In these reviews, we pick stocks that have rallied, or where businesses are interesting or changing, or where companies may be relatively unknown and so on. We present an analysis of these stocks, covering what has driven them, business prospects, threats and more. These reviews are meant to give you an understanding of a stock. They are not our stock recommendations.

Most Indian investors seeking growth or a moat-based business tend to ignore PSUs because of the belief that most PSUs operate in commodity-like businesses with cyclical earnings and a strong peg to the fortunes of the economy. But there are exceptions that prove the rule and this public sector company engaged in specialty materials combines hi-tech production capabilities with promising growth potential in emerging sectors. Here’s a deep dive into Mishra Dhatu Nigam Ltd. or MIDHANI.

Industry

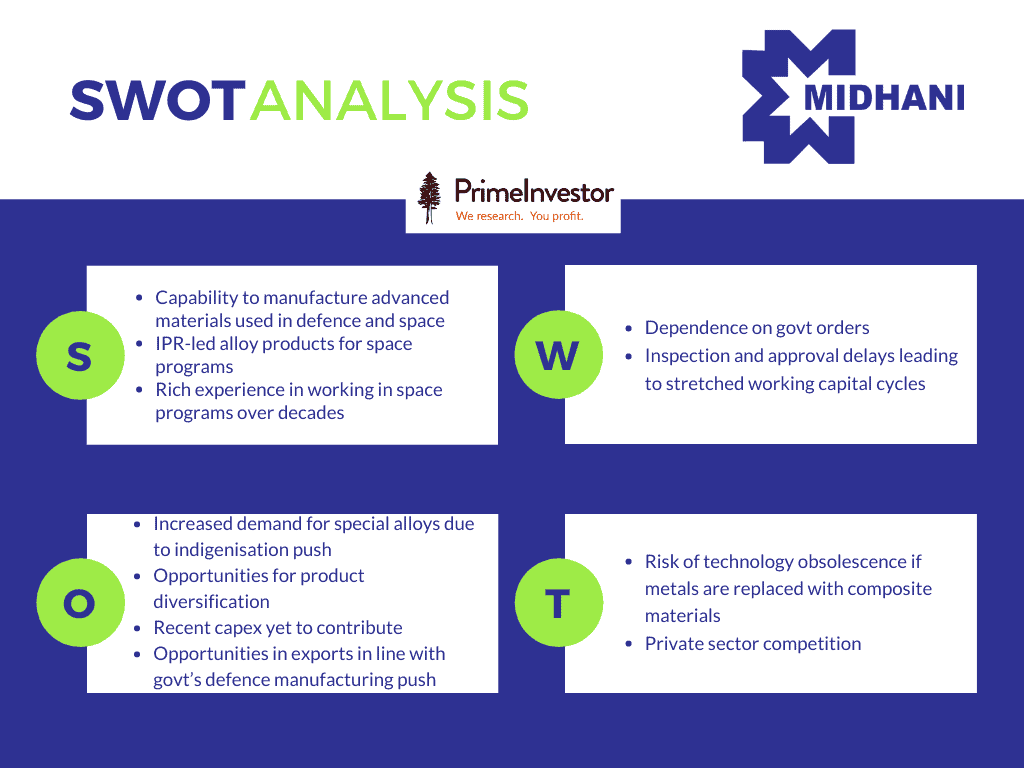

The Indian government has set a defence production target of $25 billion by 2025 (including $5 billion from exports) compared to $11 billion achieved in 2019. This points to a CAGR of about 15% over the six-year span. PSUs including ordnance factories have so far contributed 79% of defence production. In value terms, PSUs produced $6.4 billion out of $11 billion of production at the end of 2019. A thrust on domestic manufacturing and indigenisation will benefit companies in material supplies that focus on import substitutes for critical defence applications and space missions. The opening up of space research for private participation is also likely to see more action and investments in this space.

Aerospace manufacturing needs special alloys of steel, aluminium, titanium etc and composites. Currently about 70% of these raw materials are imported into India, mainly from developed countries like the US and Europe. These special alloys have superior mechanical properties and better workability which are essential for special applications in aerospace, power generation, nuclear, defence and other general engineering industries.

