A new cohort in the banking space that is getting significant attention in the market is the Small Finance Banks or SFBs. This cohort also saw two successful IPOs this year, the recent one being that of ESAF.

A while ago, there was only three broad categories in the banking sector – PSU, private, and old private. But the old private banks as a cohort have significantly weakened post the previous economic upcycle – that is, the major economic upcycle that started in 2003 and ended in 2013 with most of the banking stocks peaking in 2010. India’s nominal GDP was at $1.7 trillion then. Now, we are talking about a nominal GDP of $ 3.4 trillion while the bankable population itself has increased significantly post digitization and with the doubling of the economy.

SFBs were born from the need for financial inclusion in the middle of the last decade and they are now fast-spreading their wings wide. Some of them could soon end up being universal banks when RBI allows conversion (which RBI has originally proposed after 5 years of successful operations). The SFBs seem to have made the most out of the window of opportunity provided to them.

To put this in perspective, here are some numbers:

- The 6 listed SFBs have now matched the 7 old private sector banks in market cap (at ~Rs.80,000 crore) while commanding a premium valuation in the market, at 2.3 times price to book vs 1.2 times for old private banks.

- These SFBs have grown their book at a CAGR of 25% in last 5 years, despite Covid, and boast of a capital adequacy of 20%+ and RoA (Return on Assets) of ~2.25-2.5%.

- The No. 1 SFB (AU SFB) is now the seventh largest private bank by market cap, just behind IndusInd and IDFC First, and is more richly valued than any old private sector bank.

- The No. 2 (Equitas) and No.3 SFBs (Ujjivan) are also ahead of many of the old private sector banks in market value.

- AU SFB is also the most richly valued private bank in the market (on price to book) at this point of time.

The stellar September quarter results also serve to keep SFBs in the limelight. With the increasing importance of SFBs as a separate segment in the listed financial lending space, we deep-dive into how these companies have performed and what makes them really shine in the market. We also explain the metrics that matter in stock selection.

Small Finance Banks – Results

Here’s how the top listed SFBs* have performed in the first half of FY24 (April-September 2024)

Their stellar performance was driven by three factors:

- Strong demand for credit leading to healthy AUM growth

- Asset quality normalising to pre-Covid levels

- Ability to mobilise retail deposits, aiding profitability and RoA

#1 Healthy AUM growth

Let’s first understand the segments to which SFBs lend, before getting into growth. As mentioned earlier, SFBs were born out of the need for financial inclusion, and so they operate in segments that cater to low-income households and individuals in semi-urban and rural areas. The top two SFBs have vehicle finance (including used vehicles) and small business loans as their key lending segment. Others have micro-finance as their key lending segment. In fact, these entities were converted to SFBs either from NBFCs or micro-finance institutions.

The chart below gives a snapshot of AUM composition.

These lending segments have been fertile grounds for SFBs in the past few years as credit demand took off, and where banks and other large NBFCs have a limited play. SFBs have grown their AUM at a stellar pace of 25% in the last 5 years, despite Covid acting as a speed bump in-between. After witnessing a bit of slowdown in FY21 and FY22 due to Covid, growth has revived strongly in FY23 and H1FY24 as can be seen in the graph below.

The vehicle loan segment benefited from the strong revival in the auto CV cycle. Demand in small business loans and microfinance segments also took off due to buoyant recovery in the services sector, post Covid. The micro-finance segment also benefited from the enhancement of upper borrowing limits by RBI in 2022 apart from normalisation of demand in the aftermath of Covid. The fact that SFBs were already well-capitalised despite absorbing Covid-related shocks and could also raise money from the market in time allowed them to take full advantage of the growth in credit demand.

#2 Normalising asset quality

For SFBs, a significant share of the book comes from segments such as micro-finance, an unsecured portfolio; they do not have the means to squeeze out any recovery from loans going unpaid. Covid, therefore, took a significant toll on the asset quality of most SFBs as can be seen from the spike in NPAs in the graph below. But over FY23 and the first half of FY24, the asset quality has almost normalised to pre-Covid levels and is on an improving trajectory.

