The fans that this company makes are a household name. The company is also well known in the residential pumps market. It also has a lighting segment and also makes other appliances.

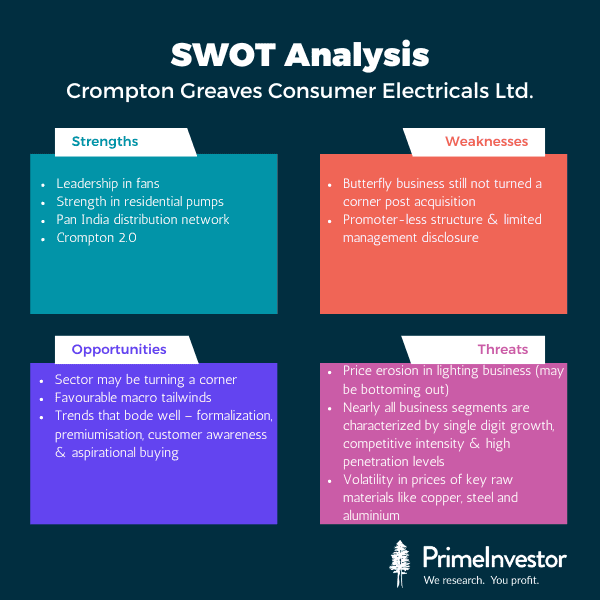

Crompton Greaves Consumer Electricals (CGCEL) needs no introduction. Recently, this company acquired Butterfly Gandhimathi Appliances Ltd. (Butterfly), a leading kitchen appliances player in the South – but things have not been smooth sailing. This acquisition, management changes and a not-so-spectacular business performance thanks to adverse consumer sentiment among other factors, have weighed down the stock in the last couple of years.

Recognising the need to shake things up, the management embarked on Crompton 2.0, a growth strategy, in July 2023. So when the Q4 results came out, marking the highest ever quarterly revenue and double digit YoY growth in revenue (standalone) for three straight quarters, the street was pleased that Crompton 2.0 may be working.

Is it a sign of good times ahead for the company? Let’s do a deep dive into this company!

What are Prime Reviews in stocks? In our stock reviews, we look at potential stock ideas. Stocks we choose for review could be in the news, or be seeing significant price action, or could be under-researched or could be emerging growth companies or those showing signs of turnaround. In these reviews, we take a detailed look at their business and industry fundamentals to check what has gone well, what is evolving, what could be the risks to the growth, what key metrics or parameters may need to be watched and more. These stocks are NOT a recommendation to buy, hold or sell the stock.

How do you use Prime Reviews in stocks? You can use these detailed stock reviews to get ideas for your own research, or to add to your watchlist, or to know more about under-researched stocks or even to understand about stock analysis & research. Note that we would not be providing regular updates on reviewed stocks, unlike our Prime Stocks.

Will these stocks become Prime Stocks? Some of the stocks we pick for review may find their way into Prime Stocks if parameters line up. We take an idea to Prime Stocks only if we feel that the risk-reward equation is highly in favour. However, it is certainly not necessary that we eventually shift all reviewed stocks into our recommendation list. Note that these stocks may form part of our smallcase portfolios – we may have such stocks in our portfolios as we can control allocations and the portfolio approach allows us to take tactical calls, unlike in Prime Stocks.

About CGCEL – a little backstory

CGCEL is not a new or young company. It has a history spanning back to pre-Independence times. The Thapar family took over the company in 1947 and it stayed there up until 2015 when debt-powered acquisitions started to stretch the balance sheet. At this point, the consumer products business was carved out to form a separate entity, CGCEL, which was taken over by a consortium of PE investors led by Advent International and Temasek and was separately listed. CGCEL owns the Crompton Greaves brands.

With the PE investors exiting by FY 23, CGCEL is now a promoter-less company owned fully by retail and institutional investors. The rest of the original entity (excluding the consumer products business) still exists as CG Power and Industrial Solutions Ltd., that faced its share of challenges and is now a subsidiary of Tube Investments in the Murugappa Group.

The Industry landscape

The consumer electricals industry comprises of the following main sub-segments: cables & wires, fans, lighting, pumps, kitchen appliances, switches / switchgears, home appliances and other small appliances.