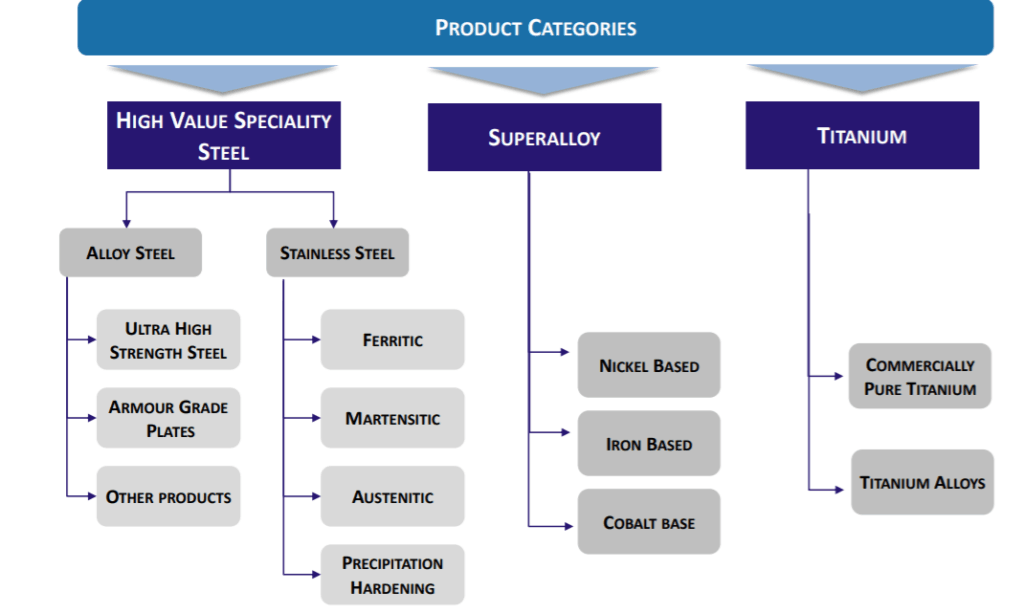

The addressable market for speciality steels in India is ~0.4 to 0.5 lakh tons, arising from the defence, power and niche engineering sectors. Special steels containing nickel, cobalt, molybdenum, titanium, and aluminium are manufactured through a vacuum melting process and are used in nuclear reactors, armours for vehicles and rocket motor casings for PSLV and GSLV of ISRO. Titanium alloys are used to make high-strength forged components such as rotors, compressor blades, hydraulic system components and nacelles. The titanium market size in India for FY18 was 3098 TPA and is expected to increase to 5231 TPA in the FY25, a CAGR of about 7.8%. Superalloys have application in sectors such as industrial gas turbines, aerospace, heat exchangers, oil and gas, and chemical processing industries.

Mishra Dhatu Nigam or MIDHANI has the technological ability to manufacture the wide range of advanced metals and alloys mentioned above, under one roof.

Company analysis

MIDHANI was established in 1973 with an aim of achieving self-reliance in research, development and supply of critical alloys and products of national security and strategic importance. It manufactures special steels, superalloys and is the sole manufacturer of titanium alloys in India. These are high value products which cater to defence, space and power. There are three types of superalloys – nickel-based, cobalt-based, and iron-based. MIDHANI is the only domestic manufacturer of all the three types of superalloys and the rest of the requirement is imported.

Source : Company Presentation

Despite this niche focus, MIDHANI’s revenues have stagnated at Rs.700-800 crore for the last five years. But they look to gain traction now, backed by five triggers.