SFBs further seem to be taking advantage of the digitisation drive; this is providing them with more data and in turn more knowledge about their customers. Online payments, GST data, and analytic services are arming SFBs with a stream of data that enables better assessment of borrowing capacity of their customers, helping better lending decision-making and pricing.

The two charts below show the asset quality trend in the last 5 years

#3 Superior profitability

The SFB segment is also known for their superior RoA, driven by their high NIM, despite high cost involved in the operations. Most SFBs are still a people (field force)-driven model, and thus their cost-to-income ratio is much higher compared to universal banks. The necessity to invest in technology has also kept operating costs elevated. The cost-to-income ratio of SFBs is in the 60% range vs the 50% or below for universal banks.

However, SFBs have still earned superior ROA and in turn superior ROE. One, they have a superior lending yield (15-25%). Two, they have tapped the retail deposit base smartly, which gives them a low-cost funding source; the ‘bank’ tag along with attractive rates has helped them pick up retail deposits. It is a commendable achievement by those SFBs who have achieved 30-35% Current and Savings Account (CASA) ratio. This is acting as a key driver of their RoA by keeping their funding costs low and earning higher spreads (NIM).

Below is a quick glimpse into the CASA, RoA and RoE of the listed SFBs

To summarize, a combination of high AUM growth, improving asset quality and lower cost funds is aiding profitability and in turn superior RoA and RoE for SFBs. This is affording them more respectable valuations in the market at this point of time.

What to look for while investing in Small Finance Banks

For investors who want to invest in SFB stocks, the market interest and strong earnings may seem attractive enough to invest. However, it’s important to note that current valuations already seem to have built in earnings performance and re-rating is largely done. At this stage, especially, when there is a sound economic upcycle driving loan book expansion, it is extremely important to check on other factors to make a more informed decision from here. This section lists these parameters on which to analyse an SFB apart from just the price-to-book value.

#1 AUM composition

While the SFB segment has performed very well in FY23 and the good run is continuing, it is important to look at the book composition to understand the risk involved in the business. The book composition tells us the following about an SFB:

- Whether the book is secured or unsecured and the possibility of potential spike in NPA during bad cycles. We have seen how NPAs spiked for unsecured lenders during Covid. The micro-finance book has been sensitive to state-wise issues in the past as well.

- the cost and complexities involved in the business model. Smaller ticket sizes combined with people-driven lending (micro lending, small business loans, mortgage-backed personal loans) will keep the cost structure elevated and will take a toll on RoA during bad cycles.

- SFBs that have made strong presence in niche verticals in secured lending are better placed to deliver sustainable growth in long term. NBFC-turned-SFBs like AU and Equitas have demonstrated scalability in verticals such as vehicle finance and small business loans to aid accelerated growth in AUM.

- SFBs with semi-urban and rural focus have been able to better expand branch network in semi-urban and urban centres and mobilise low-cost retail deposits compared to the ones with largely rural focus.

#2 Key Valuation Ratio

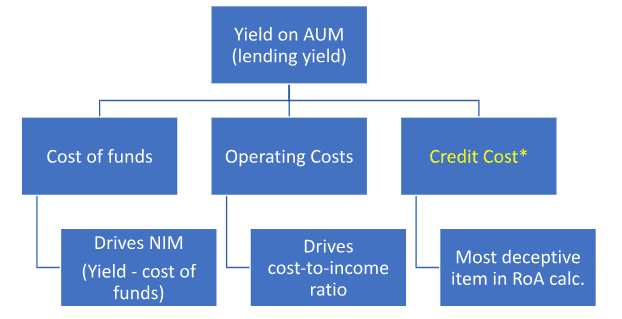

For a financial stock, RoA is the key determinant of valuation and is derived from lending yield, net interest margins, cost of funds, operating costs and asset quality

*Note: Credit cost = Provision for possible loan losses + Write-off of loans + Losses on sales of delinquent loans – gains on reversal of provision – recoveries.