While Havells, the industry leader in terms of revenue, has a presence across all the product segments, CGCEL has a presence in the fans, lighting, pumps and kitchen appliances segments but not in the cables and wires segment that accounts for more than half the industry estimated to be ~Rs. 1.2 – 1.3 trillion in size as of FY 23.

While the cables and wires segment, that was once viewed as a commodity business and was badly hit by GST implementation, has overall been a strong performer, segments such as fans and kitchen appliances are impacted by poor consumer sentiment and factors such as weather and festivals.

Below is a look at the key players in the sector and the main segments that they operate in:

The main themes that are characterizing this sector at present are:

- Formalisation - Like other sectors here too, the organized players either dominate or are seeing their share rise.

- Customer awareness: Increasing awareness has led to greater preference for more energy efficient and ‘smarter’ products and management has noticed a growing trend of people seeking to upgrade.

- Premiumisation: Premiumisation is another common theme that cuts across even the consumer electricals sector, fueling not just new but also replacement demand.

- Aspirational buying: Close on the heels of premiumisation is aspirational buying and going by management commentary, this phenomenon has not escaped even the rural segment of the market.

Macro factors like these too bode well for this sector as a whole:

- Favourable GDP expectations for FY 25 and a rising share of consumer durables in household consumption expenditure.

- Increasing urban population - In India, the urban markets (metros, Tier 1, Tier 2 and Tier 3 cities) dominate the consumer durables sector, accounting for nearly two-thirds of the market.

- Development of housing via schemes like PMAY and increasing construction activities

- Rising electrification

- Anticipated rural focus and programs such as PMAY – G that could boost rural demand (especially for products such as fans that are more accessible as against ACs).

Crompton 2.0

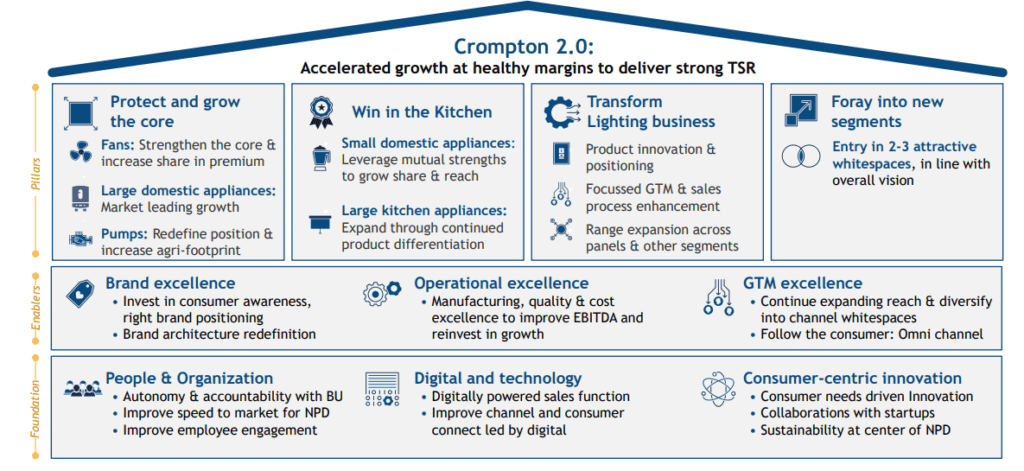

Crompton 2.0 set out a series of components that included premiumisation and diversifying product offering, a GTM strategy that works on the already strong set up, streamlining supply chain, investing in innovation, continued focus on cost cutting and a revamped management structure - all culminating into revenue and profit growth.

Source: Company presentation

Interestingly, many of the themes running through Crompton 2.0 (focus on building the brand, R&D product innovation, premiumisation of fans) were the same as what the then management had planned when the company was carved out and taken over by PE investors after 2016.

So how is it going so far?

CGCEL’s segment-wise revenue profile – ECD is the breadwinner

A look at the latest revenue break-up shows that the Electrical Consumer Durables (ECD) segment which houses the fans and pumps businesses are the breadwinners of CGCEL. The lighting segment on the other hand has faced its challenges in recent times as is also the case with the acquired kitchen appliances player – Butterfly.

Leadership in fans is not a breeze

Company presentations indicate that the fans market is estimated to be worth Rs. 11,000 crores. This covers ceiling fans (that account for 3/4ths of the market), TPW (table, pedestal, wall) and domestic exhaust / industrial fans. A classification that is gaining more importance is fans beyond a certain price point (Rs. 3,000) known as ‘premium fans’.