# 1 Space programmes and IPR-led business

MIDHANI has been associated with ISRO in all its key projects so far. The material for the rocket motor casing for PSLV and GSLV were supplied by it. There are currently three major space projects that ISRO is looking to complete by the end of 2025 – the GAGANYAAN mission, the MANGALYAAN-2, and the SHUKRAYAAN mission. Under the Gaganyaan mission, the first unmanned launch is slated for December 2021 while the manned mission will take place in 2022. The manned mission is likely to feature a titanium chamber for cosmonauts, the material for which will be provided by MIDHANI. MIDHANI will also supply titanium alloy materials for Gaganyaan’s GSLV-Mark-III rocket liquid engine thrusters, nozzle, gas bottles and cryogenic upper stage components. At present, orders relating to space contribute to 67% of the order book. Order book composition can be volatile between space and other areas which need to be watched. In FY20, MIDHANI filed 50 IPRs which were made up of 24 copyrights and 26 trademarks. Three patents were granted in FY20 apart from IPR on trademarks which were filed during FY19.

#2 Healthy margin profile

MIDHANI’s products are mostly import substitutes. Given the specialised nature of its products, input prices are generally pass-through and so there is not much of earnings volatility on account of commodity price fluctuations. An IPR led model allows it to earn significantly higher EBIDTA margins than plain-vanilla metal players. Ups and downs in the prices of raw materials may not have a major impact on its margin profile. But volatility in margins can crop up depending on the composition of its order book and execution in a specific period which shows up in the revenue mix. EBIDTA margins are likely to remain upwards of 25%, so long as space orders/execution are above 50% of the order book.

#3 Healthy order book

MIDHANI’s order book remained strong at the end of September 2020 (the latest available data) at two times FY21 revenues. Recent order flow however has favoured low-margin defence orders. But the legacy order book mix is in favour of high margin space orders. Space orders have 30-35% margins while defence orders have only 10-15%, according to management. The company claimed a higher pace of execution from Q4 and further progress on this count needs to be watched. Plant modernisation and completion of major capex programmes may also aid in better execution from FY22.

While the current order book has a healthy mix, order intake has slowed since FY19. FY21 was dominated by defence orders, and the next major order flow from space is likely once ISRO starts planning for the Mangalyaan – 2 and Sukhrayaan Missions. But, execution was skewed towards high margin space orders in recent years. For the upcoming Gaganyaan mission, MIDHANI had secured orders earlier and has been executing them.

#4 Capex to contribute

MIDHANI has undertaken both modernisation and expansion of capex at its manufacturing facilities, which is expected to begin contributions from FY22. The company has completed a Rs 200 crore modernisation recently and expects to complete major capex (detailed below) in FY21, freeing up cash flows from next fiscal year onwards. These initiatives are expected to increase operational efficiencies, reduce external dependence and contribute meaningfully to growth in the future. Debt is not a concern with this modernisation capex. Another major capex is customer funded. While the accounting treatment is unclear, the debt equity ratio is likely to stay within 0.5 for FY21 and reduce further in FY22. But the joint venture with NALCO is a key variable to watch. Depreciation on commissioned capex taken with debt for the NALCO JV can pull down earnings.

Detailed overview of the capex projects :

Wide plate mill: The mill is expected to produce wide plates from ultra-high-strength steel (maraging steel) with a capacity of 30,000 tonnes per annum. It is a special quality steel containing nickel, cobalt, molybdenum, titanium, and aluminium and is manufactured through vacuum melting process. These tough plates are to be used in nuclear reactors, in armours for vehicles and in rocket motor casings for PSLV and GSLV of ISRO. The project is in an advanced stage and expects to book orders by FY22.

Armouring plant: A unit at Rohtak to cater to the demand for body armour, vehicle armouring, bullet proof morcha, bullet resistant jackets etc. MIDHANI had completed its first commercial bullet-proof vehicles order and handed over 15 vehicles to CAPF in 2019. This composite facility is expected to meet increased requirements. Initial orders expected in FY22 may be below Rs. 100 crore with scalability in future

Spring plant: For supply of helical compression springs for railway wagons, coaches, locomotives, this will address import substitution of LHP springs for railways. Completion of the plant has been a bit delayed and was expected to be ready in FY21 itself. The plant will go on for trial production and move to business in FY22 after product approvals by Railways

#5 Diversification initiatives

MIDHANI is also seeking to enter new user markets of oil & gas, mining, power, railways, chemical and fertilizer for its specialty steel and super alloys products. The company has already put up a spring plant to cater to the Railways and is looking to supply high quality plates from its wide mill plant.

