If you’ve got a 5-year-plus timeframe, equity is the way to go as we explained this week. And yesterday’s steep correction offers up more buying opportunities for those with the risk appetite and timeframe. And if you need money in the very near term, we’ve asked you to stay safe with fixed deposits, liquid funds, and ultra short-term funds, given that the current climate offers no room for risks in the short term. But what about the in-between timeframe? What are your options should you have a horizon of 2-3 years and want better returns that fixed deposits or low risk mutual funds?

ICICI Prudential Balanced Advantage fund fits this requirement and is suited for conservative equity investors. This hybrid equity fund stands out for:

- its steady history in using valuation metrics to shift between equity, derivatives and debt, unlike other balanced advantage funds

- its ability to contain losses even in very short timeframes such as 6 months, along with lower volatility compared to peers

- its deft juggling of equity and derivatives to make the best of market movements, and consistent strong performance

If you have a 2-3 year time frame or have a longer time frame but cannot handle equity funds directly, then this low risk mutual funds is a tax-efficient option.

Strategy clarity stands out

Balanced advantage funds are clubbed with dynamic asset allocation funds in terms of SEBI category classification.

But such clubbing and no clear definitions on what the category itself is, leads to inconsistencies among funds. There are some, like Aditya Birla Sun Life Balanced Advantage, that hedge only a small part of the portfolio, to those such as HDFC Balanced Advantage that is exactly like an aggressive hybrid fund.

The confusion is compounded as many dynamic asset allocation funds also use derivatives, such as DSP Asset Allocation and BNP Paribas Dynamic Equity. The far more aggressive nature of asset allocation funds and the wide range that equity can go to makes it hard to pinpoint low risk mutual funds levels or understand fund behaviour. More, most funds in this category lack history to judge ability to correctly shift allocations or contain volatility – they are either recent launches or were different funds that came in post the SEBI mandate in 2018.

