After the market debut of other platform companies such as Eternal, FSN E Commerce and Swiggy, consumer services platform Urban Company, is planning to launch an IPO at a price band of Rs.98-103 per share (Re.1 face value) in a Rs.1900 crore offering. The issue will open on September 10th and close on 12th.

The issue comprises a fresh issue of shares worth Rs.472 crore and offer for sale worth Rs. 1428 crore. At the upper end of this price band, the company will be valued at Rs.14,970 crore.

Accel, Tiger Global, Elevation Capital and Bessemer are the major selling shareholders, together selling up to a 10% stake in the IPO.

The company’s promoters own 19.95% stake and are not part of selling shareholders.

Business

Urban Company (UC) was funded by three first generation entrepreneurs, Varun Khaitan, Abhiraj Singh and Raghav Bhal, to offer online booking to cater to the basic home services needs of urbanites in a frictionless manner. UC operates a technology driven, full-stack online platform for quality services across various home services categories. It operates in 51 cities across India, UAE and Singapore, of which 47 cities are in India. UC’s platform enables consumers to pre-book services such as cleaning, pest control, electrical work, plumbing, carpentry, appliance servicing and repair, apart from on demand house-help, painting, skincare, hair grooming and a range of salon services.

Like ride handling and food delivery this platform solves key consumer challenges arising from the rise pf double income families and paucity of time in the metros. Uber and Ola solve for cost, convenience and reliability in intra-city commutes, Zomato and Swiggy free the same consumers of cooking chores. Urban Company seeks to save consumers time and effort by aggregating high-contact household services which help urban households function smoothly. In the process, it is trying to formalize an extremely fragmented segment of India’s services economy. For UC, 87% of its revenues comes from India while UAE and Singapore contribute to 13%.

It is the India business we will focus on, as it is the main driver of IPO valuations.

Positives

#1 Wide canvas of opportunity in online services

Smartphones and internet access have catalysed the growth of India’s digital ecosystem, fostering a culture of convenience-based consumption. This is complemented by digital payments infrastructure which has fuelled online commerce. India’s Internet users are projected to reach 990-1,140 million by FY2030, covering majority of the population.