In recent times, the fans business overall underwent a transition phase as it moved from non-star rating to star rating resulting in more customers wanting energy efficient models.

For quite some time now, CGCEL has dominated the fans space despite lagging in the premium fans category. This was evidenced by the three price hikes they undertook in H2 FY 24 without compromising on market share. The harsh summer has translated into CGCEL’s fans business clocking strong, volume-led growth of 13% YoY in Q4 FY 24 and 11% FY 24. The company crossed the milestone of selling 2 crore fans per annum for the first time in FY 24 and also said that this quarter marked three continuous quarters of double digit growth for the fans business for the first time since the pandemic.

The above was driven also by a higher share of premium ceiling fans including BLDC fans and new launches.

In the premium fans segment, the company had lost out to Havells that made an earlier foray into this sub-segment and firmly entrenched itself despite venturing into the fans space much later than CGCEL. The company has made it clear that they want to grow in this sub-segment which grows faster than the overall fans segment. This would be both revenue and margin accretive.

While this has been a focus area from way back 2016-17 when share of premium fans was estimated to be ~16%, latest management conference call indicates that this has improved to more than one in every four fans sold by CGCEL. This is still lower than the market average that is estimated to be close to 40% and the management is focused on narrowing the gap.

But maintaining this dominance is not easy.

- While the CAGR between FY 18 and 23 was ~7%, this IMARC report, places the growth going forward to be only 2.11% CAGR from FY 2024 to 2032 – meaning, it is not a segment that is growing rapidly. This makes it all the more important to focus on the sub-segments that will grow at a faster clip, like premium fans.

- The fans business is seasonal with Q4 and Q1 being strong quarters when summer is at its worst.

- The business is also subject to the vagaries of the residential real estate sector though management says that a large part of their demand stems from replacement.

- With a much higher penetration rate than ACs, top legacy brands (including CGCEL, Orient, Usha, Havells and Bajaj) have dominated the competitive fans market. But things are changing and new entrants are able to make inroads – Atomberg who popularized BLDC fans have made quite an impact in the market though existing players including CGCEL have been quick to catch up with their own BLDC launches.

- A key point to note on the competition front would be CG Power & Industrial Solutions (erstwhile Crompton Greaves) plans to foray into the residential fans space, now that the non-compete period pursuant to demerger of CGEL from Crompton Greaves has lapsed. With a shared history, competition from CG Power & Industrial Solutions will need to be closely watched.

- Heightened competition with a low growth rate could mean threat to market share as well.

A force in pumps

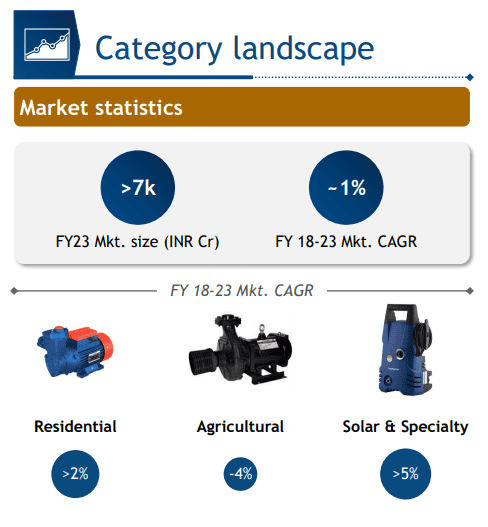

CGCEL pumps is one of the large organized players with a strong presence in North and East India and also a market leader in residential pumps. According to management they are “the largest residential pumps company in the country”. But here too, like in the case of fans, growth over the last 5 years has been in the low single digits.

To compensate, the company is targeting agricultural pumps (growth fueled by Government policy) and solar pumps. These are expected to grow faster than residential pumps and management commentary indicates that they will also be margin accretive though more specific details were not divulged.

Source: Company presentation

During the latest earnings conference call, management confirmed that these new areas of focus have started to pay off and that the company has garnered 7% to 8% of market share in the agricultural pumps space. The company has also secured additional solar pump orders to the tune of Rs 87 crore in Q4 adding to the pipeline. In addition to the above, CGCEL is also increasing the contribution of submersible residential pumps in the mix.

