If you had missed the mindboggling rally of Nvidia stock in the past year, you are not alone. Most Indians would not have participated in this multi-bagger story. (Nvidia commanded a large market share in specialized chip needed for most AI application – a segment that is more lucrative than gold now).

You missed the bus not only because Nvidia is not available locally to trade but also because there aren’t any companies similar to this giant in India. But then, there may yet be Indian companies (or upcoming ones) in the semiconductor/electronics industry that might turn out to be good investments in future. But before that, it is important for you to understand the semiconductor industry and the landscape here.

Let’s start with an example we all understand well.

Imagine the first computers: giant machines weighing 30 tons, taking up 1800 square feet of your house (almost the size of a large apartment!) that consumes 150 kilo watts of power. All that power just to do basic math! Now, look at supercomputers today that can test mathematical models for complex physical phenomena or designs, such as climate and weather, evolution of the cosmos, nuclear weapons and reactors, cryptology etc. This amazing progress happened because of advancements in semiconductor chip (Processors & graphics processing unit or GPU), the idea that computers get smaller and faster over time.

Tiny switches called transistors are the building blocks of computer chips. The more transistors a chip has, the faster and more powerful it is. But there’s a problem: if you cram too many transistors in, the chip gets too big! That’s why it’s surprising that Apple’s new A17 chip has 19 billion transistors, almost 20 times more than their older A7 chip, yet they’re both about the size of your fingernail. The secret? Engineers learned to shrink the distance between transistors, making them incredibly tiny – even smaller than a common cold virus! This lets them pack more power into the same size chip.

In fact, Intel is aiming to put a mind-blowing 1 trillion transistors on a chip by 2030, all thanks to this miniaturization trick.

Moore’s Law: Moore’s Law was proposed by Gordon Moore, the co-founder of Intel. It says: “An observation that the number of transistors on a microchip roughly doubles every two years, whereas the cost is halved over the same timeframe”.

The Semiconductor industry

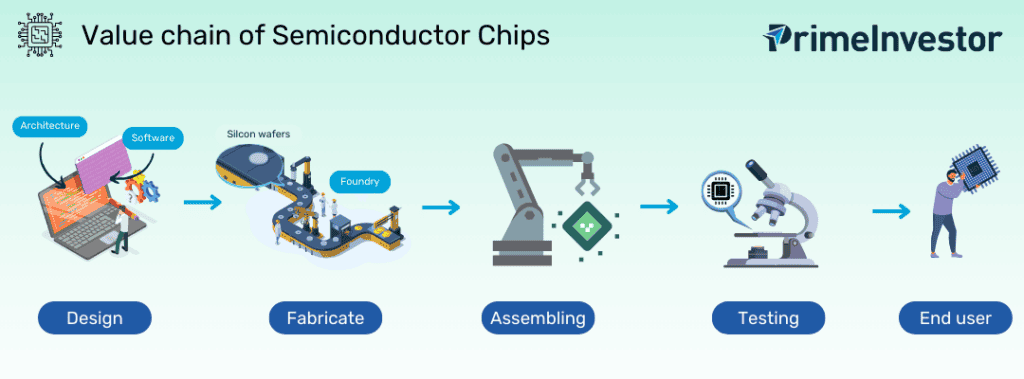

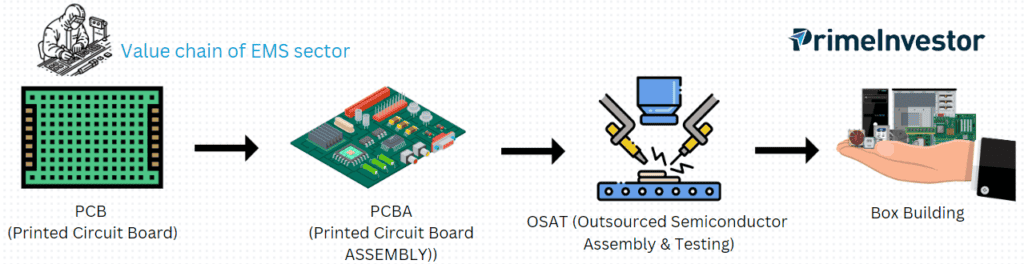

Let’s take a deep dive into the value chain of semiconductor chip manufacturing, EMS (Electronic Manufacturing Services) and OSAT (Outsourced Semiconductor Assembly and Testing) to understand the India opportunity, starting with the Value chain of Semiconductor chip manufacturing;

In the entire value chain of global semiconductor industry, the revenue generated is distributed among design (Chip making), manufacturing (foundries), and testing & assembly (OSAT) in the following way:

Now, let’s look at each of these areas in detail and where exactly the opportunities for Indian companies lie in this pie.

