Last week, we’d recommended you book profit on a theme that had played out well from our call. This week, we’re issuing an invest recommendation on a theme on the recovery that’s starting to break out of a long slump. This theme makes for a good portfolio differentiator as most other diversified equity funds, as yet, have not moved overweight by much on it. Even where they do, allocations are usually on the lower side.

The theme we are taking up now is automobiles and related sectors. The fund we think is a good way to play the sector is UTI Transportation & Logistics. The fund invests in stocks from the automobile, auto ancillary and logistics sectors, and is among the only ones that’s focused on the auto space.

What can drive the auto sector now? Why this fund? Who is the fund suitable for? Here’s more.

Troubled years

First, a bit of background. The auto sector is a cyclical one which moves in tune with overall economic growth. As such, a broad economic recovery spurs both consumer spending which benefits segments such as 2-wheelers and passenger cars as well as the core segments such as commercial vehicles (trucks, tractors and so on) and 3-wheelers. Slower growth, therefore, will lead to lower demand for CVs which will eventually trickle down into PVs and 2-wheelers.

Auto ancillaries supply components to auto manufacturers (or OEMs) and are thus in turn linked to the auto sector growth. While some segments such as tyres and batteries see replacement demand and several are exporters as well, the bulk of the auto component segment depends on the domestic auto sector growth.

And the auto sector has had a troubled 2-3 years, across segments. A shift to the new BS-VI emission norms by April 2020 necessitated capex investment, product price hikes and phasing out of older non-compliant vehicles. Higher insurance costs raised the cost of ownership. A slow economic growth additionally hurts, especially in segments such as CVs and 2-wheelers. Input cost increases upped the pressure on companies, while semiconductor chip shortage impacted the passenger vehicle segments.

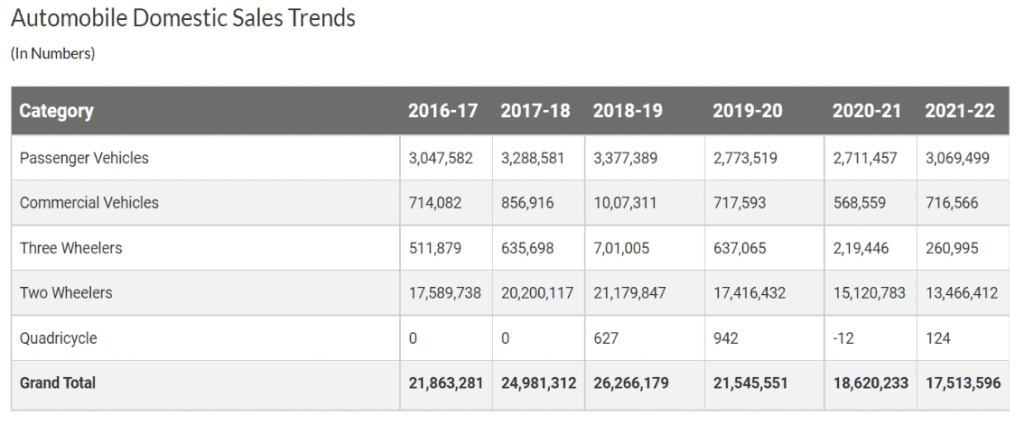

Then, of course, companies had to grapple with the long Covid-led impact. To some extent, some pockets saw support – the demand for personal mobility spurred 2-wheeler sales, supported by strong rural demand which also drove tractor sales in the early stages of Covid unfolding. But the prolonged lockdown, decline in rural income especially over the second wave, hit the mid-to-lower-income consumer segment in terms of income and spending power, and supply chain hiccups swept across the sector. FY-19, therefore, was something of a peak in terms of auto segment sales. The table below shows the sales trends for the sector.