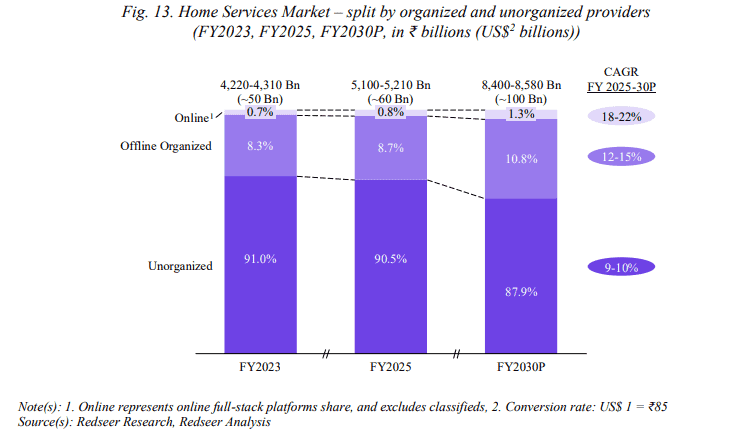

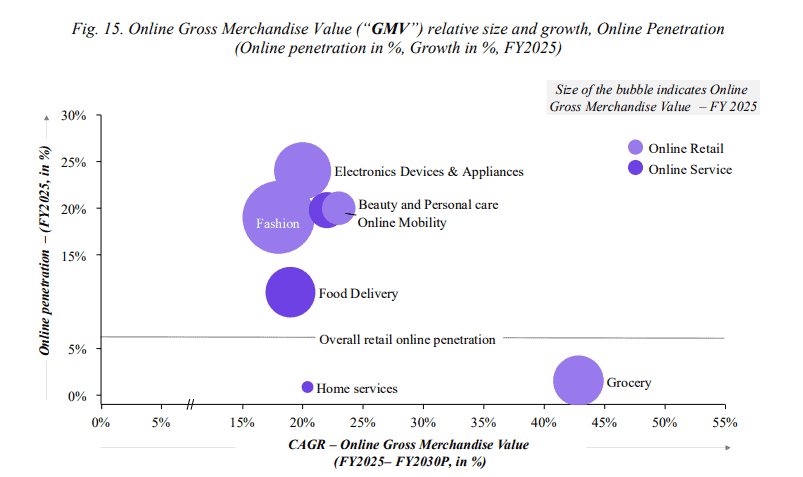

The home services market in urban India, where UC operates, is rapidly evolving and encompasses a wide array of services aimed at keeping the household running smoothly while enhancing convenience and quality of life for urbanites. According to Redseer Research, the total addressable market (TAM) for such services in physical terms is estimated at Rs.5,100-5,210 billion (~$60 billion) in FY2025, which is projected to grow at a CAGR of 10-11%, to reach Rs.8,400-8,580 billion (~$100 billion) in FY2030 driven by rising urbanization. The market is unorganized, fragmented, and offline, with overall online penetration of just <1% as of FY2025, based on net transaction value. Penetration in top 8 cities is slightly higher at 3.2%.

The growth projection of 18-22% CAGR from FY2025-2030 assumes that the online home services industry, sized at Rs.41-43 billion (Rs.4,100-4,300 crore) now, will reach 1.3% penetration by 2030 (3.5% in top 8 cities). UC currently holds ~20% share in this market while competitors such as Housejoy and Swiggy’s Pyng are other smaller players. Provided online players manage to solve for supply-side issues, the TAM for online services can offer a wider canvas of opportunity than food delivery services, given significant consumer spends on services offered that are not yet covered by these platforms (drivers and cooks for instance).

Unlike food delivery where platforms work with an organised network of restaurants and cloud kitchens, consumer services platforms like Urban Company face the challenge of onboarding, training, professionalising and retaining individual service providers who are used to working in an extremely informal setup. This presents a challenge because high-contact services require service partners to interact with prolonged periods with the consumer and deliver services in widely different and non-standard environments. This fragmentation and lack of formalisation however represents a moat too, as it is not very easy for any new player to replicate UC’s large base of trained service providers.

The informal home services market suffers from inconsistencies in availability, pricing, quality, and post-service support as it is largely unorganised. This presents an opportunity for technology-driven platforms to standardize services, fix pricing, match demand with supply. There are clear benefits for service personnel too from onboarding platforms as they gain bargaining power on fees, get access to a large target market for their services through the platform and get reasonable visibility on assignments compared to working on their own.

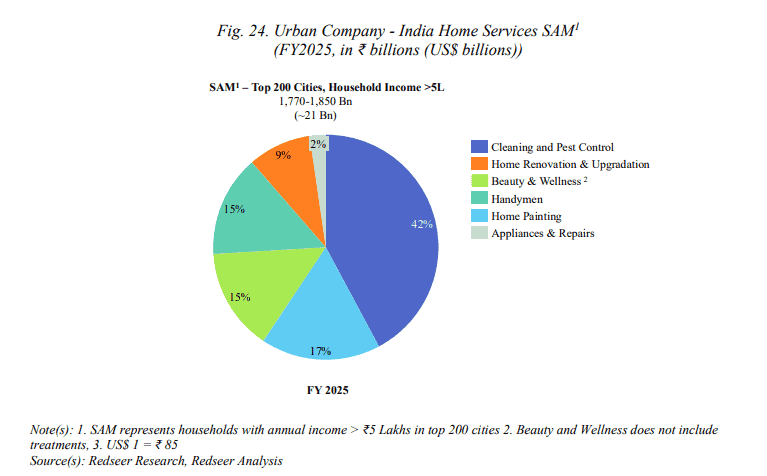

UC has presence in 47 cities In India and has potential to expand up to the top 200 cities by FY2030. It currently offers only a subset of home services with focus on beauty, cleaning and repairs (handymen). Major categories it excludes are care at home and cooks that make up ~25% of the total addressable home services market.

