The author is an external contributor. Views are personal and do not reflect the opinion and views of PrimeInvestor.

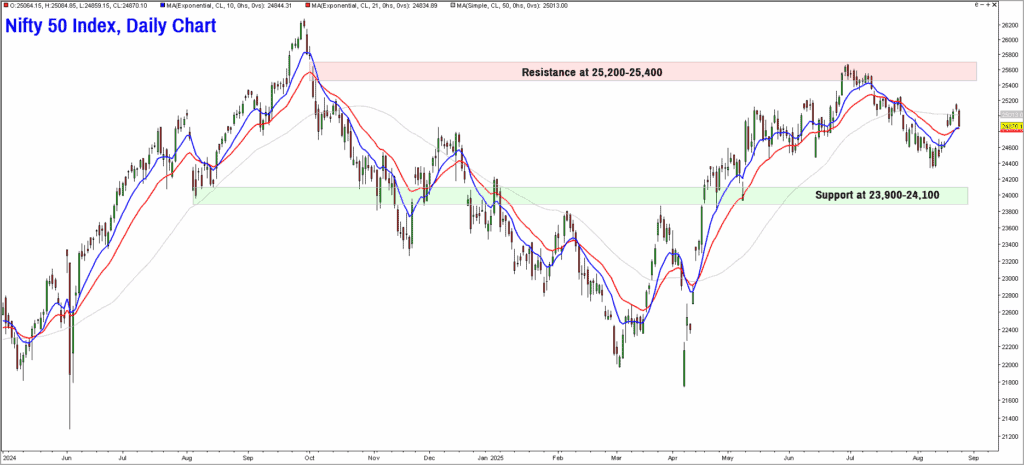

In the previous update on where the Nifty 50 could move, we suggested adopting a cautious approach. There is no change to this stance. The Nifty 50 index is still confined to the broad range of 23,900-24,100 on the lower side and 25,200-25,400 on the higher side. Expect volatile price action to persist until there is a breakout from this range.

As always, we shall take a closer look at the short-term chart of Nifty 50 index along with the breadth indicators to assess what is in store in the near-term. We will also discuss the sectors that are displaying relative strength and weakness.

Nifty Short-Term Outlook

As highlighted above, the Nifty 50 index is yet to break out of the 23,900-25,400 zone. The only positive aspect is the recent bounce from the lows of this range. After dropping to a low of 24,337 on August 8, the index recovered sharply thereafter.

The recovery off the August 8 lows has pushed the index above the short-term 10-day and the 21-day exponential moving averages, which is a positive sign. The Nifty 50 index is also surfing the 50-day simple moving average and closed a shade lower than this average on Friday.

A look at the intra-day chart of the Nifty 50 index suggests the possibility of a rally to 25,700 and beyond. This possibility would be confirmed only if the index closes above 25,400. Beyond 25,400, upside targets of 25,700 and 26,500 would open up.

Let us also look at the breadth indicators to assess the quality of the recent recovery in the Nifty 50 index. As always, we will use the PF-X% breadth indicator which tracks the percentage of stocks that are in a bullish swing in 1% box size in Point & Figure Chart.

- The PF-X% breadth indicator for the Nifty 50 universe recovered from 26% on August 8 to a high of 84% on August 20, suggesting that the recovery has been broad based.

- Similarly, there is noticeable improvement in the short-term breadth of the broader markets too. The percentage of stocks trading above their 21-day exponential moving average, from the Nifty MidSmall Cap 400 index, has improved from 13.75% on August 8 to 49.5% on August 21, suggesting buying interest creeping into broader markets.

Though these are just green shoots, and one has to await more confirmation.

Nifty MidSmall Cap 400 Index

This index is displaying signs of relative outperformance versus the Nifty 50 index, which is a healthy sign. The index is also tracing out a sequence of higher highs and higher lows which is a bullish sign. A breakout above 20,900 would suggest that the Nifty MidSmall Cap 400 index is headed to the next target of 21,900-22,300.

The positive outlook would be under threat if the index drops below swing low at 19,000. Though there are early signs of strength and outperformance in the broader markets, wait for the Nifty 50 index to cross the 25,400 level before committing fresh exposures in mid and small cap stocks.

Outlook for sectors

Now let’s turn our attention outside the bellwether and take a quick look at sectors that are bullish and outperforming Nifty 50 and the ever-important banking index.