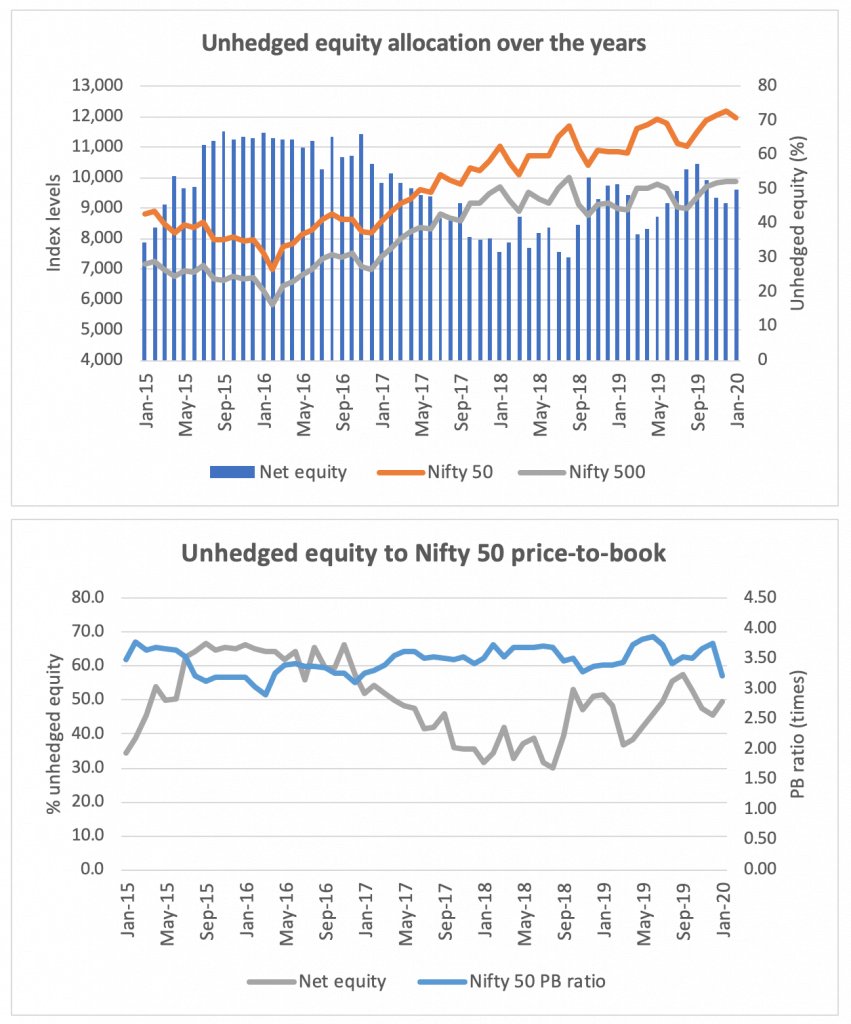

ICICI Prudential Balanced Advantage (IPru Balanced Advantage) is among the few funds that has been around across market cycles and has maintained a steady strategy. It uses a long-term price-to-book value to shift allocations, upping derivatives when valuations are high and vice versa. For example, unhedged equity dropped below 50% early on in 2017 and went all the way down to 30%-odd levels as markets heated up. Allocation then crawled higher towards the end of 2018 and moved to around 50-55% over 2019. Unhedged equity exposure runs a strong negative correlation with the Nifty 50’s price-to-book ratio as well as the index itself.

On the debt side, IPru Balanced Advantage more or less maintains a 30-35% allocation. It also tends to have a short maturity profile for the most part, briefly dipping into duration strategies in periods such as 2016 where opportunities were ripe. Over the past five years, the average portfolio maturity has been 2.7 years.

Suitability

IPru Balanced Advantage suits different needs:

- For investors with a 2-4 year timeframe, who want returns above pure debt funds and willing to take on a little higher risk. As the fund is an equity-oriented fund, it is more tax-efficient than debt funds and more so in timeframes less than 3 years.

- For conservative investors, even for those who have long-term timeframe, who want equity exposure without the high risks.

- For investors worried about the ongoing correction and wish for funds that can contain downsides, manage volatility, and deliver over time.

As a equity-oriented fund, it is not immune to market corrections in shorter periods of less than 6 months. The fund has delivered negative returns 30% of the times when returned were rolled daily for 1-month periods, since 2015. In this aspect, it is more volatile than pure debt funds. However, over longer periods, this whittles down. Rolling 6-month returns from 2015 shows that the fund delivered losses just 13% of the time. The average such loss was 2%.

Performance

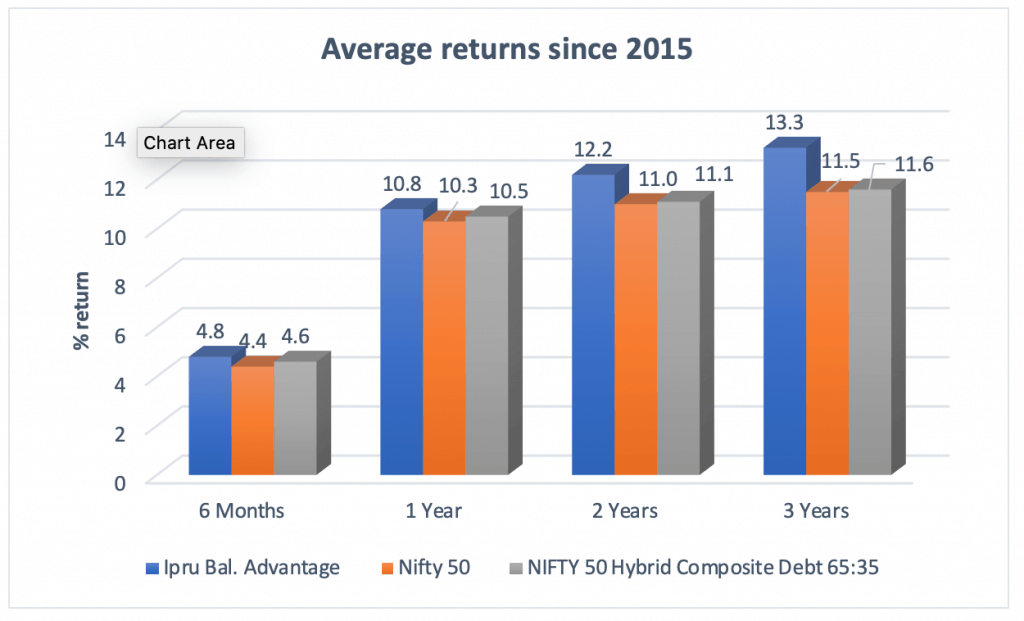

IPru Balanced Advantage on an average delivered a 1-year return of 10.8% from 2015 to now. Short-duration debt funds, in the same period, delivered an average of 7.6%. The fund has, in strong markets, delivered returns in the 15-25% range as well. In this aspect, it does fit longer-term portfolios for conservative investors too. But do not enter the fund expecting equity-like returns.