Here too, it isn’t smooth sailing.

- The pumps market in India is home to a large proportion of unorganised players and also very small organized players. Due to the fragmented nature of the market, competition is strong.

- The company has had to take price cuts in the residential pumps category in order to consolidate its leadership position. Though pricing is still at a premium to its peers, this is an indication of the degree of competitiveness.

- Like in the fans segment, CG Power has stated their intent to enter the pumps segment and this development will need to be watched carefully.

- Seasonality too comes into the mix with demand for pumps being monsoon dependent.

Lighting segment not shining bright

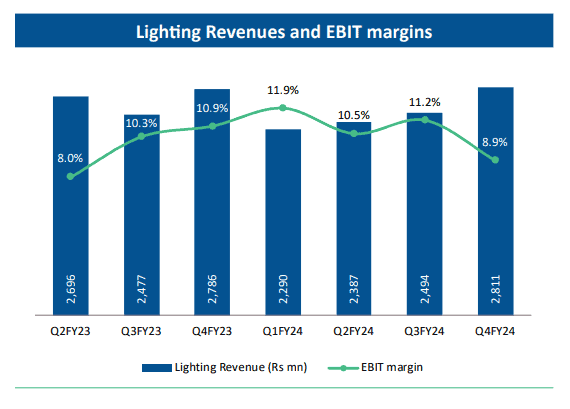

The lighting business as the MD stated during the Q4 FY 24 earnings call ‘for a while has been an area of some anxiety’. In this segment, CGCEL is not the dominant player but says it ranks around #3. There are two product categories – lamps and fixtures. The business at CGCEL is further split roughly evenly into B2B and B2C.

While pricing pressure has been a concern for some time now in the B2C space, in the past, CGCEL was criticized for being too dependent on Government orders that did not fructify and of being slow to adapt compared to players like Havells.

B2B they say has shown ‘robust growth’ and the company is building up both an enterprise business and one which caters to the Government and therefore keeps step with the economy.

All the while, B2C has ‘de-grown’ primarily due to price erosion. Under the B2C segment there are lamps, battens and ceiling lights and the management is also cleaning up the portfolio of conventional lamps where price erosion was the worst and is focusing on investing behind the brand including a campaign specifically for the South.

It is encouraging to note that management has observed a decrease in intensity of pricing pressure in H2 and the quarterly revenue trends of the lighting segment indicate that pricing pressure may have bottomed out.

Source: LKP report

Is the worst behind us?

- While the intensity of price erosion is coming down and are expected to slow down in FY 25, worries about this segment are far from over - Mr. Promeet Ghosh, MD says that it is tough to tell where the price erosion is going to go.

- Competition is stiff with strong players like Philips, Surya, Bajaj, Havells and more.

- To compound matters, cheaper Chinese alternatives (especially LED) have been flooding the market, leading to birth of a bunch of local and regional brands as well.

- However, it is expected that volume-led growth, a push behind decorative lighting and further bolstering distribution could help.

- The company is also exploring outsourcing a greater proportion of its lighting products, external sources indicate in-house manufacturing in this segment to be at 35%.

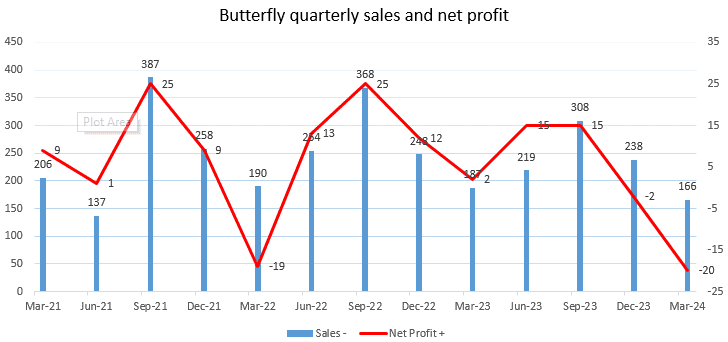

Butterfly - awaiting metamorphosis

In 2022, CGCEL acquired Butterfly Gandhimathi Appliances Limited – a leader in kitchen appliances in South India. This acquisition gave CGCEL a fast pass to enter the growing yet competitive kitchen appliances space

This acquisition was expected to bring about several revenue and cost synergies for both parties – getting Butterfly to be a pan India player through CGCEL’s extensive reach and giving CGCEL a step into the kitchen appliances space especially, in the lucrative South Indian market.

