The shift in household savings towards financial assets after Covid and the rising retail participation in equities contributed to manifold gains in market infrastructure stocks such as BSE and CDSL in the last five years. This is likely to generate a lot of interest in the IPO of National Securities Depository Ltd (NSDL), India’s oldest depository promoted by National Stock Exchange (NSE). However, if you’ve missed the stellar rally in capital market stocks and are looking to board the bandwagon through this IPO, it would be best to stay away.

In our opinion, the IPO does not offer a compelling value proposition for investors despite the discounted valuation to its listed peer CDSL. We analyse the offer and provide justification for this conclusion below.

The offer

The NSDL IPO is completely an offer for sale worth Rs.4,011 crore, with two of its major shareholders, NSE and IDBI Bank, together selling 4 crore shares. The IPO will open on July 30 and close on August 1st at a price band of Rs.760-800 per share of Rs. 2/- each. At the upper end of price band, the issue is priced at 46 times FY25 earnings.

The issue being fully offer for sale, the proceeds will go to the selling shareholders.

Post issue, the stake of NSE and IDBI Bank will fall to 15% each from 26% and 24%, respectively.

Business

NSDL is the oldest depository in India with 4 crore demat accounts under its custody at the end of FY25. A depository is an organisation that holds investors’ securities such as stocks, bonds, ETFs and mutual fund units in electronic form and acts as a custodian providing services related to buying, selling and holding of those securities.

Over a period, capital market reforms such as compulsory dematerialisation of shares of public companies and the dematerialisation of NCDs and mutual fund units in demat form has added to the indispensability of depositories in the capital market ecosystem.

Depositories have thus turned proxy plays for the shift in Indian household savings from safe fixed income avenues to riskier capital market avenues, in recent years.

The depository revenue model is simple. A depository earns earns a fee everytime a new demat account is opened in the system. It also rakes in recurring annual charges for account maintenance and transaction charges on the movement of securities “out” of the demat account. The annual charges are a “fixed” levy irrespective of value of holdings. Transaction charges are also a “fixed” levy irrespective of the value or quantity of securities moved out of the demat account, levied on the date of transaction.

As it stands today, NSDL is the second largest depository in the country, sharing a duopoly status with BSE-promoted CDSL. NSDL is also an insurance repository and a Payments Bank.

The insurance repository business contributes <1% of its total depository revenues. The payments bank entity brings in 50% of NSDL’s consolidated revenues, but makes a negligible contribution to profits (0.5%).

The bread-and-butter business for NSDL is thus the capital market depository business (including KYC registration business) which chips in with 99% of its profits.

If we were writing this note on NSDL 5 years ago, we would have termed NSDL the largest depository, with the lion’s share of demat accounts. But today, it is NSDL’s rival CDSL that is in the market leading position, with NSDL being the runner-up.

Here are the reasons why we don’t fancy subscribing to this IPO.

#1 Missing out on the post Covid market boom

If we look at the story of NSDL over the last decade, it is a story of two distinct halves.

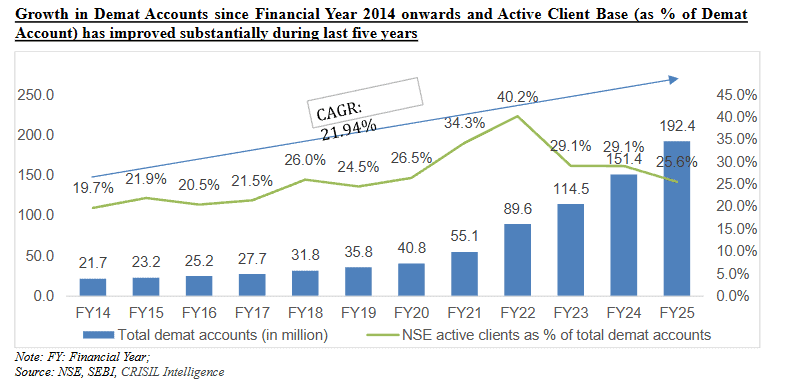

The graph below shows the big take-off in the number of demat accounts i the second half of the last decade, post Covid

Source: NSDL RHP, Page 163

India had 2 crore demat accounts in FY14 which grew at a CAGR of 11% to reach 4 crore in FY20, in a span of 6 years. But between 2020 and 2025 however, the demat accounts in the system shot up from 4 crore to 19 crore, nearly a 5X increase in 5 Years.

