We have issued an updated call (SELL) on this stock on November 30. 2023.Please click here for the update.

The Tata Technologies IPO is the second IPO in a span of almost 2 decades (18 years after the TCS IPO) from the Tata group. The IPO of Tata Technologies is a full offer for sale totalling ~Rs.3,040 crore, comprising ~ 6 crore shares at a price band of Rs.475-500 per share of face value Rs.2/-. The offer closes on November 24, 2023.

Tata Motors is selling 4.62 crore shares along with other private equity players, including group entity Tata Capital. After the IPO, Tata Motors will hold ~53% of the post issue share capital. At the higher end of the IPO price band, Tata Technologies is valued at Rs.20,280 crore

We recommend an ‘invest’ on this IPO, suitable only for long-term investors. We do not factor in any IPO listing gains. If the stock manages to list at a significant premium to its present valuation, we may consider issuing a book profit.

About the Company and Business

Tata Technologies (Tata Tech) is a full-service player in Automotive Engineering Research & Development (ER&D) space offering product development and digital solutions, including turnkey solutions, to global original equipment manufacturers (“OEMs”) and their tier 1 suppliers. It derives nearly a third of its revenues from India and a fourth from Europe and remaining from North America and Rest of the World. Apart from Automotive, Aerospace and Transportation are two adjacent and focus verticals for Tata Tech.

The ER&D services business is complemented by its Products and Education businesses that sells third-party software applications (product lifecycle management software) and provide value-added services such as consulting, implementation, systems integration and support and forms a fifth of its revenue.

Tata Tech services its clients using its global sales and delivery network comprising 19 global delivery centers in Europe, North America and Asia Pacific with ~1,434 employees in Europe, ~336 employees in North America, ~219 employees in Asia Pacific, excluding India, ~10,462 employees in India. Tata Tech counts Tata Motors including its UK Subsidiary JLR as its anchor client and Vietnam born VinFast, that made Nasdaq debut in 2023, as its key new energy (EV) client.

Industry

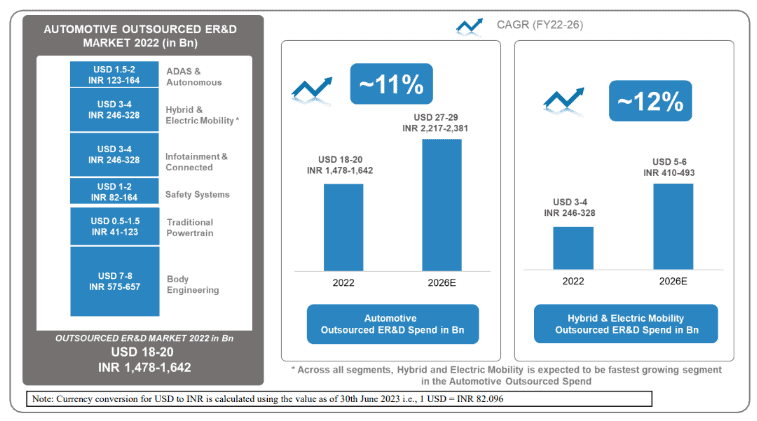

Global ER&D spend was estimated at nearly $2 trillion in 2023 and is expected to touch $2.7 trillion in 2026, growing at a CAGR of 10%. Manufacturing-led verticals have been the largest contributors, and account for half of the global ER&D spending. The automotive sector is the largest manufacturing ER&D vertical, and the second largest ER&D vertical overall, accounting for approximately 10% of global ER&D spends. Automotive ER&D spend currently stands at $180 billion and is estimated to grow at approximately 7% CAGR between 2022-2026. The automotive outsourced ER&D market is pegged at $18-20 billion and is expected to grow at a faster rate than overall automotive ER&D spending during the period 2022-2026.