Strictly, IPru Balanced Advantage isn’t really comparable with peers given the wide variety in strategies and allocations. Still, in ability to contain downsides (measured by the downside capture ratio using 1-month returns against the Nifty 50), it scores above average. The fund captures just 35% of a month’s market downside. On other risk-return metrics such as Sharpe ratio and Sortino ratio, IPru Balanced Advantage scores well above peers.

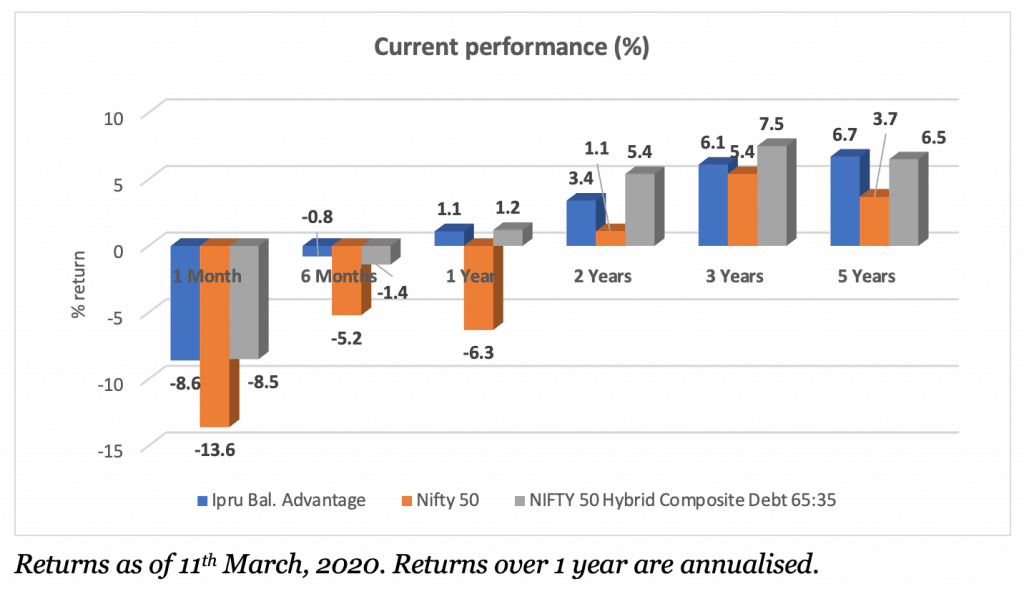

IPru Balanced Advantage’s recent performance, obviously, has been hurt by the meltdown of the past few days. The hedged equity portion of the February portfolio is also low at 8.6%. While the recent fall may be sharp, it needs to be noted that the fund may find good buying opportunities in this time. The low risk mutual funds ability to contain downsides is also strong, and as explained above, 1-month losses generally tend to dissipate over time.

30 thoughts on “Prime Recommendation: A low-risk option for the conservative equity investor”

Hi

I want to invest some money into Dynamic scheme. When I compared Prime ratings, DSP has a 5* rating, ICI Pru comes next only. Shall I go ahead with DSP? how do I decide on such occasions (where a recommended fund has a lower prime rating than a peer)

Hello Sir, if you are a subscriber, please look at our Prime Funds (our recommended list) to pick a fund in this categry provided you have made up yur mind on dynamic bonds. Our recommended list should be the desired list for chosing funds. Then our MF review tool can be used to know whether the fund you hold or choose is a buy/hold or sell. Ratings should be to only to know how funds compare with peers and not for decision making. thanks Vidya

Dear Team,

First of all congrats on the amazing job you are doing. This website is in fact way different than all the others out there!

This article, however, made me wonder whether this fund (ICICI Pru Balanced Advantage Fund) will be suitable for conservative investors. I am an investor in this fund since the last 3 years, the returns, however, have been not satisfactory. It has fallen a lot which should not have been the case as the dynamic asset allocation quant model that it follows, had less than 50% invested in equities for a very long time. It was also not spared in the calendar year 2018 downfall when it also underperformed its category and peers.

So, having doubts about it going forward? Please clarify if I am wrong.

Hello sir,

Thanks for the appreciation!

Regarding the fund – Yes, it suits conservative investors who want equity exposure. The only lower-risk alternative that gives equity exposure is equity savings funds which have very low open equity. Equity itself wouldn’t be an option if a fund like this is considered too risky.