This results in a serviceable addressable market (SAM) for UC at Rs.1,770-1,850 billion (~$21 billion), which is 35-36% of the TAM as of FY2025. UC serves middle-income households and above, with income over Rs.5 lakhs per annum, and its SAM in terms of no. of households will be 53 million households in top 200 cities that use home services (both online and offline).

UC’s platform has facilitated transactions for 14.59 million unique consumers across all geographies where it has operated since inception and has onboarded 6.81 million consumers and over 50,000 service professionals. A big chunk of this, i.e., ~47%, of total consumers have been onboarded in the last 3 years when growth accelerated for the company.

While Redseer Research estimates online market penetration to touch 1.3% by 2030, a deeper penetration in specific categories that UC focuses means a $1.5 billion plus potential market (at 4-5% penetration) and a significant pie for UC, basis its domination in the next 5 years. Overall, there can be little doubt about the large TAM or long growth runway for online home services platforms like UC.

Unlike food delivery services or quick commerce which are now two player or three player markets with more challengers entering, UC has a good lead in the online services market which seems to have lower competitive intensity.

#2 Formalising an informal market

The home services market encompasses a diverse range of services, including beauty and wellness, daily and high-frequency cleaning, professional cleaning, handymen services, appliance servicing and repairs, among others. But cleaning and pest control services account for the largest share of the SAM, contributing ~42% to the market, followed by home painting, beauty and handymen services.

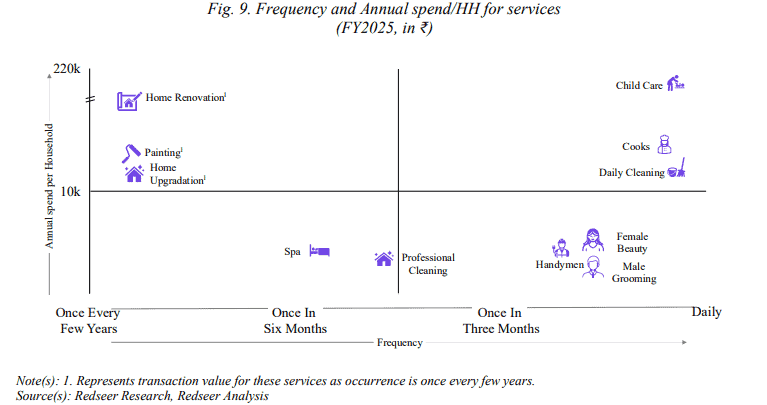

UC has decided to focus deeper on cleaning, beauty, and handymen, which are also high- frequency services.

The cleaning and pest control services categories are among the fastest growing category on UC’s platform while all three make an almost equal contribution to its business.

UC has structured its service categories into standard service units (SSUs) with defined service parameters, standard operating procedures, price and in several cases, prescribed products for use during service delivery to ensure uniform service experience to customers. This is how it differentiates its offering from unorganised players. This is achieved through in-house training and access to tools and consumables. UC has built training infrastructure of ~3 lakh sq. feet and runs 247 training classrooms across 17 cities, with 339 permanent employees staffing them. 10 of these training facilities are in North and West and 2 in South.

This combined with technology that solves for convenience forms the backbone of its service offering. UC’s tech capabilities focus on leverage technology to balance variables such as consumer location, day and time, availability of service professionals in a location at a particular time, and the skills required to perform the services, while aiming to maximize the service professionals’ earning potential and reduce travel time.

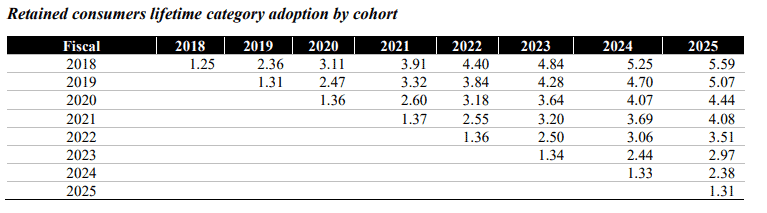

Each city is divided into multiple micro markets, each with a fleet of service professionals and a typical radius of 3-5 km. This shows the complexity involved in managing the back-end of a services platform, as opposed to one focused on selling goods or offering a single service like food delivery. The approach seems to be yielding results. UC’s retained consumers have moved across service categories and eventually end up using 4-6 super categories after spending a few years on the platform.