With increasing adoption of digitalization and requirements for technology enabled skills in the automotive industry, a lack of skilled workforce is expected to drive the outsourcing opportunity to plug the growing skills gap. Further, with an increased regulatory focus on sustainability and changing consumer preferences, electrification is expected to be the primary focus for the automotive industry. New technologies are disrupting the automotive sector with increased ER&D complexity, requiring specialized support in areas such as ‘ACES’ technologies – autonomous, connected, electrification and shared.

Tata Technologies IPO – Positives

#1 Leader in whole service automotive ER&D space

Tata Tech’s automotive ER&D services span the entire automotive value-chain and includes concept design and styling, tear down and benchmarking (“TDBM”), vehicle architecture, body engineering, chassis engineering, virtual validation, e-Powertrain, electrical and electronics, connected, manufacturing engineering, test and validation and vehicle launch. It is positioned in the “leadership zone” by Zinnov Zones for ER&D services ratings in 2023 for the seventh consecutive year and ranked first among all India-based ER&D service providers and are among the top two globally, in electrification. In addition to the spectrum of discrete service offerings, it offers turnkey full vehicle development solutions for traditional internal combustion engine (“ICE”) vehicles, plug-in hybrids (“PHEV”) and EVs.

The thought process that “technology is the heart” of vehicle in the upcoming era is making ER&D players a strategic partner in vehicle development as evidenced by the induction of a domestic ER&D service provider as a strategic partner by Renault and Honda recently. While Tata Tech may not as strong as some its competitors in digital technologies, it can leverage the expertise of Group Co. Tata Elxsi when it comes to turnkey projects and has been doing so.

Its Integration of Product lifecycle management (“PLM”), Manufacturing execution systems (“MES”), and Enterprise resource planning (“ERP”) solutions, which are the fundamental aspects of a digital thread likely provides some strength although this does not make up for areas where peers dominate. The company has built proprietary platforms and accelerators to integrate these key three aspects. This stands as a differentiator for the company.

Tata Tech counts China’s Nio and Vietnam born VinFast as its key customers among new-age OEMs while it has worked with Volvo owned Polestar as well. Needless to say, some of its learnings have come inhouse from Tata Motors. It is also reported to have worked with some of the top EV makers in the US.

#2 Tapping the outsourcing opportunity in automotive ER&D

The automotive outsourced ER&D market is pegged at $18-20 billion in 2022 and is expected to grow at a faster rate of 11% than overall automotive ER&D spending growth rate of 7% during the period 2022-26. With the increasing adoption of digitalization and high requirements for technology enabled skills in the automotive industry, a lack of skilled workforce is expected to drive the outsourcing opportunity to plug the growing skills gap. The challenge is that most of traditional skill set is ICE based, and the shift towards EVs has resulted in European automakers struggling to hire talent. India has emerged as a favorable destination for outsourced ER&D spend by global enterprises due to its large talent pool, innovation ecosystem, affordable costs, maturing in-house R&D centers landscape and geopolitical support.

The chart below sets out outsourced ER&D market spend across categories for 2022.

Due to increased regulatory focus on sustainability and changing consumer preferences, electrification is expected to be the primary focus for the automotive industry. New technologies are disrupting the automotive sector with increased ER&D complexity, requiring specialized support in ‘ACES’ technologies – autonomous, connected, electrification and shared. This has also propelled many new-age OEMs (for example – Canoo, Fisker, Li Auto, Nikola, NIO and Rivian) to outsource work to ER&D service providers for new products as they focus on reducing product development time and cost. Tata Tech is already engaged with 7 out of the top 10 automotive ER&D spenders and 5 out of the 10 prominent new energy ER&D spenders.

The ability to offer whole range of automotive ER&D services, including turnkey projects, differentiates Tata Tech from other domestic ER&D companies such as Tata Elxsi, KPIT and LTTS that are predominantly focused on digital technologies (explained in detail later) and puts it at an advantage when it comes to new-age OEMs.

Aerospace is another promising vertical next to automotive that offers significant outsourcing opportunity and Tata Tech seems to be making some inroads in this. It has been empaneled by Airbus already. Meanwhile the company is also adopting territory specific strategies, such as the EV proposition for China, aerospace proposition for France and embedded solutions for Germany to augment its growth prospects in ER&D outsourcing.

