If you’re a long-time investor in Indian mutual funds, chances are that you have found the MF categorization rules by SEBI implemented in 2017 both helpful and limiting at the same time.

Yes, the rules did make life easier for folks who analyze MF performance. It standardized MF portfolios and clearly defined labels such as large-cap, mid-cap, small-cap for equity funds, and ultra-short, short, medium and long duration for debt funds. This brought about more truth-in-labelling and made inter-scheme comparisons and benchmarking easier.

But limiting AMCs to a 36-item menu with just one scheme per category has stifled consumer choice and product innovation. It’s like forcing restaurants to pick one cuisine—South Indian, North Indian, or Chinese—with no fusion allowed, just to avoid “confusing”.

However, it is good to know that the 2017 MF categorization rules are not cast in stone and that SEBI is keen to review them as the industry evolves. It recently issued a consultation paper on July 18 on this subject. Here’s what will change with your MF choices, if these proposals are written into law.

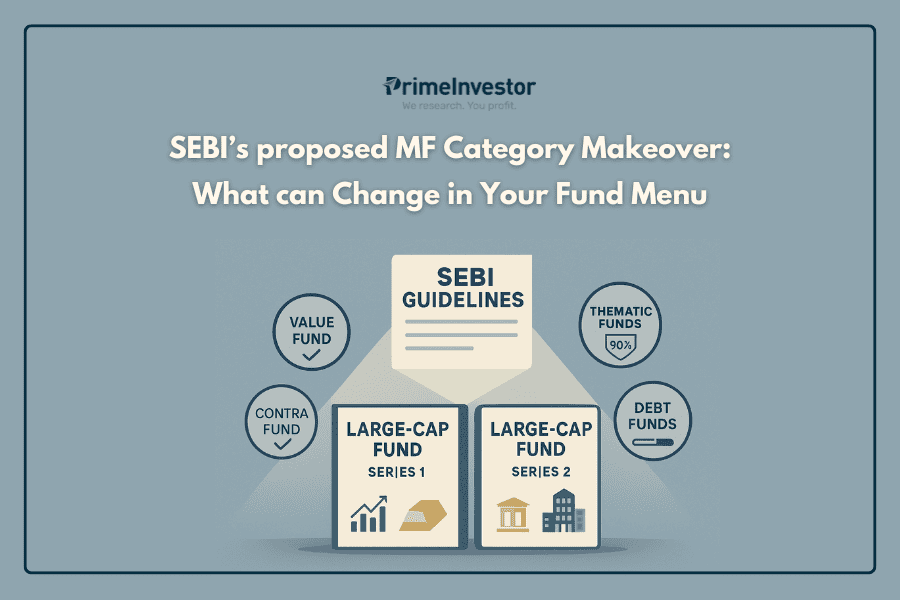

QUICK READ: What’s the proposal for MF categorization rules

Major Changes

- Two schemes per category allowed (if first scheme crosses ₹50,000 crore and completes 5 years)

- Value + Contra funds can be launched separately

- 50% overlap rule for thematic/sectoral funds to reduce NFO clutter

What’s Better

- Equity funds can invest residual money in REITs, InvITs, gold/silver (not just cash)

- Debt funds get flexibility to reduce duration during adverse market conditions

- 3 variants each of retirement and children’s funds (equity, hybrid, debt-oriented)

Key Constraints

- When 2nd scheme launches, 1st scheme stops taking new money

- New scheme’s fees capped at old scheme’s level

- Thematic funds must maintain distinct 50% non-overlapping portfolios

Bottom Line

More choice for investors, better portfolio management tools for fund managers, but with guardrails to prevent product proliferation chaos.

Note: These are proposals under consultation – final rules may differ

More schemes per category

One of the main features of the 2017 rules was the one-scheme-per-category rule. Effectively, an AMC could only offer one product each in the mainstream equity, debt and hybrid categories. Therefore, every fund house today has only one large-cap, mid-cap, small-cap, flexicap and multicap fund in its equity menu and one money market, short duration, medium duration, corporate bond fund and credit risk fund.

This has led to two kinds of challenges.

- One, the very successful schemes in some of these categories have become too large to handle. Given the liquidity and impact cost constraints in Indian markets, for instance, managing over Rs 50,000 crore in a single small-cap fund presents a challenge. Such funds when looking to build a 5% position will need to deploy Rs 2500 crore in a single stock – extremely hard to do without moving the price!

- Two, as the established AMCs have exhausted their one-scheme-per-category quota in their bread-and-butter categories, they have been launching a stream of thematic and passive fund NFOs to keep up their asset growth. This has led to a massive proliferation of complex factor funds as well as thematic funds with narrow (defence, capital markets) or very vague mandates (opportunities, innovation, business cycles etc).