A higher lending yield is as a primary driver of RoA as it can lead to healthy NIMs. But a high lending yield combined with low credit cost can be deceptive in an upcycle. Because high lending yields are also a reflection of the risk in the underlying book, there can be negative surprises should the cycle turn or a key lending segment go through a rough period..

To give a sense of the variations in lending yield in context of the lending segment, the lowest lending yield is in prime home loans at 9-10% and the highest lending yields is on personal loans and micro finance at 20-25%. Other collateralised risky loans such as vehicle, gold, property carry yields of 12-18%.

So, it is important to look at the drivers of RoA and look for a sustainable combination which include a reasonable share of secured book, a good share of low-cost retail deposits and a credit cost that reflects the actual risk in the business.

#3 Capital Adequacy Ratio (CAR)

It is extremely important for SFBs to ensure capitalisation based on their book profile. While banks may be able to operate at a lower CAR, it may be good for SFBs to operate at higher CAR due to the higher risk they carry in their book

As of now, all the SFBs are well capitalised with Tier 1 CAR above 20% compared to regulatory requirements of 15% in total CAR.

#4 Leadership of the small finance bank

CEO tenure is an important factor to consider in investing in an SFB. The 3-year term approval of CMDs by RBI applies to SFBs as well. Founding CMD at the helm for a considerable length of time can do wonders for scalability combined with discipline. So, CEO tenure and internal succession planning may be important qualitative aspects to look at.

#5 Geographical presence

One interesting thing about these SFBs is their geographical concentration. AU SFB is largely focused on West and South while Equitas, ESAF and Suryoday are largely South focused. Ujjivan’s focus is in both South and East while Utkarsh is largely an East based player. Most of the SFBs have significant concentration on a particular State as well. This data is shared by all SFBs in their earnings presentation. AU SFB, with its decision to merge unlisted Fincare SFB with itself, is heading to become a pan-India play led by its founding CEO.

Due to this geographical distribution, investors can look to play this space through multiple stocks while considering the credit culture of each geography in mind to decide on allocation.

#6 Valuations

Valuations need to be looked at in context of the parameters discussed above. Here’s how SFBs currently stack up on the price to book value

AU SFB is attracting rich valuations as it is the only SFB that has scaled in size, heading closer to being a large cap stock. It has also turned out to be the preferred bet for many fund managers and institutions. The remaining SFBs are mostly in the 2 – 2.5 times price to book band, which is neither stretched nor depressed.

A desirable combination to look for can be a good share of secured book, specialisation in some secured lending verticals, ability to garner low-cost deposits and drive cost efficiency through technology. This needs to be seen along with the valuations.

To sum up, SFBs as a distinct segment have become relevant in India’s financial space. But they differ a lot from conventional banks in many things and hence their risk-return profile is vastly different as well.

Investors may do better of by taking more informed decision on this cohort rather than just going by headline valuation multiples.

The securities quoted are for illustration purposes only and are not recommendatory.

Disclosure: We had a recommendation in Prime Stocks on an SFB earlier, which is now in the “Hold” category. This apart, we have two SFBs in our Finance Squared smallcase portfolio.

2 thoughts on “Small Finance Banks: What drives their strong performance ”

Dear Sir;

very good article.

1 query : with such performance of small finance bank i.e. AU bank; why PI team has not recommended in placing FD in this bank.

wish to know it as currently FD rates offered by AU bank are also lucrative.

Welcome your query sir,

Kindly check the FD ranking tool where we have mentioned our confidence levels on banks- “prime confidence”.

AU is at “high” on this.

Meanwhile, Equitas found place in FD reco. list because of the higher rate it offered.

So, you can use the FD ranking tool also to arrive at decision on deposits apart from reco.

Thank you

Comments are closed.