A confluence of the post-Covid stock market rally, which coincided with easy digital account opening for stock broking services and cheap mobile data, contributed to this rise.

Strangely, despite being the market leader in depository services pre-Covid, it was not NSDL which capitalised on this demat boom. The Covid era saw discount brokers such as Zerodha and Upstox disrupt legacy broking firms with their fixed low-brokerage models, no-frills execution capabilities and seamless online account opening. CDSL proved more nimble than NSDL in allying with the new discount brokers and facilitating this tech-led disruption. As discount brokers grabbed market share from traditional brokers by onboading the younger cohort of traders and investors in large numbers, NSDL fell behind, losing significant market share to CDSL.

NSDL’s market share in demat accounts tumbled to 22% in FY25 from nearly 50% in FY20. NSDL’s loss was CDSL’s gain.

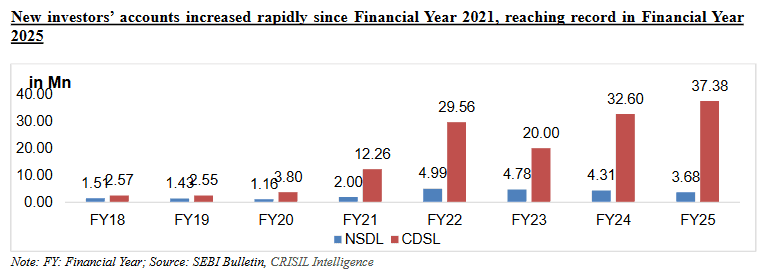

Here’s a quick look into the pace of new account opening since FY21 and how the two depositories fared

Source: NSDL RHP, Page 182

This trend has continued into FY25, even as the stock rally has paused and the markets have entered a more volatile phase. CDSL opened 10X more demat accounts than NSDL in FY25. The absolute number of demat account opening has actually been declining for NSDL in last 3 years

Looking ahead, a slowdown in the pace of demat account openings looks likely. SEBI’s regulatory interventions such as the rationalisation of F&O expiries and higher contract sizes are already beginning to curb retail participation in derivatives, a key trigger for account openings with discount brokers. Going forward, growth in demat accounts may be driven more by conventional factors such as the need to participate in IPOs or mutual funds through the dematerialised holdings route. However, CDSL looks better placed to capitalise on this than NSDL

#2 Reversal of market share equation not easy

NSDL’s loss of market share was due to its association with legacy brokers whereas discount brokers flourished in the post Covid capital market boom.

Based on the total number of active clients in NSE platform, various sources point out to the top 4 discount brokers controlling nearly a 60% share of the market with Groww leading with 23% share followed by Zerodha at 19% and then Angel One and Upstox. On the other hand, the top 5 legacy brokers including ICICI, HDFC, Kotak, Motilal & Sharekhan control only 15% of the active client base, with a lot of fragmentation further down the order.

Demat account openings are directly linked to the brokers with whom clients prefer to trade. For NSDL to claw back lost market share therefore, legacy brokers will need to regain market share from the discount brokers. This looks unlikely. The traditional broking model of offering research and recommendation services to clients as a carrot for bearing high brokerage charges, has been disrupted for good. Newer and younger investors even if they drop out of F&O, may prefer discount brokers with their slick digital platforms over legacy brokers for investing in IPOs, mutual funds and stocks.

