Tata Capital is set to launch India’s third mega NBFC IPO this year, following Bajaj Housing Finance and HDB Financial Services. Like its predecessors, the company is going public to meet regulatory listing requirements.

The Rs. 15,511 crore offering combines fresh equity and an offer for sale. The company will deploy Rs. 6,846 crore from the fresh issue to strengthen its capital adequacy ratio.

The IPO opens for subscription on October 6th and closes on October 9th, with shares priced between Rs. 310-326 (face value Rs. 10).

At the upper price band, Tata Capital will command a market capitalization of Rs. 1.35 lakh crore and debut at 3.35 times its book value.

Post-listing, promoter Tata Sons will retain an 80% stake, while the broader Tata Group will collectively hold approximately 86% of the company.

The Tata brand undoubtedly adds allure to this offering. But does the business fundamentals and financial performance justify investor interest? Let’s examine what lies beneath the blue-chip surname.

Business

Tata Capital ranks as India’s third-largest diversified NBFC by assets under management, trailing only Bajaj Finance and Shriram Finance. The company operates a nationwide network of 1,516 branches spanning 27 states and union territories.

A significant milestone came in FY25 with the merger of Tata Motors Finance (TMFL), which brought the group’s vehicle financing business under one roof and reinforced Tata Capital’s position as a diversified lending powerhouse.

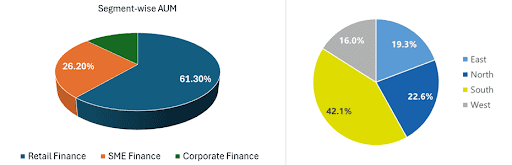

The company’s lending portfolio is strategically balanced across three segments as of FY25:

Source: Tata Capital RHP, Tata Capital FY25 AR

Retail Finance forms the consumer-facing cornerstone, offering a comprehensive suite of products including home loans, loans against property, personal loans, business loans, vehicle loans, construction equipment financing, microfinance, and education loans. These cater to both salaried professionals and self-employed individuals.

The company services home loan customers through its specialized subsidiary, Tata Capital Housing Finance (TCHFL).

SME Finance addresses the needs of small and medium enterprises through supply chain finance, equipment financing, and leasing arrangements. The segment extends further with term loans, clean-tech financing solutions, and developer finance for business growth.

Strengths

On the positives to count are its diversified book and low business model or regulatory overhang for shareholder value creation.

#1 A diversified NBFC with presence across key segments

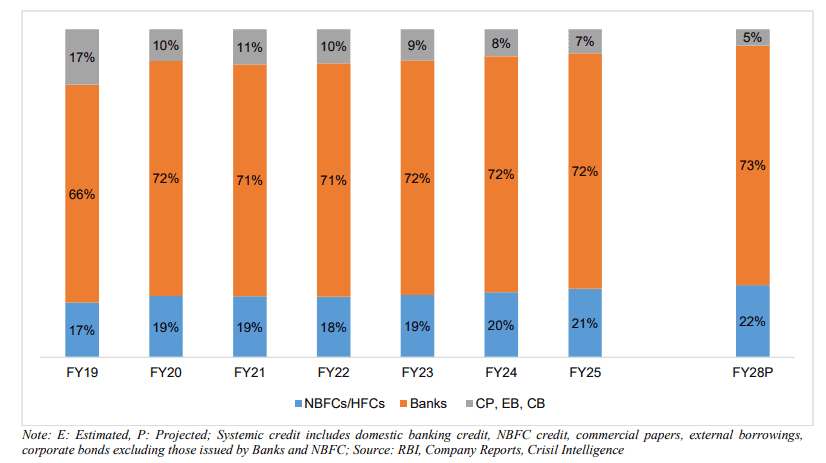

NBFCs in India have proven their right to have a profitable existence by serving the needs of niche unbanked/underserved categories with excellent underwriting skills over decades. NBFC’s share in systemic credit (overall credit including banks, NBFCs, bonds and debentures) is estimated to have increased from 12% in FY08 to 17% in FY19 and further to 21% in FY 25. This is also visible from the market value of NBFCs Vs banks.