Concerns

Client concentration, industry evolution and competition

Having discussed about the capabilities and the opportunity, Tata Tech is a bit in the middle of its journey with anchor client (Tata Motors along with JLR) contributing to a chunk of its revenue (~40% in last 3 years) along with VinFast also contributing a big chunk from the new-age OEMs. Top 5 clients contributed to 65-70% of revenue in last 3 years. Client concentration along with lumpiness of revenue from turnkey projects could make the earnings picture more volatile unless supported by new client additions. With Tata Motors’ share of revenue decreasing over the years, we hope that new client addition will help diversify.

Meanwhile, a substantial portion of automotive ER&D spend is concentrated among the top 20 companies, accounting for 73% of overall spend. The German Trios (VW, Merc, BMW), Renault, Valeo, Stellantis, Toyota, Honda, Nissan, Ford, GM, BYD, Nio and Tesla make up for most of those Top 20 and is well understood by their market dominance. If we go by the market trends in the last few years, it looks like top OEMs still want to keep their dominance over core vehicle development while inducting ER&D players as a strategic partner in the vehicle development process. For example, KPIT has been inducted as strategic partner by Renault and Honda recently.

But it is more likely that new-age OEMs (than the traditional OEMs) find Tata Tech a more worthy partner of choice. High cost of in-house ER&D, together with less time to invent and market (given the competition intensity) all point to this likely choice.

It needs to be seen whether Tata Tech will be able to bring down dependence on its anchor clients, in this backdrop. The success journey and market share gains by new-age OEMs will be critical in driving the future growth prospects of Tata Tech along with the continuing success journey of its anchor client, Tata Motors. The fact that Tata Tech is also not a strong player in digital technologies may keep it away from the opportunities that its Group Co. Tata Elxsi and other domestic ER&D players such as KPIT and LTTS are able to tap into. The digital technologies space is also growing at a much higher CAGR than the overall ER&D spend growth.

Financials and Peer Comparison

Tata Tech had a good run-in terms of earnings growth in the last 3 years, in line with other industry players, with increasing share of fixed-price contracts aiding margin expansion. The share of fixed price contract has increased from ~40% in FY21 to ~60% in FY23 and was at 58% in H1FY24. Tata Tech also has a reasonably healthy mix of on-shore: off-shore at 49:51. Though lower than some of its peers, this can act as a margin lever if improved further.

Here’s a comparison on key financial parameters on Tata Tech Vs its peers.

A strict comparison could not be made since most of its peers are diversified and focused towards digital technologies. Further, service offerings, contract mix and delivery models also create differences in margin profile. At this point of time, Tata Tech cannot not be expected to gain higher valuations than the traded tech peers for both business and financial reasons.

Verdict

The IPO is offered at 32.5 times and 29 times its FY23 earnings and FY24 earnings (annualised) respectively. This compares with 60-90 times TTM earnings for automotive focused players such as KPIT and Tata Elxsi while at a reasonable discount to diversified ER&D player LTTS (37 times).

But cheaper valuations don’t undermine the risks related to lumpiness of revenue and cash flows arising from turnkey projects and from client concentration. The journey to a more broad-based player with reduced client concentration and augmented capabilities in digital technologies may be key to sustaining these valuations post IPO and provide returns in the long run.

Long term investors can use the IPO as an entry point to Tata Tech. This company is best viewed at this juncture as a higher-end proxy play on the automotive industry and less compared with IT. To this extent, it is bound by the cyclicality of the auto business. Return expectations have to be tempered to factor this in.

You may also look at it as an indirect play on Tata Motors’ EV business as well with relatively lesser risk as compared to Tata Motors itself.

Update call dated Nov 30, 2023: Sell Tata Technologies if you got IPO allotment

Tata Technologies has made a stellar and surprising debut in stock exchanges with a 170% gain over the listing price.