Therefore, though the penetration led growth opportunities exist for both the depositories, the tie-ups with legacy brokers may not favour NSDL. There are other nuances too. Groww’s demat account openings are skewed towards equity and mutual fund savings and that Zerodha’s demat account openings are skewed towards F&O activity. But ultimately, the number of demat account opened matters for a depository as it earns ~35% of its revenue in fixed annual charges. Please note that annual charges are fixed, not linked to value of holdings.

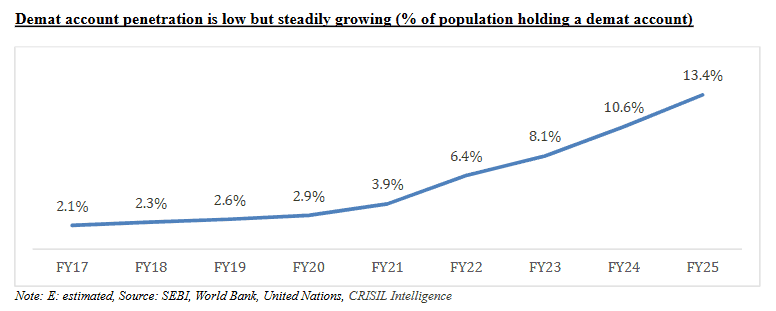

Here’s a glimpse into the demat account penetration

Source: NSDL RHP, Page 170

Note: The total number of demat accounts at 19 crores roughly translates to a penetration of 13-14% of the population and that is the rough math available. The actual penetration could be far lower if looked at based on unique PAN identification.

The best-case assumption that can be made today may be is that the market share erosion of legacy brokers may slow down.

But only a reversal in market share trend in favour of legacy brokers can tilt growth in favour of NSDL. A return of legacy brokers appears quite unlikely given the changing demographics of the Indian market.

#3 Larger share of revenues and profits

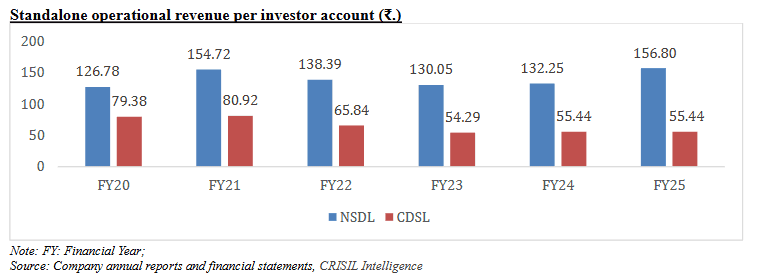

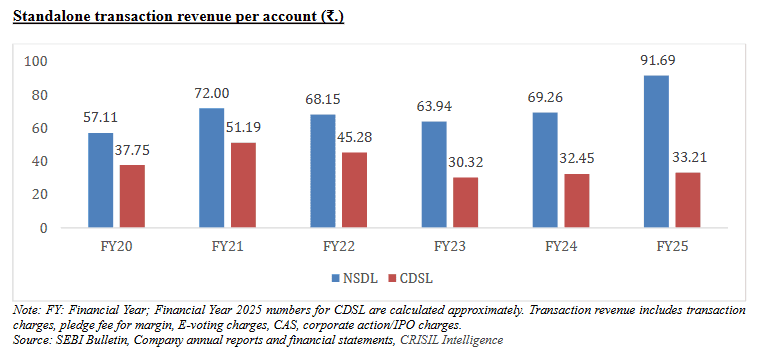

While it has lost the race on demat account openings, NSDL does have one factor in its favour. With more institutional than retail clients, it makes more revenues and profits per client than CDSL.

NSDL with 22% market share in total number of demat accounts has a 40% share of the depository services revenue and 39% of the overall profit pool in FY25.

This is because NSDL earns 3X operational revenue per investor account Vs its peer CDSL.

Currently, the total value of securities held in NSDL’s coffers is Rs.464 lakh crore Vs CDSL’s Rs.70 lakh crore. Even in the case of individual (retail) demat accounts, NSDL’s holding value at Rs.70 lakh crore is twice that of CDSL’s Rs.33 lakh crore. This is probably because This is probably because the former has a higher share of legacy investors and institutions.