While CGCEL holds 75% of Butterfly, the merger that was to be completed by end of FY 24 did not happen as public shareholders did not approve of the scheme. naturally wanting a better exit price considering they were getting less than what CGCEL paid.

This has not been without hiccups.

The management, though, says it’s not all bad news.

- Firstly, they are working on repositioning Butterfly as a lifestyle brand. Specifically, moving it away from the low margin ecommerce and corporate OMC (20% of sales) business. This will naturally hit top line.

- Further, standardisation of operating procedures with channel partners, one-time settlements, more than doubling of marketing investment, crystallization of full year EPR liability and reorganization of sourcing of bottles and flasks meant this business closed with a net loss of Rs. 20 crores - not a pretty picture. But the management has stated that it remains committed to ensure a turnaround and a new hire has been made for this – Ms. Sweta Sagar started as Chief Business Officer of Butterfly in Q4.

It is worth noting that competition is stiff in this segment too with players like TTK Prestige, Stove Kraft Limited, Hawkins, Bajaj Electricals, Preethi Industries Ltd. (Phillips), and many more. Factors such as festival season, appearance, convenience and health impact play a role in driving sales. While the pandemic forced everyone to stay home and cook, now food inflation worries are acting as a dampener. Competitor, TTK Prestige reported a drop in earnings due to consumers holding back on discretionary spending.

All things considered, management expects business to pick up momentum from Q2 FY 25 onwards with revenue and profitability moving up with double digit EBITDA margins.

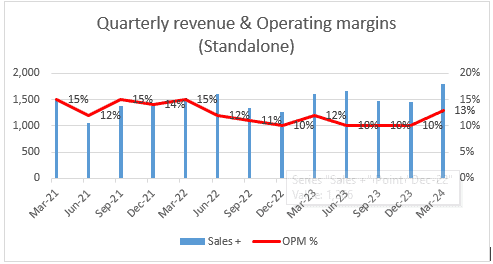

Financials and Balance Sheet Health (Standalone)

Post pandemic, the sector as a whole had to battle multiple tailwinds including low demand and input cost pressures. But now with several of the players reporting encouraging numbers for Q4 of FY 24, the expectation is that the sector may have finally turned a corner.

CGCEL too reported a 10% YoY revenue growth in FY 24 on a standalone basis as against 8.1% last year. Margins too indicate that the tide may be turning despite the fact that the company took a hit on stepped up advertising and promotion costs, one-time costs and EPR liabilities (Govt. regulation related to managing waste).

On the standalone ROCE front, the company has taken a hit since FY 22 when the Butterfly acquisition happened. But with repayment of debt, favourable management commentary on improving gross margin profile, continued focus on cost savings and evolving product mix, this could be set to improve.

Capex planned for FY 25 is only Rs. 80 – 100 crores towards manufacturing capability improvement, product development and product innovation. The company is also cash flow positive and closed the year with Rs. 215 crores of cash and cash equivalents on its books.

One of the manufacturing facilities of Butterfly too has been surrendered.

All of this should translate into an improving ROCE trend going forward, towards mid-twenties - FY 24 has already shown bottoming out.

Professionally managed, but…

Since the exit of the PE investors, CGCEL is a promoter-less entity, owned fully by retail and institutional investors.

While usually promoters and promoter holding gives us valuable inputs into crucial aspects such as overall direction for the company, corporate governance and confidence, CGCEL has the credit of being a professionally managed enterprise. Here, the board of directors and management team are key to the company’s fortunes.

While attrition and churn at the top and mid management level (including positions such as CFO, Company Secretary & Compliance Officer) have been concerns that have confronted CGCEL in the last few years, the sudden resignation of then ED and CEO Mathew Job in April 2023, an industry veteran associated with the company ever since the PE investors took over, rattled the markets enough to bring the stock to its 52week low.

Some schools of thought also attribute the sharp correction to Mr. Promeet Ghosh who took over and is still the MD and CEO. While Mr. Ghosh, of an investment banking background, is not new to CGCEL and has been associated with the company from the Temasek side and been on the board, it was clear that some had doubts on whether he was best suited for the MD and CEO position.