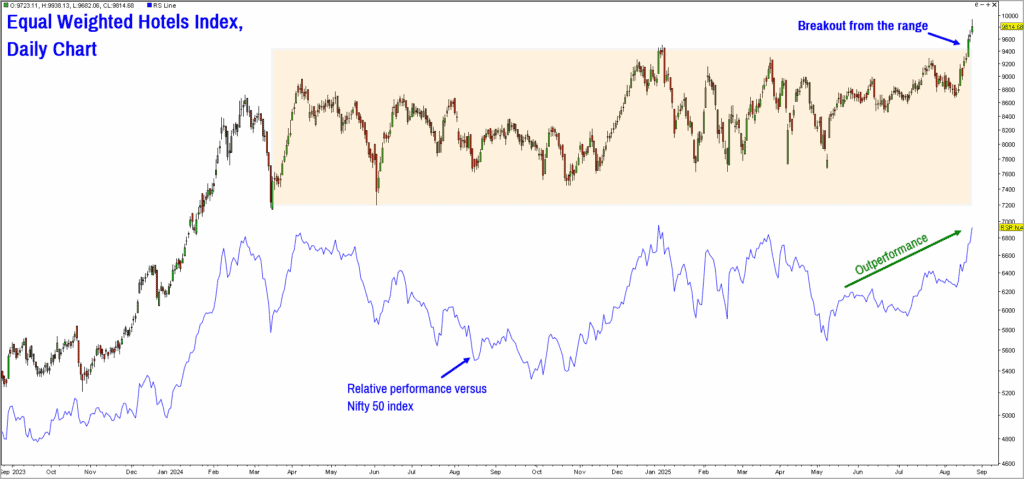

Equal Weighted Hotels Index

After several months, the stocks from the hotels sector attracted buying interest last week. Here is the chart of the equal weighted index of hotel stocks including Chalet, EIH Associated Hotels, EIH, Indian Hotels, Kamat Hotel, Lemon Tree, Royal Orchid Hotels and TGB Banquets and Hotels.

As highlighted in the above chart, the index has completed a breakout from the prior trading range which is a bullish sign. Also, there is clear evidence of outperformance of this index versus the Nifty 50 index in the past few months. Look for investment or trading opportunities in the hotel sector stocks provided the Nifty 50 index displays bullishness and positive momentum.

Nifty Auto Index

The Auto index has been displaying a lot of promise in the past few weeks. The relative performance of this index against the Nifty 50 index has shown a lot of improvement. The short-term trend would be bullish as long as this index sustains above the support zone at 22,200-22,500.

A breakout above 26,800 would indicate that the index could head to the next target zone of 28,600-29,500. Again, wait for the Nifty 50 index to cross the 25,400 level before committing fresh exposures in this sector.

Nifty Bank

Considering the weightage of the banking stocks, this is one of the key sectors in terms of having a big influence on how the Nifty 50 index behaves. Unfortunately, the banking index has struggled to sustain any bullish momentum and has also struggled to outperform Nifty 50 index on a consistent basis.

From a short-term perspective, the bank index is still tracing out a bearish sequence of lower highs and lower lows, which is not a healthy sign. Only a breakout above 58,000 would reinstate bullishness in this sector. A fall below 53,000 would be a major sign of weakness.

Other sectors displaying persistent relative weakness versus Nifty 50 includes the likes of Nifty IT, Nifty Realty, Nifty Energy & Nifty Oil & Gas.

To summarize, while the recent recovery off the August 8 lows appears promising, it is better to wait for more confirmation. On the positive side, the short-term breadth indicators are promising. Keep an eye on the stocks from the outperforming sectors discussed above. Consider exposure in these sectors only after Nifty 50 resumes its uptrend.

2 thoughts on “Technical outlook: Time to get positive on the Nifty 50?”

Hello Mr Krishnakumar, I have been following your Technical Outlook for the last 4 years, and I am really impressed with the recommendations. I am interested in learning the technical outlook based on your style. Could you please guide me to the source from which I can learn?

Thank you

Hiral

Hello Hiral:

Thanks for your comment and glad that you found our posts informative. There are tons of material available in YouTube that can serve as a starting point. But it is always better to have a structured approach to learning such skills. I do not conduct any training or educational course on my own. I would recommend checking out the Patshaala course offered by Definedge Solutions, Pune. I am associated with them and I also handle online training sessions for Definedge.

Hope this is useful.

Regards

B.Krishnakumar