Source: Page 187 of RHP

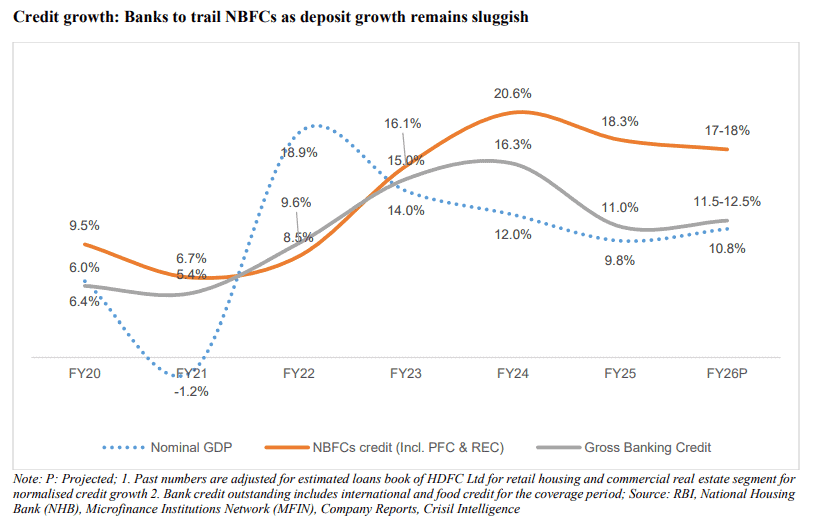

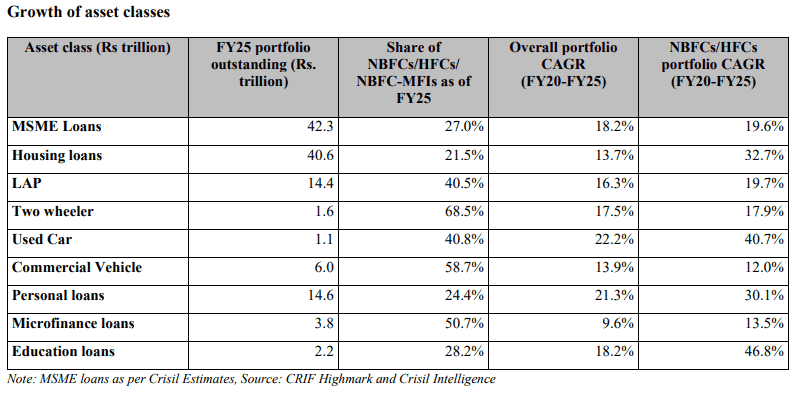

While India has four private banks with market capitalizations exceeding Rs. 1 lakh crore, Tata Capital’s listing will bring the NBFC count in this elite club to five.NBFCs have consistently outpaced banks in credit growth. Over FY20-25, NBFCs expanded at a 13.9% CAGR compared to banks’ 11.4%, with NBFCs leading in every year except FY22.

Source: Page 186 of RHP

The runway ahead looks promising. Retail credit is expected to grow at 14-16% CAGR through FY28, driven by small-ticket lending across housing, vehicles, gold, education, consumer durables, personal loans, credit cards, and microfinance.

NBFCs dominate in vehicle loans, loans against property, and gold loans, while making strong inroads into affordable housing and MSME lending. In consumer durable financing, they’ve revolutionized the space with instant loan approvals at point of purchase.

Here’s their market share across key segments:

Source: Page 194 of RHP

However, not all experiments succeeded. Prime home loans and real estate developer financing proved ill-suited to NBFC capabilities. Two-wheeler and microfinance segments have witnessed periodic stress.

Tata Capital’s strategic positioning: The company has deliberately built its portfolio around NBFC strengths: housing, vehicles, mortgages, and personal loans. While housing, mortgage, and personal loan books were developed organically, the vehicle portfolio came largely through the TMFL acquisition.

Here’s a more granular look in to Tata Capital’s overall retail loan portfolio AUM of nearly Rs. 1,43,000 crore.

Tata Capital has also developed a substantial corporate book spanning term loans, supply chain finance, equipment finance, clean-tech, and developer finance.

Here’s a quick look in to its corporate loan portfolio AUM of nearly Rs. 90,000 crore.

By IPO stage, Tata Capital has strategically aligned its retail portfolio with proven NBFC strengths through both organic growth and acquisitions. Its corporate book leverages group expertise in specialized areas like clean-tech, supply chain, and developer finance.

#2 Access to low-cost funding sources being part of Tata Group

Tata Capital’s AAA credit rating—a direct benefit of its Tata Group lineage—enables access to competitively priced funding. Its borrowing costs match those of top-tier NBFC peers, while its international market access provides an additional edge, particularly for long-tenure clean-tech financing.

In FY25 alone, the company raised $400 million internationally, leveraging its BBB- rating (on par with India’s sovereign rating). This is part of its overall plan to raise $2 billion in international bonds.

Post-IPO capital strength

The IPO will significantly bolster Tata Capital’s balance sheet. Tier 1 capital adequacy ratio will jump from 12.8% to approximately 16%, with total CAR approaching 20%.