Therefore, SEBI now proposes to allow all AMCs to launch a second scheme in the main categories, subject to the following conditions:

- The first scheme in the category should have completed 5 years and manage assets of over Rs 50,000 crore.

- The second scheme should have identical investment objectives, strategies and asset allocation as the first scheme.

- When the second scheme is launched, the first should stop accepting subscriptions.

- The TER of the new scheme will be capped at the TER of the first scheme, even if the 2nd scheme is much smaller.

- The second scheme should be named the same as the first one with an additional identifier. For instance, Large-cap Fund series 1, 2 and so on.

- AMC can merge the two schemes if first one witnesses a sharp fall in assets, after the stoppage of subscriptions. But no more than 2 schemes can exist in a category at any given time.

On the positive side, this proposal can help AMCs tackle size and maneuverability problems in small-cap, mid-cap and debt funds. The cap on the 2nd scheme’s TER will ensure that AMCs don’t’ launch a second scheme just to earn a fatter fee. However, on the minus side, the requirement that subscriptions to the first scheme be shut, may hurt in practice.

A fund which allows only redemptions and no inflows can get neglected by AMCs and investors may try to switch to the newer version. Large redemptions can also lead to the first scheme’s portfolio quality deteriorating, as high-quality liquid holdings may be sold out first to meet redemptions.

Besides this, the paper proposes the following tweaks to the equity, debt and other categories.

What’s in it for Equity funds

SEBI proposes to increase the permitted categories of equity MFs from 11 to 12 and offer equity MFs greater flexibility in investing the residual portion of their portfolios. Here’s what will change with equity MFs if the proposals are accepted:

# Value plus Contra funds

AMCs will be allowed to offer separate Value and Contra funds, instead of just one of these types. This is a good thing because a Value strategy is quite different from a Contra strategy. A Value fund picks stocks that are trading below their intrinsic value or at cheap valuations. A Contra fund picks companies from sectors that are unfashionable in the markets, have a lot of negativity associated with them (like IT services or tariff plays right now).

Or they pick companies that are in a cyclical downturn, temporary difficulties or are actively disliked by investors for some reason. Both Value and Contra are also good styles to own in an expensive market, because they deliberately look for unfancied stocks. Some fund houses such as HDFC and ICICI Pru, for instance, which are good at Value and Contra styles, can launch new products managed by seasoned fund managers. SEBI however has the caveat that the Value and Contra funds from an AMC cannot have a portfolio overlap of more than 50%.

# No overlap rule

In a bid to stem the gusher of thematic NFOs, SEBI has proposed a new overlap rule for sectoral and thematic funds. If the new proposals take effect, MFs will have to ensure that any new sectoral or thematic equity funds that they launch don’t have an overlap of more than 50% with their existing sectoral or thematic funds. This no-overlap condition must be met immediately after the NFO and also on an ongoing basis, with AMCs conducting six-monthly portfolio checks to weed out overlaps. Existing sectoral/thematic funds do not get off the hook either. They will also need to ensure that their portfolios don’t overlap by over 50% with each other.

The consequences for AMCs running older overlapping sectoral or thematic funds however, are not too dire. If overlaps are found to exceed 50%, the AMC will have 30 days’ time to rectify them. If not, investors in both schemes will be given a free exit, without exit load. If investors don’t bother to exit, one guesses, the schemes can continue with overlaps!

# More leeway to diversify

SEBI also proposes to give equity fund managers greater leeway to diversify their portfolios beyond stocks and boring old cash equivalents. Therefore, it has proposed that equity schemes be allowed to look beyond money market instruments for the ‘residual’ portion of their portfolios.

“Residual” portion here refers to the portion of the portfolio not invested in the primary asset required for the category. Therefore, large-cap funds will be able to invest upto 20% in these assets (as 80% had to be in large-cap stocks) and mid-cap and small-cap funds can invest upto 35% (as they need to have only 65% exposure to their primary asset). Strangely, Multicap funds will be able to park only 25% in these residual assets (because they need to have a minimum 25% in every market cap bucket). But flexicap funds can park upto 35%. The menu of assets allowed is quite wide.

Apart from money market instruments and bonds, equity funds can now invest in gold and silver instruments, REITs and InvITs for their residual portions. This is a very good thing for two reasons. When stocks are over-valued, equity fund managers need not seek shelter in low return earning money markets. They can explore higher return avenues such as InvITs, REITs. Gold and silver, apart from carrying low correlation with equities have been known to perform well when equities stumble. This can help reduce risk while bumping up long-term returns on equity schemes.