#1 Design

The first step in making a computer chip is designing it. This is like creating a blueprint, and it's done by architects and software engineers.

There are two main types of chip companies:

- IDM (Integrated Device Manufacturer): These companies, like Intel, do everything themselves. They design, build, assemble, test, package, and sell their own chips. They don't rely on other companies to make their chips.

- Fabless Design House: Companies like AMD and NVIDIA design their chips, but they don't have factories to build them. Instead, they rely on manufacturers like TSMC and Samsung to make their chips for them.

#2 Fabrication

Companies like TSMC and Samsung (also an IDM) are called foundries (check the large foundries and their revenue here). They're the factories that build the chips. These chips start out from silicon wafers, thin slices of ultra-pure silicon, which is the main ingredient in sand. The foundries don't make the silicon wafers themselves; they get them from other suppliers. Then, the foundries put these wafers through a complex series of steps to transform them into working semiconductor chips.

#3 Assembly & testing

Even though India isn't a major player in the entire chip-making process, it does have a role in a crucial stage the Outsourced Assembly & testing or OSAT stage.

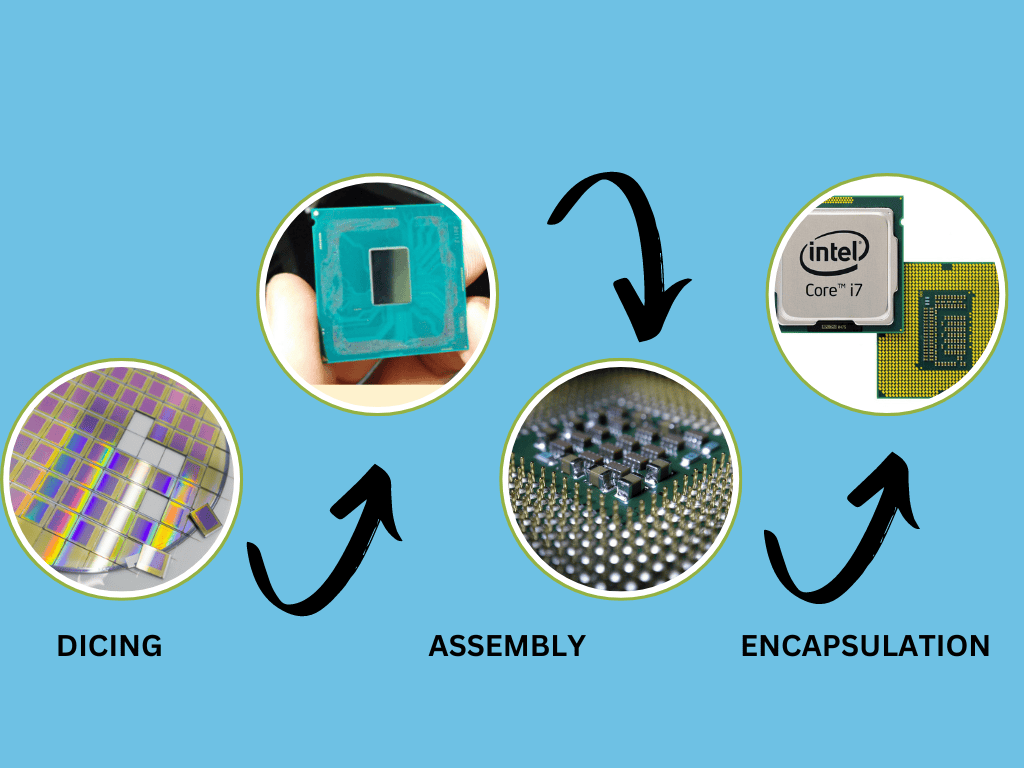

It involves the following steps:

- Dicing: First, these individual chips need to be separated from the wafer. This process is called dicing, where the wafer is precisely cut into tiny pieces, each containing a single chip.

- Assembly: Next, each chip is mounted onto a base called a lead frame. This lead frame has tiny metal connections that allow the chip to communicate with the outside world. Then, thin gold wires are attached to connect the chip to the lead frame.

- Encapsulation: Finally, the whole thing is covered in a protective shell to shield the delicate chip. A lid is then attached to complete the package.

Once the chips are assembled, they go through a series of tests to ensure they're working perfectly. This includes checking for:

- Electrical leaks: Any tiny escapes of electricity that shouldn't be happening

- Humidity: How well the chip handles moisture in the air

- Temperature: How the chip performs under hot and cold conditions

- Stress: Pushing the chip to its limits to see if it can handle demanding situations

After passing these tests, the chips are ready for the next step.