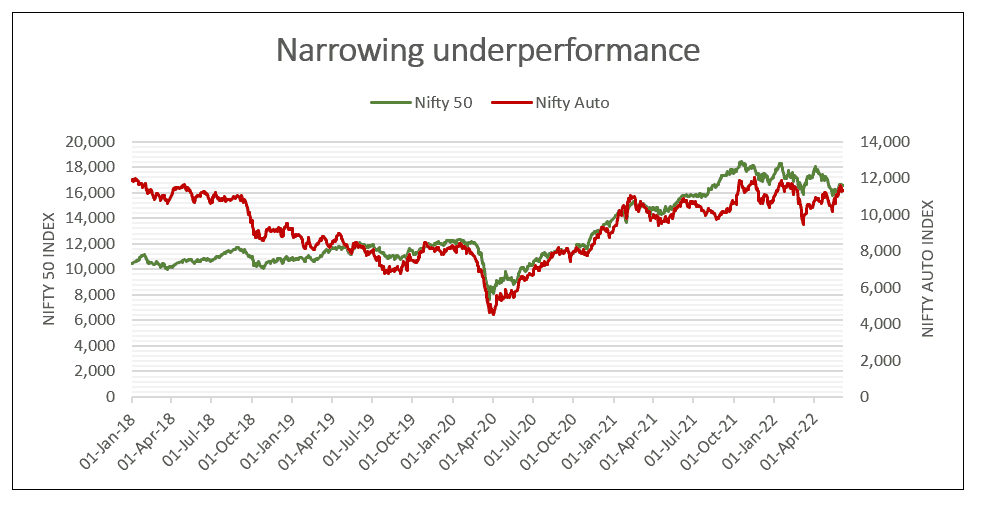

Stock markets, accordingly, ignored the auto sector. The Nifty Auto index has underperformed the Nifty 50 from about early 2019 onwards. In the last 4 calendar years, the auto index has fallen short of the Nifty 50.

The recovery

But this bleak scenario may be set to change:

- One, both automobiles and logistics are linked to core economic growth. Opening up of the economy, therefore, will lead to increase in logistics demand and in turn demand for both trucks and buses. Increased government spending on infrastructure and logistics can also aid demand. Growth for OEMs will translate into growth for auto component makers.

- Two, recovery is taking root in CVs and the logistics sectors. Momentum began building up towards the end of FY-22 for CV players. May 2022 sales have surpassed the May 2019 (pre-Covid) numbers. Truck operators are seeing freight rates firming up and profitability is intact. They have moved to replace their older vehicles, with the average fleet age at about 9.5 years, or expand fleet size.

- Three, the logistics sector is seeing a shift from the unorganised to the organised segment, which can further aid growth and demand. Rising road freight demand and a tepid CV segment in the past 3 years has also resulted in something of a demand-supply mismatch, which can also push CV demand and up utilisations. Auto makers have also launched sophisticated and fuel-efficient models.

On the consumer side, PV sales showed recovery towards the close of FY22 and momentum seems to be getting back in the first 2 months of FY23. Within PVs, though, it’s the SUV segment that has seen recovery for players such as Maruti, Tata and Hyundai and not the small car segment – suggesting that it is the more affluent consumer segment which is driving demand for now.

Entry-level consumers, therefore, appear to be putting off purchases. This could be due to the lower-to-middle group taking a more severe hit on their income and rural demand hurting the small-car demand. 2-wheeler sales are also yet to recover to their pre-Covid levels. To this extent, the sector is not entirely out of the woods yet and recovery is not across segments.

However, a broader economic recovery can help bring back demand in 2-wheelers and the small-car PV segment too. Companies do appear upbeat on improvement in rural incomes, aided by normal monsoons and rising agri-commodity prices. Prices of inputs such as steel may also correct or slow the momentum in their rise, with commodity prices starting to cool off globally and government initiatives helping reduce margin pressures.

What can also hold the broader auto sector in good stead in the medium term is the government’s production linked incentive (PLI) scheme for the sector worth Rs. 26,000 crore. The scheme aims to take the contribution of the sector to our GDP to double digits from the 7% now. It has received overwhelming response from companies with planned capex outlay of Rs. 75,000 crores, coming from both OEMs and component makers over the next 5 years.

Markets already appear to have taken note of the potential change in the sector’s fortunes. From an underperformer, the Nifty Auto index is starting to do better than the Nifty 50. Several auto component players have also seen stock prices rally. As the chart below shows, the 1-month rolling returns of the Nifty Auto index is starting to do better than the Nifty 50. The Nifty Auto index is also narrowing the gap by which it has trailed the Nifty 50 for nearly 3 years now.

The thematic fund

The last 20 years has seen the domestic auto and ancillary companies building significant competencies that match global standards, be it in engine technology or emission and safety norms. With a basket of top-quality OEMs and component makers catering to both domestic and global markets and demand recovery in sight, the listed auto and ancillary space provides an opportunity for investors for the next few years at reasonable valuations.