What’s in it for Debt funds

The changes SEBI has proposed for debt funds are mostly cosmetic. The key ones are:

- The word “duration” in debt fund names will be replaced with the word “term”. So ultra-short, short and medium duration funds will now be known as ultra-short, short and medium-term funds.

- Low Duration Debt funds, which refers to schemes with portfolio Macaulay duration of 6-12 months, is proposed to be called ‘Ultra- short-to-Short-term debt funds’. Dynamic bond funds will be called All Seasons Bond Funds.

- Medium and Medium-to-long term debt funds will be allowed to reduce their Macaulay duration to 1 year, in adverse situations against their current rigid norm that they need to maintain their duration at 3 or 4 years. During periods where market interest rates rise sharply, medium and medium-to-long duration debt funds end up losing ground on falling bond prices. This leeway to move to shorter durations of 1 year, under anticipated adverse situations, can help them deliver a smoother journey to investors by stemming the fall in NAV in such situations. However curiously, long-term funds which invest in 7-year plus securities, have not been given this leeway.

- A new category called Sectoral scheme will be allowed under debt funds. 80% of this sectoral scheme’s assets can be invested in bonds from a single sector, with no duration constraints. However, no credit calls will be allowed in sectoral funds as only AA+ and above rated bonds will be eligible for investment. AMCs should however ensure that Sectoral debt scheme portfolios do not overlap over 60% with other debt funds. Given that all borrowers within a sector or segment can see a simultaneous rise in default risks (consider microfinance, gold loans, vehicle loans or unsecured retail loans for instance), Sectoral debt funds may prove quite a risky category to invest in. Funds keen to launch them may stick to low-risk sectors such as home finance, PSUs or banking.

- Debt schemes (except for overnight, liquid, ultra short, low duration and money market schemes) can invest the residual portions of their portfolios in REITs and InvITs. Both REITs and InvITs can be good diversifiers with their ability to generate rising income with the prospect of capital gains.

- Arbitrage funds have been allowed to invest their residual portfolios in gilts with less than 1 year maturity. This can provide protection to investors in situations where arbitrage funds see a large influx of money or market opportunities for arbitrage suddenly dry up.

What’s in for other categories

There are minimal changes proposed to hybrid funds. In this category, SEBI has mooted the requirement that Equity Savings funds be required to maintain a net equity exposure of 15%-40% at all times. Hybrid funds, other than arbitrage and dynamic allocation funds, will also be allowed to invest their residual portfolios in REITs and InvITs, like debt funds.

So far, solution-oriented funds have been restricted to one plain-vanilla Retirement Fund and one generic Children’s Fund. The new proposals suggest allowing AMCs to launch three variants of retirement funds and three variants of children’s funds. Therefore, both Retirement and Children’s schemes may be permitted in 3 variants – one equity-oriented scheme (at least 80% in equity), a hybrid scheme (40%-60% in equity, rest in debt, upto 10% in gold) and a debt-oriented scheme (minimum 65% in debt, upto 25% in equity and gold/silver).

The residual portion can also go into REITs and InvITs. There’s also a proposal to allow Lifecycle Fund of Funds with target dates which can initially invest in equity funds and then move to hybrid or debt schemes as the target date approaches. These funds will have a 5-year lock-in period. These target date Fund of Funds can be a useful addition to investors who would like to maintain goal-based portfolios.

Overall, there may be no major upheavals from the new categorization circular. But do keep track of whether the 2 schemes per category rule and the new additions to equity, debt and solution-oriented categories, make the cut.

8 thoughts on “SEBI’s proposed MF Category Makeover: What can Change in Your Fund Menu”

What is the Credit Risk Matrix in context of Debt Mutual Funds ?

Can you please explain or share any link for that

Hi,

Firstly, appreciate any good content on mutual funds, especially because it is rare.

Just a thought that since these are still under discussion, isn’t it premature for you to discuss it with MF investors? Your opinion and guidance would be so much more valuable once the changes are officially implemented by SEBI.

At this stage, it may just confuse MF investors.

Thank you. Useful feedback. Most Sebi consultation papers do make it into law with minor or no changes. We like to cover important ones so readers can be well informed to take decision. When regulations are notified we often don’t get the details in the consultation paper.

QUICK READ: What’s the proposal for MF categorization tules (rules?)

Done. Thanks!

Thanks for the update. Interesting reading

Interesting update.

Equity funds can invest residual money in REITs, InvITs, gold/silver (not just cash) – seems to be a good development and might reduce overvaluation in the market a bit. Also it makes these funds almost like multi asset or somewhat dynamic asset allocation funds.

But do you think the existing funds will have to take approval from unit holders or they can directly start investing in these assets ?

Thanks.

Yes it is. As this is still in the consultation stage, difficult to say. I think unitholder consent will be taken once to change the scheme mandate and thereafter will be allowed