The high promoter holding of ~86% post-listing provides strategic flexibility, allowing the company to tap capital markets as needed for long-term growth funding.

#3 Clear path for value creation without structural constraints

Tata Capital stands as the Tata Group’s sole flagship lending arm heading to public markets—and unlike recent NBFC listings, it faces no business model ambiguities or regulatory headwinds that could impede shareholder value creation.

While regulatory compulsion drives this listing (similar to peers), the parallels end there.

Consider the contrasts:

Bajaj Housing Finance went public shortly after HDFC’s merger with HDFC Bank—a corporate action that essentially questioned the rationale for large standalone NBFCs in prime housing finance.

HDB Financial Services listed amid regulatory discussions about restricting banks and their NBFC subsidiaries from operating in overlapping businesses—potentially threatening its very standalone existence.

Tata Capital faces no such overhangs. Its diversified model and strategic positioning align well with regulatory intent and market realities.

The real test lies ahead

Having aligned its portfolio with NBFC sweet spots, Tata Capital has completed the groundwork. The challenge now is execution—and that will ultimately determine whether this IPO creates lasting shareholder value.

Limitations

Tata Capital lacks the focused specialization that defines many successful NBFCs. Moreover, its largest business verticals aren’t high-yielding segments—a constraint that limits its ability to generate superior returns on assets.

#1 N0 specialised lending segment with superior profitability

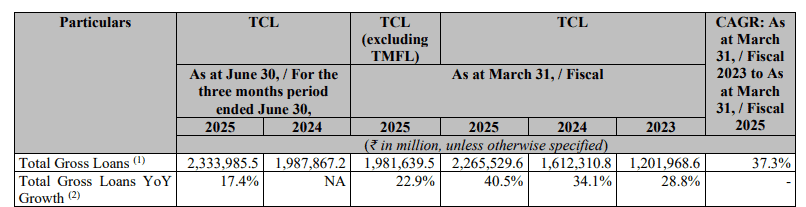

Tata Capital has aggressively expanded its loan book at 35-40% CAGR over the past three years post-Covid, but lacks a dominant high-margin segment with proven staying power.

Prime home loans—forming 30% of its retail book—is its largest segment, but offers no competitive moat for NBFCs. The company is building an affordable housing book (now a fifth of home loans), though this remains nascent.

Vehicle finance (21% of retail) came via the TMFL merger and comprises mainly commercial vehicle and construction equipment loans. However, TMFL’s historical profitability has been underwhelming.

Source: Page 317 of RHP

The segments that were contributing to profitability were mortgage loans (20% of retail pie), personal loans (11% of retail pie) and small business loans (7% of retail pie).

These books have 16-18% yield and have grown at 25-30% in the last 3 years, a good take-off phase for these segments post Covid. With no asset quality issues in the last 3 years, these segments have been profitability drivers. But these are the segments that have started to show head-ache for banks and NBFCs in the recent past and it would be difficult to assume these high growth segments continue to mimic the growth rate and profitability of past 3 years.

The remaining 39% non-retail book comprise of SME loans with average ticket size of Rs.25 crore followed by clean-tech financing, supply chain financing and real estate developer financing. The SME and supply chain financing are two thirds of this pie while clean-tech and developer loans form the remaining one third. Clean-tech is a long tenure (average 23 years) low yield book (10.4%) with average ticket size of Rs.137 crore though profitable due to low-cost funding access for Tata Capital. This has also helped to build this book aggressively, at 35% CAGR in last 3 years, and boosting overall AUM. The long-term profitability outcomes of such lumpy books will have to be watched.

The bottom line: Despite operating across NBFC-friendly segments, Tata Capital hasn’t built a specialized, consistently profitable niche with a long operational track record. This diversification without dominance raises questions about financial resilience if multiple segments simultaneously face growth or profitability pressures.