This listing has straightway made it the second most expensive stock, at 76 times earnings, in the whole ER&D space behind KPIT. This valuation is at a significant premium to its prospects, especially given the risks we have mentioned in our IPO call.

If you were lucky to get an allotment, you can consider pocketing the gains. One can also take cues from the listing of Sona BLW two years ago and the subsequent price action. In the last 18 months, it was one of the very few stocks from the auto space to deliver negative returns when the sector was going through a bull run.

We will continue to keep track of the company and reissue a call if valuations afford any opportunities.

12 thoughts on “Tata Technologies IPO: Should you invest?”

How is TTL comparable to say Tata Elixi which seems to be a higher PE. Does this mean Elixi price will come down as TTL is bigger than Elixi in terms of revenues

Welcome your query sir,

As mentioned in the IPO report, players like Tata Elxsi & KPIT work solely on software/digital tech side.

They are also emerging as preferred partners for OEMs looking to EV transition & autonomous vehicles. Just check these two sites on how legacy OEMs are planning for future

https://www.ampere.cars/en/

https://www.shm-afeela.com/

Tata Tech currently takes more of turnkey projects which includes using capabilities of Tata Elxsi on software side. This apart client concentration issue is also there at this point of time. These can lead to earnings volatility

The good thing about IPO is that it has taken it into account of these factors in the IPO pricing. That also explains lower PE for Tata Tech

Tata Elxsi’s PE can come down only if it’s growth falls and not due to Tata Tech’s listing or that of Tata Tech’s lower valuation

Hope this clarifies

Thank you

Who are the technology partners for existing market leaders in Automobiles such as Maruti , Hyundai , Eicher ? Or is it still in-house and not separately disclosed ?

Welcome your query sir,

A big shift is now happening in passenger cars than CV with the vehicle architecture itself undergoing a big change.

So, a it is vehicle manufacturer, software Co and vendors with a software Co assuming a bigger role in vehicle design.

It is R&D stage now for most Cos in this transition. Kindly look at these two sites for further insights on future direction

https://www.shm-afeela.com/en/

https://www.ampere.cars/en/

For Maruti and Hyundai much of the collaboration and R&D may be happening at parent level, not heard anything so far.

Same for Eicher as it is now using more of Volvo technology.

Hope this clarifies.

Thank you

Can tata motors dvr share holders apply in existing shareholder option?

Welcome your query sir,

In the offer doc, they have only mentioned Tata Motors Ltd (TML) shareholders.

Since DVR carry only 1/10th voting right, I doubt if DVR holders can bid in the quota.

Thank you

I am holding TataMotors DVR shares & on the eve of this IPO subscription Tata Motors have themselves sent out an email communication to me sharing IPO details & the various bid options (/shareholder category / retail investor / HNI etc.) . Wouldn’t that indicate that DVR shareholders bid will be considered valid under shareholder category??

Welcome your query sir,

DVR has 1/10 voting rights as that of ordinary shares. Didn’t find any mention in RHP as to the available quota for DVR shareholders.

Kindly check in IPO window during application. It may reflect there once you feed your demat ID

Thank you

Thank you for the update.

Just wondering, why do registerar of such high profile entities keep such important matters fuzzy in RHP? Something for SEBI to look into, as investors benefits are at stake, isn’t it?

Thanks for the detailed analysis. Really helpful. One related query- Tata Motors share price had a significant run up leading in to this IPO. Does it make sense to hold on to this scrip? Will be nice to have your views.

Thanks & Good day..

Welcome your query sir,

It is natural for parent Co shares to rally ahead of their subsidiary IPOs

In general, Tata Motors has been a challenging Co to research and forecast numbers due to its volatile overseas business (JLR).

So, we haven’t recommended the stock at any point of time and so we don’t have an opinion on it.

We had it in our Auto++ smallcase, which we exited after a good run up for reason mentioned above.

Thank you

Understand your position. Thanks for the hint though 🙂

Comments are closed.