One can draw comfort from the fact that many of the board members have had a long association with the company, including Mr. Shantanu Khosla, formerly MD and is now the non-executive vice-chairman of the board.

One thing that is hard to ignore is the management’s stance on sharing details and guidance numbers where their stance clearly seems to be ‘less is more’.

Valuation

From the above, it may seem like CGCEL is trading at a discount to Havells India. However, it is important to note here that Havells has a much wider range of businesses that it participates in that gives its revenue a very different mix. Bajaj Electrical on the other hand has recently separated its EPC business thereby improving the margin profile of Bajaj Electrical. Orient Electricals reported a drop in profits thereby resulting in a high PE buoyed by other factors. Expected improvement in margin is keeping their valuations elevated at this point of time.

On a standalone basis, CGCEL is trading at ~46 times FY 25 earnings and this seems reasonable, as long as the company is able to expand margins to drive PAT growth, retain and grow market share in the increasingly competitive space, navigate the challenges around B2C lighting and also get Butterfly on track.

What would help with conviction on these fronts is greater degree of detail in the information that the management shares.

Disclosures and Disclaimers

The following Disclosures are being made in compliance with the SEBI Research Analyst Regulations 2014 (hereinafter referred to as the Regulations).

1. PrimeInvestor Financial Research Pvt Ltd is a SEBI-Registered Research Analyst having SEBI registration number INH200008653. PrimeInvestor Financial Research Pvt Ltd, the research entity, is engaged in providing research services and information on personal financial products. This Research Report (called Report) is prepared and distributed by PrimeInvestor Financial Research Pvt Ltd with brand name PrimeInvestor.

2. PrimeInvestor Financial Research Pvt Ltd, its partners, employees, directors or agents, do not have any material adverse disciplinary history as on the date of publication of this report.

3. I, Pavithra Jaivant, author/s and the name/s in this report, hereby certify that all of the views expressed in this research report accurately reflect my/our views about the subject issuer(s) or securities. I/We also certify that no part of my/our compensation was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report. I/we or my/our relative or PrimeInvestor Financial Research Pvt Ltd do not have any financial interest in the subject company.

I/we or my/our relative or PrimeInvestor Financial Research Pvt Ltd do not have beneficial ownership of 1% or more in the subject company at the end of the month immediately preceding the date of publication of the Research Report. I/we or my/our relative or PrimeInvestor Financial Research Pvt Ltd do not have any material conflict of interest. I/we have not served as director / officer, etc. in the subject company in the last 12-month period.

4. I, Pavithra Jaivant, do not hold this stock as part of my investment portfolio. I/analysts in the Company have not traded in the subject stock thirty days preceding this research report and will not trade within five days of publication of the research report as required by regulations.

5. PrimeInvestor Financial Research Pvt Ltd has not received any compensation from the subject company in the past twelve months. PrimeInvestor Financial Research Pvt Ltd has not been engaged in market making activity for the subject company.

6. In the last 12-month period ending on the last day of the month immediately preceding the date of publication of this research report, PrimeInvestor Financial Research Pvt Ltd has not received compensation or other benefits from the subject company of this research report or any other third-party in connection with this report.

2 thoughts on “Prime Stock Review – Are prospects getting brighter for this electricals player?”

Excellent analysis. SWOT is very good, lot of challenges.

One naive question, why PE of 60-70-80 for this sector is normal? This is given that the sector not growing by leaps and bounds anyway. So wonder why market value the sector for such high PE.

Thank you for your kind feedback Sir.

Also – your question on PE – it is a very pertinent question.

So the sector has been battling many challenges that have put pressure on earnings. For instance in the lighting space the companies have had to deal with price erosion that negated growth in volumes. In fans they had to comply with energy rating requirements. In between demand moderation also put companies on a backfoot to take price hikes to offset commodity price inflation post-Covid. Further players like Crompton and V Guard also took on debt for the acquisitions, leading to interest related costs.

However, things seem to be changing for the better. Price erosion in lighting may have bottomed out. Fans is out of inventory related mess. Companies are also charting out road maps for growth. All of which could bode well for profitable growth despite factors such as intense competition.

This could result in markets affording them a multiple that looks high on current earnings. The profit growth in FY25 and FY26 will look far higher than revenue growth due to margin expansion and the PE multiple will normalise.

Comments are closed.