This seems to be helping NSDL in earning more per account.

The below data shows that NSE’s demat accounts are earning it more in terms of fixed fee as well as transaction charges.

Source: NSDL RHP, Page 192

The proportion of these two components in their total revenue are almost similar for both the depositories

Source: NSDL RHP, Page 191

While NSDL is clearly on the back foot in terms of number of demat accounts and its ability to add new accounts, it still has a firm foothold on the revenue and profit share pools from the depository business. However, while the legacy accounts may deliver steady cash flows and offer visibility on earnings, growth may still be hard to come by.

In the last 5 Years, NSDL has grown its revenues and profits (excluding that of Payments bank) at 17% and 21% CAGR, respectively whereas CDSL has grown its revenues and profits at 38% and 43%, respectively. Note that NSDL Payments bank has revenue equivalent to that of its depository business but with negligible PAT. Including payments bank business, NSDL’s consolidated revenue has grown at a CAGR of 34%, but the PAT growth is still the same 21% CAGR as NSDL Payment bank’s net profit was just Rs.2 crore on revenue of Rs.722 crore.

Conclusion

NSDL has missed out on the large growth opportunity from equity market participation post-Covid. That growth may now be tapering off.

In this backdrop, it is hard to justify buying into the NSDL stock at the IPO valuation of 46 times its trailing earnings. Yes, this is at a discount to CDSL and also to its own pre-IPO grey market price cited for unlisted stock transactions. But with the pace of demat account openings set to slow, this valuation may not provide any margin of safety to investors.

Here’s a quick glimpse into key parameters for NSDL and CDSL

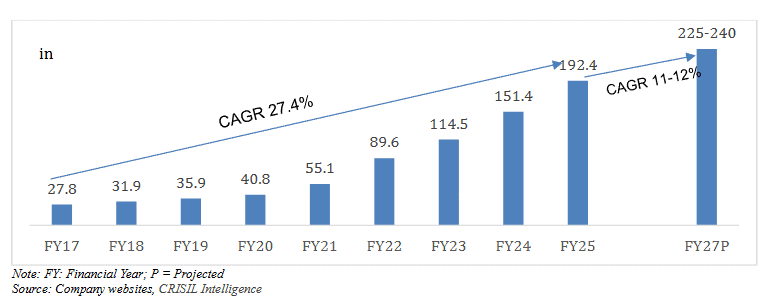

CDSL has been fetching valuation of close to 50 times earnings since its listing and that is mainly for its high growth. After a 36% CAGR in demat account additions in the last 5 years, CRISIL estimates the growth to moderate to 11-12% for next 2 years.

This opens up the possibility of a valuation de-rating threat for CDSL. If such a derating should unfold, NSDL too will be vulnerable to it.

Source: NSDL RHP, Page 197

If valuation of CDSL re-aligns to lower growth, it may open up investing opportunities in the stock. Currently though, it appears best to give the NSDL IPO a miss.

4 thoughts on “NSDL IPO: Should you subscribe?”

Super awesome analysis. Boldly going where no one has gone before. Appreciate the candid conclusion backed by facts, data and logic. At some point, would you be happy to consider (a pilot if not a full blown production service) unlisted share analysis? There is a lot of investor interest but very little opensource intel or insightful perspectives to steer investment decisions.

While this conversation is on, I need your opinion on this because you also provide stock recommendations. I have been with ICICIdirect since 2011.I am an investor, I just purchase good stocks based on your (and some other sources) recommendations. I have around 10L in stocks.

If I want to shift, I will have to go through a lot of paperwork to transfer it to one of these discount brokers. Is it worth it?

It is not much of paperwork actually, especially if you are a resident Indian. So you can go ahead. But if the work is daunting and you are not a frequent investor, as long as the online platform is decent, it should not matter much in our view. Vidya

Very insightful article. Thanks a lot. For me the red flag was the fact that almost the entire issue is an offer for sale.