To tap into another large market opportunity, UC has recently introduced InstaHelp to address the domestic help needs of households when regular domestic help is unavailable. UC has also introduced a pilot for a subscription-based bathroom cleaning services in micro-markets with high density of cleaning demand, at a weekly or bi-weekly frequency at an attractive pricing.

These are services that solve important urban household challenges and enhance customer stickiness on the platform and positions UC to continuously expand the value of online home services market while increasing its share of the pie as well.

#3 Scale and cost management driving path to profitability

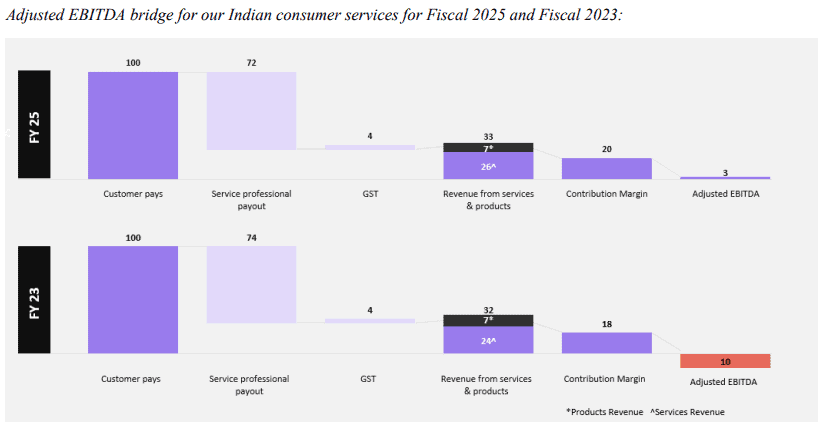

A combination of scale and in-house product consumption for services delivery (brand tie-ups, contract manufacturing) has led to an uptick in UC’s contribution margin and EBIDTA margin over the last three years. UC’s take rates are at 28% at services level and this translated into adjusted EBIDTA of 10% in FY25 for its India services business.

Below is a glimpse into UC’s key financial parameters for its India services business.

UC’s India services business that contributes to 77% of its total revenues has two components – services revenue and in-house products consumed to deliver the services.

Services contribute 80% while products contribute to 20%.

Two key line items that stayed flat or even declined marginally over the last 3 years are employee costs and ad expenses. With revenue accelerating, ad expenses have fallen from 30% to 15% of revenue while employee costs have fallen from 60% to 30% (employee costs include ESOP costs which were very high in 2023).

This has helped the domestic Adjusted EBIDTA margin to move up from a negative 30% in FY23 to a positive 10% range in FY25 and further to 12% in the 3 months ended June 2025.

But with UC expanding into more cities, further investments in training and technology are inevitable, Ad spends and employee costs may therefore not have further room to shrink materially, and may move up. As per the Redseer Report, ~38% of UC’s SAM is located in the top 8 cities in India and the remaining 62% in the following 192 cities. We will also need to see if uptake of online services will be as healthy outside the top 8 cities and whether UC is able to maintain its margins while chasing further penetration.

Having said this, UC’s path to profitability is visible while the margins may settle over the next 3 -5 years.

Key Challenges

Not about the size of opportunity, but about the switch!

While UC is solving important urban problems, the online penetration for online services is at <1% now and expected to reach only 1.3% in the next 5 years. This is due to the existence of a large unorganised ecosystem. UC itself is focusing only on few specific services where it can provide more value to its customers.

Even if we assume that UC’s specific categories achieve much higher penetration, it can translate to a SAM of $1-1.5 billion for online service providers, with UC being market leader. Unlike ride handling and food delivery where we saw a huge inflection point in customer habits during Covid, this shifts in habits does not seem to have happened for online services.

UC’s customer growth and partner growth numbers suggest that this could be because business growth in UC’s case is constrained by the pace at which it is able to onboard, professionalise and retain its service partners. If customer adoptions are not matched by growth in service partners, the demand for online services can go unfulfilled. This can result in lower growth for UC compared to food delivery or quick commerce.