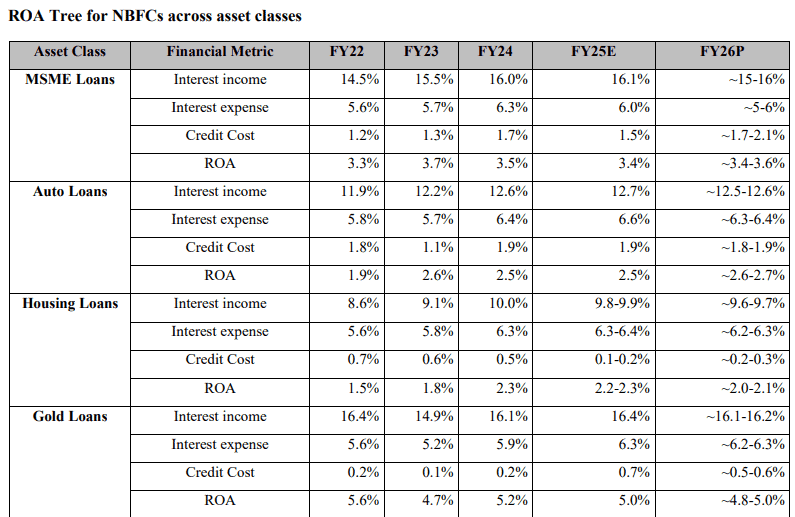

#2 RoA profile to stay mediocre Vs specialised peers

Tata Capital’s RoA stood at 2.1% excluding TMFL and 1.8% post-merger in FY25. The post-merger figure reflects the business reality going forward, with vehicle finance now integral to growth.

Interestingly, its corporate segments currently match retail profitability—thanks to low-cost funding and focus on high-ticket clean-tech financing leveraging group expertise.

However, Tata Capital lacks the high-RoA niches that power specialized NBFCs. While MSME loans, vehicle finance, affordable housing, and small-ticket gold loans deliver strong returns for focused players, Tata Capital’s retail book is dominated by low-margin prime home loans and TMFL’s inherited vehicle portfolio with its weak profitability track record.

Here’s the RoA landscape across key NBFC segments:

Source: Page 197 of RHP

Tata Capital’s RoA structure: 6% NIM (including fees), 2.5% operating expenses, 1-1.5% credit costs, translating to 2-2.5% RoA—depending on how credit costs evolve.

This positions Tata Capital as a ~2% RoA business—firmly in mediocre territory.

The cyclical resilience of this RoA remains untested, with over half the book built aggressively in just three years and a major segment (vehicle finance) added through M&A.

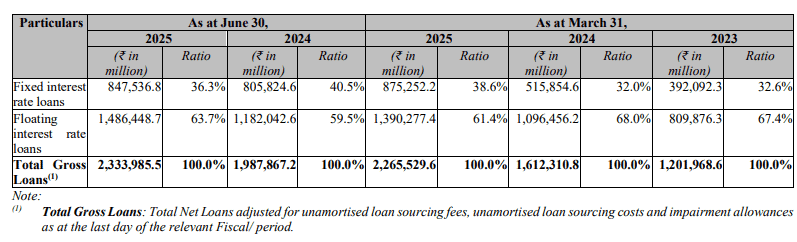

#3 No major benefit from rate cycle

One of the factors pulling investors towards NBFCs at this point of time is the rate cycle where NBFCs were expected to obviously reap immediate benefits. Those with high share of low ticket, fixed rate, short and medium tenure loans were expected to benefit. While this very benefit is in question now with the present stance of RBI, the benefit, if at all, is likely to be minimal for Tata Capital compared to some of its peers with two thirds of its loans being on floating rates.

Source: Page 55 of RHP

Financial Performance

Here’s a quick look into Tata Capital’s consolidated financial performance for the last 3 years. The spike in credit cost is pursuant to merger of TMFL with itself in FY25 and this also reflects the reality going forward.

Until then, heavy reliance on home loan book has kept credit cost low.

Credit cost is likely to be in the 1-1.5% band going forward, but unlikely to dip below 1%

Peer Comparison

Here’s a quick comparison of key parameters of Tata Capital with its NBFC peers to which it is equated at this time of IPO.

Valuation

At the upper end of Rs.326 per share, the issue is priced at 3.35 times post issue price to book value, which is looking expensive considering two aspects:

- Tata Capital’s relatively weaker hold in profitable retail lending space beyond home loans, capping its RoA potential.

- Replicating the aggressive growth of past 3 years with similar profitability can be difficult going forward and with TMFL integration also to deal with.

Should you invest?

Given these challenges, investors should skip the IPO and wait for a better entry point around 2.5x price-to-book if the stock corrects post-listing.

While Tata Capital avoids the structural issues plaguing Bajaj Housing and HDB Financial Services, it hasn’t demonstrated the specialized edge or profitability track record that would justify a premium valuation over established peers. At 3.35x book, the market is pricing in potential that remains unproven.

General Disclosures & Disclaimers

Important note: When we call an IPO ‘avoid’ and it still lists with gains, we understand the questions that follow. Here’s our approach: we evaluate fundamentals, not listing-day sentiment. Short-term euphoria-driven gains aren’t part of our analysis—we’re focused on sustainable value.