They might be sent back to companies like TSMC for further processing, or they could be shipped directly to chip designers like AMD or NVIDIA for use in their final products.

Is India a chipmaker?

Ironic as it may seem – Many Indian nationals are engaged in the area of semiconductor design in large global companies. Yet, India is yet to make any meaningful progress in this space in the areas that we discussed earlier.

Here is a simple article on why India can’t make the chip. The various headwinds include the mammoth scale of investments, right technology partnerships, technology transfers and skilled labour.

What we have at present in India is a rising wave of Electronics Manufacturing companies (EMS) that are primarily into assembly of electronic products and manufacturing of basic components like printed circuit boards (discussed further below). This too comes from an increased thrust on domestic electronics manufacturing, through government policies.

Before we talk about what the future holds for India, let us look at what the country’s present capabilities are and what kind of players are present.

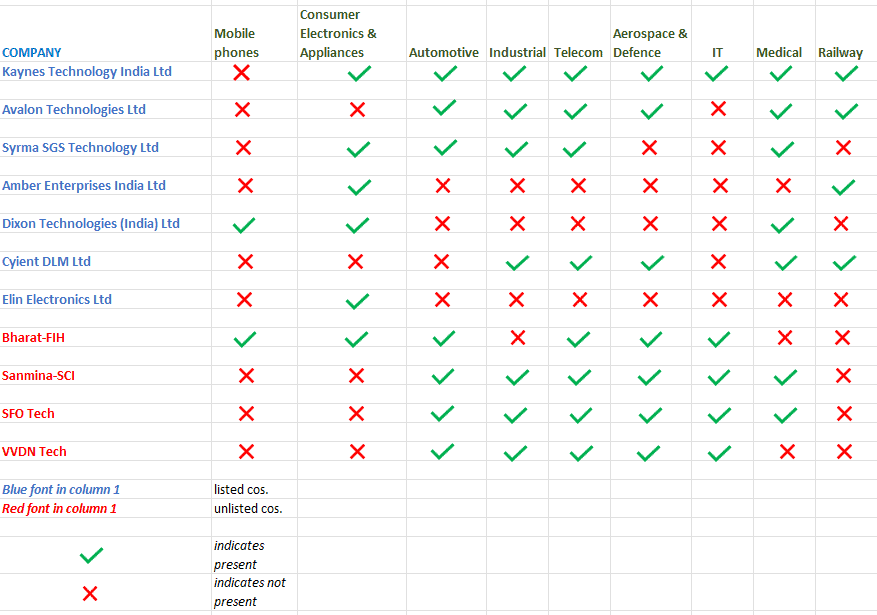

If we look at the current EMS landscape, there are finished product companies like Dixon, Amber, Bharat FIH (Foxconn, Unlisted), etc and there are a bunch of component manufacturers like Kaynes Tech, Syrma SGS, Avalon, etc.

The component players are currently involved in PCB manufacturing, PCB assembly (PCBA) and Box Build for a range of industries.

We will quickly discuss about these in detail and then about the opportunity for Indian EMS companies.

PCB (Printed Circuit Board): The printed circuit board (PCB) is the essential foundation for most modern electronic devices. It provides the physical base upon which all the other components are mounted and connected, enabling them to function together.

PCBA (Printed Circuit Board Assembly): A Printed Circuit Board Assembly (PCBA) is created by populating a bare PCB with various electronic components.

BOX Building: Box building is like the final assembly line for many electronics. Imagine a pre-built box. Inside this box goes a special circuit board called a PCBA. This PCBA is like the brain of the device, holding all the important parts like the processor and memory. Other components like screens, keyboards, power supplies, and buttons are then carefully placed inside and connected with wires to the PCBA. After a thorough check to make sure everything works perfectly, the box is closed, and you have a complete electronic device, like a laptop! While box building helps companies make electronics faster and cheaper, it limits how creative they can be with the design and the types of parts they can use.

The table below tells us what each of the players in the listed EMS space are into.

Source: Company & Industry reports

While the companies above may not be in higher end of the value chain now, venturing into OSAT (outsourced semiconductor assembly and test) will move them higher in the value chain and also enable them to earn high-value services income from testing and assembly as shown below. (you can also see this video to understand OSAT)

From an investors’ point of view, an EMS component manufacturer entering OSAT is something to take notice of. The outcomes are high value services income, customer stickiness and better scalability versus competition due to presence across the value chain. This significantly enhances a company’s competitive advantage in the highly commoditized EMS manufacturing ecosystem. Since it involves material investment to set up an OSAT facility, only few players from the EMS component manufacturing are likely to venture into it.