Returns – it will be lower than funds such as hybrid aggressive, so expecting high returns from this type of fund is not really a good idea. Comparing it with category is very tricky because, as explained in the analysis, each fund is doing something very different and have widely varying debt, equity and derivative exposure. In a year like 2018, any fund that had high debt would have scored – like DSP Dynamic, for example. So comparison in this category is not at all straightforward and is very misleading unless each fund’s asset allocation trend is taken. Also note that 2018 was a year where funds were re-aligning to SEBI categories and peers again are not really comparable. IPru Bal Advantage didn’t underperform category in 2018, even ignoring asset allocation patterns – it was not the best performer, yes, but it was above-average. But a fund that’s above average consistently is preferable to one that’s at the top sometimes. A fund can’t really be the top every single time.

Ipru is not a dynamic asset allocation fund. By true definition, a dynamic asset allocation fund will move from 0-100 in each asset class. Funds such as Franklin Dynamic PE are cases in point. I Pru maxes out at 35% in debt. In this current market, yes it has fallen. But that’s because its open equity is high, which is actually a good thing because markets are low. Equity exposure and market movement are conversely related for this fund. This is also why we’ve said that it’s better suited for a 2-4 year holding now.

Thanks,

Bhavana

Dear Bhavana

Good analytical article on why ICICI Bal adv fund among all the choices available.

Has the fund confirmed they will maintain it as an equity oriented fund with min 65% in equity and derivatives? Otherwise, one will lose equity tax advantage. They seem to keep the option open. Tax is an important element to consider.

Btw, another group of potential investors for this fund: Those who have a lump sum on hand and want to invest it in equity fund (in addition to equity SIP they might already be doing). Invest the available lumsum in this fund (instead of parking it in debt fund and executing an STP) and when the equity portion crosses say 80% , start shifting to another pure equity fund. This way, you are allowing the experienced fund manager to ride the volatility and then shift to equity fund at own convenience. Isn’t this a better strategy than an STP from a debt fund?

Hello sir,

No, the fund will remain an equity oriented fund. By mandate, it cannot go more than 35% in debt.

Regarding the strategy you’ve outlined – no, it would not be a good idea at all. It over-complicates the investment, without benefit. The concept of an STP is simple – you have a large sum to invest in equity, investing at one go throws up market timing risks, so you spread it out. And instead of it earning sub-par returns in your SB account, you put it in liquid funds because you don’t suffer losses on liquid funds (under normal circumstances) even on 1-day basis.

By putting it into a bal adv fund, you are already taking on equity market risks. These funds can deliver even 6-month losses. If the equity portion has to cross a high level then it means equity is undervalued, and you will be redeeming at lower returns at that point. That’s unnecessary. This negates the objective of STP from debt to equity. And if the equity mark is not reached – because the level you’re setting is your own and arbitrary – you can be holding the fund too long and miss investing in equity itself.

Thanks,

Bhavana

This is a good clarification. 🙂

Will it be difficult to calculate tax as this is a dynamic asset allocation fund?

Hello ma’m,

No, as explained in the analysis, the fund is a balanced advantage fund and is taxed like an equity fund.

But you’re correct where dynamic asset allocation funds are concerned – here, tax depends on the date on which you sell. The equity allocation of the preceding 12 months is taken to see whether it is equity-oriented or debt-oriented. Some dynamic asset allocation funds are trying to maintain equity orientation for taxation purposes, of late. And therefore the category gets even more confusing 🙂

Regards,

Bhavana

Hi,

I am glad you started this platform. As one of those first few who opened an account with funds India, I am glad the team has stuck together. I would like to get in touch with Sreekanth, have his funds india email. You need to build a classy and great product better than funds india. Till date no such product exists

Hello sir,

Thank you for the appreciation and support! Please mail [email protected] to get in touch with Srikanth and any of us.

Regards,

Bhavana

If possbile please compare the different BAF’s and their strategies…like DSP Dynamic Asset allocation, Motilal Dynamic Equity etc..so that we can compare

Hi Kartheek,

It’s a very tall order to compare strategies of every single balanced advantage/dynamic asset allocation there is, and it is not really necessary to do so, either. We’ll analyse and review/recommend funds we think are quality ones or ones to watch out for, so you can refer to this for your own analysis or investments.

