amara Raja Batteries Limited had a long-standing collaboration with US-based Johnson Controls which came to an end in 2019, with the hive-off and sale of the battery division by Johnson Controls to private equity player Brookfields. The new entity re-named as Clarios retained the 24% stake originally held by Johnson Controls, until it sold 10% in the open market recently. After the sale, it still retains 14% under the public-shareholding category. This could pave the way for new partnerships with global players in the Lithium-ion battery technology but could miss out on a jump start on the new-gen battery front due to Johnson’s exit.

#5 Cost savings through recycling

The company is heavily dependent on lead as raw material and so its upward price movement does have an effect on margins. While it tends to pass on the price impact without much lag in a good demand environment, in a weak demand scenario post-Covid this may prove difficult. Global lead prices however have been lower in the past two years compared to earlier years, which translated into higher operating profits and net margins for Amara Raja Batteries Limited. In 2021 so far, lead prices have risen 16% and the margin pressure was reflected in Q4 numbers. But a recent Fitch report predicts moderate lead prices of $2113 per tonne, up just 5% from current levels, through CY22 to CY25 considering demand-supply factors and downside pressure due to the shift to Lithium-ion batteries. This should help ARBL to operate at stable margins.

Over the medium to long term, the evolution of a reverse supply chain for recycling of storage batteries could also help players like Amara Raja Batteries Limited reap cost savings on the raw material side and act as a partial hedge against rising raw material prices. Amara Raja Batteries Limited on its part has set up over 30+ pan India collection points via franchises to source used batteries, with recycling expected to reduce procurement costs. The company has also approved capex of Rs. 280 crore in February 2021 to be spent over the next 18 months, for setting up a greenfield lead acid recycling plant with an estimated capacity of 1 lakh tonnes per annum.

Peer Comparison

Though second in terms of sales and market share, Amara Raja Batteries Limited has stayed ahead of its rival Exide Industries on some key metrics.

Key risks

#1 Despite a pilot foray, Amara Raja Batteries Limited has not yet made meaningful progress in the Lithium-ion battery segment. While standardisation is possible in 2 and 3-wheeler segments, each vehicle manufacturer will have their own requirements and cell chemistry in passenger cars. In the case of 4 wheelers, the EV battery accounts for 40% of the cost of the entire vehicle. The battery pack design including the assembly of modules with cooling features will need a lot of customisation according to the needs of individual customers.

So, these are early days to talk about the nature and potential of business in that segment for battery makers like Amara Raja Batteries Limited. Lithium-ion batteries / cells are packaged into a module, which is available in different types. A regular cylindrical cell type which is high in energy and easy to manufacture, second the prismatic model usually packaged in steel or aluminium but very costly to manufacture and lastly the pouch-cell type, which is light weight and cost effective but of lower life span when exposed to high humidity or temperature.

Rivals like Exide have moved faster to de-risk their business by inking global partnerships. Even as Amara Raja Batteries Limited has just set up a pilot line for 2 and 3-wheeler Lithium-ion batteries, Exide had partnered with a Switzerland based Lithium-ion cell manufacturer leclanche for a 75:25 JV called Nexcharge way back in FY18 and has ready production lines for all the three types of Lithium-ion battery modules. It has also bagged an order for 3000 battery packs for an electric 3-wheeler from a large OEM for a value of Rs 18 crore.

Amara Raja Batteries Limited recently announced its plans to set up a new Energy SBU (strategic business unit) focussed on lithium cells and battery packs, EV chargers, energy storage systems, advanced home energy solutions and related products and services entailing an investment of over $1 billion, though specifics have not been provided. These plans will need to be fleshed out to assess the contribution to Amara Raja Batteries Limited’s revenues, investment requirement in phases and impact on financials.

#2 With any new and disruptive technology, a threat to the current sales and market shares of established players like Amara Raja Batteries Limited can come from completely new contenders. New players are flocking in numbers to the Lithium-ion battery segment in India.

- TDSG (Toshiba-Denso Suzuki Gujarat) has been set up inside Maruti Supplier park with an investment of Rs.1310 crore and has become operational by February 2021.

- Tata Chemicals is working with ISRO and CSIR - CECRI and has launched its Lithium-ion battery recycling operations with Tata Auto comp GY battery division. It is also expected to manufacture battery casings with a planned investment of Rs. 800 crore

- ATL Amperex Technology has spent over Rs. 550 crore to acquire land near Haryana for a Lithium-ion battery manufacturing plant. It plans to invest over Rs. 700 crore

- Li-energy has been allocated 125 acres of land in the SEZ, Thondi, Tamilnadu

#3 A faster-than-expected adoption of EVs by consumers and policymakers could significantly impair revenue and profit visibility for storage battery players like Amara Raja Batteries Limited. Major adoption may kick in from the 2 and 3-wheeler segments initially helped by liberal subsidies from the Government. But the path to Lithium-ion technology adoption is not so clear in 4-wheelers. With complex options to choose from and OEMs yet to finalise their preferred type of battery and BMS design, the shift to Lithium-ion may not happen all that quickly, offering a breather to players like ABRL.

Valuation

The slow progress on Lithium-ion battery technology and exit of the long-standing joint venture partner have created a justifiable overhang on ARBL’s stock valuations. It currently trades at a PE of 19.7, lower than its last 1 year and 3-year averages.

Suitability

Overall given its financial metrics, Amara Raja Batteries Limited is currently a sound holding for investors seeking stable companies at decent valuations. Amara Raja Batteries Limited’s ability to break into the Lithium-ion segment and its ability to ink new collaborations with global players to power this foray, will be factors to watch if the stock is to be re-rated. With ARBL making more Rs 300-400 crore in free cash flows every year, normal capacity expansions can be comfortably funded while any larger capex plans are likely to entail dilution.

6 thoughts on “Stock Review : Amara Raja Batteries – A fancied stock that has lost speed”

Quite an analysis 🙂

entry of new players with international tie up, in segment may further dent market share of Amar Raja.

Recycling of batteries, which are majorly in fragmented segments, may further put pressure on new SALES.

So in that context view of PRIMEINVESTOR pl

You’re right 🙂 That’s what we have alluded too as well. Vidya

the analysis is good and assume the recommendation is on hold, It would have been powerful if management comments on Lithium Ion progress, update included as that can change the outlook of the analysis,

Please refer your conclusion: Overall given its financial metrics, Amara Raja Batteries Limited is currently a sound holding for investors seeking stable companies at decent valuations. Amara Raja Batteries Limited’s ability to break into the Lithium-ion segment and its ability to ink new collaborations with global players to power this foray, will be factors to watch if the stock is to be re-rated.

It would appear that the stock is presently correctly valued and a hold; but for it to become a desirable buy, its future plans will need to be watched.

Thanks a lot for a detailed analysis.

Sudhakarudu

Comments are closed.