UTI Transportation and Logistics is among the only funds to exclusively play the auto and related themes. On the auto front, the fund invests in OEMs and auto ancillaries. On the logistics side, the fund invests in a range of companies, from airlines to ports to fleet owners.

In this respect, it is a far broader play on the theme’s potential than just the Nifty Auto index. There are two ETFs, from ICICI Prudential and Nippon India, that have Auto ETFs. The UTI Transportation fund is preferable to the ETF as it allows capturing of a wider belt of opportunities.

The Nifty auto index is highly concentrated, with the top 10 constituents making up about 87% of the portfolio. Moreover, the top few are skewed towards OEMs with the likes of Maruti Suzuki, M&M, Tata Motors and Bajaj Auto accounting for 60% of the index weight.

The UTI Transportation fund is also top-heavy; the top 10 portfolio stocks make up half the portfolio weight. But the fund still taps into several other pockets. The four stocks mentioned above, for example, together have only about 33% weight in the fund’s portfolio. Given that auto, logistics and related sectors move in tune with the economy, access to a wider range can offer better returns.

During times when the Nifty Auto has rallied, over the past 7-year period, the fund has soared more. For example, the average 1-year gain in the Nifty Auto was 21.6% between 2015 and now. The average fund return stood at 26%. This, it manages with similar volatility.

For another, the fund actively juggles between stocks and sectors within the logistics and auto spaces. For example, it booked profits in stocks that rallied such as VRL Logistics and Schaeffler India. It upped stakes in stocks such as M&M, Bharat Forge, and Concor which have started rallying. This helps to better maintain returns. On a rolling 1-year basis in this period, UTI Transportation beat the Nifty Auto index a good 81% of the time. On longer 3-year return periods, the fund beat the index all the time.

Suitability

UTI Transportation & Logistics is suitable only for investors with a high risk appetite. It can be used to diversify portfolios and play a theme that other equity funds do not really offer. Given the current market conditions, invest in phases over the next 3-6 months. Cap allocations to 5-7% of your portfolio and treat the fund as a tactical play. While the theme will be longer term by nature of about 2-3 years as the auto sector picks up, it cannot be part of long-term portfolios as a cyclical downturn will drag returns.

15 thoughts on “Fund recommendation: Catching a theme on the recovery”

hi ! shall I invest on this theme? are too late on boarding? how do you foresee EV theme, if EV theme picks up this fund can, assist or you will let us know on New EV themes Fund? Thanks

You may but don’t do SIPs and wait for corrections to add more. If you want a play on EV, more likely our Auto++ Smallcase ( https://www.smallcase.com/smallcase/primeinvestor-auto++-PRIMNM_0002 ) will work for you. It has also run up a bit though. So don’t invest your entire allocation in one shot. On EV, we have covered it in detail here: https://www.primeinvestor.in/auto-ancillaries-ev-disruption-winners/

Vidya

Just got to see this recommendation. Is this fund still a good buy ? I can keep for 4 years . a Lumpsum amount upto 10% of MF portfolio can i allocated? AUM is small hence this quesiton.

Yes, you can still invest. The fund remains part of our recommended fund list Prime Funds (under Strategy/ thematic). – thanks, Bhavana

Hi PI Team,

I welcome such recommendation.

Can I still make a fresh lumpsum entry to UTI Transportation & Logistics Fund(G)-Direct Plan or I am late now?

Yes, you can still invest. The fund remains part of our Prime Funds recommendation list. – thanks, Bhavana

Will there be exit call on this MF from Prime Investor once this theme will have cyclical downturn ?

Yes, we will give a call when needed. – thanks, Bhavana

Hi, Can you also write on manufacturing theme?. It looks interesting right now -ICICI Pru Manufacturing fund.

We’re looking at the theme 🙂 We’ll alert if we add this theme to our recommendations. – thanks, Bhavana

Thanks for this heads up. Could you help me if this MF is better or the ICICI Auto ETF would be an alternate choice.

Thanks

madhavan

Please read the section ‘The thematic fund’. The fund vs the auto index is explained there. – thanks, Bhavana

Excellent and timely analysis of this sector.

The details about which companies have qualified for PLI scheme in auto and whether the UTI fund holds these stocks would help in relating these both positives.

Thanks !

Started investing since April 22. Good to see this article and kind of validates my original thinking about investing in this theme!

Great! 🙂 thanks, Bhavana

Comments are closed.