Thanks,

Bhavana

Hi, do we have the latest prime rated funds list ? Last I have seen is the Dec 2019 edition. Is a new one available?

Regards

Siva

Hello,

Our updation and review schedule is at the end of every quarter. We’d published in December since we had just been up and running. So the next update is will be using end-of-March data, and will be out around mid-April.

Thanks,

Bhavana

Of. late, I am not able to stomach the volatility due to my age and over a period of time, I am planning to come out of direct equity once for all ( once the markets rebounds). Please suggest few more good balanced fund like this and it is enough if it beats PPF, FD etc. marginally. I am willing to lock it up indefinitely as I have other fixed investments

Regards

Sankar N

Hello sir,

You can go to Prime Funds, where we have recommendations on funds. You will find balanced funds there – please read the “why this fund” to check if the strategy suits you. We also have portfolio recommendations which you can look through. You may find our portfolios for retirees (https://www.primeinvestor.in/portfolio-life-situation-retiree/) or for capital preservation (https://www.primeinvestor.in/prime-portfolio-details/?id=19) useful.

Regards,

Bhavana

Hello Bhavana

Greetings and good wishes.

Is it a good option to switch over my existing investments in HDFC Mid-Cap Opportunities Fund and Kotak Standard Multicap Fund to ICICI Pru Balanced Advantage Fund ? I am 59 years old and can hold on my investments for upto 8 years if I invest now.

Your expert advice will be much appreciated.

Regards

Chandramouli

Hello,

At this time, it may seem that selling is the best option. But hold off on it for now, because you will be doing so at lows. Markets currently are extremely panicky and are reacting very quickly, very sharply to news and developments. Since you don’t need the proceeds immediately, you have the ability to hold. You can avoid incremental investments especially in mid-cap since you soon will be in the post-retirement phase. You can make investments in hybrid or debt funds (check Prime Funds for recommendations).

But it also depends on how much you have invested in equity, its break up of mid-caps/small/large, and when you started investing :). Kotak Standard Multicap and HDFC Midcap are both quality funds, and you can continue to hold both for the timeframe you’ve mentioned.

Thanks,

Bhavana

Hello Bhavana,

Your response is much valued and appreciated. I am just doing nothing at this moment and have avoided fresh investments into mid-cap as well. I am already investing in hybrid fund (Mirae Hybrid Equity Fund) and can think of diverting investments in mid-cap to this fund when the overall market situation improves and stabilizes.

% of overall investments in mid/small/large cap funds are 9.59/4.53/44.87 .

You may please advice me appropriate strategy to follow from hereon.

Regards,

Chandramouli

Hello sir,

Please write to us at [email protected] for specific queries, so we can track them better.

We’re restricted from providing very individual-specific strategies and investments, as we are not RIAs. Generally speaking, if mid-cap and small-cap allocation is less than 30% of your overall allocations it is fine. For those close to retirement, holding measured mid-cap and small-cap is fine if they do not need the proceeds in the next 5-7 years and if they are willing to weather declines.

In your case, the allocation appears low – although you may want to check the figures as it doesn’t add up to 100%. Ensure that your regular income needs post retirement are comfortably met. If not, you will have to shift from equity to safer options even before 8 years.

Thanks,

Bhavana

Hi, I was wondering if the Prime team could also suggest an ideal investment amount for each recommendation. This will help novices like me understand and plan better.

Hello,

It would actually be very difficult to give an amount for each recommendation. That’s because your investment amount depends on how much you can save, what other funds you have, and what your risk appetite and timeframe is. Say I was recommending a mid-cap fund. Now, if I say invest Rs 10,000 in it and your total savings in the month itself is Rs 10,000 then it would absolutely not work – too much concentration, too high a risk. If your monthly investment was Rs 100,00 then Rs 10,000 would be too low especially if you had a high risk appetite. Giving an amount figure sometimes also give others the impression that they can’t invest smaller or larger amounts. Where it is necessary, we mention what kind of allocation to give – for example, don’t put more than 30%, put only 10% and so on.

For new investors, we have readymade recommended portfolios (https://www.primeinvestor.in/ready-to-use-portfolios) We have created multiple portfolios for different needs/goals – you can look through them and see which one fits your requirement. These portfolios give funds/ETFs/FDs along with the proportion you should invest in each of them. Based on the amount you have to invest, apply the proportion and invest that amount in each of the funds given in the portfolio.

Thanks,

Bhavana

Understood, thank you.

Comments are closed.