A JV with NALCO under the name of Utkarsha Aluminium Dhatu Nigam to manufacture high end aluminium alloys has been incorporated. It involves an estimated capital expenditure of Rs 4,500 crore to be funded through a debt: equity mix of 70:30. MIDHANI and NALCO have invested Rs.20 crore each in the JV (by way of initial share capital, rights issue). The companies are also scouting for a technology partner and eventual equity stakes and contribution will be based on it. There are however uncertainties relating to the execution and timing of contribution to revenues, this being a very large project with a technology partner yet to be finalised. MIDHANI and HAL have also signed a MoU recently for development and production of composite raw materials during Aero India 2021 held in Bengaluru. Other areas of diversification include bio medical implants using Titanium shape memory alloys for which it has signed a transfer of technology agreement with CSIR-National Aerospace Laboratories in 2017.

Valuation

At current price, the stock is trading at about 23 times FY2021 expected earnings which is at a premium to other defence PSUs like Bharat Electronics, HAL and Bharat Dynamics. The market appears to be factoring in superior growth from MIDHANI, though its ROE and RoCE profile are inferior to Bharat Electronics, HAL and Bharat Dynamics. For FY21, the company is yet to declare its full financial results. But it has announced that it achieved turnover of Rs. 810 crore, which translates into Rs.342 crore in Q4. This points to strong execution in Q4. Unlike most other PSUs which are viewed as dividend plays with mature growth prospects, MIDHANI by virtue of its high margins, pricing power and presence in a niche space is viewed more as a growth stock playing on the privatisation and indigenisation of the defence and space industries in India.

Though earnings growth has remained muted for the last 5 years, there is potential for earnings to grow in double digits between FY21 and FY25 on the back of capacity expansion, better execution (reflected in Value of Production) and new revenue streams apart from external growth drivers. Being a player on ‘material supplies space’ that are largely import substitutes, it should be able to demonstrate growth at or above the overall defence production growth rate of 15% through FY25.

Key risks

#1 Despite its promising core business, MIDHANI is not without risks. It has a stretched working capital cycle and this is generally the case with defence PSUs. Sometimes, inspection and approval delays push back sales realisations as happened in FY20. Inventory at the end of FY20 was Rs. 910 Crore, higher than FY2020 sales of Rs. 713 crore. The position remained unchanged with inventory and receivables at Rs. 923 crore and Rs. 336 crore at the end of H1 FY2021. A higher proportion of orders from defence rather than aerospace may weaken its earnings profile and RoE and keep the working capital cycle stretched.

A DuPont analysis shows that though RoE is steady over the last 5 years, it has lately been driven by PAT margins and leverage. Asset turnover ratio has fallen significantly due to the significant accretion to inventory. The situation may improve from FY22 if the pace of inspection and approval of finished products gathers steam.

#2 The JV with NALCO for aluminium alloy manufacturing plant with capacity of 60,000 tonnes per annum involves an estimated capital expenditure of Rs 4,500 crore and will be funded on a debt: equity mix of 70:30. In case MIDHANI needs to shell out money for a 50% stake (about Rs 650 crore), that will put strain on its financials. Even smaller capex projects undertaken by the company have seen significant delays.

#3 Impending stake sales by the government are always a potent overhang on PSU stocks. Speculation on a 10% offer for sale by the government has been going rounds for some time though the final dates have not been announced. There can be significant price volatility around the OFS and the higher supply of shares after this, could pressure stock prices.

#4 The company is exposed to the price volatility of some critical imported raw materials such as nickel, cobalt, and tungsten from several countries. Currency fluctuations can impact raw material costs. The company does not hedge against currency rate fluctuations given the duration of purchase contracts.

3 thoughts on “Stock Review : Mishra Dhatu Nigam (MIDHANI) – A material growth proxy on defence and space”

Thanks for the reply. I must say its a very good analysis of the PSU.

Cheers!!

Can this become a multi bagger? its consolidating from last 5 years now and ready for break out?

Thanks for your query sir

For the time being, it is only a stock review and not a recommendation considering the pros and cons.

Comments are closed.