What the future holds for Indian players

A few players in India appear to be ambitious and striving to be part of the semiconductor ecosystem by first venturing into OSAT. This by itself can be called a giant leap from where India is today – with potentially positive or negative outcomes. Just to give some ground-level examples on this front:

- HCL Tech is partnering Foxconn for a $400 million OSAT plant in Karnataka.

- Murugappa Group company CG Power and Industrial Solutions has signed an agreement with two foreign entities to set up an Outsourced Semiconductor Assembly and Test (OSAT) facility and plans to invest close to $1 billion (~Rs 7,600 crore) in India over five years.

It is to be noted that OSAT requires relatively less investment than actual chip manufacturing.

But the Tata Group is building a much larger ambitious plan. Tata Electronics, a leading Indian electronics company is following the giant footsteps of the likes of TSMC and Samsung (note that it is still a miniature venture compared with the giants) by venturing into chip manufacturing itself. The company plans to establish chip fabrication plants in Gujarat and Assam, with operations targeted to begin by 2026. To solidify their position in this industry, Tata Electronics is making a significant financial commitment, pledging a staggering $90 billion over the next five years. Recently, the company raised its authorised share capital by 4X to Rs 10,000 crore.For OSAT, the company is investing close to $3 billion (~Rs.27,000 crores).

Elon Musk's Tesla has signed a strategic agreement with Tata Electronics to source semiconductor chips for its global operations

So, to sum up, Indian companies are electronic manufacturers and not chip makers for semiconductor industry!

India’s listed opportunity is largely in the EMS space with some venturing into OSAT and a rather ambitious plan by the Tatas into chip manufacturing. We will try to review promising listed EMS companies that are gaining ground in OSAT or chip making. Such company specific report will be available only for Prime Growth subscribers. Upgrade if you do not have one today.

The securities quoted are for illustration purposes only and are not recommendatory.

11 thoughts on “Prime Sector Insight: The Semiconductor industry and India’s opportunity”

Well written!

Thank you sir

I highly recommend a book “When the Chips Are Down” by Pranay Kotasthane (Author), Abhiram Manchi (Author) for those who are interested in understanding the geopolitics of semiconductor industry.

sir is it true that some software companies like tata elxi are help in Chip Designing?

https://www.tataelxsi.com/news-and-events/tata-elxsi-collaborates-with-arm-to-accelerate-the-software-defined-vehicle-journey-for-oems

Hi sir,

Yes, Tata Elxsi is involved in chip design, but not at the core architecture level like companies such as Nvidia, Intel, and AMD. These companies focus on designing the chip’s fundamental structure, while Tata Elxsi specializes in optimization and application-specific design. They create software tailored to run on specific chips, maximizing their performance for particular tasks. For example, if a company develops a chip for self-driving cars, Tata Elxsi can develop software that fully utilizes the chip’s capabilities.

Very informative article. Please keep us updated on Indian Companies entering chip design/manufacturing.

Thank you, sir. For sure, we will review some good companies in this space.

Very good article ! Thanks for this !

Kept hearing about Reliance group and Vedanta’s plans as well in this sector, is there any real progress or just market bytes?

Hi sir,

Vedanta and Foxconn initially planned a $19.5 billion partnership to make computer chips in India.

They both wanted to use technology from a European company called STMicro. However, the Indian government wanted STMicro to invest money in the project, which made STMicro less interested. Additionally, Vedanta wanted the chip factory in Gujarat, while Foxconn preferred Maharashtra, which offered more financial incentives.

These disagreements, along with the fact that Vedanta is mainly a mining company and Foxconn specializes in assembling electronics rather than making chips, contributed to the failure of the partnership.

Reliance is considering venturing into the production of computer chips. They have engaged in discussions with foreign companies, but details regarding timelines, investment commitments, and technological support remain unclear. Despite Reliance’s substantial financial resources, competing with global chip manufacturing giants without robust technological backing will be challenging.

For your knowledge, the machines required to manufacture today’s advanced semiconductors are incredibly expensive for Indian companies to invest in. A single machine costs between $300 million and $350 million, and only 40 to 50 of these machines are produced annually by a company called ASML. The incremental capital expenditure for this sector is estimated at $15 to $20 billion, indicating that India has a substantial path ahead before becoming a major player in semiconductor manufacturing.

Excellent, Need of the hour. Well Articulated!

Thank you sir

Comments are closed.