Financial Performance

Here’s a quick glimpse into UC’s consolidated financial performance including international business and the native products business

In-house products consumption for service delivery, control over employee expenses and Ad expenses were the key factors that enabled the platform to move towards Adjusted EBIDTA profitability in FY25

With UC’s addressable online service market expected to grow at 18-22% in the next 5 years till FY2030 and UC itself being at a dominant and focused player in this space, it should be able to grow at a higher rate (25-30%) than the overall market. Successful diversification into new services can add to this growth. This may still be a tad lower than the 35% growth rate in the last 3 years, but still very healthy.

In the last two fiscals, UC has also expanded into home solutions by launching products such as water purifiers and electronic door locks under its ‘Native’ brand to further leverage its service network. This was 10% of revenue in FY25 and UC has recently added wall panels to complement its home painting services, communicating its intent to expand its product basket. The product portfolio expansion appears to be an inevitable part of its growth strategy.

Adjusted EBIDTA margins may have to evolve over next 5 years taking into account of its expansion plans beyond top cities and also new services and products it is planning to enter into. Consolidated adjusted EBIDTA margins may inch up towards 8-10% if international business losses narrow down and if the products business turns profitable.

UC may have pruned down its discretionary costs ahead of its IPO to turn profitable, as is visible from flat employee and ad spends over last 3 years. The 12% adjusted EBIDTA margin that we see in Q1FY26 may or may not continue. Investors should therefore not assign too high a weight to the ‘turnaround’.

Valuation

At the IPO valuation, UC is valued at ~13 times its consolidated revenue and ~17 times its India business (scalable and profitable) revenue. As the table below shows, this prices it at a material premium to Swiggy and Nykaa. If we build in 25-30% growth rate and 8% sustainable adjusted EBIDTA margin, the IPO valuation factors in medium term growth for the next 5 years.

UC has no directly comparable peers in the listed space but investors are bound to evaluate it relative to other platform companies.

On the negative side, UC’s business may have a lower TAM and appears more challenging to scale than food delivery or quick commerce players. On the plus side though, these challenges offer a moat and reduce competitive threats in this sector which can pressure pricing or stretch out UC’s path to profitability.

On the balance sheet, UC’s is lean and cash rich and mirrors that of food delivery platforms being a cash-n-carry business with technology as the key asset.

Our Take

UC appears to be a scalable platform with the path to profitability also becoming visible. But the IPO pricing still appears steep for reasons explained above.

Investors can re-visit the opportunity post listing at 20-25% decline from the IPO price.

2 thoughts on “Urban Company IPO: Should you subscribe?”

Their main advantage is their monopoly. There are no other significant competitors, especially in the grooming sector (except for Yes Madam).

I’ve been using Urban Company regularly for almost four years. They are exploitative towards both customers and (extremely for) operators. When regulators come knocking (UC would be shut down in a labour-respecting jurisdiction), or when a better competition emerges, I expect UC to feel severe heat. Every operator I’ve spoken to from grooming to RO repair to plumbing to carpentry has expressed desperation to migrate if other platforms come up. They want freedom like cabs and autos have for Ola, Uber, or Rapido, etc.

For a service sector they literally have no customer care. Trying contacting as a customer for anything – chat, email, phone – none, nada!

This doesn’t look like an attractive business model in the long run at all. But seeing how retail investors have responded in the last few years, I think one can still play on it for IPO gains if they have the expertise.

By the way,

> UC currently holds ~20% share in this market while competitors such as Housejoy, TaskRabbit, Handy, Thumbtack

TaskRabbit and Thumbtack never launched in India, right? I hope the article was referring to India, as it mentioned it in very much the Indian context. These platforms don’t operate in Singapore or the UAE either. Am I missing something?

Welcome your query sir,

You are right on your observation.

The market for online players are still small in size and Urban Co. is the only major one in this online space with a total revenue pie of 4,000 cr. Either the take-off in online is happening very slowly or there are challenges to that

We will have to see it in due course. If it catches up steadily, then good.

You are right on the names, thanks for notifying.

Only Housejoy and Pyng here and more of smaller players around.

Thank you